Managed Learning Service Market Key Insights:

To Get More Information on Managed Learning Service Market - Request Sample Report

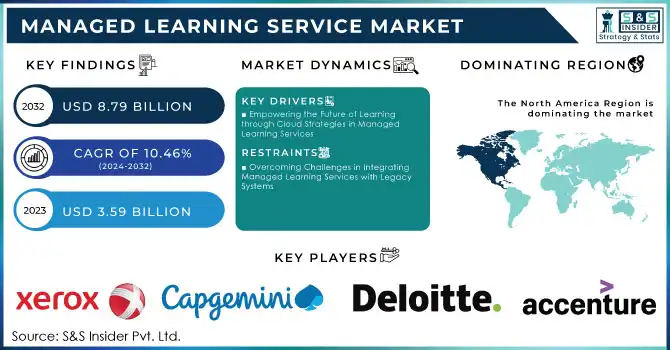

The Managed Learning Service Market size was valued at USD 3.59 Billion in 2023 and is expected to Reach USD 8.79 Billion by 2032 and growing at a CAGR of 10.46% over the forecast period of 2024-2032.

The Managed Learning Services (MLS) market is evolving rapidly, fueled by advancements in technology, changing organizational needs, and growing demands for adaptable learning solutions. MLS enables organizations to outsource key functions in learning and development (L&D) to external experts, covering areas such as strategic consulting, vendor management, and content delivery. Once seen primarily as a cost-saving solution, MLS has now become a critical tool in helping organizations achieve broader business goals. This transformation parallels the massive digital shifts seen in global connectivity and technology adoption: in 2000, only half of Americans had broadband at home, but today, that number is over 90%. Similarly, worldwide internet access has increased from under 7% of the population in 2000 to over half today. Technological trends, like the explosive growth of mobile technology (from 740 million cell phone subscriptions globally at the start of the 2000s to over 8 billion today), highlight a societal shift towards digital-first solutions, impacting how MLS providers incorporate AI, machine learning, and automation into learning systems for efficient, personalized, and scalable results.

Managed Learning Services providers are crucial in implementing digital learning solutions that can seamlessly integrate face-to-face, hybrid, and virtual training. This flexibility has become increasingly important, as recent surveys, like CIPD’s 2023 Learning at Work Report, reveal that more than half (53%) of L&D departments are experiencing heightened workloads. Post-pandemic trends underscore the importance of L&D in fostering skills aligned with organizational growth, leading to more outsourcing as companies seek next-generation learning insights. Additionally, U.S. health expenditures reflect a similar trend in resource allocation, with projected spending expected to surpass $6 trillion by 2028. Organizations today expect MLS providers to aid in strategy, digital transformation, and evaluations, ensuring that L&D aligns seamlessly with internal resources for a future-ready workforce.

Market Dynamics

Drivers

- Empowering the Future of Learning through Cloud Strategies in Managed Learning Services

A key market driver for the Managed Learning Services (MLS) market is the growing integration of cloud computing within corporate strategies, enhancing resilience, cost efficiency, and tailored solutions. As cloud adoption accelerates, companies are increasingly utilizing cloud services to prepare for economic uncertainties, with 41.4% of cloud leaders expanding their cloud-based services, 33.4% shifting from legacy software, and 32.8% migrating on-premises workloads to the cloud. This shift underscores the demand for MLS to support the upskilling of workforces to manage cloud environments efficiently. Over half of organizations are prioritizing hiring or retraining to optimize cloud spending. However, achieving cloud financial operations (FinOps) maturity remains challenging, with 37.1% of companies in the “crawl” stage of FinOps, 41.7% in the “walk” stage, and only 19.5% operating at the “run” stage, where FinOps is fully integrated. By delivering specialized, cloud-savvy L&D services, MLS providers enable companies to overcome these hurdles. Furthermore, industry cloud platforms, anticipated to be adopted by over 50% of enterprises by 2027, promote agility, innovation, and sector-specific adaptability, underscoring the need for MLS to support tailored industry solutions. Additionally, automated cloud optimization tools save time and cut costs for 40% of professionals, fostering sustainable growth. With the increasing reliance on cloud technologies and industry-specific solutions, MLS becomes instrumental in preparing cloud-competent workforces, positioning MLS as a critical driver in maximizing cloud-driven transformation and value.

Restraints

- Overcoming Challenges in Integrating Managed Learning Services with Legacy Systems

Integrating Managed Learning Services (MLS) with existing legacy Learning and Development (L&D) systems presents a considerable challenge, particularly for organizations with diverse and outdated platforms. Legacy systems, often built on older technologies, may lack compatibility with newer cloud-based MLS solutions, creating integration hurdles. One major obstacle is the data migration process, which involves securely transferring vast amounts of training data, employee performance records, and learning resources. This task requires cleansing, standardizing, and reformatting the data, making it time-consuming and costly. Additionally, legacy systems may need customization to align with modern MLS platforms, involving adjustments to workflows, user interfaces, and content management systems, which demands significant technical expertise and can inflate project costs. Technology compatibility is another barrier, as older systems may rely on outdated programming languages or hardware incompatible with modern MLS solutions. In some cases, upgrades or complete system replacements may be necessary, leading to potential operational disruptions and downtime. User adoption can also be negatively impacted, as employees familiar with the old systems may face challenges when transitioning to a new MLS-driven environment.

Key Segment Analysis

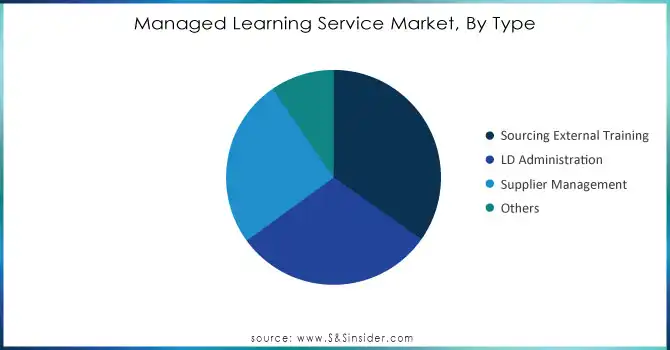

By Type

In 2023, Learning and Development (L&D) Administration accounted for the largest revenue share of 35% in the Managed Learning Services (MLS) market, highlighting its crucial role in optimizing organizational learning. The increasing complexity of corporate learning environments, with diverse modes like in-person training, online courses, and AI-driven platforms, drives the demand for efficient L&D administration. By outsourcing these services, companies streamline operations, reduce administrative burdens, and enhance internal resource allocation. L&D administration also plays a vital role in tracking learner progress, measuring training outcomes, and ensuring compliance with industry standards. With a growing focus on personalized learning and employee experience, the demand for L&D administration within MLS is expected to continue rising, further cementing its market dominance.

Do You Need any Customization Research on Managed Learning Service Market - Inquire Now

By Delivery

In 2023, Instructor-led Training (ILT) accounted for the largest revenue share of around 41% in the Managed Learning Services (MLS) market, highlighting its ongoing importance in corporate learning. ILT remains a top choice for organizations seeking interactive, personalized training experiences, enabling learners to engage directly with instructors and receive real-time feedback. Despite the growth of digital learning tools, ILT is preferred for complex subjects requiring expert guidance and hands-on learning. Additionally, ILT allows for high customization, enabling organizations to tailor training to specific needs. Many MLS providers offer hybrid models, blending ILT with e-learning or virtual classrooms to enhance flexibility. As employee development gains priority, ILT is expected to maintain its market leadership due to its effectiveness in delivering personalized, in-depth training.

Regional Analysis

In 2023, North America dominated the Managed Learning Services (MLS) market with a revenue share of around 39%, cementing its leadership in global learning services. This dominance stems from the region’s advanced infrastructure, early adoption of technology, and robust investments in workforce development. North American organizations prioritize employee upskilling and talent retention, driving the demand for MLS to align learning initiatives with business goals.Product development in the region focuses on AI-driven learning tools, immersive technologies like VR/AR, and blended learning models to enhance engagement and outcomes. MLS providers are continuously evolving their offerings to meet diverse organizational needs. Country-specific growth, particularly in the U.S. and Canada, further strengthens North America's MLS position. The U.S. emphasizes professional development in sectors like tech and healthcare, while Canada focuses on workplace education. These factors, combined with the region’s commitment to technological innovation, ensure continued growth and influence in the MLS market.

In 2023, the Asia-Pacific (APAC) region emerged as the fastest-growing market for Managed Learning Services (MLS), driven by rapid industrialization, digital transformation, and a strong emphasis on workforce skill development. APAC’s large, diverse workforce across industries like IT, manufacturing, and healthcare demands customized learning solutions. Countries such as China, India, Japan, and South Korea lead the adoption of MLS to enhance skills and stay competitive globally. In response, MLS providers are developing scalable, AI-driven, mobile, and e-learning solutions to cater to the region’s cultural and linguistic diversity. With government investments in education and workforce upskilling, APAC is accelerating MLS adoption, positioning itself as a dominant player in the global market.

Key Players

Some of the major key players in the Managed Learning Service Market with products:

-

Accenture (Learning Experience Platform, Custom Learning Solutions)

-

IBM (IBM Watson Talent, Digital Learning Solutions)

-

Deloitte (Deloitte Learning Management System, Digital Learning Strategy)

-

Tata Consultancy Services (TCS) (TCS iON Learning Solutions)

-

Capgemini (Digital Learning Solutions, Learning Technology Platform)

-

SAP (SAP SuccessFactors Learning Management)

-

KPMG (KPMG Learning Solutions, Digital Learning Transformation)

-

Infosys (Infosys Learning Solutions, Learning Technology Services)

-

CGS (Learning Solutions Platform, Virtual Instructor-Led Training)

-

Xerox (Xerox Learning Solutions, Employee Training Solutions)

-

Skillsoft (Skillsoft Learning Suite, Online Training and Courses)

-

LinkedIn Learning (Online Learning Platform, Professional Development Courses)

-

Cornerstone OnDemand (Learning Management System, Talent Management Solutions)

-

Pluralsight (Tech and Creative Learning Platform, Professional Development)

-

Pearson (Pearson Learning Solutions, Educational Content and Platforms)

-

Saba Software (Saba Cloud Learning Management, Talent Development Solutions)

-

Learning Tree International (Instructor-led Training, Certification Programs)

-

Harvard Business Publishing (Harvard ManageMentor, Corporate Learning Solutions)

-

Docebo (AI-Powered Learning Platform, Learning Management System)

-

Udemy for Business (Online Learning Platform, Corporate Training Solutions)

List of potential customer companies for Managed Learning Services (MLS), categorized by industry:

Corporations (Large Enterprises)

-

Microsoft

-

Google

-

Amazon

-

Apple

-

General Electric (GE)

Government Agencies

-

U.S. Department of Defense

-

National Health Service (NHS) - UK

-

Australian Government

-

U.S. Federal Government

-

European Union

Retailers

-

Walmart

-

Target

-

Home Depot

-

Best Buy

-

Costco

Recent Developments

-

November 2024, a recent development in talent transformation is Accenture’s Learn Vantage platform, which helps businesses build a workforce equipped with the necessary skills to thrive in the age of generative AI. This initiative focuses on creating a people-centric learning strategy, empowering employees to embrace new technologies and drive business growth.

-

July 2024, IBM has developed and integrated AI-driven predictive analytics to optimize supply chain management. This advancement allows businesses to forecast demand, improve inventory management, and reduce operational costs by anticipating potential disruptions before they occur.

-

July 2024, Tata Realty has enhanced its employee learning experience by leveraging AI-powered EdCast to deliver personalized learning journeys. This platform enables employees to access a wide range of skill-building opportunities, aligning their development with the company’s strategic objectives.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 3.59 Billion |

| Market Size by 2032 | USD 8.79 Billion |

| CAGR | CAGR of 10.46% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Sourcing External Training, LD Administration, Supplier Management, Others) • By Organization Size (Small Medium Enterprise, Large Enterprise) • By Delivery Mode (Distance Learning, Instructor-led Training, Blended Learning) • By Industry Vertical (BFSI, IT, Telecom, Media, Entertainment, Healthcare, Retail, Manufacturing, Government, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia-Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia-Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Accenture, IBM, Deloitte, Tata Consultancy Services (TCS), Capgemini, SAP, KPMG, Infosys, CGS, Xerox, Skillsoft, LinkedIn Learning, Cornerstone OnDemand, Pluralsight, Pearson, Saba Software, Learning Tree International, Harvard Business Publishing, Docebo, Udemy for Business. |

| Key Drivers | • Empowering the Future of Learning through Cloud Strategies in Managed Learning Services |

| RESTRAINTS | • Overcoming Challenges in Integrating Managed Learning Services with Legacy Systems |