Industrial Ethernet Market Report Scope & Overview:

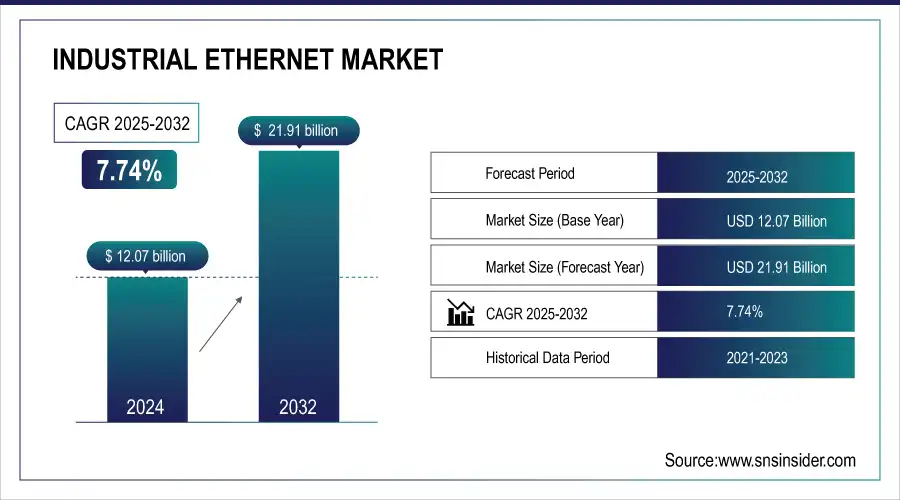

The Industrial Ethernet Market was valued at USD 12.07 billion in 2024 and is expected to reach USD 21.91 billion by 2032, growing at a CAGR of 7.74% from 2025-2032.

To Get more information on Industrial Ethernet Market - Request Free Sample Report

The Industrial Ethernet market is witnessing increased adoption across industries like manufacturing, automotive, energy, and healthcare, driven by automation and real-time data needs. Regional infrastructure expansion is strongest in North America and Europe, while Asia-Pacific sees rapid growth due to smart factory initiatives. Cybersecurity threats are rising, particularly in industrial control systems, prompting higher investments in security measures. Additionally, growing data traffic from automation and cloud analytics is driving demand for higher bandwidth and reliable network solutions. The report also highlights trends such as AI integration, Time-Sensitive Networking (TSN), and the rise of private 5G networks complementing Industrial Ethernet.

Market Size and Forecast

-

Market Size in 2024: USD 12.07 Billion

-

Market Size by 2032: USD 21.91 Billion

-

CAGR: 7.74% from 2025 to 2032

-

Base Year: 2024

-

Forecast Period: 2025–2032

-

Historical Data: 2021–2023

Industrial Ethernet Market Trends

-

Rising demand for seamless communication in industrial automation is driving the industrial Ethernet market.

-

Integration with IIoT, AI, and cloud platforms is enhancing real-time data transfer and process efficiency.

-

Growing adoption in manufacturing, energy, automotive, and logistics sectors is boosting market growth.

-

Increasing need for scalable, secure, and high-speed networking solutions is shaping adoption trends.

-

Expansion of Industry 4.0 initiatives and smart factories is fueling deployment.

-

Advancements in deterministic Ethernet and time-sensitive networking (TSN) are improving reliability and latency.

-

Collaborations between automation vendors, network providers, and enterprises are accelerating innovation and large-scale implementation.

Industrial Ethernet Market Growth Drivers:

-

Growing adoption of Industry 4.0 and industrial automation is fueling the demand for high-speed and reliable Industrial Ethernet networks.

The rising need for automation among various industries , like manufacturing, automotive, energy, etc. Ethernet-based networks are earning much attention due to the rise of Industry 4.0 initiatives that focus on smart factories, real-time data exchange, and harmonized communication of all kinds of industrial devices. As such, low-latency and high-speed data transfer becomes a new solution to initiate Industrial Ethernet has entirely taken over the fieldbus systems, adopted cooling/contact technologies similar to those. Also, the development of Time-Sensitive Networking enhances the reliability and synchronization of network systems, thus turning Industrial Ethernet into a key element in today's and future factories. Industrial IoT and the rising reliance on cloud-based analytics increase the need for resilient and scalable Ethernet networks.

Industrial Ethernet Market Restraints:

-

High initial investment and complexity in integrating Industrial Ethernet with legacy systems hinder market adoption.

The low initial cost of Industrial Ethernet would facilitate adoption, but so many years as high initial costs from network infrastructure, Hardware, and software integration inhibits the adoption of Industrial Ethernet. For many industries, and particularly SMEs, the gradual migration from traditional fieldbus systems to Ethernet is rendered well-nigh impossible as it requires entirely new cabling, routers with higher functionality to support smarter devices and more security. Furthermore, integrating Industrial Ethernet with existing systems can prove to be somewhat complex, which means more trained personnel with increased costs in operations. Network customizations needed due to the specific needs of industry remains another hurdle for implementation, stalling mass adoption in price-sensitive markets.

Industrial Ethernet Market Opportunities:

-

The integration of 5G and edge computing enhances Industrial Ethernet capabilities for real-time industrial communication.

Industrial Ethernet is also undergoing new growth by converging with new technologies like 5G and edge computing. Besides Industrial Ethernet, 5G network adds ultra-reliable low-latency communication capabilities to smart factories and automated production lines. By allowing data to be processed in real time, at the edge of the network, edge computing reduces reliance on cloud infrastructure and improves response times. These Innovations Improve Performance for Industrial Ethernet, and Help Make these Networks More Efficient and Better Integrated for Mission Critical Applications. Additionally, government programs promoting smart manufacturing and digital transformation are fueling investment in industrial networking capabilities.

Industrial Ethernet Market Challenge:

-

Rising cybersecurity threats in industrial networks pose significant risks to data integrity and operational continuity.

Industrial Ethernet networks are being increasingly connected, providing a wider attack surface for emerging cybersecurity risks. Cyberattacks targeting industrial control systems can have dire consequences for businesses, and the threats ICS face, including ransomware, data breaches, and unauthorized access, can severely disrupt their operations. Cloud services and IIoT devices add points of entry to the attack surface, compelling industries to pour resources into strong security frameworks, firewalls, intrusion detection systems, and network segmentation, which are all inevitably breached. One more challenge faced by businesses is compliance with IEC 62443, NIST, and other cybersecurity regulatory standards. One of the major challenges in adopting Industrial Ethernet is to keep the network operational and seamless even while insuring against the security threats described above.

Industrial Ethernet Market Segment Analysis

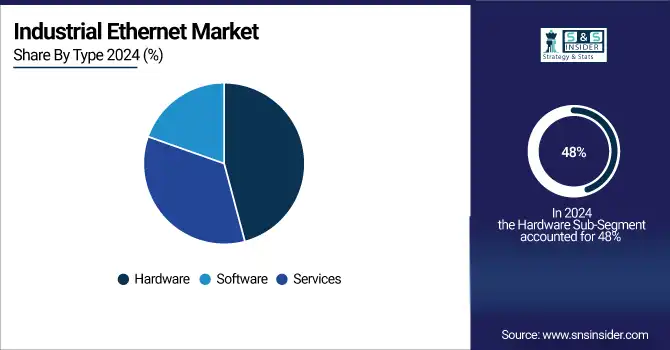

By Type, Hardware segment dominated the Industrial Ethernet Market with the largest revenue share, Software segment is projected to grow fastest during the forecast period.

In 2024, the hardware segment dominated the market and accounted for 48% of revenue share. Hardware that has to work in industrial environments needs to be very rugged and able to withstand harsh conditions — high temperatures, humidity, dust, and vibrations. Components like industrial ethernet switches, routers, and cables are built on very rigorous specifications to deliver consistent network performance in harsh environments. Durability and reliability of hardware components are of utmost importance to prevent any network failure which could prove costly for you in terms of downtime or even safety hazards.

The software segment is expected to see significant growth during the forecast period. As industrial networks become more complex and larger than ever, automated management and monitoring of the network infrastructure is required. This makes comprehensive network visibility, diagnostics, and real-time monitoring tools absolutely essential to maintain optimum network performance and promptly respond to any issues.

By Protocol, PROFINET protocol segment dominated the Industrial Ethernet Market, EtherCAT is expected to grow at the fastest rate.

In 2024, The PROFINET protocol segment dominated the market and accounted for significant revenue share. The robustness and real-time functions of PROFINET have proven their worth, especially for industrial applications with high demands. It has to provide real-time data transfer and synchronization at a high level of precision, as required in applications like motion control and process automation. PROFINET is the dominant form of industrial Ethernet, which is due to the high-level performance and reliability characteristics it has along with the need for rigorous control over industrial processes in various industries.

EtherCAT protocol segment is anticipated to grow at the fastest rate during the forecast period. EtherCAT is a very high performance and highly efficient real-time control technology. Its distinct feature is the ability to process data on-the-fly, meaning that data is processed while going through the network nodes, providing very low latencies and high synchronization accuracy.

By End-Use, Automotive & Transportation segment dominated the Industrial Ethernet Market, Electrical & Electronics segment is projected to grow at the fastest CAGR.

In 2024, the Automotive & Transportation segment dominated the market and held the largest market revenue share. Following the move of the automotive industry to automation and digitalisation on the manufacturing level, industrial Ethernet has largely been adopted. automotive manufacturing facilities have more advanced technologies such as robotics, automated guided vehicles, and real-time data analytics that improve production efficiency, quality control, and flexibility. Such technologies require high-speed, reliable communication among many production stages to work effectively, and that is where Industrial Ethernet provides the infrastructure to exchange data seamlessly. How the demand for advanced communication networks is growing within the automotive sector with the emergence of electric and autonomous vehicles

The Electrical & Electronics segment is expected to register the fastest CAGR during the forecasted period. As electronic devices become smaller and more complex, their manufacturing processes require increasingly advanced automation and control technologies. These manufacturing methodologies require high-speed and reliable communication among machines, processes, and resources, and Industrial Ethernet provides the communication infrastructure to help ensure that the advanced manufacturing techniques are operating as efficiently as possible, producing high-quality products.

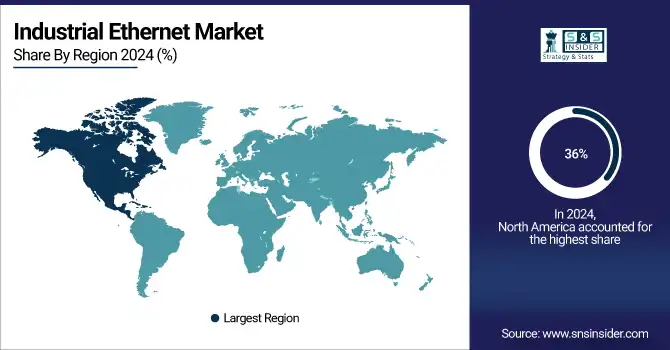

Industrial Ethernet Market Regional Analysis

North America Industrial Ethernet Market Insights

In 2024, North America dominated the market and accounted for 36% of revenue share. The North American market is spread among several key solution providers, including Rockwell Automation, Cisco Systems, and Belden Inc., that is coated with leading developers of the industrial Ethernet technologies and have wide distribution networks across the region. The constant innovation and the designing of new products as per the specific requirements of the industrial applications have increased the growth of the market.

Get Customized Report as per Your Business Requirement - Enquiry Now

Asia Pacific Industrial Ethernet Market Insights

Asia Pacific is anticipated to register the fastest CAGR in the industrial Ethernet market over the forecast period. The Asia Pacific region, particularly from a perspective of industrialization and urbanization, with countries like China, India, and other Southeast Asian countries, is witnessing a rapidly growing economic area. Such growth propels accelerating demand for advanced manufacturing technologies and automation, which requires a reliable industrial Ethernet solution.

Europe Industrial Ethernet Market Insights

Europe is witnessing robust growth in the Industrial Ethernet Market, driven by the increasing adoption of Industry 4.0, smart manufacturing, and automation across sectors. Strong presence of key players and government initiatives supporting digital transformation are accelerating deployment. Rising demand for real-time communication, improved efficiency, and secure networking in automotive, energy, and process industries further boost expansion, positioning Europe as a major contributor to global market growth.

Middle East & Africa and Latin America Industrial Ethernet Market Insights

The Industrial Ethernet Market in Middle East & Africa and Latin America is expanding steadily, supported by growing investments in oil & gas, energy, and manufacturing industries. Rising digital transformation initiatives and infrastructure modernization projects are fueling adoption. Demand for reliable, scalable, and secure networking solutions is increasing as industries focus on automation and efficiency, positioning both regions as emerging markets with significant growth potential in the coming years.

Industrial Ethernet Market Competitive Landscape:

Cisco Systems, Inc.

Cisco Systems is a global leader in networking, cybersecurity, and IT infrastructure solutions, serving enterprises, service providers, and governments worldwide. The company offers a broad portfolio, including Ethernet switches, routers, wireless solutions, and cloud-driven platforms that enable secure connectivity and digital transformation. With a strong emphasis on AI-driven networking and automation, Cisco plays a critical role in advancing enterprise and data center operations.

-

In November 2024, Cisco raised its annual revenue forecast, driven by heightened demand for networking products like Ethernet switches and routers, fueled by AI advancements.

Arista Networks, Inc.

Arista Networks specializes in cloud networking solutions for large data centers, enterprises, and high-performance computing environments. Its products include software-driven, scalable Ethernet switches designed for AI workloads, cloud platforms, and data-intensive applications. The company is recognized for its Extensible Operating System (EOS), which enhances automation and programmability, making it a key player in the AI-driven cloud networking space.

-

In December 2024, Arista Networks reported a 20% YoY revenue increase to $1.8 billion, fueled by AI data center switch demand, despite stock decline from conservative 2025 outlook.

Tejas Networks Limited

Tejas Networks is an India-based telecommunications equipment company specializing in optical networking products, broadband access solutions, and wireless technologies. Its offerings cater to telecom operators, internet service providers, utilities, and government organizations, enabling scalable and cost-effective connectivity. Tejas plays a pivotal role in bridging the digital divide through innovative, locally developed telecom solutions that support next-generation broadband and digital infrastructure initiatives globally.

-

In March 2024, Tejas Networks signed an MoU with Telecom Egypt and partners to enhance Egypt’s broadband infrastructure, aiming to expand internet access and technological expertise.

Key players

Some of the Industrial Ethernet Market Companies

-

Cisco

-

Rockwell Automation

-

Moxa

-

Phoenix Contact

-

Schneider Electric

-

ABB

-

Hewlett Packard Enterprise (HPE)

-

Omron

-

Advantech

-

Beckhoff Automation

-

General Electric (GE)

-

Honeywell

-

Siemens Healthineers

-

Hitachi Industrial Equipment Systems

-

Toshiba Infrastructure Systems & Solutions

-

WAGO Kontakttechnik GmbH

-

Weidmüller Interface GmbH & Co. KG

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 12.07 Billion |

| Market Size by 2032 | USD 21.91 Billion |

| CAGR | CAGR of 7.74% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Hardware, Software, Services.) • By Protocol (EtherCAT, EtherNet/IP, PROFINET, POWERLINK, SERCOS III, CC-Link IE) • By End-Use (Automotive & Transportation, Oil & Gas, Energy & Power, Food & Beverages, Chemical & Fertilizer, Electrical & Electronics, Aerospace & Defense, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Siemens, Cisco, Rockwell Automation, Belden, Moxa, Phoenix Contact, Schneider Electric, ABB, Hewlett Packard Enterprise (HPE), Huawei, Omron, Advantech, Beckhoff Automation, General Electric (GE), Honeywell, Siemens Healthineers, Hitachi Industrial Equipment Systems, Toshiba Infrastructure Systems & Solutions, WAGO Kontakttechnik GmbH, Weidmüller Interface GmbH & Co. KG |