Disaster Recovery as a Service (DRaaS) Market Size & Overview:

Get more information on Disaster Recovery as a Service (DRaaS) Market - Request Sample Report

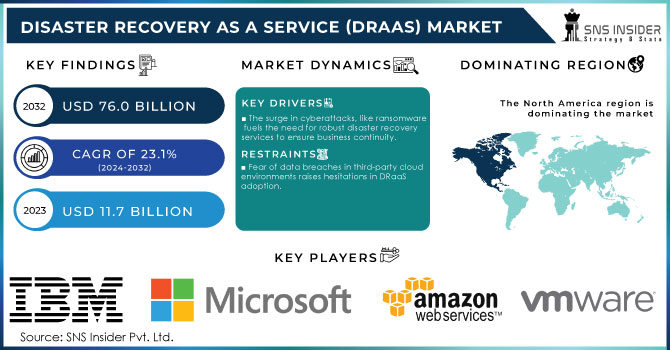

Disaster Recovery as a Service (DRaaS) Market Size was valued at USD 11.7 Billion in 2023 and is expected to reach USD 76.0 Billion by 2032, growing at a CAGR of 23.1% over the forecast period 2024-2032.

The Disaster Recovery as a Service market is growing substantially due to the increasing concerns over data security and business continuity. The primary drivers include the high frequency of cyber-attacks and natural disasters compelling companies to invest in better disaster recovery procedures. In addition, government initiative are also propelling the adoption of DRaaS. For example, according to U.S. Department of Homeland Security, (2023), cyber incidents in the U.S. have surged by 17% compared to the previous year, resulting in considerable financial and operational disruptions for businesses. In UK, the volume of data breaches reported to authorities has also advanced by 15% in 2023 hence necessitating businesses to put considerable emphasis on disaster recovery. Moreover, the NIST cybersecurity framework underscore the importance of preparing for incidences of disasters to improve the prospects of recovery. The framework contributes toward the early adoption of DRaaS solutions because it highlights disaster recovery planning as a key component of the organization’s resilience. In Europe, the Global Data Protection Regulation prescribes strict penalties to companies that fail to guarantee the availability and integrity of data during disasters. The need to adopt DRaaS solutions is further compounded by the need to reduce the risks associated with cloud adoption.

Disaster Recovery as a Service (DRaaS) Market Dynamics

Drivers

-

The increasing migration to cloud environments drives demand for scalable and flexible DRaaS solutions.

-

The surge in cyberattacks, like ransomware, fuels the need for robust disaster recovery services to ensure business continuity.

-

Strict regulations, such as GDPR, push organizations to adopt DRaaS to meet disaster recovery requirements.

One of the main drivers of the Disaster Recovery as a Service market is the increasing prevalence of sophisticated cyberattacks, namely ransomware. Ransomware attacks have surged dramatically in recent years, with a 2023 report by SonicWall noting a 62% year-over-year increase in ransomware attacks globally. They target critical infrastructure, government agencies, and companies of all sizes alike, causing operational halts, data loss, and financial damage. The 2021 Colonial Pipeline ransomware attack, for instance, has halted a significant portion of the U.S. fuel supply for days, underlining the need for companies to maintain exhaustive disaster recovery plans. For instance, the service allows businesses to efficiently safeguard their data and switch these during such breaches, thereby minimizing the time required for the recovery processes. In addition to that, a 2023 IBM Security survey has indicated that the cost of an average data breach has amounted to $4.45 million. As such, organizations that do not maintain effective disaster recovery solutions risk suffering from months of downtime, while losing sensitive data and their reputations. DRaaS helps mitigate these risks by providing near-instant recovery capabilities, ensuring that businesses can quickly resume operations following an attack.

Restraints:

-

Fear of data breaches in third-party cloud environments raises hesitations in DRaaS adoption.

-

Limited bandwidth and latency in some regions hinder the performance of DRaaS during data recovery.

One of the main concerns of organizations that implement the DRaaS solution is the vulnerability and security risks of sensitive data that are being stored in third-party clouds. Because valuable information is being processed and stored off-premises, the danger of a data leak increases, especially in highly regulated sectors like finance and healthcare. According to IBM Security’s 2023 average global cost of a data breach report of $4.45 million and the results of the Cloud Security Alliance survey that show 63% of companies worrying about cloud data security most in the event of utilizing cloud services.

Disaster Recovery as a Service (DRaaS) Market Segment Analysis

By Deployment

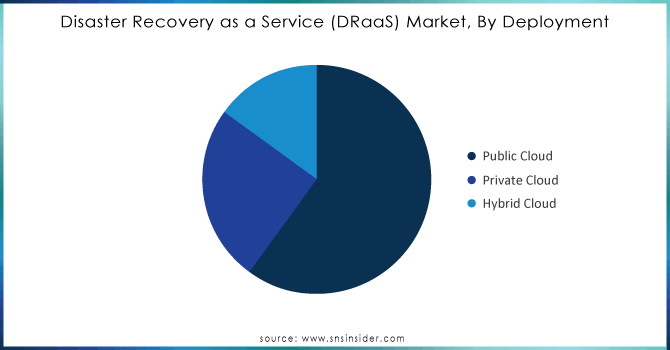

The public cloud segment held over 65% market share in 2023. That will remain the leading offering during the forecast period. The reasons include the solution’s low cost, scalability, and relative ease of implementation, making it popular with both small and medium-sized businesses and large corporations. At the same time, the hybrid cloud segment is expected to grow at the fastest CAGR, as more and more entities start demanding greater versatility and control. The solution serves as a compromise between a private and a public cloud, creating a more reliable data storage option with some level of scalability. Government statistics from the U.S. National Institute of Standards and Technology (NIST) indicate that 70% of enterprises are expected to adopt hybrid cloud models by 2027, further accelerating the growth of this segment.

Need any customization research/data on Disaster Recovery as a Service (DRaaS) Market - Enquiry Now

By End-Use

The Banking, Financial Services, and Insurance segment held more than 22% of the revenue share in the DRaaS market in 2023. The BFSI industry has increasingly favoured disaster recovery solutions to protect their customer’s data, abide with the government’s regulations and laws, and ensure the continued operations after a disaster. The banking sector in the U.S. has had to operate under the stringent regulations of foreign governments as in the case of the Sarbanes-Oxley Act. On the other hand, in Europe, the European Banking Authority has laid out its framework to guide banking institutions in regard to outsourcing. the IT & telecommunications segment is projected to grow at the fastest CAGR during the forecast period. According to the Telecommunications Regulatory Authority, data handled by telecommunications companies increase by 25% annually. Moreover, the most recent digital transformation in the IT sector has become the most significant pivot to the deployment of DRaaS solutions.

Regional Dominance

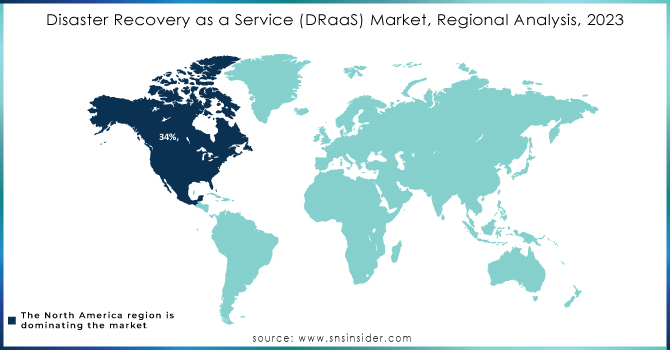

North America dominated the global DRaaS market in 2023, having a market share of around 34%, according to the U.S. Department of Commerce. The region’s lead is significant due to the high rate of cloud computing penetration as well as the increased frequency of cyberattacks and natural disasters. The U.S. government in collaboration with the Cybersecurity and Infrastructure Security Agency had been actively conducting disaster recovery initiatives for the improvement of the critical infrastructure of the country. Additionally, the presence of the risk-based regulatory standards in the U.S. and Canada is instrumental for the drive toward DRaaS platforms, such as the Federal Risk and Authorization Management Program. North America’s growth is also facilitated by a significant IT infrastructure base and the presence of notable cloud service providers, including Amazon Web Services, and Microsoft Azure. At the same time, Europe is predicted to grow at a moderate pace driven by the requirements of compliance with GDPR and increasing investments into the cloud infrastructure of the governments and enterprises.

Latest News in DRaaS Market

-

July 2024, The US Department of Homeland Security announced the new $1.2 billion initiative to develop the disaster recovery infrastructure across the federal government departments. The program will focus on the integration of advanced disaster recovery as a service solution to reduce the risks associated with cyberattacks and natural disasters.

-

April 2024, The National Cyber Security Centre in the UK announced the new partnership focusing on the cooperation with major cloud providers to work on the development of the national, UK’s country-wide disaster recovery framework to help avoid the downtime the businesses face in case of cyberattacks and infrastructure failures.

-

In February 2024, Cohesity teamed up with Veritas in developing advanced data security and management solutions as part of the companies’ R&D initiatives to provide customers with groundbreaking services.

-

In December 2023, 11:11 Systems introduced its new DR service, 11:11 DRaaS for Azure. The latest disaster recovery as a service offering was tailored specifically for use in the Microsoft Azure cloud, providing universal access and highly customizable DR plans.

-

In October 2023, Veeam Service Provider Console was introduced as a backup as a service solution for Microsoft Azure and Microsoft 365, allowing for the efficient management of backups in any organization.

Key Players

-

IBM Corporation (IBM Cloud Disaster Recovery, IBM Resiliency Orchestration)

-

Microsoft Corporation (Azure Site Recovery, Microsoft Hyper-V Replica)

-

Amazon Web Services (AWS) (AWS Elastic Disaster Recovery, AWS Backup)

-

VMware, Inc. (VMware vSphere Replication, VMware Site Recovery Manager)

-

Sungard Availability Services (Recover2Cloud, Managed Recovery Program)

-

Acronis International GmbH (Acronis Cyber Protect, Acronis Disaster Recovery)

-

Zerto (Zerto Virtual Replication, Zerto Cloud Continuity Platform)

-

Veeam Software (Veeam Backup & Replication, Veeam Cloud Connect)

-

Dell Technologies (Dell EMC RecoverPoint, Dell EMC PowerProtect)

-

Cisco Systems, Inc. (Cisco UCS, Cisco HyperFlex)

-

Carbonite, Inc. (Carbonite Server Backup, Carbonite Endpoint Backup)

-

Arcserve (Arcserve UDP Cloud Direct, Arcserve Continuous Availability)

-

Axcient, Inc. (Axcient Fusion, Axcient Replibit)

-

Datto, Inc. (Datto SIRIS, Datto ALTO)

-

TierPoint (TierPoint Managed Disaster Recovery, TierPoint Cloud to Cloud Recovery)

-

iland Internet Solutions (iland Secure DRaaS, iland Secure Cloud Console)

-

IBM Resiliency Services (IBM Business Continuity, IBM Cyber Resilience Services)

-

Flexential (Flexential DRaaS, Flexential Cloud)

-

InterVision (InterVision Disaster Recovery, InterVision Cloud Recovery)

-

Expedient (Expedient Push Button DR, Expedient Enterprise Cloud) and others

| Report Attributes | Details |

| Market Size in 2023 | USD 11.7 Billion |

| Market Size by 2032 | USD 76.0 Billion |

| CAGR | CAGR of 23.1 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments |

• By Service Type (Self-service DRaaS, Assisted DRaaS, Managed DRaaS) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles |

IBM Corporation, Microsoft Corporation, Amazon Web Services (AWS), VMware, Inc., Sungard Availability Services, Acronis International GmbH, Zerto, Veeam Software, Dell Technologies, Cisco Systems, Inc., Arcserve, Axcient, Inc., Datto, Inc. |

| Key Drivers | • The increasing migration to cloud environments drives demand for scalable and flexible DRaaS solutions. • The surge in cyberattacks, like ransomware, fuels the need for robust disaster recovery services to ensure business continuity |

|

Restraints |

•Fear of data breaches in third-party cloud environments raises hesitations in DRaaS adoption |