Cognitive Assessment and Training Market Report Scope & Overview:

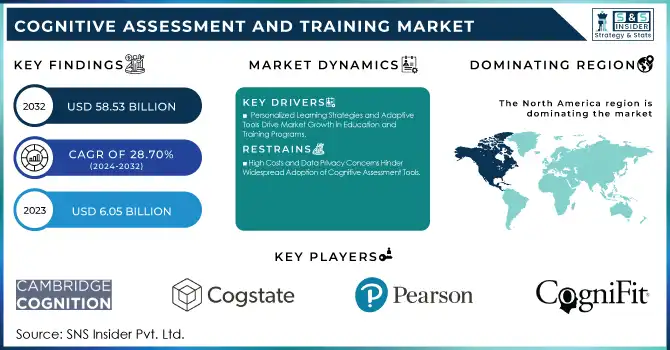

The Cognitive Assessment and Training Market was valued at USD 6.05 billion in 2023 and is expected to reach USD 58.53 billion by 2032, growing at a CAGR of 28.70% over the forecast period 2024-2032.

Get More Information on Cognitive Assessment and Training Market - Request Sample Report

Increasing awareness of mental health and cognitive well-being in various sectors such as healthcare, education, and the corporate sector, is a major force driving the growth of the cognitive Assessment and Training Market. However, the increasing incidences of disorders like Alzheimer's, dementia, and other cognitive impairments in a vast population have demanded early diagnosis, as well as management of the same. Healthcare providers and researchers are using the smart and innovative cognitive assessment tools available today to monitor and improve cognitive function, improving patient outcomes. Furthermore, the elderly population across the globe is growing which indirectly fuels the expansion of the market as aging people require cognitive training to be mentally fit. According to global population estimates, people aged 60 years and above will number more than 1.4 billion (16.5% of the population) by 2030 and 2.1 billion by 2050. And in the U.S., there are 6.9 million people 65 and older living with Alzheimer’s, with the number expected to reach 13.8 million by 2060. Worldwide, there are 55 million people with dementia, and every year, there are 10 million new cases. Other findings revealed that 63% of organizations are investing in employee cognitive and mental health programs in order to improve the productivity and well-being of their employees.

Cloud-based platforms and AI-based tools are among the recently developed technologies driving the market's growth. These innovations offer accessible, efficient, and scalable solutions for individuals, communities, and organizations, making them both geographically and demographically neutral in terms of adoption. Cognitive training tools are becoming a requisite in the education and corporate space to enhance learning outcomes in the former and employee performance in the latter. Increase Adoption Due To Integration Of Biometric Assessment–Biometric assessments lend high accuracy & security increasing the trust & acceptance levels amongst consumers. Moreover, the development of the market is driven by supportive government initiatives and new funding for mental health programs. In conclusion, the merging of healthcare requirements, advancements in technology, and institutional interest highlights the strong growth potential of the Cognitive Assessment and Training Market. In FY 2024, the Biden-Harris Administration has provided USD 70 million for 333 grantees across 48 states to implement integrated mental health services. Healthcare USD 10.8 billion for mental health and substance use services. As of 2023, more than 63% of organizations worldwide have reported that it is making investments in employee cognitive health programs. In addition, 25% of cognitive assessment tools are projected to have a biometric element by 2024, increasing the accuracy and trust of the assessments.

MARKET DYNAMICS

KEY DRIVERS:

- Personalized Learning Strategies and Adaptive Tools Drive Market Growth in Education and Training Programs

The rise of personalized learning strategies drives the market predominantly in institutes and training programs. Adaptive learning algorithms are increasingly being integrated into the classrooms to replace the traditional one-size-fits-all teaching methods which have little to no effect on students' performance. With such potential in these platforms, teachers can customize assigned content, speed, and style to create the biggest impact a person student can possess and perform. Likewise, brain-training apps and gamified cognitive tools have attracted people hoping for the customized magic bullet of improved memory, attention, and problem-solving ability. The demand for this tool was fueled further by their widespread availability, due to the explosion of smartphones and internet access. This is one of the key growth drivers as it helps to ensure optimal user outcomes, given how personalized, data-driven learning is emphasized. 73% of U.S. K-12 schools will have adopted adaptive learning technology by 2024, a move toward more customized learning experiences. The smartphone craze will also propel the mobile-enabled brain-training tools, with an estimated 90% of U.S. adults likely to own smartphones. More than 85% of the global edtech companies will adopt AI-powered, adaptive learning platforms to improve student performance and engagement.

- Workplace Wellness Programs Drive Market Growth with Cognitive Assessments Enhancing Productivity and Employee Health

Moreover, workplace wellness programs have become an essential factor in market growth, since businesses are realizing the relationship between employee cognitive health and productivity. Cognitive assessment tools are increasingly being adopted by companies to aid in workforce development, manage workplace stress, and support innovation. Such programs usually include some cognitive training modules that help increase the attention, decision-making, and overall resilience of employees. These tools are also used by employers in recruitment and promotions to assess candidates for cognitive skills to better fit them into roles where they are likely to succeed. As hybrid and remote work models continue to proliferate, mental health care has become even more vital, as employees have to cope with the difficulties of staying productive while juggling what at times feels like an endless stream of work and home-life burdens. Cognitive Assessment give employers actionable ideas on how to create supportive work environments for their employees. Workplace wellness has become a crucial driver for market growth, as this trend not only enhances employee satisfaction and retention but also aids organizational success. 64% of employers will increase their wellness offerings and 76% of employees feel burned out, with 28% feeling burned out very often. More than 71% of working adults also reportedly suffer from stress symptoms, which leads to a necessity for cognitive assessment tools. Cognitive assessments are used by 45% of HR managers in recruitment, and 45% of companies offer mental health resources for remote workers to address work-life issues.

RESTRAIN:

- High Costs and Data Privacy Concerns Hinder Widespread Adoption of Cognitive Assessment Tools

The key restraint in the Cognitive Assessment and Training Market is the high cost of advanced tools and technologies. Many cognitive assessment solutions, particularly those utilizing AI, biometric sensors, or cloud-based platforms, require significant investment in both development and deployment. This can limit their adoption, especially in emerging markets or among smaller organizations with constrained budgets. Additionally, the complexity of integrating such tools into existing systems may require specialized knowledge, adding to the operational costs and creating barriers to widespread implementation. Another challenge is the issue of data privacy and security. As cognitive assessments often involve sensitive personal and health data, ensuring robust data protection is crucial. Regulatory compliance, such as GDPR in Europe, adds complexity to the adoption process. Mismanagement or breaches of data could lead to legal consequences, eroding trust among users and limiting the market's growth potential.

KEY MARKET SEGMENTS

BY COMPONENT

Solutions accounted for a 54.6% share of the Cognitive Assessment and Training Market in 2023. The dominant position is due to the growing demand for such advanced, highly scalable, and automated cognitive assessment solutions that provide a bespoke experience to the users. Solutions especially software platforms allow healthcare providers, educators, and businesses to perform large-scale cognitive assessments with minimal effort. Usually powered by AI, ML, and cloud technology, these platforms help in the quick analysis of data, instant feedback, and greater user engagement. The increasing need for solution-based offerings as organizations and institutions are increasingly looking to integrate cognitive assessments within their existing system has led to a significant market share.

Services are projected to grow at the highest CAGR during the forecast period of 2024-2032, owing to the growing demand for customization, implementation assistance, and continuous management. With the rising adoption of cognitive assessment tools by organizations, the demand for expert services to consult, customize, and integrate these tools is also noticeable. In addition to this, tracking, analytics, and feedback services are essential to ensure they are driving the results of cognitive training programs. This trend has also been extended by the growth of subscription models and managed services in sectors such as healthcare and corporate training. Moreover, the continuing requirements of real-time updates and training for users and administrators are driving the subscription demand which will lead to the fastest-growing segment in the coming years.

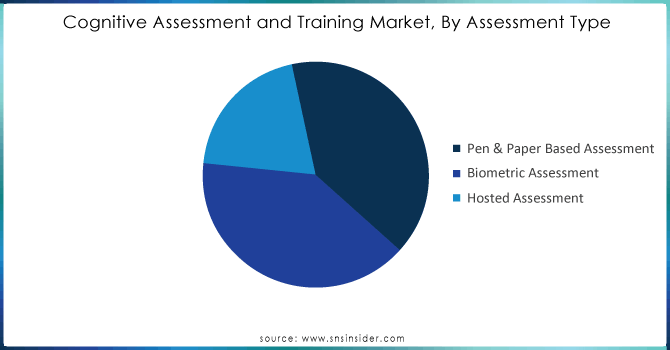

BY ASSESSMENT TYPE

Pen & paper-based assessments took the largest share by Cognitive Assessment and Training Market, accounting for 47.6% in 2023, since historically it has always been part of the educational, clinical, and corporate sectors. Such assessments have persisted as checks of choice as a result of their simplicity, low cost, and low implementation burden. This has made them the mainstay in cognitive assessment for years as they do not need high-end technology behind them, making them available in areas with lower penetration of digital infrastructure. Standard testing, although often the most practical solution in many developing countries where technology systems may not be available, remains in use in traditional educational systems. Even aside from that, they also continue to be popular for other official and standardized tests, as they are more familiar, simpler, and easier to score. In addition, they require a minimal setup cost along with very little continued technical support and thus continue to lead in practice from various sectors even if the digitalization trend is emerging.

The Hosted Assessments segment is expected to gain maximum growth in the Cognitive Assessment and Training Market between 2024 and 2032. This has been led by the surge in the demand for digital technologies across industries, as well as the necessity for scalable, flexible, and efficient cognitive assessment solutions. Remote administration, real-time data processing, and quicker analysis in hosted assessments improve efficiency over conventional pen and paper methods significantly. The growing popularity of e-learning platforms, work-from-home culture, and online training programs have propelled the demand for hosted assessments can effectively fit into online education systems and corporate training systems. Moreover, hosted assessments present automated scoring and data analytics capabilities that provide insights into cognitive performance and improve decisions. Cloud Hosting to Transform Cognitive Assessment & Training Landscape Cloud hosting is anticipated to grow exponentially, driven by the rising demand for personalized learning, data security, and integration with other software to deliver seamless user experience.

BY APPLICATION

In 2023, the Cognitive Assessment and Training Market was led by Clinical Trials, accounting for a share of 37.5%, and is anticipated to be the fastest-growing segment throughout the period 2024-2032. The large share in 2023 is attributed to the growing use of cognitive assessments for the assessment of the influence of treatments, drugs, and interventions on mental and cognitive functions in clinical research. In a clinical trial, cognitive testing is an important aspect, particularly in the context of neurodegenerative disease, mental disorders, and cognitive deficits clinical trials, as it produces objective data that is then used to demonstrate whether or not treatments work. Led by the growing global trend toward precision medicine and individualized healthcare, there is an increasing clinical need for more sophisticated, precise cognitive assessments, which further stimulates the uptake of cognitive training tools in clinical trials. This rapid growth has largely been driven by ongoing innovation and development in the areas of new medical research and cognitive measurement technologies. More pharma companies and researchers favor digital and AI-based cognitive assessments due to reduced trial processes, improved accuracy of results, and decreased time spent on evaluations. The increasing incidence rates of mental illnesses and neurodegenerative disorders are also contributing to this trend since more clinical trials and treatment research are needed. Abstract: As research, regulation, and technology improve in the field of health care, assessment can be expected to continue to have its largest revenue-generating market sector in clinical trials

BY INDUSTRY VERTICAL

Healthcare dominated the Cognitive Assessment and Training Market, with a 35.6% market share in 2023, and is expected to grow at the highest CAGR from 2024 to 2032. The primary cause of this dominance is involved with the growing importance of cognitive assessments in diagnosing and treating various cognitive disorders like Alzheimer's, dementia, and other neurodegenerative disorders. They want to integrate tools that allow them to assess cognitive domains in a better way to help track cognitive health, evaluate the effectiveness of treatments, and tailor care plans. The growth of cognitive assessment technologies in the healthcare sector is driven by the increasing geriatric population across the globe, along with increasing demand for cognitive health interventions and monitoring. The predicted rapid growth in health (healthcare) can also be attributed to the increasing attention to mental health and cognitive health together with the advancement in digital health technologies. AI-based tools, mobile apps, and remote cognitive assessment tools are enabling the assessment of cognitive functions and monitoring of progress over time more easily and outside traditional clinical settings. The innovations make this more affordable, beneficial, and scalable for patients and health professionals. In addition, with the growing focus on mental health and the introduction of personalized medicine, health agencies are making high capital investments in cognitive training and assessment tools to better the health status of the population. Under these factors, the cognitive assessment market will gain rapid growth in the healthcare sector during the forecast period.

REGIONAL ANALYSIS

In 2023, North America held the largest market share of 38.7% in the Cognitive Assessment and Training Market and is expected to continue holding a significant share, owing to the presence of established healthcare systems, infrastructure, and advanced education institutions coupled with a significantly high corporate sector. North America held the largest share of the cognitive assessment and training market in 2016 owing to increasing awareness of mental health, the growing geriatric population, and the growing demand for employee wellness and performance management. In North America, you have firms such as Cogstate, a global leader in the field of cognitive assessment tools, which is very active in the area of clinical trials, especially with pharma and biotech. Lumosity, a popular brain-training platform that helps improve mental abilities like memory attention, and problem-solving skills, is used widely throughout the region.

Asia Pacific is estimated to register the highest CAGR from 2024 to 2032. The high rate of adoption of digital technologies, rising healthcare awareness, and the proliferation of online education and e-learning platforms in the region are some of the key drivers boosting the growth of the region. Additionally, the expanding and aging population in countries such as China, India, and Japan will offer some growth from the rising use of cognitive assessment to identify and monitor cognitive health. In the Asia Pacific, the players included CogniFit offering clinical and individual cognitive training tools heavily used in India and Japan. At the same time, there is another important cognitive research-related project in Beijing, where China’s State Key Laboratory of Cognitive Neuroscience and Learning is conducting cognitive research which together with the great interest in cognitive tests in the region, also brings more attention to the topic. The broader investments into (a) healthcare infrastructure and (b) education technology in these countries will accelerate the adoption of cognitive assessment tools.

Need any customization research on Cognitive Assessment and Training Market - Enquiry Now

Key players

Some of the major players in the Cognitive Assessment and Training Market are:

-

Cambridge Cognition Ltd (CANTAB Mobile, CANTAB Connect)

-

Cogstate Ltd (Cogstate Brief Battery, Cogstate Research)

-

Pearson (WAIS-IV, WISC-V)

-

CogniFit Inc (CogniFit Brain Training, CogniFit Cognitive Assessment)

-

PAR, Inc. (Wechsler Adult Intelligence Scale, Wechsler Intelligence Scale for Children)

-

Signant Health (Cognigram, eSource)

-

Clario (CNS Vital Signs, CNS Vital Signs for Clinical Trials)

-

Linus Health (BrainHQ, BrainHQ for Healthcare)

-

KERNEL (KERNEL Flow, KERNEL Flux)

-

Neurotrack Technologies, Inc. (MotiConnect, MotiConnect for Healthcare)

-

Cognetivity Neurosciences (CognICA, CognICA for Healthcare)

-

Koninklijke Philips N.V. (Philips Brain Performance Center, Philips Cognitive Healthcare)

-

Lumosity (Lumosity App, Lumosity for Healthcare)

-

Akili Interactive Labs (Akili Interactive, Akili Interactive for Healthcare)

-

Posit Science (BrainHQ, BrainHQ for Healthcare)

-

Neurotrack (MotiConnect, MotiConnect for Healthcare)

-

BrainCheck (BrainCheck, BrainCheck for Healthcare)

-

MAX Solutions (MAX Cognitive Training, MAX Cognitive Training for Healthcare)

-

Looxid Labs (LooxidLink, LooxidLink for Healthcare)

-

Newbase (Newbase Cognitive Training, Newbase Cognitive Training for Healthcare)

Some of the Raw Material Suppliers for Cognitive Assessment and Training Companies:

-

Intel Corporation

-

NVIDIA Corporation

-

Qualcomm Incorporated

-

Advanced Micro Devices (AMD)

-

Microsoft Corporation

-

Google Cloud

-

Amazon Web Services (AWS)

-

IBM Corporation

-

Atos SE

-

Oracle Corporation

RECENT TRENDS

-

In October 2024, Medidata and Cogstate formed a strategic partnership to transform neurology clinical trials by integrating AI-powered cognitive assessments and clinician solutions. The collaboration aims to enhance data quality, efficiency, and patient outcomes through advanced analytics and a unified platform for clinical trials.

-

In August 2024, CogniFit launched the CAB K-12, an innovative cognitive assessment tool for students, evaluating key cognitive areas to enhance personalized learning. The tool aims to improve academic outcomes by identifying strengths and challenges in cognitive development.

-

In October 2024, Brook Health partnered with Linus Health to enhance cognitive care by enabling same-day screenings and assessments for early detection of cognitive impairments.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 6.05 Billion |

| Market Size by 2032 | USD 58.53 Billion |

| CAGR | CAGR of 28.70% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Solutions, Services) • By Assessment Type (Hosted Assessment, Biometric Assessment, Pen & Paper Based Assessment) • By Application (Clinical Trials, Classroom Learning, Brain Training, Corporate Learning, Research, Other) • By Industry Vertical (BFSI, Retail, IT and Telecom, Education, Healthcare, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Cambridge Cognition Ltd, Cogstate Ltd, Pearson, CogniFit Inc, PAR, Inc., Signant Health, Clario, Linus Health, KERNEL, Neurotrack Technologies, Inc., Cognetivity Neurosciences, Koninklijke Philips N.V., Lumosity, Akili Interactive Labs, Posit Science, Neurotrack, BrainCheck, MAX Solutions, Looxid Labs, Newbase. |

| Key Drivers | • Personalized Learning Strategies and Adaptive Tools Drive Market Growth in Education and Training Programs • Workplace Wellness Programs Drive Market Growth with Cognitive Assessments Enhancing Productivity and Employee Health |

| RESTRAINTS | • High Costs and Data Privacy Concerns Hinder Widespread Adoption of Cognitive Assessment Tools |