Cloud Security Posture Management Market Report Scope & Overview:

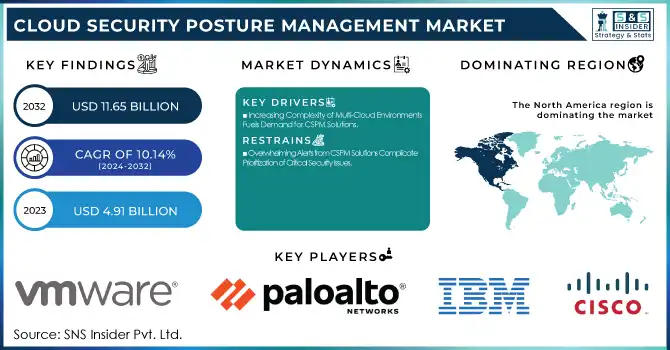

The Cloud Security Posture Management Market was valued at USD 4.91 billion in 2023 and is expected to reach USD 11.65 billion by 2032, growing at a CAGR of 10.14% from 2024-2032.

To get more information on Cloud Security Posture Management Market - Request Free Sample Report

The Cloud Security Posture Management market is growing significantly due to the increased pace of organizations' adoption of the cloud as they speed up digital transformation initiatives. Now, with 67% of enterprise infrastructure in the cloud and 92% of organizations adopting or planning a multi-cloud strategy, securing such complex systems is critical. CSPM solutions help businesses in detecting misconfigurations, enforcing security policies, and ensuring compliance, making them inevitable for managing increasing risks associated with cloud environments. This increased use of cloud platforms, coupled with the growing rate of cyberattacks, which is reported to be 2,365 in 2023 affecting 343,338,964, has significantly boosted the demand for CSPM tools that protect sensitive data and mitigate vulnerabilities.

There is an increasing demand for CSPM solutions in the future with the growing extension of cloud services. Hybrid and multi-cloud architecture increases the complexity of security management. Today, 89 percent of companies utilize a multi-cloud approach, while 80 percent have a hybrid strategy that leverages either private or public cloud computing. This creates a need for an integrated posture management system to manage the entire infrastructure automatically, even as more and more organizations become multi-cloud users. It also arises due to changing compliance regulations and an organizational desire to prevent expensive breaches such as that found in the United States average data breach that had a value of USD 9.36 million in 2024. This is pushing more companies in different sectors to invest in CSPM for the maintenance of their security posture, minimization of risks, and compliance with industry standards.

Opportunities for CSPM tools are set to grow as AI and machine learning continue to transform the cybersecurity landscape. In December 2024, Obsidian Security advanced its security capabilities by integrating AI and cloud technologies, enhancing identity threat protection and cloud posture management. These innovations allow CSPM platforms to offer more sophisticated threat detection, automated incident response, and predictive capabilities, providing businesses with stronger, more proactive security measures. Additionally, the increasing adoption of DevOps and CI/CD practices presents an opportunity for CSPM tools to be integrated directly into the development pipeline, embedding security from the outset and ensuring vulnerabilities are identified earlier. As the cloud environment continues to evolve, CSPM tools will remain essential for maintaining a robust security posture and business continuity.

MARKET DYNAMICS

DRIVERS

-

Increasing Complexity of Multi-Cloud Environments Fuels Demand for CSPM Solutions

The rapid adoption of multi-cloud strategies by organizations has significantly heightened the complexity of managing cloud security. With organizations utilizing diverse cloud platforms such as AWS, Azure, and Google Cloud, each with its unique configurations, permissions, and resources, maintaining a robust security posture becomes increasingly challenging. The lack of uniformity across these environments makes it difficult to ensure consistent security controls and mitigate risks effectively. As cloud infrastructure grows more intricate, manual security management becomes inefficient and prone to errors. This complexity drives the need for automated Cloud Security Posture Management tools, which provide organizations with the ability to continuously monitor, assess, and enforce security policies across multiple cloud environments, ensuring a streamlined, compliant, and secure cloud infrastructure.

-

DevOps and CI/CD Practices Drive the Need for Continuous Security with CSPM Tools

The rapid adoption of DevOps and Continuous Integration/Continuous Deployment practices has created a demand for continuous security monitoring. As these practices emphasize quick, iterative releases, cloud environments experience frequent and complex changes, making it challenging to maintain a secure posture. The fast pace of deployment often results in overlooked vulnerabilities and misconfigurations, which can lead to security risks. To address these challenges, Cloud Security Posture Management tools provide real-time visibility, ensuring continuous monitoring of security configurations and policies across cloud environments. By automating the detection and remediation of potential risks, CSPM tools enable organizations to maintain security while maintaining the agility and speed of DevOps and CI/CD practices. This need for ongoing security assessment is driving the adoption of CSPM solutions.

RESTRAINTS

-

Overwhelming Alerts from CSPM Solutions Complicate Prioritization of Critical Security Issues

CSPM solutions can generate a high volume of security alerts, including many that are false positives, which creates challenges for organizations in managing and responding to these alerts efficiently. With a constant stream of notifications, it becomes difficult for security teams to discern which issues are genuinely critical and require immediate action. This overwhelming influx of alerts can lead to alert fatigue, where teams may overlook or delay addressing significant vulnerabilities. Additionally, the sheer number of alerts can create a backlog, hindering organizations from proactively managing their cloud security posture. As a result, the effectiveness of CSPM tools may be diminished, making it harder for organizations to ensure the security of their cloud environments and meet compliance requirements promptly.

-

High Initial Costs of CSPM Solutions Hinder Adoption Among Smaller Organizations

The deployment of CSPM solutions often involves significant initial costs, which can be a barrier for smaller organizations or those with limited budgets. These costs encompass setup, integration, ongoing maintenance, and staff training, all of which can strain financial resources. For many organizations, especially startups or SMBs, the financial investment required to implement comprehensive CSPM tools may outweigh the perceived benefits, leading them to delay or forgo adopting these solutions. Furthermore, the complexity of integration with existing systems and cloud environments adds to the overall expense. As cloud security threats continue to evolve, organizations without the necessary resources may struggle to justify the expense of CSPM tools, leaving them vulnerable to security risks. This financial strain limits broader market penetration, especially among smaller companies.

SEGMENT ANALYSIS

By Component

In 2023, the Solution segment led the Cloud Security Posture Management market with the highest revenue share of approximately 70%. This dominance is driven by the increasing demand for comprehensive security solutions that offer real-time monitoring, threat detection, and automated compliance management across multi-cloud environments. Organizations are increasingly opting for integrated CSPM solutions to mitigate the risks associated with complex cloud infrastructures, ensuring streamlined, proactive security posture management.

The Services segment is expected to grow at the fastest CAGR of around 12.14% from 2024 to 2032. This growth can be attributed to the rising need for specialized consulting, implementation, and ongoing support services to optimize CSPM tools within unique organizational environments. As businesses continue to embrace cloud technologies, the demand for expert guidance and tailored services to manage evolving security threats is accelerating, making the Services segment a key area of expansion in the CSPM market.

By Enterprise Size

In 2023, the Large Enterprise segment dominated the Cloud Security Posture Management market, capturing around 68% of the revenue share. This dominance is driven by the significant resources and complex infrastructure of large enterprises, which necessitate robust, scalable security solutions. Their increased reliance on multi-cloud environments and the need to manage vast amounts of sensitive data have made CSPM tools indispensable for ensuring compliance, mitigating risks, and maintaining operational continuity across their expansive networks.

The SME segment is projected to grow at the fastest CAGR of approximately 11.33% from 2024 to 2032. As SMEs increasingly adopt cloud technologies to scale their operations and improve efficiency, the need for affordable, scalable CSPM solutions is rapidly expanding. With the growing frequency of cyber threats and regulatory pressures, SMEs are recognizing the critical importance of securing their cloud infrastructures, driving demand for tailored, cost-effective CSPM services to protect their businesses from evolving security risks.

By Cloud Type

In 2023, the Public segment led the Cloud Security Posture Management market, accounting for approximately 52% of the revenue share. This dominance is largely attributed to the widespread adoption of public cloud services by enterprises seeking scalable, flexible, and cost-effective infrastructure solutions. Public cloud providers such as AWS, Microsoft Azure, and Google Cloud continue to expand their market presence, driving the need for robust CSPM tools to ensure secure and compliant cloud environments for businesses of all sizes.

The Hybrid segment is projected to grow at the fastest CAGR of about 12.18% from 2024 to 2032. As organizations increasingly adopt hybrid cloud models to balance the benefits of both public and private clouds, the complexity of managing security across these diverse environments drives the demand for specialized CSPM solutions. Hybrid cloud configurations require advanced security tools that can seamlessly integrate and safeguard data across both on-premises and cloud infrastructures, positioning the Hybrid segment as a key growth area in the CSPM market.

By Cloud Service Model

In 2023, the SaaS segment dominated the Cloud Security Posture Management market, capturing around 49% of the revenue share. This dominance is driven by the increasing reliance of businesses on SaaS applications for critical functions, such as customer relationship management, finance, and collaboration. As SaaS platforms continue to expand, organizations face heightened security concerns, making robust CSPM tools essential for maintaining compliance and protecting sensitive data in the cloud.

The IaaS segment is projected to grow at the fastest CAGR of approximately 11.76% from 2024 to 2032. The rise in cloud-based infrastructure adoption by businesses looking for flexible, scalable computing resources is fueling this growth. As organizations migrate more workloads to IaaS environments, they require comprehensive security solutions that can manage and secure dynamic, virtualized infrastructures, thereby driving the demand for CSPM solutions tailored to IaaS-specific security challenges.

REGIONAL ANALYSIS

In 2023, North America led the Cloud Security Posture Management market, securing approximately 38% of the revenue share. This dominance is attributed to the region's advanced technological infrastructure, high adoption rate of cloud services, and a strong presence of major CSPM solution providers. With a large number of enterprises in North America transitioning to multi-cloud and hybrid cloud environments, the demand for comprehensive cloud security solutions to safeguard sensitive data and ensure regulatory compliance has been a key driver of the market.

The Asia Pacific region is expected to grow at the fastest CAGR of around 12.16% from 2024 to 2032. This growth is driven by the rapid digital transformation and increasing cloud adoption across emerging markets, including India, China, and Southeast Asia. As organizations in the region recognize the critical need for robust cloud security amidst evolving cyber threats, the demand for CSPM solutions is expected to surge, positioning Asia Pacific as the fastest-growing market for cloud security services.

Get Customized Report as per Your Business Requirement - Enquiry Now

KEY PLAYERS

-

Cisco Systems (Cisco Secure Cloud, Cisco Umbrella)

-

International Business Machines Corporation (IBM Security QRadar, IBM Cloud Pak for Security)

-

Palo Alto Networks, Inc. (Prisma Cloud, Cortex XSOAR)

-

VMware, Inc. (VMware Carbon Black Cloud, VMware vSphere)

-

Microsoft Corporation (Microsoft Defender for Cloud, Azure Security Center)

-

Check Point Software Technologies (CloudGuard, Dome9)

-

Zscaler (Zscaler Internet Access, Zscaler Private Access)

-

Sophos Group plc (Sophos Cloud Optix, Sophos XG Firewall)

-

Atos SE (Atos Digital Cloud Services, Atos Security Management Services)

-

Forcepoint (Forcepoint Cloud Security, Forcepoint DLP)

-

CrowdStrike Holdings, Inc. (CrowdStrike Falcon, CrowdStrike Cloud Security)

-

Netskope (Netskope Security Cloud, Netskope Private Access)

-

Trend Micro, Inc. (Trend Micro Cloud One, Trend Micro Deep Security)

-

Fortinet (FortiGate Cloud, FortiCloud)

-

Qualys, Inc. (Qualys Cloud Platform, Qualys VMDR)

-

Fujitsu Ltd (Fujitsu Cloud Services, Fujitsu Managed Security Services)

-

Radware Ltd (Radware Cloud WAF, Radware Cloud DDoS Protection)

-

Oracle Corporation (Oracle Cloud Infrastructure Security, Oracle Cloud Guard)

-

Arctic Wolf Networks (Arctic Wolf Managed Detection and Response, Arctic Wolf Cloud Security)

-

Entrust Corporation (Entrust Identity as a Service, Entrust Secure Cloud)

-

DivvyCloud Corporation (DivvyCloud Cloud Security, DivvyCloud Compliance Monitoring)

-

Lookout (Lookout Cloud Security, Lookout Mobile Endpoint Security)

-

Aqua Security (Aqua Cloud Native Security, Aqua K8S Security)

-

Aujas Cybersecurity Ltd (Aujas Cloud Security, Aujas Vulnerability Management)

-

Fidelis Cybersecurity (Fidelis Cloud Security, Fidelis Elevate)

-

Foreseeti (Foreseeti Risk Management, Foreseeti Cloud Protection)

RECENT DEVELOPMENTS

-

In June 2024, Cisco unveiled advancements in its Security Cloud, introducing Cisco Hypershield with AI-driven security across multiple domains, new Cisco Secure Firewall 1200 Series, and a unified management system, Security Cloud Control, aimed at enhancing enterprise defenses.

-

In November 2024, IBM launched a generative AI solution, Autonomous Security for Cloud, to enhance security and compliance across AWS environments. The AI-powered automation streamlines security management, helping organizations address misconfigurations and mitigate risks.

-

In November 2024, Microsoft enhanced Defender for Cloud with CSPM innovations, focusing on securing AI applications and cloud environments. The update introduces improved API security posture management and container security, aiming to strengthen AI components' defense across cloud infrastructures.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 4.91 Billion |

| Market Size by 2032 | USD 11.65 Billion |

| CAGR | CAGR of 10.14% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Solution, Services) • By Cloud Service Model (SaaS, IaaS, PaaS) • By Cloud Type (Public, Private, Hybrid) • By Enterprise Size (SME, Large Enterprise) • By Vertical (IT & Telecom, Retail, BFSI, Healthcare, Defense/Government, Manufacturing, Energy, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Cisco Systems, International Business Machines Corporation, Palo Alto Networks, Inc., VMware, Inc., Microsoft Corporation, Check Point Software Technologies, Zscaler, Sophos Group plc, Atos SE, Forcepoint, CrowdStrike Holdings, Inc., Netskope, Trend Micro, Inc., Fortinet, Qualys, Inc., Fujitsu Ltd, Radware Ltd, Oracle Corporation, Arctic Wolf Networks, Entrust Corporation, DivvyCloud Corporation, Lookout, Aqua Security, Aujas Cybersecurity Ltd, Fidelis Cybersecurity, Foreseeti |