Legal Bill Review Software Market Key Insights:

Get More Information on Legal Bill Review Software Market - Request Sample Report

The Legal Bill Review Software Market Size was valued at USD 1.44 Billion in 2023 and is expected to reach USD 3.71 Billion by 2032, growing at a CAGR of 11.1% over the forecast period 2024-2032.

The Legal Bill Review Software Market is growing significantly due to the increasing complexity of legal billing requirements and the need for improved financial oversight. According to the United States Government Accountability Office, legal expenditures across federal agencies have grown 12% in the past two years, raising total costs to over $3 billion in 2022. It is essential to streamline these costs and ensure that compliance with legal standards is achieved to manage the budget effectively. In addition, the tools provide law firms and corporate legal departments the opportunity to review the invoices and audit them for compliance with fee agreements, which can lead to substantial cost savings. The development of the Legal Bill Review Software Market is further enhanced by the increasing pace of the industry's digitalization, which is partially fueled by government initiatives in the public and private sectors. For example, according to the Legal Services Corporation, almost 70% of legal aid organizations use technology to provide services currently. Meanwhile, the growing popularity of alternative fee arrangements between clients and legal service providers has generated the demand for billing arrangements that can be more complex than hourly billing but remain auditable and transparent.

A significant trend in the legal billing software market is the integration of automation into the bill review process. Automated analysis tools can quickly validate the billing of a legal firm, identifying whether the claims are valid without considerable manual oversight, leading to reductions in review times and a smaller amount of mistakes related to human error. This efficiency is vital for firms aiming to scale their operations while keeping costs under control. Cloud-based legal bill review solutions are also on the rise, providing flexible and scalable options for legal teams. This technology enables access from anywhere, enhancing collaboration and integration with other business tools particularly advantageous for global firms managing operations in various locations. The shift towards remote work and digital infrastructure underscores the importance of cloud solutions in legal technology strategies.

Market Dynamics

Drivers

-

Clients are demanding clearer billing practices, prompting law firms to adopt software that enhances transparency in legal costs and billing procedures.

-

Law firms are increasingly utilizing automation and AI to streamline the invoice review process, reduce manual workloads, and improve accuracy in billing.

-

The shift to hybrid work environments has amplified the need for cloud-based solutions, allowing legal professionals to manage billing remotely and collaboratively.

One of the primary drivers for the growth of the legal bill review software market is the increasing demand for transparency in legal billing practices. Clients, especially corporate entities, are becoming more discerning about legal costs, pushing law firms to adopt more transparent billing methods. According to a recent survey by the Association of Corporate Counsel (ACC), approximately 66% of in-house counsel expressed a strong preference for law firms that provide detailed billing practices, emphasizing the need for clear and itemized invoices. Transparency not only builds trust but also enhances client relationships, as clients can better understand the value they receive for their legal expenditures. For instance, firms like Norton Rose Fulbright have implemented innovative billing solutions that include detailed breakdowns of hours worked and specific tasks performed. This level of clarity allows clients to assess the efficiency and effectiveness of the legal services provided, ultimately fostering a more collaborative working relationship.

Moreover, the demand for transparency aligns with broader trends in business where stakeholders seek accountability and clarity in financial transactions. As clients increasingly hold law firms accountable for their billing practices, the adoption of legal bill review software becomes essential for ensuring compliance with client guidelines and maintaining a competitive advantage in the market. This shift is reflected in the growing number of law firms adopting automated solutions to meet these client demands effectively.

Restraints

-

The initial investment required for legal bill review software can be significant, which may deter smaller firms from adopting these solutions.

-

Many legal professionals may be reluctant to transition from traditional billing methods to automated systems, hindering the adoption of new technologies.

-

Legal firms are often cautious about cloud-based solutions due to potential data breaches and security vulnerabilities associated with sensitive client information.

There is a significant limitation to the development of the legal bill review software market, which is data security issues. In this regard, law firms handle highly sensitive information, which makes them an attractive target for cyberattacks. In addition, although most firms use cloud systems, it is concerning that the 2023 report of the International Legal Technology Association states that more than 60% of all law firms experienced a data breach or other cyber incident. Similarly, the American Bar Association highlights that nearly 29% of law firms considered data security one of the major concerns associated with the adoption of new technologies. Businesses may also have these fears regarding potential breaches as the General Data Protection Regulation and Health Insurance Portability and Accountability Act introduce heavy fines and penalties in case of a data breach. Consequently, firms may be reluctant to adopt automated billing systems due to fears that breaches will erode client loyalty and result in legal repercussions, hindering the adoption of billing innovations.

Market Segmentation Analysis

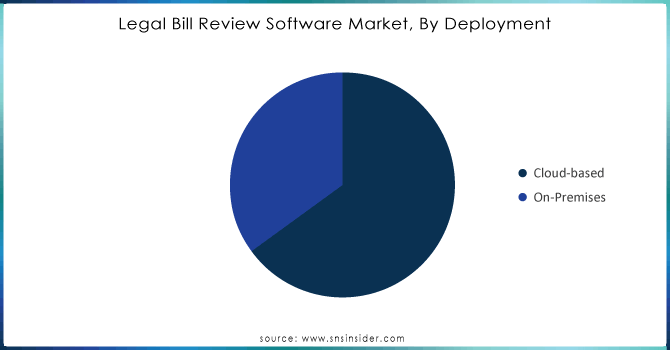

By Deployment

In 2023, the cloud-based segment dominated by accounting for 66% of the market share. The leading position of cloud solutions can be driven by the variety of benefits, cloud-based software is more cost-effective, allows to scale, and is more accessible to law specialists. As estimated by the Federal Cloud Computing Strategy report, the adoption of cloud technology helps federal agencies to reduce overall operational costs by 20-30%. Because the billing system is available from any point, it allows the billing agents to work remotely and to provide law specialists with more opportunities for collaboration. Besides, the U. S. Department of Justice has already approved several cloud products to implement in the legal sector to enhance the processes of work. Therefore, many law firms decide to transfer their billing system to cloud software. Finally, at present, AI and machine learning technologies are intensively embedded in cloud platforms; therefore, cloud solutions provide even more opportunities to automate time-consuming routine tasks such as invoice loading as well as error tracking. As the technology continues to develop rapidly, billing systems that are incorporated into the cloud look more promising, as they are capable of adopting modern solutions.

Need Any Customization Research On Legal Bill Review Software Market - Inquiry Now

By End-Use

The law firms segment held the largest revenue share 42% in 2023. This segment is expected to lead the market in the forecast period. This growth is driven by the rising rates of legal cases, and a demand to improve billing efficiency to boost profits. For instance, some U.S. government statistics suggest that the number of cases filed in federal courts has been rising by over 5% every year. Moreover, legal professionals are keen on using software that contributes to law firms’ productivity and compliance with various rules and regulations.

Conversely, the government agencies segment is projected to register the fastest compound annual growth rate (CAGR) from 2024 to 2032. Meanwhile, government agencies are increasingly using legal bill review software to optimize spending, as the OMB data suggests that the recent U.S. fiscal budgets have been allocating over $1.5bn to legal services. As government entities face heightened scrutiny over their spending, the implementation of specialized software for bill review will become essential for ensuring fiscal responsibility and accountability.

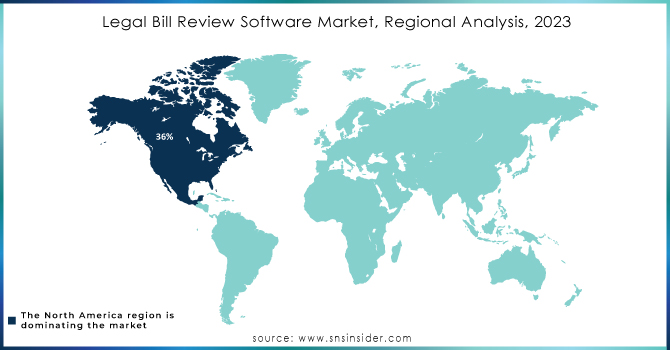

Regional Analysis

In 2023, North America led the legal bill review software market and accounts for a considerable market share, 36%. North America could emerge as a leader in this segment owing to its advanced legal structure, the tech-friendly approach of law firms, and regulations that facilitate the adoption of legal tech solutions. According to the information provided by the American Bar Association, up to 80% of law firms have implemented technology into the billing process. Moreover, the region’s focus on enhancing efficiency and cutting the costs of legal support can be a driving force behind the growing use of bill review software. This mirrors the need for clarity and efficiency when handling legal costs, predominantly in the U.S. Law firms are increasingly choosing to use automated and cloud-based solutions to maximize the utility of billing while also ensuring that they meet their clients’ demands. The request stems from a growing need to access billing information remotely and facilitate a discipline that catalyzes collaboration among legal entities. The U.S. legal bill review software market is expected to grow at a significant CAGR. Law firms are incorporating AI solutions and automation, which marks the increased use of cloud-based software for hybrid remote working and remote access to billing details.

Conversely, the Asia-Pacific region is anticipated to experience the fastest CAGR from 2024 to 2032, fueled by the increasing adoption of legal technology among emerging economies. Government initiatives in countries like India and China are pushing for digitalization within the legal sector, with recent policies aimed at modernizing legal practices. For instance, the Indian government allocated over $200 million for legal technology projects in its latest budget. As firms in the Asia-Pacific region recognize the benefits of legal bill review software in streamlining their billing processes, market growth in this area is expected to accelerate significantly.

Recent Developments

-

In 2024 August, the U.S. Department of Justice initiated a program that encourages government agencies to start using legal bill review software for the optimal application of their legal spending. This initiative is part of a broader effort to enhance financial accountability and efficiency across federal agencies, aiming to reduce legal expenditures by 15% over the next five years.

-

ELM Amplify User Conference. The primary information that was disclosed there touched upon unlocking the power of AI technology in legal bill review. It is worth mentioning that this session comprised a number of events since there were leaders from the industry who discussed the ways they had managed to be highly successful using AI and managed services in legal requirements.

-

In April 2024, Brightflag released new features. Thus, the first one Invoice Summaries – can help provide a seamless summary that is going to facilitate the invoice approval process. Furthermore, the Ask Brightflag button can also make the system of legal matter administration more intuitive, which implies that no manual sendings will be required here.

-

In September 2023, Wolters Kluwer worked with the Legal View Bill analyzer service to develop their Flex platform. Thus, now customers can upload the available invoices and Bill Analyzer will use the data stored in the Billing Guidelines to conduct an invoice review. Here, it is necessary to add that the legal invoice intelligence is based on the statistical analysis of a huge number of legal invoices.

Key Players

-

Wolters Kluwer (LegalVIEW BillAnalyzer, CheetahLaw)

-

Clio (Clio Manage, Clio Grow)

-

CosmoLex (CosmoLex Legal Practice Management, CosmoLex Accounting)

-

PracticePanther (PracticePanther, Panther Chat)

-

AbacusNext (AbacusLaw, TimeSolv)

-

Zola Suite (Zola Suite Legal Practice Management, Zola Billing)

-

Bill4Time (Bill4Time Time Tracking, Bill4Time Invoicing)

-

Rocket Matter (Rocket Matter Practice Management, Rocket Matter Time Tracking)

-

Timeslips (Timeslips Billing Software, Timeslips Premium)

-

MyCase (MyCase Billing, MyCase Client Portal)

-

Legal Files (Legal Files Case Management, Legal Files Billing)

-

SmartAdvocate (SmartAdvocate Case Management, SmartAdvocate Billing)

-

LexisNexis (Lexis+ Billable Hours, LexisNexis Practice Management)

-

Legal Tracker (Legal Tracker Bill Review, Legal Tracker Spend Management)

-

Everlaw (Everlaw Review, Everlaw Billing)

-

TrialDirector (TrialDirector 360, TrialDirector iPad)

-

CaseFox (CaseFox Billing, CaseFox Time Tracking)

-

eBillingHub (eBillingHub for Law Firms, eBillingHub for Clients)

-

TimeSolv (TimeSolv Billing, TimeSolv Time Tracking)

-

PCLaw (PCLaw Billing, PCLaw Practice Management), and others in final Report.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 1.44 Billion |

| Market Size by 2032 | USD 3.71 Billion |

| CAGR | CAGR of 11.1% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Deployment (On-Premises, Cloud-based) • By End Use (Corporate Legal Departments, Law Firms, Government Agencies, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Wolters Kluwer, Clio, CosmoLex, PracticePanther, AbacusNext, Zola Suite, Bill4Time, Rocket Matter, Timeslips, MyCase, Legal Files, SmartAdvocate, LexisNexis, Legal Tracker, Everlaw, TrialDirector, CaseFox, eBillingHub, TimeSolv, PCLaw. |

| Key Drivers | • Clients are demanding clearer billing practices, prompting law firms to adopt software that enhances transparency in legal costs and billing procedures. • Law firms are increasingly utilizing automation and AI to streamline the invoice review process, reduce manual workloads, and improve accuracy in billing. |

| RESTRAINTS | • The initial investment required for legal bill review software can be significant, which may deter smaller firms from adopting these solutions. |