Cloud Robotics Market Report Scope & Overview:

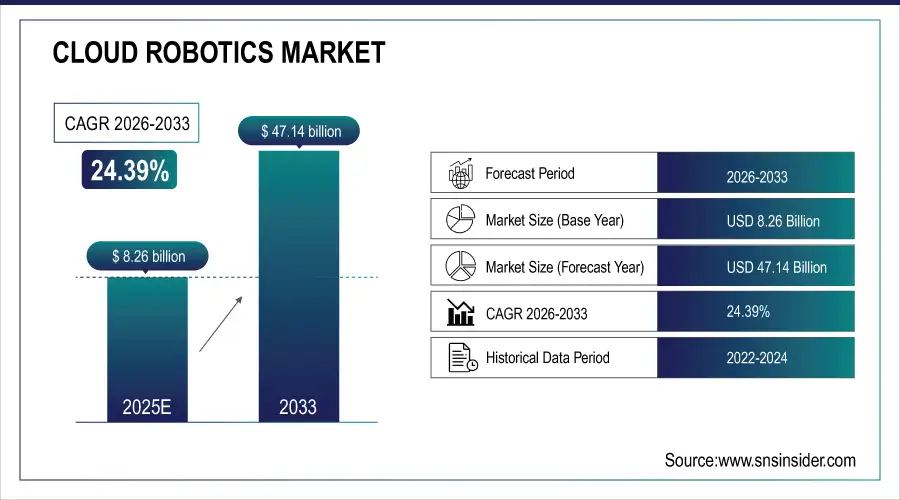

The Cloud Robotics Market was valued at USD 8.26 billion in 2025E and is expected to reach USD 47.14 billion by 2033, growing at a CAGR of 24.39% from 2026-2033.

The Cloud Robotics Market is growing rapidly due to increasing integration of cloud computing with robotic systems, enabling real-time data processing, enhanced automation, and remote operation capabilities. Rising adoption of robotics in manufacturing, healthcare, logistics, and defense is driving demand for scalable, connected solutions. Advancements in AI, IoT, and machine learning technologies are further enhancing robot intelligence and efficiency. Additionally, businesses are leveraging cloud robotics to reduce costs, improve operational flexibility, and accelerate innovation across industries.

In 2024, over 65% of industrial robotics deployments incorporated cloud connectivity for data analytics and remote control; by 2025, more than 40% of healthcare and logistics robots are expected to leverage cloud-based AI for real-time decision-making and operational efficiency.

Cloud Robotics Market Size and Forecast

-

Market Size in 2025: USD 8.26 Billion

-

Market Size by 2033: USD 47.14 Billion

-

CAGR: 24.39% from 2026 to 2033

-

Base Year: 2025E

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information on Cloud Robotics Market - Request Free Sample Report

Cloud Robotics Market Trends

-

Rapid adoption of cloud-connected robots for real-time data processing and enhanced operational efficiency globally

-

Integration of AI and machine learning in cloud robotics enables smarter decision-making and autonomous functionality

-

Growing demand in manufacturing and logistics sectors drives development of scalable, cloud-based robotic solutions

-

Expansion of edge-cloud computing reduces latency, improving performance and responsiveness of robotic systems in real-time

-

Rising investments in collaborative cloud robots for healthcare, agriculture, and service industries enhance productivity and safety

-

Increased focus on cybersecurity and data privacy in cloud robotics to protect sensitive operational information

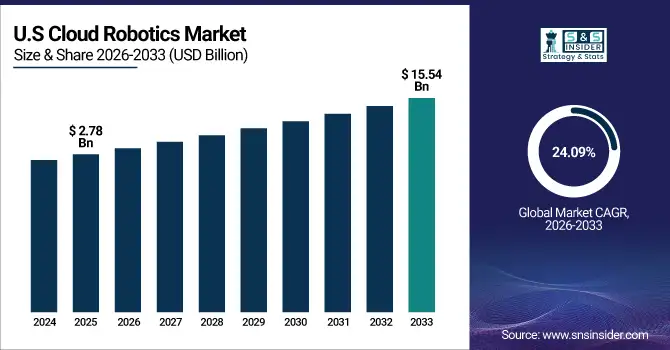

U.S. Cloud Robotics Market was valued at USD 2.78 billion in 2025E and is expected to reach USD 15.54 billion by 2033, growing at a CAGR of 24.09% from 2026-2033.

Growth in the U.S. Cloud Robotics Market is driven by increasing adoption of cloud-connected robots for manufacturing, healthcare, and logistics applications. Advancements in AI, IoT, and real-time data processing, combined with the need for cost-efficient, scalable, and flexible automation solutions, are fueling market expansion.

Cloud Robotics Market Growth Drivers:

-

Increasing adoption of collaborative robots (cobots) in manufacturing and healthcare is boosting demand for cloud robotics platforms and services

The growing use of cobots in industries like manufacturing, healthcare, and logistics is driving demand for cloud robotics solutions. Cobots require advanced data processing, real-time monitoring, and seamless integration with enterprise systems, which cloud platforms efficiently provide. Cloud robotics enables remote control, analytics, and coordination of multiple cobots across locations. As industries increasingly rely on human-robot collaboration to enhance productivity, safety, and precision, the need for cloud-based robotic services, including software, storage, and AI integration, is expanding rapidly.

As of 2024, more than 55% of new cobot installations in logistics and healthcare utilized cloud-connected systems for analytics and coordination; global cloud robotics adoption in cobot operations is expected to exceed 70% by 2025, fueled by needs for remote monitoring, AI integration, and cross-facility scalability.

-

Scalability and flexibility offered by cloud robotics solutions enable businesses to expand robotic capabilities without significant capital investment or infrastructure constraints

Cloud robotics allows companies to scale robotic operations efficiently by leveraging remote computing, storage, and software-as-a-service platforms. Organizations can deploy new robots or update existing systems without investing heavily in local infrastructure or IT resources. This flexibility reduces upfront costs, accelerates deployment, and enables rapid adaptation to changing operational demands. Industries across manufacturing, logistics, and healthcare benefit from scalable cloud-based solutions that support real-time analytics, remote monitoring, and coordinated multi-robot operations, making cloud robotics a cost-effective, flexible, and future-ready approach to automation.

In 2024, 70% of healthcare and logistics robotics adopters reported faster deployment times using cloud platforms, while 60% cut operational costs by integrating SaaS-based robotics solutions—accelerating scalability and real-time coordination across fleets.

Cloud Robotics Market Restraints:

-

High initial investment and implementation costs for cloud robotics solutions limit adoption, particularly among small and medium-sized enterprises globally

Cloud robotics solutions require substantial upfront investments in hardware, software, and cloud infrastructure. Small and medium-sized enterprises (SMEs) often face budget constraints, limiting their ability to deploy advanced robotic systems. High maintenance costs, subscription fees for cloud services, and the need for skilled personnel further increase the financial burden. These cost challenges slow adoption rates, particularly in developing regions, and create barriers for businesses seeking to leverage robotics for automation, efficiency, and scalability in manufacturing, logistics, healthcare, and other sectors.

Over 65% of SMEs cite upfront costs exceeding USD50,000 as a key barrier to cloud robotics adoption; 58% report recurring cloud and maintenance expenses as unsustainable, and 70% in developing regions lack access to skilled personnel—collectively limiting deployment despite strong interest in automation benefits.

-

Data security and privacy concerns in cloud-based robotics systems create risks, restricting deployment in sensitive industrial and healthcare applications

Cloud-connected robots transmit and store large volumes of sensitive data, including operational metrics and personal information. Vulnerabilities in data encryption, access controls, or cloud networks can expose organizations to cyberattacks, data breaches, and intellectual property theft. Industries such as healthcare, defense, and pharmaceuticals are particularly cautious due to strict regulatory requirements and potential legal consequences. These concerns restrict deployment of cloud robotics in sensitive environments and force companies to invest heavily in cybersecurity measures, slowing overall market adoption despite the technological advantages offered by cloud-connected robotic systems.

In 2024, 68% of cloud robotics deployments in healthcare and defense reported cybersecurity as a top barrier; 43% of organizations delayed adoption due to data privacy concerns, while global cloud robotics breach incidents rose by 27% year-over-year.

Cloud Robotics Market Opportunities:

-

Integration of AI and machine learning with cloud robotics enables smarter, adaptive, and autonomous robotic systems across industries

The convergence of artificial intelligence and machine learning with cloud robotics allows robots to learn from data, adapt to dynamic environments, and perform complex tasks autonomously. Industries such as manufacturing, healthcare, logistics, and agriculture can benefit from intelligent robotic systems that optimize efficiency, reduce errors, and improve productivity. Cloud connectivity enables real-time data sharing, centralized control, and collaborative operations among multiple robots. This integration creates significant opportunities for deploying advanced robotic solutions capable of continuous learning and self-optimization, driving innovation across sectors.

In 2024, 65% of new robotic deployments in logistics and manufacturing leveraged AI-driven cloud platforms, reducing downtime by 22% and improving task accuracy by up to 30% through continuous learning and real-time data sharing.

-

Growing adoption of Industry 4.0 and smart factories provides opportunities for cloud robotics in manufacturing automation and predictive maintenance

Industry 4.0 initiatives and smart factory implementations are accelerating demand for cloud-connected robotics in manufacturing environments. Cloud robotics enables automation of repetitive tasks, real-time monitoring of production lines, and predictive maintenance of machinery, reducing downtime and operational costs. Manufacturers can leverage data analytics and remote robot management to optimize workflows and improve supply chain efficiency. The combination of cloud robotics with IoT sensors and AI-driven insights provides a scalable solution, offering manufacturers enhanced flexibility, productivity, and competitiveness in increasingly automated industrial landscapes.

In 2024, 68% of manufacturers deployed cloud-connected robotics; by 2025, over 75% leveraged cloud robotics for real-time monitoring and predictive maintenance, cutting downtime by 30% and operational costs by 22%.

Cloud Robotics Market Segment Highlights

-

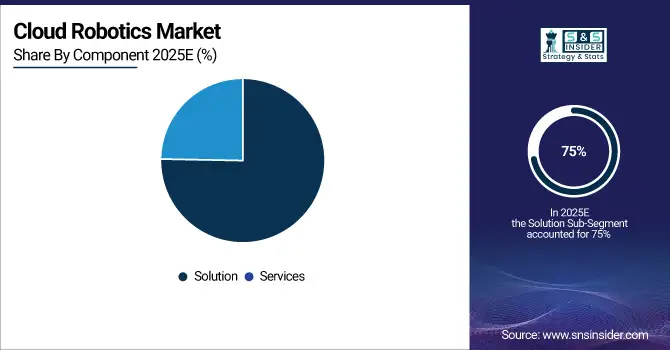

By Component: In 2025, Solution led the market with 75% share due to high demand for integrated robotics platforms, while Services is the fastest-growing segment (2026–2033)

-

By Service Model: In 2025, SaaS led the market with 50% share owing to ease of deployment and scalability, while IaaS is the fastest-growing segment (2026–2033)

-

By Robot Type: In 2025, Industrial Robots led the market with 60% share driven by manufacturing automation demand, while Service Robots is the fastest-growing segment (2026–2033)

-

By Industry Vertical: In 2025, Manufacturing led the market with 32% share due to widespread robotics adoption, while Retail & E-commerce is the fastest-growing segment (2026–2033)

Cloud Robotics Market Segment Analysis

By Component, Solution segment led in 2025; Services segment expected fastest growth

Solution segment dominated the Cloud Robotics Market with the highest revenue share of about 75% in 2025 due to increasing deployment of integrated robotics solutions, rising adoption across industries, and demand for automation that improves operational efficiency.

Services segment is expected to grow at the fastest CAGR from 2026-2033 owing to expanding demand for cloud-based maintenance, consulting, support, and managed services, enabling businesses to optimize robotic performance and scalability while reducing upfront costs and operational complexities.

By Service Model, SaaS segment led in 2025; IaaS segment expected fastest growth

SaaS segment dominated the Cloud Robotics Market with the highest revenue share of about 50% in 2025 due to its easy accessibility, lower upfront costs, and widespread adoption for deploying robotic applications on cloud platforms.

IaaS segment is expected to grow at the fastest CAGR from 2026-2033 driven by increasing demand for scalable computing resources, storage, and infrastructure to support complex robotic operations and AI-driven workloads.

By Robot Type, Industrial Robots segment led in 2025; Service Robots segment expected fastest growth

Industrial Robots segment dominated the Cloud Robotics Market with the highest revenue share of about 60% in 2025 due to widespread adoption in manufacturing, automotive, and electronics industries for automation of repetitive and precise tasks.

Service Robots segment is expected to grow at the fastest CAGR from 2026-2033 owing to rising demand in healthcare, hospitality, logistics, and retail for tasks like delivery, cleaning, and customer interaction.

By Industry Vertical, Manufacturing segment led in 2025; Retail & E-commerce segment expected fastest growth

Manufacturing segment dominated the Cloud Robotics Market with the highest revenue share of about 32% in 2025 due to high integration of robotic automation for assembly, material handling, and production efficiency.

Retail & E-commerce segment is expected to grow at the fastest CAGR from 2026-2033 driven by rising adoption of cloud robotics for inventory management, order fulfillment, and last-mile delivery solutions.

Cloud Robotics Market Regional Analysis

North America Cloud Robotics Market Insights

North America dominated the Cloud Robotics Market with a 40% share in 2025 due to the presence of advanced industrial automation infrastructure, strong R&D capabilities, and high adoption of robotics across manufacturing, healthcare, and logistics sectors. Supportive government initiatives, extensive enterprise investment, and early technology adoption further reinforced the region’s leadership.

Get Customized Report as per Your Business Requirement - Enquiry Now

Asia Pacific Cloud Robotics Market Insights

Asia Pacific is expected to grow at the fastest CAGR of about 27.18% from 2026–2033, driven by rapid industrialization, increasing manufacturing automation, and growing adoption of cloud-based robotics solutions. Expanding smart factories, rising demand for service robots, and strong government support for Industry 4.0 initiatives are accelerating market growth in the region.

Europe Cloud Robotics Market Insights

Europe held a significant share in the Cloud Robotics Market in 2025, supported by its advanced manufacturing ecosystem, strong adoption of automation technologies, and presence of leading robotics solution providers. Growing industrial digitization, increasing investment in smart factories, and focus on Industry 4.0 initiatives further strengthened Europe’s position in the cloud robotics market.

Middle East & Africa and Latin America Cloud Robotics Market Insights

The Middle East & Africa and Latin America together showed steady growth in the Cloud Robotics Market in 2025, driven by increasing industrial automation, growing adoption of smart manufacturing technologies, and rising investments in logistics and service robotics. Expanding infrastructure, supportive government initiatives, and gradual technological modernization further strengthened the regions’ market presence.

Cloud Robotics Market Competitive Landscape:

Amazon Web Services (AWS)

Amazon Web Services (AWS) is a subsidiary of Amazon and a global leader in cloud computing services. It provides a wide range of infrastructure services including computing power, storage, and databases, enabling companies to scale applications efficiently. AWS supports cloud robotics solutions by offering AI, machine learning, and IoT services that allow robots to process data, make decisions, and collaborate remotely. Its robust, secure, and scalable platform makes it a key player in cloud robotics and industrial automation.

-

September 2025, AWS decided to retire its RoboMaker service, its cloud‑robotics simulation platform, recommending customers migrate to AWS Batch instead.

Microsoft Corporation

Microsoft Corporation is a multinational technology company headquartered in Redmond, Washington, known for software, hardware, and cloud solutions. Its Azure Cloud platform enables cloud robotics by providing computing, AI, and IoT services that allow robots to operate collaboratively and process real-time data. Microsoft focuses on integrating cloud, AI, and edge computing to support intelligent automation across industries. Its strong developer ecosystem, enterprise solutions, and innovation in cloud-based services make it a leader in the cloud robotics market.

-

April 2024, Microsoft announced new industrial‑AI cloud solutions at Hannover Messe, including an edge + cloud system to monitor and control robots via Azure IoT Operations.

IBM Corporation

IBM Corporation, headquartered in Armonk, New York, is a global technology and consulting company specializing in AI, cloud computing, and enterprise solutions. IBM supports cloud robotics through its IBM Cloud platform, Watson AI, and IoT technologies, enabling robots to process large data sets, perform predictive maintenance, and collaborate in real-time. IBM combines advanced analytics, hybrid cloud infrastructure, and cognitive computing to provide intelligent automation solutions, making it a major player in cloud robotics for manufacturing, healthcare, and logistics sectors.

-

May 2025, IBM unveiled new hybrid-AI technologies enabling enterprises to build AI agents with their own data, boosting AI scalability via IBM Cloud and its watsonx platform.

Google LLC (Alphabet)

Google LLC, part of Alphabet Inc., is a multinational technology company known for search, advertising, cloud computing, and AI. Through Google Cloud, it provides cloud infrastructure, AI, and machine learning services that support cloud robotics applications. Google Cloud allows robots to process large-scale data, learn from experiences, and communicate efficiently across networks. Its investments in AI, robotics, and IoT technologies make it a significant innovator in cloud robotics, enabling smart, autonomous, and collaborative robotic systems globally.

-

March 2025, Google DeepMind introduced Gemini Robotics and Gemini Robotics‑ER, two AI models designed to control robots with vision, language, and action capabilities.

Key Players

Some of the Cloud Robotics Market Companies

-

Amazon Web Services (AWS)

-

Microsoft Corporation

-

IBM Corporation

-

Google LLC (Alphabet)

-

Rockwell Automation Inc.

-

Huawei Technologies Co., Ltd.

-

ABB Ltd.

-

FANUC Corporation

-

KUKA AG

-

Hit Robot Group Co. Ltd

-

CloudMinds Technologies Co. Ltd

-

C2RO Cloud Robotics Inc.

-

Rapyuta Robotics Co. Ltd

-

Ortelio Ltd

-

V3 Smart Technologies PTE Ltd

-

Formant

-

OTTO Motors (Clearpath Robotics)

-

Locus Robotics

-

Zebra Technologies

-

Universal Robots (Teradyne)

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 8.26 Billion |

| Market Size by 2033 | USD 47.14 Billion |

| CAGR | CAGR of 24.39% From 2026 to 2033 |

| Base Year | 2025 |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Solution, Services) • By Service Model (SaaS, IaaS, PaaS) • By Robot Type (Industrial Robot, Service Robot) • By Industry Vertical (Manufacturing, Military and Defense, Retail and E-commerce, Healthcare, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Amazon Web Services (AWS), Microsoft Corporation, IBM Corporation, Google LLC (Alphabet), Rockwell Automation Inc., Huawei Technologies Co., Ltd., ABB Ltd., FANUC Corporation, KUKA AG, Hit Robot Group Co. Ltd, CloudMinds Technologies Co. Ltd, C2RO Cloud Robotics Inc., Rapyuta Robotics Co. Ltd, Ortelio Ltd, V3 Smart Technologies PTE Ltd, Formant, OTTO Motors (Clearpath Robotics), Locus Robotics, Zebra Technologies, Universal Robots (Teradyne) |