Forensic Accounting Services Market Report Scope & Overview:

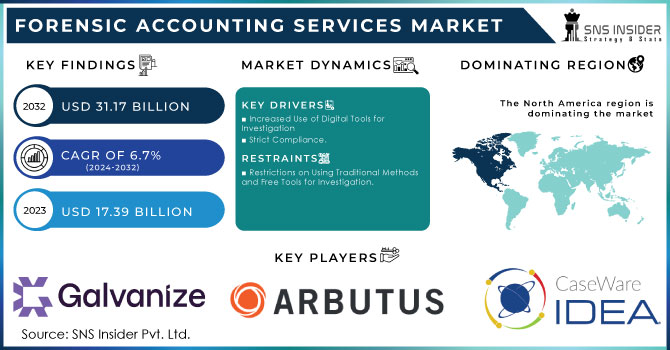

The Forensic Accounting Services Market Size was valued at USD 13.79 Billion in 2023 and is expected to reach USD 25.89 Billion by 2032 and grow at a CAGR of 7.31% over the forecast period 2024-2032.

The Market is growing rapidly due to rising corporate fraud, financial crimes, and regulatory compliance needs. Industries like banking, insurance, law enforcement, and government are leveraging forensic accounting to prevent fraud and support litigation. Advanced technologies such as AI, big data, blockchain, and machine learning enhance fraud detection and risk assessment. Leading firms like Deloitte, PwC, KPMG, CaseWare IDEA, and OpenText are expanding AI-driven forensic solutions. Increased cybercrime, stricter regulations, and corporate governance reforms drive market demand. With growing investments in forensic technology and fraud prevention, forensic accounting is becoming essential for due diligence, ensuring transparency and compliance.

Get More Information on Forensic Accounting Services Market - Request Free Sample Report

Market Dynamics

Key Drivers:

-

Increasing Corporate Fraud and Regulatory Compliance Requirements Propel the Forensic Accounting Services Market Growth

The rising incidences of corporate fraud, financial crimes, and money laundering have fueled the demand for forensic accounting services. Governments and financial regulators worldwide are implementing stricter compliance laws, anti-money laundering (AML) regulations, and financial reporting standards, compelling organizations to adopt forensic accounting solutions. With the growing complexity of financial transactions, mergers, acquisitions, and tax compliance, businesses are increasingly relying on forensic accountants to identify financial irregularities, conduct fraud investigations, and mitigate risks.

Moreover, high-profile corporate scandals and financial misstatements have intensified the need for transparent auditing and fraud prevention frameworks. Companies are leveraging AI-driven forensic tools, blockchain-based audits, and predictive analytics to strengthen their fraud detection mechanisms. Industries such as banking, insurance, government, and law enforcement are the primary adopters of forensic accounting solutions, ensuring compliance with evolving regulatory frameworks. This increasing focus on financial transparency and risk mitigation is driving the rapid growth of the forensic accounting services market.

Restraint:

-

High Cost of Forensic Accounting Services Limits Adoption Among Small and Medium-Sized Enterprises (SMEs)

Despite the growing importance of forensic accounting, the high cost of forensic investigations, auditing tools, and compliance software poses a significant challenge, especially for SMEs and startups. Hiring forensic accountants or outsourcing forensic services can be expensive, making it difficult for smaller businesses to invest in fraud detection solutions.

Additionally, advanced forensic technologies such as AI-powered fraud analytics, blockchain auditing, and big data analysis tools require substantial financial investment, infrastructure, and skilled professionals, further increasing costs. Many organizations opt for traditional auditing methods rather than investing in forensic accounting solutions due to budget constraints. Moreover, forensic investigations can be time-consuming and resource-intensive, adding to operational expenses. The lack of affordable forensic accounting solutions for small businesses restricts market penetration, as larger enterprises remain the primary users. Addressing cost-related concerns through scalable, cost-effective forensic solutions could help drive broader adoption across diverse industry verticals.

Opportunity:

-

Integration of AI, Big Data, and Blockchain Enhances Efficiency in Forensic Accounting Services

The integration of artificial intelligence (AI), big data analytics, and blockchain technology is revolutionizing forensic accounting services by improving fraud detection, risk assessment, and compliance auditing. AI-powered tools can analyze vast amounts of financial data, identify anomalies, and detect fraudulent activities in real-time, reducing human error and investigation time. Big data analytics enables forensic accountants to track financial transactions across global networks, strengthening fraud prevention mechanisms.

Meanwhile, blockchain technology offers a transparent and immutable ledger, ensuring financial records remain secure and tamper-proof. Leading forensic firms, including Deloitte, PwC, and KPMG, are adopting AI-driven forensic tools and blockchain auditing systems to enhance financial transparency and fraud detection capabilities. The growing demand for automated forensic solutions presents a significant opportunity for market expansion, enabling businesses to adopt cost-effective and efficient forensic accounting practices that comply with evolving financial regulations and corporate governance standards.

Challenge:

-

Shortage of Skilled Forensic Accountants and Experts Hampers Market Growth

The forensic accounting services market faces a significant talent gap, as there is a shortage of qualified forensic accountants, fraud examiners, and forensic auditors with expertise in handling complex financial investigations. The increasing use of AI, machine learning, and blockchain in forensic accounting requires professionals with technical proficiency and analytical skills, but there is a limited workforce with the necessary qualifications. Many organizations struggle to find trained forensic specialists who can interpret forensic data, analyze financial discrepancies, and provide litigation support.

Furthermore, forensic accounting requires certifications such as Certified Fraud Examiner (CFE), Chartered Accountant (CA), and Certified Forensic Accountant (CFA), which demand extensive training and experience. The lack of specialized educational programs and hands-on training in forensic accounting technologies further contributes to the talent shortage. To bridge this gap, industry leaders are investing in training programs, AI-driven forensic platforms, and collaborative initiatives to develop the next generation of forensic accounting professionals.

Segments Analysis

By Component

In 2023, the Services segment dominated the Forensic Accounting Services Market, accounting for 54% of total revenue due to the increasing demand for fraud investigation, litigation support, risk assessment, and regulatory compliance consulting. Companies and government agencies rely on forensic accounting firms to detect financial irregularities, conduct in-depth forensic audits, and ensure adherence to evolving financial regulations. Leading firms such as Deloitte, PwC, and KPMG have expanded their forensic services portfolio, integrating AI-driven forensic analytics, blockchain-based audit trails, and predictive fraud detection tools.

For instance, PwC launched an AI-powered forensic investigation tool in 2023, enhancing real-time fraud detection and transaction monitoring capabilities. Similarly, Deloitte introduced a blockchain forensic solution to improve the accuracy of financial fraud investigations.

The rise in cyber fraud, money laundering cases, and corporate scandals has further fueled demand for forensic accounting services. Additionally, forensic accounting plays a critical role in mergers and acquisitions, bankruptcy investigations, and compliance auditing. The adoption of cloud-based forensic solutions and data analytics services has further strengthened the segment’s growth.

By End-user

In 2023, the Banking and Insurance segment dominated the Forensic Accounting Services Market, accounting for 38% of total revenue, driven by the rising cases of financial fraud, money laundering, and regulatory compliance requirements. Banks and insurance firms are increasingly investing in forensic accounting solutions to detect fraudulent transactions, prevent cybercrime, and ensure adherence to stringent regulations such as AML (Anti-Money Laundering) laws, KYC (Know Your Customer) norms, and IFRS (International Financial Reporting Standards). Leading financial institutions are partnering with forensic accounting firms to enhance fraud detection and risk mitigation.

Deloitte launched an AI-driven fraud analytics platform in 2023, offering real-time transaction monitoring and anomaly detection. Similarly, PwC introduced a blockchain-powered forensic solution to improve transparency in financial audits and claim assessments.

With the increasing adoption of AI, machine learning, and big data analytics, forensic accounting is playing a crucial role in strengthening financial security and operational efficiency in the banking and insurance sectors. The rise of digital banking, mobile payments, and cryptocurrency transactions has further intensified the need for advanced forensic investigation services.

The Law Enforcement Agencies segment is experiencing the fastest growth in the Forensic Accounting Services Market, with a CAGR of 8.24% during the forecast period, driven by the increasing need for financial crime investigations, cyber fraud detection, and asset recovery in criminal cases. Governments and regulatory bodies are actively adopting forensic accounting solutions to combat financial crimes, terrorism financing, and corruption. Law enforcement agencies rely on forensic accountants to track illicit financial activities, analyze money laundering schemes, and support legal proceedings.

With the rise of cyber-enabled financial crimes, ransomware attacks, and tax evasion cases, forensic accounting has become a crucial asset for law enforcement. Additionally, the growing collaboration between forensic accounting firms, cybersecurity agencies, and government bodies is accelerating the adoption of AI-driven fraud detection solutions.

Regional Analysis

In 2023, North America dominated the Forensic Accounting Services Market, accounting for an estimated 41% market share, driven by the region’s stringent financial regulations, high fraud incidence rates, and strong presence of forensic accounting firms. The U.S. and Canada are at the forefront, with regulatory bodies such as the Securities and Exchange Commission (SEC), Financial Crimes Enforcement Network (FinCEN), and Public Company Accounting Oversight Board (PCAOB) enforcing strict financial compliance measures.

Additionally, the rise in cyber-enabled financial crimes, corporate scandals, and increased litigation cases has fueled the demand for forensic accounting services. The North American market is expected to maintain its dominance, driven by technological advancements and regulatory enforcement actions in financial crime investigations.

Asia Pacific emerged as the fastest-growing region in the Forensic Accounting Services Market in 2023, with an estimated CAGR of 9.5%, driven by rising financial fraud cases, regulatory reforms, and rapid digital transformation. Countries such as China, India, Japan, and Singapore are experiencing a surge in corporate fraud investigations, cybercrime incidents, and money laundering activities, prompting businesses and governments to invest heavily in forensic accounting services.

In 2023, KPMG launched an AI-powered forensic risk assessment tool in India, strengthening fraud detection in the banking and corporate sectors. Similarly, Deloitte introduced blockchain-based forensic audit solutions in China, improving transparency in financial transactions. The increasing adoption of cloud-based forensic tools, AI-driven fraud analytics, and big data solutions is further driving market growth. With expanding financial sectors, stricter anti-fraud regulations, and growing awareness of financial crime risks, Asia Pacific is poised to become a key player in the forensic accounting landscape, with significant investment opportunities in the coming years.

Need any customization research on Forensic Accounting Services Market - Enquiry Now

Key Players

Some of the major players in the Forensic Accounting Services Market are:

-

Galvanize (ACL Analytics, HighBond)

-

CaseWare IDEA (IDEA Data Analysis Software, CaseWare Monitor)

-

Arbutus Software Inc. (Arbutus Analyzer, Arbutus Connect)

-

Fulcrum Management (Fulcrum Audit, Fulcrum Risk Management)

-

Nuix Cygna Labs Corp (Nuix Workstation, Nuix Investigate)

-

e-fense (Helix3 Pro, Live Response)

-

Passware (Passware Kit Forensic, Passware Encryption Analyzer)

-

OpenText (EnCase Forensic, OpenText Axcelerate)

-

Cellebrite (UFED Cloud Analyzer, Cellebrite Pathfinder)

-

Sama Audit Systems & Software Pvt Ltd. (Sama Audit Tool, Sama Fraud Detection System)

-

Deloitte (Deloitte TrueVoice, Deloitte Radar)

-

PwC (Halo Forensics, PwC Fraud Detection Analytics)

-

Ernst & Young (EY Virtual Analytics Infrastructure, EY Helix)

-

Grant Thornton (Fraud Analytics Solution, GT Forensic Technology)

-

BDO International (BDO Digital Forensics, BDO Fraud Analytics)

-

KPMG International (KPMG Discovery Radar, KPMG Forensic Data Analytics)

Recent Trends

-

May 2024: Galvanize introduced a new suite of AI-powered analytics tools designed to enhance forensic accounting capabilities, enabling auditors to detect anomalies and potential fraud more effectively.

-

September 2024: CaseWare extended the availability of its Environmental, Social, and Governance (ESG) reporting application to the Netherlands, Belgium, Luxembourg, and Denmark, supporting firms with sustainability reporting across all stages.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 13.79 Billion |

| Market Size by 2032 | US$ 25.89 Billion |

| CAGR | CAGR of 7.31 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Solution - Forensic Tools/Software, Audit/Accounting Software, Services) • By End-User (Banking and Insurance, Law Enforcement Agencies, Government, Accounting Firm) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Galvanize, CaseWare IDEA, Arbutus Software Inc., Fulcrum Management, Nuix Cygna Labs Corp, e-fense, Passware, OpenText, Cellebrite, Sama Audit Systems & Software Pvt Ltd., Deloitte, PwC, Ernst & Young, Grant Thornton, BDO International, KPMG International |