Chelated Iron Agriculture Micronutrient Market Overview:

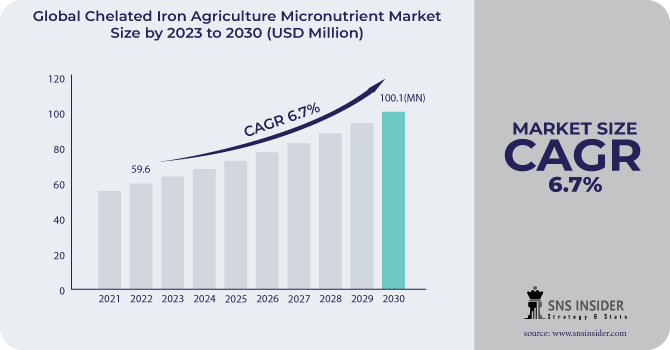

The Chelated Iron Agriculture Micronutrient Market size was USD 59.6 million in 2022 and is expected to Reach USD 100.1 million by 2030 and grow at a CAGR of 6.7% over the forecast period of 2023-2030.

Chelated iron agriculture micronutrient is an iron-based fertilizer that is bound to a chelating agent. Chelating agents are molecules that have multiple binding sites that can attach to the iron atom. This binding makes the iron more soluble and available to plants. Chelated iron agriculture micronutrients are used to improve the yields and quality of crops.

Based on application, the cereals are the major segment with more than 31% of the market share in 2022. Chelated iron agriculture micronutrients are used to improve the yields and quality of cereals such as wheat, rice, and corn. Iron is essential for photosynthesis and other important plant processes. The fruits & vegetables segment is predicted to grow at a CAGR of 7.9%. Chelated iron agriculture micronutrients can help to improve the color and quality of fruits and vegetables, as well as their nutritional value.

MARKET DYNAMICS

KEY DRIVERS

-

Advancements in chelating agents

Precision agriculture and other sustainable farming approaches are assisting farmers in using chelated iron micronutrients more efficiently and effectively. New chelating agents that are more effective and environmentally friendly than existing chelating agents are being developed. Plants absorb amino acid chelates more readily than standard chelating chemicals such as EDTA. Additionally, amino acid chelates are more biodegradable, reducing the environmental impact of chelated iron micronutrients.

-

Growing demand for high-quality agricultural products

RESTRAIN

-

Lack of awareness of chelated iron micronutrients

Many farmers are unaware of the benefits of chelated iron micronutrients over traditional fertilizers, such as higher bioavailability and efficiency in overcoming iron deficiency. Additionally, some farmers may be hesitant to utilize chelated iron micronutrients since they are more expensive than regular fertilizers. Furthermore, chelated iron micronutrients are frequently offered to a particular clientele, such as organic farmers or farmers that adopt sustainable farming methods. This can make it difficult for farmers to access chelated iron micronutrients.

OPPORTUNITY

-

Government support for sustainable agriculture

Governments all across the world are supporting sustainable agriculture practices because they understand the benefits. Chelated iron micronutrients play a significant role in sustainable agriculture. The Indian government recently implemented a Nutrient Subsidy Scheme to encourage the use of balanced fertilizers, which include chelated iron micronutrients. In addition, the US Department of Agriculture maintains a number of initiatives that promote sustainable agriculture, such as the Environmental Quality Incentives Program. Farmers who employ conservation methods, such as using chelated iron micronutrients to promote soil health, are eligible for EQIP financial aid.

CHALLENGES

-

High cost of chelated iron micronutrients

The manufacturing of chelated iron micronutrients is complex and more expensive than the manufacturing of traditional fertilizers. Furthermore, the chelating chemicals required to attach the iron to the chelate molecule are costly. The high cost of chelated iron micronutrients is a major impediment to the chelated iron agriculture micronutrient market's expansion.

IMPACT OF RUSSIA UKRAINE WAR

The reduced supply of chelated iron micronutrients has led to increased prices. According to research by the International Fertilizer Industry Association (IFA), since the start of the war, the cost of chelated iron micronutrients has risen by 25%. In 2023, the war is projected to diminish the world's supply of chelated iron micronutrients by 15%. Ukraine's agricultural productivity is severely hampered by the war. This is due to the fact that farmers have been unable to get fertilizer and other inputs or plant crops. As a result, crop yields in Ukraine are anticipated to be lower this year. Micronutrients containing chelated iron can also lessen the demand for synthetic fertilizers.

IMPACT OF ONGOING RECESSION

Recessions can have a significant impact on the chelated iron agriculture micronutrient market, as farmers may reduce their spending on agricultural inputs during a recession. According to the International Fertilizer Industry Association (IFA), a 1% drop in world GDP can result in a 0.5% drop in global fertilizer consumption. The market for chelated iron agriculture micronutrients in fruits and vegetables may be more resilient to a recession than the market for chelated iron agriculture micronutrients in grains.

MARKET SEGMENTATION

by Application

-

Cereals

-

Fruits & vegetables

-

Pulses & Oilseeds

-

Others

REGIONAL ANALYSIS

North America is the largest market for chelated iron agriculture micronutrients accounting for 47% market share in the forecast period. the United States is expected to grow at a CAGR of 6.9% in 2022. The growth is attributed to the rising demand for improved agricultural practices in this region. North American farmers are increasingly using chelated iron micronutrients to improve the yields and quality of their crops.

Europe had a significant market for chelated iron agriculture micronutrients in the forecast period. This is due to the advancements in chelating agents and sustainable farming practices. European farmers are also increasingly farming activities to comply with environmental regulations. Germany is being driven by the increasing demand for food and agricultural products, as well as the growing awareness about the benefits of using chelated iron micronutrients among farmers.

Asia-Pacific is the fastest-growing region in the global chelated iron agriculture micronutrient market. The China region is expected to grow at a CAGR of 7.2% in 2022. Growing agriculture and the dominance of small-scale manufacturers may be seen throughout the Asia-Pacific region. Furthermore, the region's enormous agricultural area and government initiatives to promote the agriculture sector have driven market expansion.

REGIONAL COVERAGE

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

KEY PLAYERS

Some major key players in the Chelated Iron Agriculture Micronutrient Market are ADAMA Agricultural Solutions Ltd., Bayer CropScience AG, BASF SE, Land O’Lakes Inc. Monsanto Co., Sumitomo Chemical Co., Ltd, The Dow Chemical Co., Yara International ASA, Nufarm Limited, The Mosaic Company, Syngenta International AG, Agrium Inc., Akzo Nobel N.V., and other key players.

Bayer CropScience AG-Company Financial Analysis

RECENT DEVELOPMENTS

In 2022, ICL announced the launch of a new line of innovative foliar and fertigation solutions under its Nova brand of water-soluble fertilizers in North America. Nova FINISHTM, Nova PULSETM, Nova ELEVATETM, and Nova FLOWTM are the company's flagship products.

| Report Attributes | Details |

| Market Size in 2022 | US$ 59.6 Million |

| Market Size by 2030 | US$ 100.1 Million |

| CAGR | CAGR of 6.7 % From 2023 to 2030 |

| Base Year | 2022 |

| Forecast Period | 2023-2030 |

| Historical Data | 2019-2021 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Application (Cereals, Fruits & vegetables, Pulses & Oilseeds, and Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | ADAMA Agricultural Solutions Ltd., Bayer CropScience AG, BASF SE, Land O’Lakes Inc. Monsanto Co., Sumitomo Chemical Co., Ltd, The Dow Chemical Co., Yara International ASA, Nufarm Limited, The Mosaic Company, Syngenta International AG, Agrium Inc., Akzo Nobel N.V. |

| Key Drivers | • Advancements in chelating agents • Growing demand for high-quality agricultural products |

| Market Opportunity | • Government support for sustainable agriculture |