Distribution Automation Market Report Scope & Overview:

To Get More Information on Distribution Automation Market - Request Sample Report

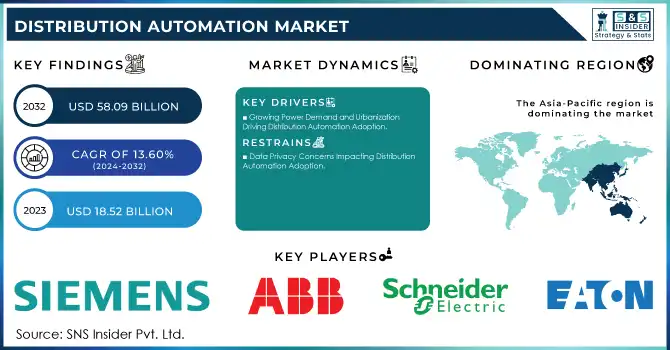

The Distribution Automation Market was valued at USD 18.52 billion in 2023 and is expected to reach USD 58.09 billion by 2032, growing at a CAGR of 13.60% from 2024-2032.

The Distribution Automation market is experiencing substantial growth, driven by the increasing need for reliable, efficient, and cost-effective energy distribution systems. Global renewable energy consumption reached 90.23 EJ, and as energy consumption rises and grid complexity grows, utilities are increasingly turning to automation solutions to ensure the stability and reliability of their infrastructure. This shift is further fueled by advancements in technologies such as smart meters, sensors, and automated control systems, which allow for more efficient power distribution management. These technologies are essential for reducing downtime, minimizing outages, and enhancing service continuity, making them integral to modern grid operations. For Instance, In October 2024, Itron launched distribution automation solutions to improve grid reliability and efficiency, further supporting the growing integration of renewable energy sources and accelerating the demand for advanced distribution automation systems.

As utilities continue to face increasing pressure to improve operational efficiency and reliability, the demand for DA systems is expected to grow even further. By the end of 2023, 1.06 billion smart meters have been installed worldwide, reflecting the growing adoption of digital solutions. With the global push toward digitalization, utilities are adopting smart grids and IoT-based technologies that enable real-time monitoring, predictive maintenance, and better load management. This shift toward automation enhances grid performance and enables utilities to optimize resources and reduce costs in the long run. Moreover, with regulatory pressures on reducing carbon footprints and improving energy efficiency, adopting DA solutions is becoming increasingly critical. In December 2024, DigiKey partnered with MediaTek to distribute power-efficient systems-on-chip supporting IoT applications, which further enhance automation solutions and grid efficiency.

Looking to the future, the Distribution Automation market holds immense opportunities driven by technological advancements. Emerging technologies like artificial intelligence, machine learning, and big data analytics are set to elevate DA systems through predictive analytics, real-time fault detection, and automated decision-making. For instance, In December 2024, Kirin Holdings introduced Sigma Synx, an AI-controlled system developed by Mitsubishi Heavy Industries, designed to reduce logistics workforce requirements by up to 50%, highlighting AI’s potential. These innovations will enhance DA systems’ capabilities and support efficient energy management, especially in sectors like electric vehicle infrastructure. The market will play a pivotal role in shaping smarter, sustainable energy systems worldwide.

Market Dynamics

Drivers

-

Growing Power Demand and Urbanization Driving Distribution Automation Adoption

The rapid urbanization and rising power demand, especially in emerging economies, are driving the need for smarter and more scalable grid solutions. As cities expand and populations grow, the demand for electricity surges, placing greater pressure on traditional power distribution systems. Distribution automation plays a crucial role in managing this increased demand by enabling real-time monitoring, fault detection, and adaptive energy management. With DA systems, utilities can optimize energy distribution, reduce outages, and ensure reliable power supply to densely populated urban areas. Moreover, as urban centers increasingly adopt smart technologies, DA solutions help integrate renewable energy sources and improve grid flexibility, meeting the evolving energy needs of growing cities. This shift toward automation is essential to support sustainable urban development and ensure efficient energy consumption in the face of rising demand.

-

Technological Innovations Driving the Advancement of Distribution Automation

Innovations in sensors, communication networks, data analytics, and artificial intelligence are transforming distribution automation, enabling smarter, more efficient grid management. IoT-based sensors provide real-time data collection, offering granular insights into grid performance and energy consumption. Advanced metering infrastructure enhances the ability to monitor and control the grid remotely, improving response times and decision-making processes. Meanwhile, AI algorithms can predict energy demand, identify potential issues, and optimize grid performance with minimal human intervention. Generative AI is also revolutionizing distribution automation by optimizing logistics, inventory management, and customer service, helping companies reduce lead times by up to 30%. These advancements allow utilities to better manage distribution networks, reduce operational costs, and enhance system reliability, offering greater scalability, flexibility, and efficiency in managing modern energy grids.

Restraints

-

High Initial Investment Costs in Distribution Automation Adoption

The deployment of distribution automation systems requires substantial upfront investment in advanced technologies, infrastructure upgrades, and specialized equipment. These costs can be a significant barrier, particularly for utilities in developing regions with limited budgets or competing priorities. For instance, In October 2024, METRO Inc. launched a new automated distribution center in Toronto, completing a nearly USD 1 billion supply chain modernization project, highlighting the significant investments needed for such technological advancements. The need to purchase new automation devices, sensors, communication networks, and software systems, along with the potential costs of integrating these into existing infrastructure, can create financial strain. For many utilities, the capital expenditure required for DA may outweigh the perceived short-term benefits, slowing adoption.

-

Data Privacy Concerns Impacting Distribution Automation Adoption

The integration of distribution automation systems relies heavily on the collection and analysis of vast amounts of data, including information from consumers and grid operations. This raises significant concerns about data privacy, ownership, and sharing. The sensitive nature of this data ranging from consumer energy usage patterns to grid performance metrics may be vulnerable to unauthorized access or misuse. Utilities and consumers alike may be hesitant to adopt DA technologies due to fears of data breaches or the loss of control over personal and operational information. In regions with strict data protection laws, utilities may face regulatory hurdles or legal challenges when implementing DA systems. As a result, these privacy concerns can slow the widespread adoption of distribution automation technologies, hindering their full potential.

SEGMENT ANALYSIS

By Component

In 2023, the software segment dominated the distribution automation market with the highest revenue share of approximately 44%. This dominance can be attributed to the increasing demand for advanced software solutions that enable real-time monitoring, data analytics, and automation control in grid systems. These software platforms provide utilities with the ability to optimize energy distribution, improve reliability, and enhance decision-making capabilities, making them essential in modernizing the electrical grid and driving efficiency.

The field devices segment is expected to grow at the fastest CAGR of around 14.44% from 2024 to 2032. This growth is primarily driven by the rising need for smart sensors, circuit breakers, and switches that play a critical role in automating grid operations. As the demand for more precise, real-time data collection and fault detection increases, field devices become indispensable in supporting automation systems. The growing adoption of IoT and smart grid technologies further fuels this rapid expansion, enhancing grid resilience and operational efficiency.

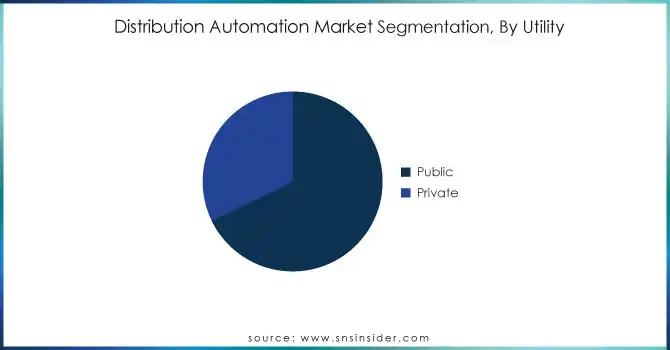

By Utility

In 2023, the public segment dominated the distribution automation market, capturing the highest revenue share of approximately 68%. This dominance stems from the substantial investments made by government utilities in modernizing electrical grids and ensuring enhanced energy distribution efficiency. Public sector entities are increasingly focusing on upgrading aging infrastructure, implementing smart grid solutions, and complying with regulatory mandates for sustainability, making them the primary adopters of distribution automation technologies.

The private segment is poised to grow at the fastest CAGR of about 15.35% from 2024 to 2032. The rapid adoption of advanced distribution automation systems by private companies is driven by the need for improved operational efficiency, cost savings, and greater flexibility. With private sector utilities focusing on innovations, reduced downtime, and more dynamic grid management, the demand for automation solutions is expected to surge, fueling significant growth in this segment over the coming years.

By Communication Technology

In 2023, the wired communication technology segment dominated the distribution automation market, accounting for approximately 67% of the revenue share. This dominance can be attributed to the established reliability and robustness of wired networks, which are critical for secure and stable communication in grid automation. Wired systems, including fiber optics and copper cables, provide high data transfer rates and minimal interference, making them ideal for large-scale, long-term infrastructure projects where consistent and secure connectivity is essential for utilities to manage energy distribution efficiently.

The wireless communication technology segment is expected to grow at the fastest CAGR of about 15.23% from 2024 to 2032. The rapid shift toward wireless solutions is driven by their flexibility, scalability, and ease of deployment. Wireless technologies, such as 5G and LoRaWAN, enable real-time data transmission across vast, distributed networks without the limitations of physical wiring. This growing demand for more agile and cost-effective solutions for smart grids and remote monitoring is positioning wireless communication as the future of distribution automation, fueling its rapid expansion.

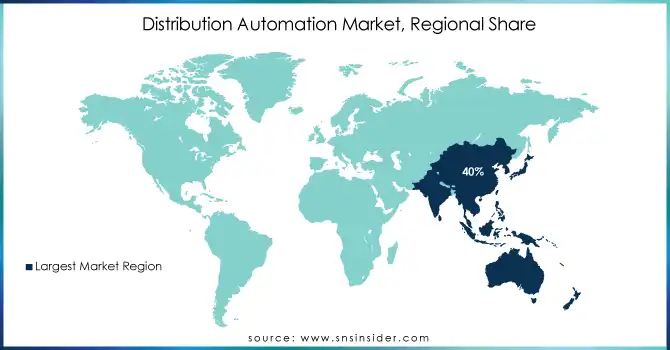

Regional Analysis

In 2023, Asia Pacific dominated the distribution automation market, holding the highest revenue share of about 40%. This dominance is largely due to the region's rapid urbanization, growing industrialization, and increasing demand for reliable electricity. Countries like China and India are heavily investing in smart grid infrastructure and grid modernization projects to improve efficiency, reduce losses, and meet the rising energy needs of their expanding populations. These initiatives, coupled with government support for sustainability and renewable energy integration, have driven the widespread adoption of distribution automation technologies in the region.

North America is expected to grow at the fastest CAGR of around 15.05% from 2024 to 2032. This growth is fueled by ongoing investments in smart grid systems, technological advancements, and a strong focus on enhancing grid resilience. The region's utilities are increasingly adopting distribution automation to address the challenges of aging infrastructure, integrate renewable energy, and improve operational efficiency. With favorable government policies and a growing emphasis on sustainability, North America is poised for rapid expansion in the distribution automation market in the coming years.

Do You Need any Customization Research on Distribution Automation Market - Enquire Now

KEY PLAYERS

-

Siemens AG (SICAM A8000, Ruggedcom Switches)

-

ABB (Relion Protection Relays, Grid Automation Controllers)

-

General Electric Company (GE) (Multilin Relays, Grid IQ Solutions)

-

Schneider Electric SE (Easergy T300, EcoStruxure Grid)

-

Landis+Gyr (Gridstream Advanced Metering, Load Control Switches)

-

Power System Engineering (Distribution System Studies, DER Integration Services)

-

S&C Electric Company (TripSaver II Reclosers, IntelliRupter Fault Interrupters)

-

Cisco Systems, Inc. (Industrial Ethernet 5000 Series, Catalyst 9300 Switches)

-

Xylem Inc. (Sensus Stratus Meters, AMI Solutions)

-

Eaton (Cooper Form 6 Recloser Controls, Yukon Feeder Automation)

-

Itron Inc. (OpenWay Riva, CENTRON Meters)

-

Hubbell (Quazite Underground Enclosures, Power Systems Reclosers)

-

CE Power Engineered Services (Protection Relay Testing, Substation Automation Solutions)

-

G&W Electric (Vista Underground Distribution Switchgear, Lazer Automation Solutions)

-

Beckwith Electric (M-7679 Tapchanger Control, M-6200A Recloser Control)

-

Toshiba (Distribution Transformers, Gridstream Metering Solutions)

-

Mitsubishi Electric (Digital Substation Automation Systems, Static Var Compensators (SVC))

-

Minsait ACS (PRISM SCADA, Centrix Feeder Automation)

-

Ingeteam (INGEPAC EF Protective Relays, Distribution Automation Systems)

-

Kalkitech (SYNC Gateways, Grid Automation Solutions)

-

Trilliant Holdings (Smart Metering Solutions, SecureMesh WAN)

Recent Developments:

-

In 2024, Siemens launched the SICAM Enhanced Grid Sensor (EGS), a solution designed to improve transparency and efficiency in power distribution networks. It enhances grid monitoring and supports the integration of renewable energy, advancing distribution automation efforts.

-

In December 2024, ABB opened a Technology Hub in London to showcase its smart power distribution and building automation solutions, offering interactive demonstrations to enhance customer engagement and technical training.

-

In February 2024, GE Vernova secured multi-million dollar orders from Power Grid Corporation of India (PGCIL) for 765 kV Shunt Reactors, supporting India's energy transition and renewable integration goals.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 18.52 Billion |

| Market Size by 2032 | USD 58.09 Billion |

| CAGR | CAGR of 13.60% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Software, Hardware, Field Devices) • By Communication Technology (Wired, Wireless) • By Utility (Public, Private) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Siemens AG, ABB, General Electric Company (GE), Schneider Electric SE, Landis+Gyr, Power System Engineering, S&C Electric Company, Cisco Systems, Inc., Xylem Inc., Eaton, Itron Inc., Hubbell, CE Power Engineered Services, G&W Electric, Beckwith Electric, Toshiba, Mitsubishi Electric, Minsait ACS, Ingeteam, Kalkitech, Trilliant Holdings |

| Key Drivers | • Growing Power Demand and Urbanization Driving Distribution Automation Adoption • Technological Innovations Driving the Advancement of Distribution Automation |

| RESTRAINTS | • High Initial Investment Costs in Distribution Automation Adoption • Data Privacy Concerns Impacting Distribution Automation Adoption |