Food Flavors Market Report Scope & Overview:

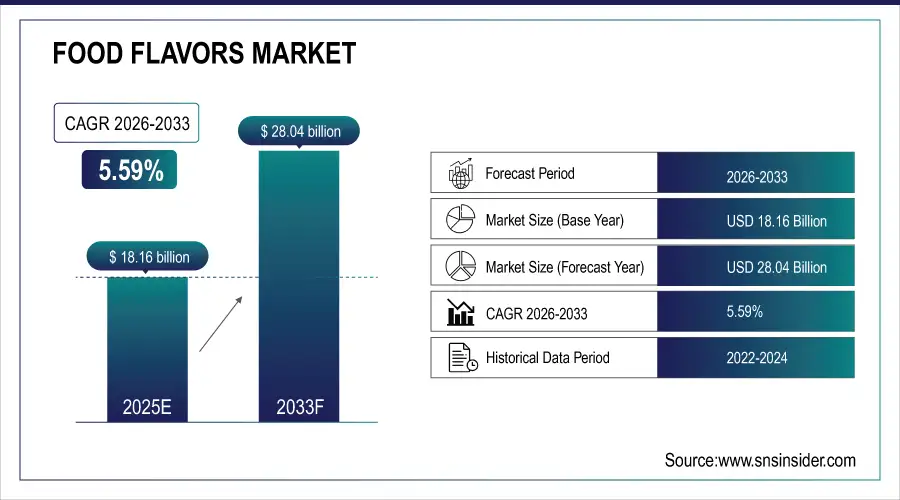

The Food Flavors Market Size was valued at USD 18.16 Billion in 2025E and is expected to reach USD 28.04 Billion by 2033 and grow at a CAGR of 5.59% over the forecast period 2026-2033.

The Food Flavors Market analysis, driven by increasing consumer preference for natural and clean-label products, rising demand for convenience and processed foods, and the growth of the global bakery, beverage, and dairy sectors. Technological advancements in flavor extraction and formulation, along with innovation in exotic and functional Flavors, are boosting market expansion. According to analysis, over 35% of new flavor launches incorporate advanced extraction or encapsulation technologies.

Market Size and Forecast:

-

Market Size in 2025: USD 18.16 Billion

-

Market Size by 2033: USD 28.04 Billion

-

CAGR: 5.59% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information on Food Flavors Market - Request Free Sample Report

Food Flavors Market Trends

-

Growing consumer preference for natural and clean-label Flavors boosts market demand globally.

-

Rising health consciousness encourages manufacturers to develop innovative functional flavor offerings.

-

Expansion of bakery, dairy, and beverage industries drives flavor consumption significantly.

-

Technological advancements in extraction and encapsulation improve flavor quality and stability.

-

Increasing disposable incomes in emerging regions create new opportunities for flavor adoption.

-

Regional taste preferences inspire manufacturers to launch locally tailored and exotic Flavors.

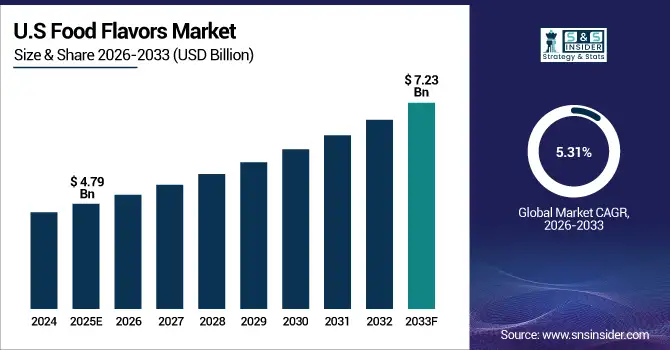

The U.S. Food Flavors Market size was USD 4.79 Billion in 2025E and is expected to reach USD 7.23 Billion by 2033, growing at a CAGR of 5.31% over the forecast period of 2026-2033, driven by high consumer awareness of celiac disease, strong health consciousness, and demand for clean-label products. Widespread retail availability, product innovation, and e-commerce adoption drive sustained growth and market dominance.

Food Flavors Market Growth Drivers:

-

Consumer Demand for Natural Flavors Drives Global Food Market Growth Rapidly

Food Flavors Market Growth Due to the Consumers are increasingly seeking healthier food and beverage options, driving demand for natural and clean-label Flavors. Natural Flavors are perceived as safer and healthier compared to synthetic alternatives, appealing to health-conscious Millennials and Gen Z. This trend is amplified by social media influence and awareness campaigns about artificial additives. Manufacturers are responding with innovative natural extracts (fruit, plant-based, and botanical Flavors), which boosts product diversification and market growth.

Clean-Label Adoption: Around 58% of global packaged food products now highlight “natural flavor” or “clean-label” on packaging.

Food Flavors Market Restraints:

-

High Costs of Natural Ingredients Limit Market Expansion Worldwide Significantly

One of the key restraints is Natural flavor production often involves expensive extraction processes, seasonal raw materials, and lower yields compared to synthetic Flavors. These higher costs increase the final product price, limiting adoption in price-sensitive markets. Additionally, fluctuations in raw material availability due to climate or supply chain disruptions further restrict consistent production. This cost factor acts as a restraint, slowing down the overall market expansion, especially in emerging regions where affordability is critical.

Food Flavors Market Opportunities:

-

Emerging Markets Offer Huge Potential for Flavors Industry Expansion Globally

Emerging regions, particularly Asia Pacific, Latin America, and the Middle East, are witnessing rapid urbanization, rising disposable incomes, and a growing food and beverage industry are major opportunities of food Flavors market. This creates an opportunity for flavor manufacturers to introduce region-specific Flavors and expand distribution networks. Additionally, increasing popularity of packaged foods, beverages, and bakery products in these regions provides significant growth potential. Companies can leverage this trend by launching affordable, locally-preferred, and natural flavor offerings.

Flavor Innovation: Region-specific Flavors (spices, tropical fruits, and local herbs) could capture ~25% of incremental market share.

Food Flavors Market Segmentation Analysis:

-

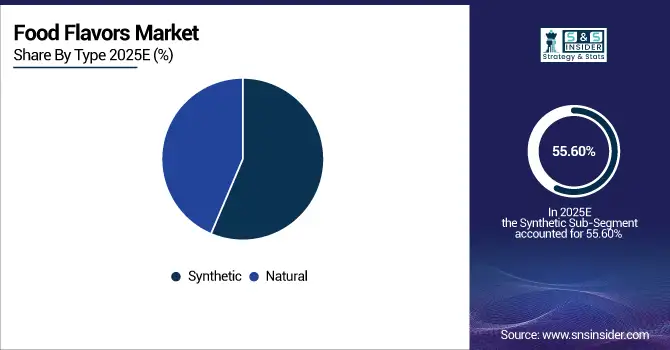

By Type, in 2025, Synthetic led the market with a share of 55.60%, while Natural is the fastest-growing segment with a CAGR of 7.03%.

-

By Form, in 2025, Liquid & Gel led the market with a share of 60.02%, while Dry is the fastest-growing segment with a CAGR of 6.50%.

-

By Flavor, in 2025, Chocolate led the market with a share of 28.90%, while Fruit & Nut is the fastest-growing segment with a CAGR of 7.10%.

-

By Application, in 2025, Bakery led the market with a share of 28.40%, while Convenience Foods is the fastest-growing segment with a CAGR of 6.90%.

By Type, Synthetic Lead Market and Natural Fastest Growth

The Synthetic segment leads the market in 2025, capturing the largest share due to its cost-effectiveness, consistent quality, and widespread use across bakery, beverage, and dairy products. However, the Natural segment is the fastest-growing, driven by increasing consumer demand for clean-label, health-conscious, and plant-based products. Manufacturers are innovating with fruit, botanical, and plant-derived Flavors to meet this trend. Rising awareness of artificial additives and social media influence further accelerate the adoption of natural Flavors, presenting significant growth opportunities globally.

By Form, Liquid & Gel Lead Market and Dry Fastest Growth

The Liquid & Gel segment leads in 2025, holding the largest share due to its versatility, ease of application, and compatibility with beverages, bakery, and dairy products. Meanwhile, the Dry segment is the fastest-growing, driven by increasing demand for powdered and shelf-stable flavored products, particularly in snacks and convenience foods. Advances in encapsulation and drying technologies, along with growing interest in functional and natural ingredients, are fueling the adoption of dry Flavors, creating significant growth opportunities globally.

By Flavor, Chocolate Lead Market and Fruit & Nut Fastest Growth

The Chocolate segment leads in 2025, holding the largest share due to its universal appeal, extensive use in confectionery, bakery, and beverage products, and strong consumer preference globally. Meanwhile, the Fruit & Nut segment is the fastest-growing, fueled by rising demand for natural, clean-label, and exotic Flavors. Innovation in tropical, berry, and nut-based flavor profiles, along with increasing health-conscious consumption and social media influence, is accelerating adoption, providing significant growth opportunities for manufacturers across all regions.

By Application, Bakery Lead Market and Convenience Foods Fastest Growth

The Bakery segment leads in 2025, holding the largest share due to the extensive use of Flavors in bread, cakes, pastries, and confectionery products, driven by growing consumer demand for indulgent and premium bakery items. Meanwhile, the Convenience Foods segment is the fastest-growing, fueled by increasing demand for ready-to-eat and packaged meals in urban and emerging regions. Innovations in natural and functional Flavors, coupled with busy lifestyles and rising disposable incomes, are accelerating the adoption of flavored convenience products globally.

Food Flavors Market Regional Analysis:

North America Food Flavors Market Insights:

The North America dominated the Food Flavors Market in 2025E, with over 36.60% revenue share, due to the presence of major flavor manufacturers, high consumer awareness, and strong demand for natural and clean-label products. The bakery, dairy, and beverage industries are major consumers of Flavors, while technological advancements in flavor formulation and extraction enhance product innovation. Rising health consciousness, premiumization trends, and increasing popularity of functional and exotic Flavors further support market growth.

Get Customized Report as per Your Business Requirement - Enquiry Now

U.S. and Canada in Food Flavors Market Insights

The U.S. and Canada lead the Food Flavors Market due to high consumer awareness, strong demand for natural and clean-label Flavors, advanced flavor formulation technologies, and well-established bakery, beverage, and dairy industries. Rising health consciousness and premium product trends further drive market dominance.

Asia Pacific Food Flavors Market Insights:

The Asia Pacific region is expected to have the fastest-growing CAGR 6.46%, driven by rapid urbanization, rising disposable incomes, and increasing demand for packaged and convenience foods. Growing health awareness and preference for natural and clean-label Flavors are fueling innovation in fruit, botanical, and plant-based flavor offerings. Expansion of the bakery, beverage, and dairy sectors, along with adoption of exotic and functional Flavors, further accelerates market growth. Manufacturers are focusing on scalable production and distribution strategies to capture the increasing consumption and evolving consumer preferences in the region.

China and India Food Flavors Market Insights

China and India are driving growth in the Food Flavors Market due to rapid urbanization, rising disposable incomes, and increasing demand for packaged, convenience, and functional foods. Growing health awareness and preference for natural and region-specific Flavors further accelerate market adoption.

Europe Food Flavors Market Insights

The Europe Food Flavors Market is well-established, characterized by high consumer awareness, strong demand for natural and clean-label Flavors, and a focus on premium and functional products. Innovation in exotic, botanical, and health-oriented Flavors drives product diversification across bakery, beverage, and dairy sectors. Increasing adoption of sustainable and eco-friendly flavor production techniques, along with regulatory support for clean-label initiatives, further strengthens market growth. Manufacturers are leveraging advanced flavor extraction and formulation technologies to meet evolving taste preferences and maintain competitiveness in this mature and dynamic region.

Germany and U.K. Food Flavors Market Insights

The U.K. and Germany are experiencing growth in the Food Flavors Market due to increasing consumer preference for natural, clean-label, and premium Flavors, rising demand in bakery, beverage, and dairy sectors, and strong innovation in functional and exotic flavor offerings.

Latin America (LATAM) and Middle East & Africa (MEA) Food Flavors Market Insights

The Latin America (LATAM) and Middle East & Africa (MEA) regions are witnessing gradual growth in the Food Flavors Market, driven by rising disposable incomes, urbanization, and increasing demand for packaged and convenience foods. Consumers are showing a growing preference for natural, clean-label, and region-specific Flavors, while bakery, beverage, and dairy sectors expand rapidly. Flavor manufacturers are investing in innovative formulations, including exotic and functional Flavors, and enhancing distribution networks to meet evolving taste preferences, health-conscious trends, and increasing consumption, thereby creating significant growth opportunities across these emerging regions.

Food Flavors Market Competitive Landscape:

Symrise AG is a key contributor to the Food Flavors Market, providing a wide range of natural, synthetic, and specialty Flavors for various applications including bakery, beverages, and convenience foods. Through partnerships, sustainable extraction technologies, and functional flavor innovations, Symrise addresses the increasing consumer preference for clean-label, health-oriented, and exotic Flavors. Its strong focus on R&D and global distribution strengthens market presence and supports the growing demand across developed and emerging regions.

-

In October 202, Symrise and Aplantex Bio confirmed a partnership to develop new technologies for accessing plant-based molecules as raw materials for flavor production.

Firmenich SA is a major player in the Food Flavors Market, offering innovative Flavors for beverages, confectionery, bakery, and dairy sectors. The company emphasizes natural, functional, and exotic flavor development, aligning with consumer trends toward clean-label and health-conscious products. Strategic partnerships, biotechnological advancements, and sustainable production practices enhance Firmenich’s ability to deliver high-quality Flavors globally, expanding its footprint and driving growth in both mature and emerging food and beverage markets.

-

In April 2025, DSM-Firmenich announced a strategic partnership with Inscripta to drive biotech innovations in well-aging skincare, combining expertise in nutrition, health, and beauty.

Mane SA is a leading player in the Food Flavors Market, specializing in natural and clean-label Flavors for bakery, beverages, dairy, and savory products. The company focuses on innovation through research in exotic, functional, and plant-based Flavors to meet evolving consumer preferences. Mane’s expansion of production facilities, coupled with sustainable sourcing and technological advancements, enables it to capture growing demand in emerging markets, driving global flavor adoption and market growth.

-

In April 2025, Mane unveiled a new facility in North America, increasing its manufacturing capacity fivefold. The plant enhances manufacturing efficiencies and supports the company's environmental, social, and governance (ESG) goals.

Food Flavors Market Key Players:

Some of the Food Flavors Market Companies are:

-

Givaudan

-

International Flavors & Fragrances Inc. (IFF)

-

Firmenich SA

-

Symrise AG

-

Kerry Group

-

Mane SA

-

Sensient Technologies Corporation

-

Takasago International Corporation

-

T. Hasegawa Co., Ltd.

-

Robertet Group

-

Archer Daniels Midland Company (ADM)

-

Huabao International Holdings Limited

-

Frutarom Industries Ltd.

-

Solvay S.A.

-

Ingredion Incorporated

-

Döhler GmbH

-

Synergy Flavors, Inc.

-

Bell Flavors & Fragrances

-

Flavor Producers LLC

-

TastePoint Flavors

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 18.16 Billion |

| Market Size by 2033 | USD 28.04 Billion |

| CAGR | CAGR of 5.59% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Natural, Synthetic) • By Form (Liquid & Gel, Dry) • By Flavor (Chocolate, Fruit & Nut, Vanilla, Spices & Savory, Others) • By Application (Bakery, Beverages, Confectionery, Dairy, Convenience Foods, Snacks, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Givaudan, International Flavors & Fragrances Inc. (IFF), Firmenich SA, Symrise AG, Kerry Group, Mane SA, Sensient Technologies Corporation, Takasago International Corporation, T. Hasegawa Co., Ltd., Robertet Group, Archer Daniels Midland Company (ADM), Huabao International Holdings Limited, Frutarom Industries Ltd., Solvay S.A., Ingredion Incorporated, Döhler GmbH, Synergy Flavors, Inc., Bell Flavors & Fragrances, Flavor Producers LLC, TastePoint Flavors, and Others. |