Cochlear Implant Market Key Insights:

Get More Information on Cochlear Implant Market - Request Sample Report

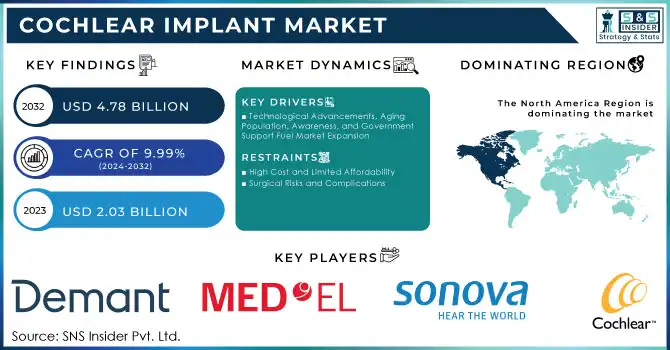

The Cochlear Implant Market Size was valued at USD 2.03 billion in 2023 and is expected to reach USD 4.78 billion by 2032 and grow at a CAGR of 9.99% over the forecast period 2024-2032.

The Cochlear Implant Market is experiencing substantial growth, driven by technological advancements, an aging global population, and increasing awareness about hearing loss treatment options. According to the World Health Organization (WHO), over 5% of the world’s population (around 430 million) people suffer from some kind of hearing loss, and this number is projected to rise significantly. Approximately 1.5 billion people are expected to be living with some form of hearing loss by 2050, making cochlear implants an essential solution for an expanding market.

Technological advancements in cochlear implants are a significant factor in this growth. The introduction of fully implanted cochlear implants, which eliminate the need for external components, is one such innovation driving interest in the market. These devices are expected to contribute to the increasing adoption of cochlear implants, with patients seeking a more discreet and comfortable option. Additionally, continuous improvements in sound quality, battery life, and wireless connectivity are further enhancing the functionality and user experience, thereby making cochlear implants more appealing to a wider range of people.

Pediatric cochlear implantation is a key area of market expansion. Studies show that over 90% of children who receive cochlear implants early in life experience significant improvements in speech and language development. As awareness of these benefits grows, early intervention is becoming more common, particularly in developed regions. The American Cochlear Implant Alliance (ACIA) 2023 reported that more than 58,000 children have received cochlear implants in the U.S. alone.

Government initiatives, expanded insurance coverage, and better reimbursement policies are also contributing to market growth. In the U.S., for example, Medicare and several private insurers now provide coverage for cochlear implants, making them more accessible to a broader population. The adoption of cochlear implants is also rising in emerging markets, particularly in the Asia-Pacific region, where improving healthcare infrastructure and growing disposable incomes are fueling demand.

Market Dynamics

Drivers

-

Technological Advancements, Aging Population, Awareness, and Government Support Fuel Market Expansion

The Cochlear Implant Market is being driven by several key factors, including technological advancements, an increasing aging population, rising awareness, and supportive government initiatives. Technological innovation is one of the most significant drivers, as cochlear implants have evolved from bulky devices to smaller, more efficient systems with enhanced sound quality. For instance, the development of fully implanted cochlear implants has eliminated the need for external components, offering patients a more discreet solution. Additionally, wireless connectivity, longer battery life, and improvements in sound processing algorithms are making cochlear implants more effective and user-friendly, further driving demand.

The aging global population is another major driver, as age-related hearing loss becomes more prevalent. According to the National Institute on Deafness and Other Communication Disorders (NIDCD), one in three adults between the ages of 65 and 74 experiences hearing loss, with the percentage increasing to half of those over 75. This growing demographic is increasing the demand for hearing solutions, including cochlear implants.

Increasing awareness about the benefits of early intervention, particularly in pediatric patients, is also propelling market growth. Studies have shown that 90% of children receiving cochlear implants before the age of 2 show substantial improvements in language development. As public awareness campaigns grow, more individuals are seeking early diagnosis and treatment for hearing loss.

Finally, supportive government policies, such as reimbursement coverage and expanded insurance options, are making cochlear implants more accessible. For example, in the U.S., Medicare and private insurance plans increasingly cover cochlear implant procedures, expanding access to a wider patient base. These factors are collectively contributing to the ongoing growth of the cochlear implant market.

Restraints

-

High Cost and Limited Affordability

Cochlear implants are expensive, and the cost of surgery, rehabilitation, and post-implantation care can be prohibitive for many patients, limiting market growth in lower-income regions.

-

Surgical Risks and Complications

Although generally safe, cochlear implantation involves surgery, which carries risks such as infection, device malfunction, and complications that can deter some patients from opting for the procedure.

Key Segmentation Analysis

By Age Group

In 2023, the adult segment dominated the cochlear implant market, accounting for a significant share. This dominance can be attributed to the increasing prevalence of age-related hearing loss among the aging population. As the global population continues to age, more adults are experiencing hearing impairment, driving the demand for cochlear implants. According to the National Institute on Deafness and Other Communication Disorders (NIDCD), nearly one in three adults between the ages of 65 and 74 experiences hearing loss, with the percentage increasing to over 50% in those over 75. Adults, particularly those above 65 years, are more likely to seek cochlear implants as a solution to age-related hearing loss, which has contributed to the adult segment’s substantial market share in 2023.

The fastest-growing segment during the forecast period was the pediatric age group. The growth of this segment can be attributed to increasing awareness about the benefits of early intervention in children with hearing loss. Cochlear implants provide children with the opportunity for early language and speech development, especially when implanted before the age of 2. Studies have shown that children receiving cochlear implants at an early age experience significant improvements in speech and language development, which is leading to a rise in demand for pediatric cochlear implants. Additionally, early diagnosis and treatment through newborn hearing screening programs are encouraging more parents to opt for cochlear implants for their children. This trend is expected to continue, with pediatric cochlear implants experiencing rapid market expansion in the coming years.

By End-use

In 2023, hospitals were the dominant end-use segment in the cochlear implant market. Hospitals offer a comprehensive range of services, including diagnostic assessments, surgical procedures, and post-operative rehabilitation, making them the primary setting for cochlear implantation. The availability of skilled medical professionals, advanced surgical facilities, and comprehensive patient care in hospitals make them the preferred choice for cochlear implant procedures. Hospitals also cater to a wide range of patients, including both adults and pediatric individuals, which further solidifies their dominance in the market.

The fastest-growing segment for cochlear implants throughout the forecast period was clinics. With the increasing number of specialized clinics providing audiology and cochlear implant services, many patients are opting for treatment in these settings due to their convenience and personalized care. Clinics tend to offer a more accessible and less formal environment than hospitals, which appeals to individuals seeking outpatient procedures. Moreover, as insurance coverage expands and reimbursement options increase, clinics are becoming more affordable and accessible to a wider patient base, contributing to their rapid growth in the cochlear implant market.

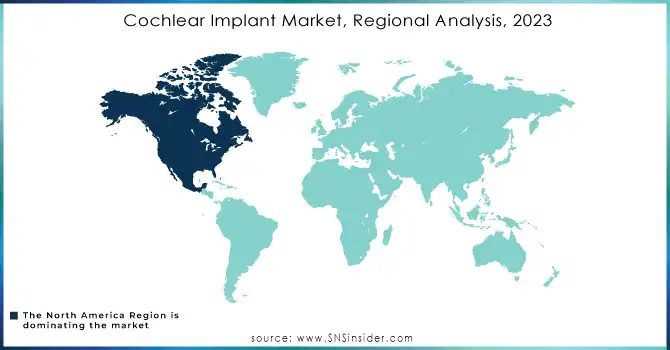

Regional Analysis

North America dominated the cochlear implant market, accounting for the largest market share in 2023. This is primarily due to advanced healthcare infrastructure, high healthcare spending, and supportive government policies. In the United States, insurance coverage, including Medicare and private plans, increasingly includes cochlear implants, making them more accessible. Additionally, the presence of leading cochlear implant manufacturers and robust healthcare systems contribute to the region’s dominance. The growing aging population and rising awareness about the benefits of early intervention in hearing loss further drive market growth in this region.

Europe held a significant share of the global market, driven by a similar combination of aging demographics and strong healthcare systems. Countries like Germany, the UK, and France are key markets, with government reimbursement policies helping increase accessibility to cochlear implants. Awareness campaigns and initiatives promoting early detection and intervention for hearing loss also play a key role in market expansion.

The Asia-Pacific region is the fastest-growing market for cochlear implants. This growth is attributed to rising healthcare awareness, improving medical infrastructure, and increasing adoption of advanced healthcare technologies. Countries such as Japan, China, and India are seeing significant demand for cochlear implants, driven by growing middle-class populations, improving healthcare accessibility, and government initiatives to address hearing loss.

Need Any Customization Research On Cochlear Implant Market - Inquiry Now

Key Players

-

-

Cochlear Nucleus Implants (e.g., Nucleus 7 Sound Processor, Nucleus Kanso 2 Sound Processor)

-

Cochlear Osia Bone Conduction Implant

-

-

-

Phonak Sky Marvel (for pediatric users)

-

-

MED-EL Medical Electronics

-

SYNCHRONY Cochlear Implants

-

Sonnet 2 Sound Processor

-

Rondo 3 Single-Unit Processor

-

-

-

Oticon Medical Ponto Bone Anchored Hearing Systems

-

Neuro Cochlear Implants

-

-

Zhejiang Nurotron Biotechnology Co., Ltd.

-

Nurotron Nuro-CI Cochlear Implant System

-

Nurotron Nuro-3 Sound Processor

-

-

Amplifon S.p.A. (GAES)

-

Amplifon Cochlear Implants (distributed under various partner brands like Cochlear Ltd.)

-

-

Shanghai Listent Medical TECH Co., Ltd.

-

Listent Cochlear Implants (including various sound processors and implant systems)

-

-

-

Neubio Cochlear Implant System (focused on advancing cochlear implant technology, including processor devices and accessories)

-

-

Cochlear Bone Anchored Solutions AB

-

Bone Anchored Hearing Systems (BAHS) (such as Baha 5 Sound Processor)

-

-

EarTech

-

EarTech Cochlear Implant Systems

-

Recent Developments

-

In May 2024, Cochlear announced its plans to integrate the Oticon Medical cochlear implant business, recently acquired from Demant, in the upcoming months. This integration is expected to enhance the company's product portfolio and boost its revenue growth.

-

In December 2023, Sonova received approval from the U.S. FDA and announced the expansion of its Marvel CI product range to enhance hearing care services for patients.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 2.03 Billion |

| Market Size by 2032 | US$ 4.78 Billion |

| CAGR | CAGR of 9.99% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Age Group [Adult (Adult Unilateral Implants, Adult Bilateral Implants), Pediatric (Pediatric Unilateral Implants, Pediatric Bilateral Implants)] • By End-use (Clinics, Hospitals, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Cochlear Ltd., Sonova, MED-EL Medical Electronics, Demant A/S, Zhejiang Nurotron Biotechnology Co., Ltd., Amplifon S.p.A. (GAES), Shanghai Listent Medical TECH Co., Ltd., Neubio AG, Cochlear Bone Anchored Solutions AB, EarTech |

| Key Drivers | • Technological Advancements, Aging Population, Awareness, and Government Support Fuel Market Expansion |

| Restraints | • High Cost and Limited Affordability • Surgical Risks and Complications |