Coffee Machine Market Report Scope & Overview:

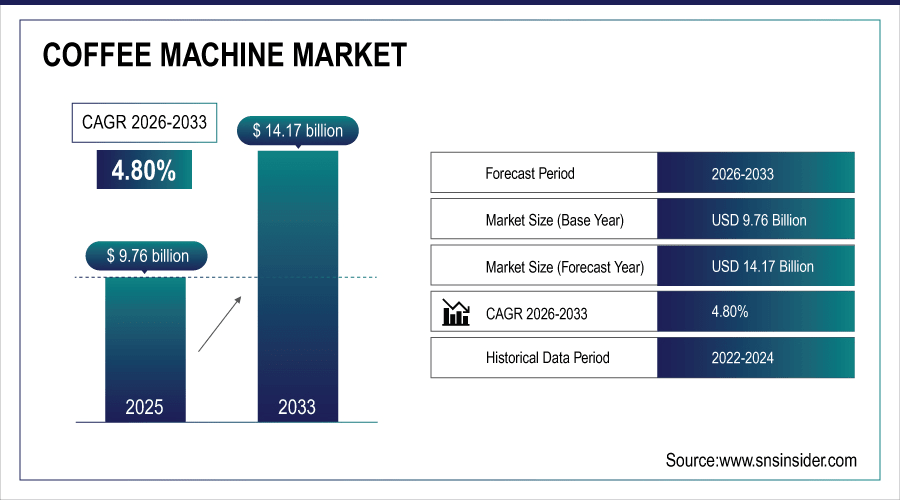

The Coffee Machines Market Size was valued at USD 9.76 Billion in 2025E and is projected to reach USD 14.17 Billion by 2033, growing at a CAGR of 4.80% during the forecast period 2026–2033.

The Coffee Machines Market analysis examines consumption patterns and development trends across products such as drip coffee machines, espresso machines, capsule/pod machines, and French press. The market is divided based on the technology, material, application and distribution channel such as online retail, specialty stores and direct sales. Increasing coffee culture, expanding home and office usage is fueling the global market growth in major regions, with higher demand for automatic & easy to use brewing system.

Drip coffee makers, espresso machines, and capsule/pod coffee machines accounted for nearly 60% of the Coffee Machines Market in 2025, driven by rising home and office consumption.

To Get More Information On Coffee Machines Market - Request Free Sample Report

Market Size and Forecast:

-

Market Size in 2025: USD 9.76 Billion

-

Market Size by 2033: USD 14.17 Billion

-

CAGR: 4.80% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

Coffee Machines Market Trends:

-

Coffee machines are transitioning from humble appliances to lifestyle statements, and increasingly smart or automated machines are winning over tech savvy homeowners.

-

A breakneck pace of urbanization and a hectic work life are driving demand for convenient, fast-brew solutions in homes and offices.

-

With the emergence of E-commerce and online retailing, consumers are looking for convenient options to get access to high end coffee machines.

-

With environmentally conscious millennials and Gen Z buyers preferring sustainable materials and energy-efficient designs.

-

Growth in the Asia Pacific is driven by growing cafe culture, higher disposable income and trend for modern, café-style home brewing.

U.S. Coffee Machines Market Insights:

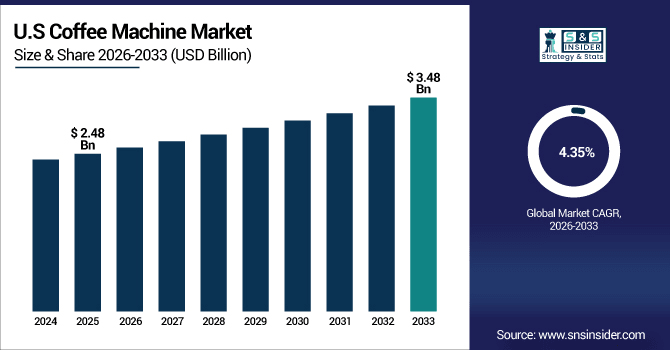

The U.S. Coffee Machines Market is projected to grow from USD 2.48 Billion in 2025E to USD 3.48 Billion by 2033, at a CAGR of 4.35%. That growth is spurred by smart, automatic and single-serve machines, increased home and office consumption, online retailing and the fashion for specialty branded coffee.

Coffee Machines Market Growth Drivers:

-

Rising demand for smart, automated, and single-serve coffee machines that deliver café-quality beverages at home and in offices is fueling global market growth.

The Coffee Machines Market is growing due to increasing consumer preference for smart, convenient, and single-serve machines that provide a café-like experience at home and in offices. The world installed base for coffee machines is likely to exceed 200 million units by 2025, driven by urbanization; rising disposable incomes, and growing retail & e-commerce channels. Technology advancements and convenient designs have continued to boost market popularization around the world.

Rising demand for smart, automated, and single-serve coffee machines drove nearly 42% of global coffee machine sales in 2025, fueled by home and office consumption and the growing preference for café-quality beverages.

Coffee Machines Market Restraints:

-

High coffee machine costs and complex maintenance requirements restrain market adoption and slow global growth.

The Coffee Machines Market is being affected due to various factors such as costly products and maintenance issues. Cost pressures are impacting 34.5% of manufacturers rising from expensive inputs/components to energy-efficient technology, and supply chain delays leading to delayed delivery times. Increasing consumer awareness about energy usage, safety, and machine durability limits penetration in some regions. These limitations affect smaller regional brands the most, as competitive at low-cost appliances combined with smart alternatives and volatile component costs still prevent overall global market growth.

Coffee Machines Market Opportunities:

-

Growing preference for smart, app-enabled, and specialty coffee machines offers significant global market growth opportunities.

Rising adoption of app-enabled, smart, and speciality coffee makers to drive the global market. More than 38% of new products launched in 2025 were orientated around single, automated or personalized brewing systems designed for both the home and office. Growing number of retails, e-commerce channels are aiding accessibility, and advancements in brewing technology, connectivity and better specialty experiences will also keep propelling market growth until 2033 for the world coffee machines market.

Rising demand for single-serve and automated coffee machines contributed to nearly 40% of global sales growth in 2025.

Coffee Machines Market Segmentation Analysis:

-

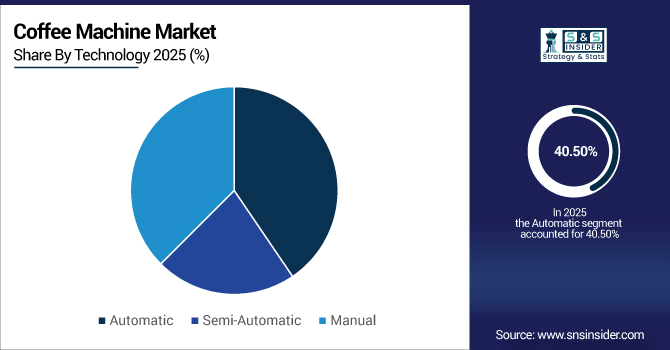

By Technology, Automatic machines dominated with a 40.50% share in 2025, while Semi-Automatic machines are projected to expand at the fastest CAGR of 6.35%.

-

By Product Type, Drip Coffee Makers held the largest market share of 32.45% in 2025, while Capsule/Pod Coffee Machines are expected to grow at the fastest CAGR of 6.10%.

-

By Material, Stainless Steel accounted for the highest market share of 38.60% in 2025, and Plastic machines are expected to record the fastest CAGR of 5.90%.

-

By Application, Home segment held the largest share in 2025 with 45.25%, while Commercial segment is expected to grow at the fastest CAGR of 6.20%.

-

By Distribution Channel, Online Retail held the largest share of 37.80% in 2025, while Direct Sales is expected to grow at the fastest CAGR of 6.50%.

By Technology, Automatic Machines Dominate While Semi-Automatic Machines Grow Fastest:

The use of automatic coffee machines in 2025 dominated at nearly 80 million units globally, valued for convenience, reliability, and features like grinders or milk frothers. Semi-automatic machines were fast-growing, with around 55 million units sold to enthusiasts seeking greater control over brewing. Rising home barista culture, office automation, and e-commerce penetration across Europe, North America, and APAC are accelerating adoption.

By Product Type, Drip Coffee Makers Lead While Capsule/Pod Machines Expand Rapidly:

The consumption of drip coffee makers in 2025 dominated at more than 62 million units worldwide, remaining the first choice for domestic and office use due to reliability and low cost. Capsule/pod machines were fast-growing, with about 38 million units sold, reflecting rising consumer demand for single-serve, quick, and customizable coffee experiences. Accelerated urbanization, cafe-style trends, and specialty coffee culture are driving growth in Asia-Pacific, North America, and Europe.

By Material, Stainless Steel Machines Lead While Plastic Machines Expand Rapidly:

Stainless steel coffee machines in 2025 dominated at approximately 70 million units due to durability, premium feel, and energy efficiency. Plastic machines were fast-growing, reaching around 48 million units thanks to affordability, light weight, and ease of use. Growth is fueled by domestic consumption, office installations, and a rising preference for aesthetically appealing machines across North America, Europe, and APAC.

By Application, Home Segment Dominates While Commercial Segment Expands Rapidly:

Home coffee machine consumption in 2025 dominated at over 90 million units as households embraced café-style brewing. Commercial segment installations were fast-growing, with around 40 million units for offices, hotels, and cafés. Urbanization, on-the-go lifestyles, and rising disposable incomes are driving demand, with the highest growth in Asia-Pacific as both businesses and homes adopt specialized and automated machines.

By Distribution Channel, Online Retail Leads While Direct Sales Expand Rapidly:

Online retail sales of coffee machines in 2025 dominated at over 75 million units worldwide, driven by convenience, variety, and quick delivery. Direct sales were fast-growing, totaling around 35 million units through brand stores and OEM channels, reflecting bulk office purchases and direct manufacturer-consumer engagement. Growth is accelerated in Europe, North America, and APAC by increasing e-commerce adoption and consumer preference for doorstep delivery.

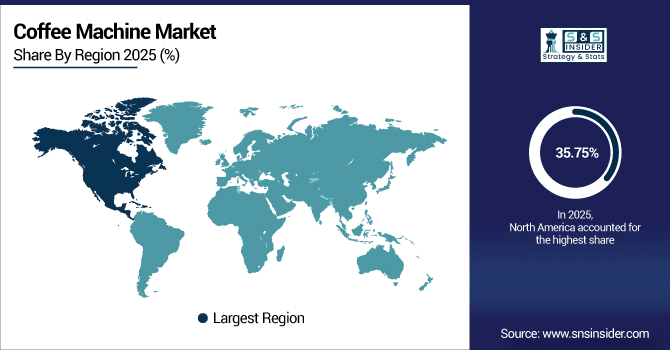

Coffee Machines Market Regional Analysis:

North America Coffee Machines Market Insights:

North America dominates the Coffee Machines Market with a 35.75% share in 2025, driven by rising home and office consumption. The installed base of coffee machines in the region is forecast to surpass 75 million by 2033, driven by time-pressed consumers seeking café-style experience at home and an appetite for automated and craft models. Internet retailing and niche retailers have increased accessibility while smart and single-serve machines are driving regional growth through innovation.

Get Customized Report as Per Your Business Requirement - Enquiry Now

U.S. Coffee Machine Market Insights:

By 2025, the US had installed more than 28 million coffee machines in homes and offices, including nearly 12 million smart and single-serves. Online retail accounted for some 9 million purchases, and specialty stores generated 7 million. Meanwhile, growth is driven by convenience, automation and the growing coffee culture nationwide.

Asia-Pacific Coffee Machines Market Insights:

The Asia-Pacific coffee machines market is growing at a CAGR of 5.62%, with over 55 million units installed in 2025, including 22 million in China and 10 million in Japan. Drip and capsule/pod machines reign, with online retail and specialty stores representing more than 15 million units. Quick regional growth is being fueled by greater urbanization, higher disposable income, on-the-go lifestyles and the increasing popularity of café-style home brewing.

China Coffee Machines Market Insights:

By 2025, China had more than 22 million coffee machines installed, with 12 million drip and 10 million capsule/pod. Online retail made up about 9 million units, and the remainder through specialty stores. The increase is being generated by urbanisation, busier lifestyles, growing disposable incomes and a shift towards more convenient café style home brewing.

Europe Coffee Machines Market Insights:

In 2025, the installed base of coffee machines in Europe was more than 28 million units, dominated by Germany with over eight million machines, followed by the U.K. (7.5 million) and France (6.8 million). Speciality stores and online retail added 15 million units, while direct sales made up the rest. Rising home and office consumption, on-the-go lifestyles, growing popularity of café-style brewing and consumers’ preference for automated and single-serve coffee machines in the region are set to drive growth.

Germany Coffee Machines Market Insights:

In 2025, Germany had more than 8 million coffee machines installed, including over 4.5 million drip and some 3.5 million capsule/pod machines. Online retail made around 4 million purchases, and specialty stores accommodated the remainder. Urbanisation, hectic lifestyle and more inclination towards hassle-free, automated and café type of home brewing is catalysing market growth.

Latin America Coffee Machines Market Insights:

In 2025, the largest installed coffee machine bases in Latin America were expected to be in Brazil (4 million), Mexico (3.2 million) and Argentina (1.7 million). An estimated 5 million units were sold through specialty stores and supermarkets; the rest, 3.9 million units, through online retail. Increasing urbanization, higher disposable incomes and greater use of automated products and single-serve appliances support market growth in the region.

Middle East and Africa Coffee Machines Market Insights:

In 2025, the Middle East & Africa accounted for over 4.8 million coffee machines installed including sale of 2.8 million units through specialty stores and supermarkets while online retail sold about 2 million units across Middle East & Africa region. Market growth is attributed to urbanization, growing disposable income On-the-go lifestyles and demand for automatic & single serve coffee machines.

Coffee Machine Market Competitive Landscape:

Nestlé’s Nespresso rules the single-serve coffee category, with more than 22 million machines operating globally by 2025. The company manufactures 4+ billion coffee capsules annually, and is present in over 60 countries. Loyalty to the brand, ease of capsule use, and ubiquity increasingly appeal to higher-end drinkers. Sustainability Also, it has capped collection programs and new coffee blends, all of which further solidify its position as the leader in convenient high-quality home and office coffee offerings.

-

In March 2025, Nespresso introduced the Vertuo Next Smart Machine, which has app connectivity that allows you to brew it from afar and write up your own coffee profiles. They also launched limited-edition “Master Origins Ethiopia” capsule range, featuring single-origin premium blends.

Keurig Dr Pepper sells more than 18 million coffee machines annually, and by 2025, consumers around the world will have consumed an estimated 7 billion K-Cups. The company has 1,200 potentials outside coffee brands as partners and sends machines to 45 countries. Its K-Cup technology and convenience to serve a well marketed product to multiple distribution outlets makes attractive option for households, market pursuit especially in the United States and increasingly internationally.

-

In April 2025, Keurig introduced the K-Supreme Plus Smart Brewerk featuring multi-stream technology to extract more flavor. They also grew their reusable K-Cup collection, aimed at sustainable and eco-friendly brewing.

De’Longhi installed more than 15 million coffee machines across the world in 2025, and sells 3.5 million fully automatic machines each year. The company, which operates in 80 countries, is known for high-quality espresso and drip and professional-grade products. Driven by its emphasis on premium design, café-style home brewing trends and growing global reach, Aveo appeals to a broad market of consumers who desire convenience and the enjoyment of quality coffee.

-

In May 2025, De’Longhi introduced the Dinamica Plus fully automatic machine with touch-screen controls and personalized specialty drinks. They also came out with a new, compact Dedica Latte Crema for small kitchens and office spaces.

Coffee Machines Market Key Players:

Some of the Coffee Machines Market Companies are:

-

Nestlé S.A. (Nespresso)

-

Keurig Dr Pepper Inc.

-

De'Longhi S.p.A.

-

Breville Group Ltd.

-

Philips N.V. (Saeco & Gaggia)

-

Panasonic Corporation

-

Jura Elektroapparate AG

-

Hamilton Beach Brands Holding Co.

-

Bosch (Tassimo)

-

Melitta Group

-

Cuisinart

-

Smeg S.p.A.

-

Rancilio Group

-

La Marzocco

-

Rocket Espresso

-

Krups (Groupe SEB)

-

Mr. Coffee (Newell Brands)

-

Illycaffè S.p.A.

-

Oster (Newell Brands)

-

Simens (Bosch Group)

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 9.76 Billion |

| Market Size by 2033 | USD 14.17 Billion |

| CAGR | CAGR of 4.80% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type (Drip Coffee Makers, Espresso Machines, Capsule/Pod Coffee Machines, French Press, Others) • By Technology (Automatic, Semi-Automatic, Manual) • By Material (Stainless Steel, Plastic, Aluminum, Others) • By Application (Home, Commercial, Office, Others) • By Distribution Channel (Online Retail, Specialty Stores, Department Stores, Brand Outlets, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Nestlé S.A. (Nespresso), Keurig Dr Pepper Inc., De'Longhi S.p.A., Breville Group Ltd., Philips N.V. (Saeco & Gaggia), Panasonic Corporation, Jura Elektroapparate AG, Hamilton Beach Brands Holding Co., Bosch (Tassimo), Melitta Group, Cuisinart, Smeg S.p.A., Rancilio Group, La Marzocco, Rocket Espresso, Krups (Groupe SEB), Mr. Coffee (Newell Brands), Illycaffè S.p.A., Oster (Newell Brands), Siemens (Bosch Group) |