Cocktail Syrups Market Report Scope & Overview:

Get More Information on Cocktail Syrups Market - Request Sample Report

The Cocktail Syrups Market size was valued at USD 4.80 billion in 2023 and is expected to reach USD 7.13 billion by 2032 and grow at a CAGR of 4.50% over the forecast period of 2024-2032.

The number of cocktail bars worldwide has witnessed a considerable increase, with an 8% growth in the US alone in 2022, reflecting a growing consumer preference for craft cocktails. Additionally, the pandemic-induced shift towards home mixology led to a 40% surge in online sales of cocktail syrups in 2020, highlighting the rising popularity of DIY cocktails. Furthermore, social media platforms like Instagram and TikTok have seen increased engagement around cocktail-related hashtags like #cocktailtime and #mixology, indicating a growing interest among wider audiences and younger generations.

Recent developments in the market also demonstrate its dynamism and innovation. Fever-Tree's acquisition of Cocktail Crate in 2023 exemplifies the growing synergy between premium mixers and cocktail syrups, catering to consumer demand for convenient, high-quality cocktail solutions. Monin's launch of the all-natural Le Fruit de MONIN range aligns with the increasing preference for healthier and natural cocktail ingredients. Additionally, Liber & Co.'s expansion into new markets like Asia and Europe underscores the growing global appetite for premium handcrafted syrups amidst the burgeoning cocktail culture worldwide. These instances collectively reflect the cocktail syrup market's responsiveness to evolving consumer preferences and the increasing demand for high-quality, unique, and convenient cocktail experiences.

Market Dynamics

Drivers

-

Growing cocktail culture and increasing demand for unique flavors and experiences.

-

Rise in premium spirits consumption driving demand for high-quality mixers.

-

Increasing health consciousness leads to demand for low-sugar, natural, and organic syrups.

-

Continuous innovation in flavors, catering to diverse consumer preferences.

-

Convenience trend boosting the popularity of RTD cocktails and cocktail kits with pre-made syrups.

The convenience trend is a major catalyst for the cocktail syrups market, driven by consumers' desire for easy yet high-quality cocktail experiences. This is evident in the surging popularity of ready-to-drink (RTD) cocktails and cocktail kits, both of which often incorporate pre-made syrups. In 2022, the global RTD market experienced a 10% growth, with cocktails being the fastest-growing segment. The U.S. witnessed an even more impressive 42% volume growth in RTD cocktails, surpassing spirits and wine. Further emphasizing this trend, cocktail kits saw a remarkable 141% increase in sales during the 2020 holiday season.

A notable example of this trend is Bacardi's 2023 launch of a range of RTD cocktails under its Bombay Sapphire and Grey Goose brands, incorporating pre-made syrups as essential ingredients. This move by a leading spirits producer underscores the growing significance of pre-made syrups in the booming RTD cocktail market. The rise of RTD cocktails and cocktail kits reflects a shift in consumer behavior towards convenience and ease of use, without compromising on quality or flavor. Pre-made syrups enable consumers to effortlessly create sophisticated cocktails at home or on the go, fueling the demand for these products and positioning them as a significant driver of the cocktail syrups market.

Restraints

-

Competition from alternative mixers like fresh juices, sodas, and tonics.

-

Regulations regarding alcohol content and labeling restrictions in certain regions.

-

High production costs for artisanal and handcrafted syrups, limiting affordability for some consumers.

Opportunities

-

Expanding into emerging markets with a growing cocktail culture, like Asia and Latin America.

-

Developing functional syrups with added health benefits, like antioxidants or vitamins.

-

Partnering with bars and restaurants to create signature cocktails and promote brand visibility.

-

Leveraging e-commerce platforms to reach a wider audience and offer personalized cocktail solutions.

-

Investing in sustainable packaging and production practices to appeal to eco-conscious consumers.

Challenges

-

Maintaining consistent quality and flavor profiles across different batches of syrups.

-

Building brand awareness and loyalty in a crowded market with numerous competitors.

-

Adapting to changing consumer preferences and staying ahead of emerging flavor trends.

-

Complying with varying regulations and labeling requirements in different countries.

The constant evolution of consumer tastes and the emergence of new flavor trends present a significant hurdle for sustained growth in the cocktail syrups market. According to a 2023 CGA Strategy survey, 52% of consumers actively seek novel and unique cocktail flavors, emphasizing the need for continuous innovation. For instance, Small Hand Foods' 2022 launch of globally-inspired syrups featuring unique ingredients like yuzu, hibiscus, and cardamom exemplifies the industry's response to the increasing demand for exotic and adventurous flavors. this also highlights the challenge for cocktail syrup producers to stay ahead of the curve. To thrive in this dynamic market, companies must prioritize continuous market research, experimentation with novel ingredients, and agile product development to meet the ever-changing demands of consumers.

Impact of Russia-Ukraine War:

The Russia-Ukraine war has triggered a ripple effect on the cocktail syrups market through various channels. Supply chain disruptions due to logistical challenges and trade restrictions have led to delays, shortages, or increased costs. The conflict has also fueled inflationary pressures, driving up the prices of raw materials and production costs. Changing consumer preferences, influenced by economic uncertainty and geopolitical tensions, have led consumers to seek more affordable or locally sourced options. Additionally, trade restrictions and sanctions have impacted the import and export of cocktail syrups and related ingredients, forcing companies to adapt their strategies. The volatility in currency exchange rates further complicates international trade and transactions, adding to the challenges faced by the industry.

Market segmentation

By Product

-

Fruit

-

Vanilla

-

Herbs and Seasonings

-

Others

By Product, Fruit held the highest revenue share of more than 67% in 2023 due to its unparalleled versatility and wide appeal. Their diverse range of flavors, from classic options like citrus and berries to exotic choices like passion fruit and mango, allows for endless creativity in crafting cocktails that cater to a broad spectrum of tastes and preferences. Additionally, their perceived health benefits and familiarity further enhance their allure, particularly as consumers increasingly seek natural ingredients and lower sugar content. Leading brands like Monin and Liber & Co. continue to innovate within this category, launching new all-natural fruit syrups and unique flavor combinations like blood orange cordial, solidifying fruit syrups as the dominant force in the ever-evolving cocktail market.

By Flavor

-

Sweet

-

Sour

-

Salty

-

Mint

The sweet Flavor segment dominated the Cocktail Syrups Market with the highest revenue share of more than 55% in 2023 due to their versatility, ability to balance other cocktail ingredients, and widespread use in popular drinks. Their broad spectrum of flavor profiles, ranging from classic simple syrup to more complex options like vanilla, caramel, or chocolate, enables diverse cocktail creations that cater to various preferences. Sweet syrups are essential in balancing the acidity or bitterness of other ingredients, resulting in a harmonious drinking experience. Their prominence in popular cocktails like Daiquiris, Margaritas, and Old Fashioneds further drives their demand. Brands continue to innovate within this category, as seen with Liber & Co.'s Gum Syrup, a unique offering with complex flavors, and Sonoma Syrup Co.'s Brown Sugar Syrup, adding depth to classic cocktails. The significant revenue share of sweet flavor syrups underscores their fundamental role in mixology and widespread consumer appeal.

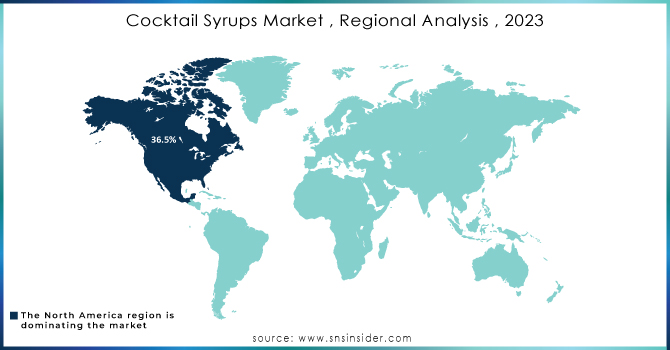

Regional Analysis

North America held the largest revenue share of more than 36.5% in 2023 in the Cocktail Syrups Market. This is attributed to a confluence of factors, including a vibrant bar and restaurant scene, the growing popularity of craft cocktails, and a strong consumer preference for high-quality, artisanal mixers. The region's thriving cocktail culture, characterized by numerous establishments offering innovative and sophisticated drinks, fuels the demand for diverse and premium cocktail syrups. Moreover, the pandemic-induced surge in home mixology further propelled market growth, as consumers sought to recreate their favorite cocktails at home, leading to increased sales of cocktail syrups through various channels.

The Asia Pacific Cocktail Syrups Market is set to experience the highest CAGR from 2024-2031. The rising disposable incomes of consumers in emerging countries have led to a growing demand for premium beverages, including cocktails. The rapid urbanization in the region has resulted in a burgeoning nightlife scene and a proliferation of bars and restaurants, further boosting the consumption of cocktails and, consequently, cocktail syrups. Consumers in the Asia Pacific are increasingly seeking novel and exotic flavor profiles in their beverages, leading to a heightened demand for unique and diverse cocktail syrups. Several companies have launched innovative cocktail syrups tailored to the Asia Pacific palate. For instance, Monin recently introduced a range of Asian-inspired flavors like Yuzu, Lychee, and Pandan, catering to the region's unique taste preferences.

Get Customized Report as per Your Business Requirement - Request For Customized Report

REGIONAL COVERAGE:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of the Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

Key Players:

ADM WILD Europe GmbH & Co. KG, Döhler, Kerry Group PLC, Liber & Co., Toschi Vignola s.r.l., The Simple Syrup Co., Giffard, MONIN, Bristol Syrup Company, Torani, Royal Rose Syrups, Fee Brothers, and BG Reynolds

Recent Development:

-

In January 2024, Fee Brothers introduced its latest product: Mole Bitters, the newest addition to the brand's extensive line of flavors. This unique offering adds to the brand's reputation for innovation and quality.

-

In May 2023, Fee Brothers announced the launch of Turkish Tobacco Bitters, marking the first product release of the year. This addition to their impressive range of flavors further solidifies Fee Brothers' position as a leader in the industry.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 4.80 Billion |

| Market Size by 2032 | US$ 7.13 Billion |

| CAGR | CAGR 4.50% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Fruit, Vanilla, Herbs and Seasonings, and others) • By Flavor (Sweet, Sour, Salty, and Mint) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | ADM WILD Europe GmbH & Co. KG, Döhler, Kerry Group PLC, Liber & Co., Toschi Vignola s.r.l., The Simple Syrup Co., Giffard, MONIN, Bristol Syrup Company, Torani, Royal Rose Syrups, Fee Brothers, and BG Reynolds |

| Key Drivers | • Growing cocktail culture and increasing demand for unique flavors and experiences. • Rise in premium spirits consumption driving demand for high-quality mixers. • Increasing health consciousness leading to demand for low-sugar, natural, and organic syrups. • Continuous innovation in flavors, catering to diverse consumer preferences. • Convenience trend boosting the popularity of RTD cocktails and cocktail kits with pre-made syrups. |

| Restraints | • Growing awareness of the health risks associated with excessive sugar consumption. • Competition from alternative mixers like fresh juices, sodas, and tonics. • Regulations regarding alcohol content and labeling restrictions in certain regions. • High production costs for artisanal and handcrafted syrups, limiting affordability for some consumers. |