Web Hosting Services Market Report Scope & Overview:

Get more information on Web Hosting Services Market - Request Sample Report

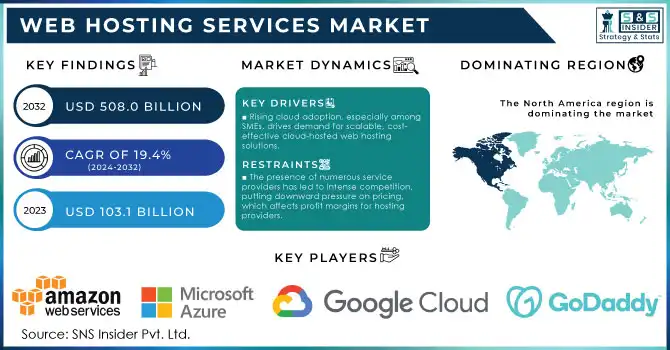

Web Hosting Services Market Size was valued at USD 103.1 Billion in 2023 and is expected to reach USD 508.0 Billion by 2032, growing at a CAGR of 19.4% over the forecast period 2024-2032.

The rapid growth of the global web hosting services market is attributed to the digital economy, increased e-commerce activity, and government initiatives to enhance digital infrastructure. With the latest data from the U.S. Department of Commerce (DOC) indicating e-commerce sales accounted for 15.7% of total retail sales in 2023, the online trend is growing at a remarkable pace, and businesses need reliable hosting services to ensure that their websites remain online and can perform reliably and safely for customers. The government has also expanded high-speed internet and cybersecurity infrastructures that are essential for the integrity of digital platforms. Initiatives like the Federal Communications Commission’s Broadband Deployment or the European Commission’s Digital Strategy are focused on creating an ideal environment for web hosting services by providing internet access and security to both urban and rural areas. Digital inclusivity is also improved through these initiatives, allowing a greater number of businesses to thrive on the Internet, thus contributing to the demand for strong web hosting infrastructure.

According to the International Trade Administration, the U.S. digital services exports, which include web hosting, reached $260 billion in 2023. This shows the increasing market for hosting solutions since organizations around the world are going digital. In addition, the demand for flexibility, customization, and high security from web hosting solutions supported by content providers will further fuel the long-term growth of the market as organizations are adapting more use of cloud infrastructure to optimize operational processes and reduce costs.

Web Hosting Services Market dynamics

Drivers

-

Increasing cloud infrastructure adoption, especially by small and medium enterprises (SMEs), drives demand for cloud-hosted solutions that offer scalable and cost-effective web hosting options.

-

As more businesses move online, especially in e-commerce, the need for reliable web hosting services is expanding, driven by the demand for high uptime and security features.

A crucial factor boosting the web hosting services market is the increasing adoption of cloud hosting solutions, especially in various forms of SMEs. Cloud hosting offers a flexible and scalable infrastructure, enabling businesses to effectively manage online operations and adapt to fluctuations in demand. Such a trend is driven in part by the growing digitization of services and the spread of remote work which is raising the requirement for online access and resiliency. According to statistics, a significant number of businesses moved from their servers to the cloud. Approximately 94% of enterprises around the globe employed some type of cloud service in 2023, with cloud-based apps representing roughly 89% of the total enterprise workloads, highlighting the heavy dependence on cloud infrastructure & services. Such a trend is more evident in SMEs which can leverage cloud hosting as an economic hosting alternative whose cost is attributed to IT infrastructure thus avoiding the necessity of a heavy up-front investment.

Furthermore, a 2024 survey revealed that 73% of small business owners now consider cloud services crucial to their operations due to the flexibility and enhanced security features they offer. A real-world example of this shift is evident in the e-commerce sector, where companies like Shopify and WooCommerce rely heavily on cloud hosting to ensure high availability and security for their clients’ stores. As these companies expand and offer tailored cloud-based hosting options, they further drive market demand, particularly for managed hosting solutions that simplify operations for smaller enterprises.

Key Restraints

-

The presence of numerous service providers has led to intense competition, putting downward pressure on pricing, which affects profit margins for hosting providers.

-

With rising cyber threats, maintaining robust security protocols has become costly for hosting providers, which may limit adoption among smaller businesses wary of data privacy risks.

A key restraint in the web hosting services market is the high cost and complexity of ensuring robust security and data privacy. With the increase in cyber threats, web hosting providers are under pressure to provide their clients with the most stringent security standards for privacy and data protection. It needs constant upgrades, a high-tech cybersecurity framework, and compliance with ever-evolving data protection regulations like GDPR and CCPA. For smaller web hosting providers, these expenses can be difficult to manage, creating barriers to entry and potentially limiting market growth. Additionally, clients, especially in sectors handling sensitive data (like healthcare and finance), demand rigorous security, adding pressure on providers to prioritize advanced security features over other service upgrades. The complexity of implementing these security measures without disrupting service reliability and speed is also a significant concern, making it a complex hurdle for companies aiming to attract a broad range of clients.

Web Hosting Services Market Segment analysis

By Type

In 2023, the web hosting services market was dominated by the shared hosting segment, which accounted for 34% of revenue share. Despite rising cloud prices, shared hosting is still largely the solution of choice for small and medium-sized businesses (SMBs) and even individuals who want to make their online presence felt with minimum capital. According to the U.S Small Business Administration, there were 33.2 million small businesses in 2023, 99% of all U.S. businesses, most of whom are looking for affordable web hosting as they venture online. Shared hosting provides the ideal balance of affordability and essential features, such as limited storage and security, which are sufficient for smaller websites. Initiatives like the Help to Grow Digital initiative in the UK are backed by governments across the world to aid the digitization of small businesses, which encourages small and medium-sized businesses to focus on digital tools such as web hosting to improve their output and outreach. It is this drive for digitization that has proved especially attractive to smaller enterprises looking for budget entry points into the digital economy, and consequently shared hosting.

By Application

In 2023, public websites accounted for the largest share of 54% of the market. Corporate websites, news portals, and e-commerce platforms that are public websites are the foundation of the digital economy. Government initiatives aimed at digital literacy and matching online transparency have nudged organizations to create an online presence around which customers or the public could build amidst the pandemic. For instance, the eGovernment Action Plan 2021–2027 of the European Union, focuses on digital service provision among public services and between them and the citizens, as a result of which there emerges an excess in the number of public sector websites. Moreover, private sector companies are spending massively on public websites to reach digital epoch people. According to 2023 data from the U.S. Census Bureau, e-commerce businesses have increased by 28%. This surge in new public websites underscores the growing reliance on web hosting services, especially as businesses recognize the need for accessible and informative websites to attract and retain customers.

By End Use

In 2023, the web hosting services market was led by the enterprise segment, which accounted for 90% of the total market. This segment is largely driven by large enterprises, which depend on advanced hosting services that help manage high traffic volumes and enhance data security. Enterprise quality hosting offers dedicated resources, sophisticated cybersecurity measures, and the scalability required of businesses managing large amounts of data or heavy customer traffic. In 2023, The U.S. Bureau of Labor Statistics found that there were over 7 million companies that employed over 100 workers; Many of these companies require dedicated or cloud hosting solutions to keep operations running smoothly while keeping customers happy. This is one of the key things these organizations pay the most attention to hence premium hosting can provide extremely reliable and secure hosting solutions. With the digital transformation gaining traction enterprise-level hosting is becoming more essential than ever in ensuring that businesses stay competitive and profitable in a connected economy.

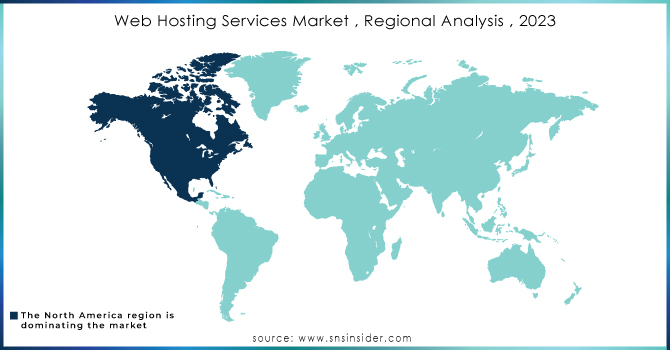

Regional Analysis

North America led the global web hosting services market, in 2023 accounting for a 40% share. The leadership in this respect is due to a high concentration of tech-savvy businesses, heavy internet penetration, and a strong government that has policies in support of a digital economy. The broadband internet availability in urban and rural locations accounted for 97% and 77% respectively by 2023 according to the U.S. Federal Communications Commission which is further boosting the web-hosting market as proper internet connectivity is the basic requirement for business to offer their services. Finally, e-commerce is one of the top industries/fields and programs implemented by the Canadian government as well as the U.S. government, and at this time, there are different types of programs to stimulate businesses to integrate into a digital solution to boost their productivity.

On the other hand, the Asia-Pacific region is growing with a significant CAGR, making it the fastest-growing region. India, China, and Japan are at the forefront of this expansion, driven by programs such as India’s Digital India initiative and China’s Internet Plus program to encourage internet use and the digitization of businesses. China has about 1 billion internet users, according to the Ministry of Industry and Information Technology within the country, as of 2023, providing a wide-scope market for web hosting solutions. A rise in Internet usage on mobile devices, following the same tendency with investments into technology from abroad, treats the Asia-Pacific region as a quickly expanding market for web hosting assistance.

Need any customization research on Web Hosting Services Market - Enquiry Now

Key Players

Key Service Providers/Manufacturers

-

Amazon Web Services (AWS) – (Amazon EC2, Amazon Lightsail)

-

Microsoft Azure – (Azure App Service, Azure Virtual Machines)

-

Google Cloud Platform – (Google Compute Engine, Google App Engine)

-

GoDaddy – (Web Hosting, WordPress Hosting)

-

Bluehost – (Shared Hosting, VPS Hosting)

-

IBM Cloud – (IBM Cloud Virtual Servers, IBM Cloud Bare Metal Servers)

-

HostGator – (Shared Web Hosting, Dedicated Hosting)

-

Liquid Web – (VPS Hosting, Dedicated Hosting)

-

InMotion Hosting – (Business Hosting, Dedicated Servers)

-

SiteGround – (Cloud Hosting, WordPress Hosting)

Key Users of Web Hosting Services

-

Netflix

-

Spotify

-

Airbnb

-

Slack

-

Dropbox

-

Pinterest

-

Adobe

-

NASA

-

Snapchat

-

Reddit

Recent Developments in the Web Hosting Market

-

The U.S. Federal Communications Commission has announced a new round of funding for rural broadband expansion, expected to increase demand for web visible unicorn hosting in under-served regions (October 2023)

-

HostPapa, a leading cloud service and web hosting provider for small and medium-sized businesses (SMBs) in North America, acquired Deluxe Corporation's web hosting and logo design divisions in June 2023. Adding Deluxe’s extensive global client base and expanding its presence in several markets extends and strengthens HostPapa’s ability to serve local small- and medium-sized businesses (SMBs).

-

In April 2023, CloudMinister Technologies Pvt. Ltd. introduced new scalable and cost-effective web hosting plans tailored to meet the online needs of SMBs, providing a reliable hosting option for growing businesses.

| Report Attributes | Details |

| Market Size in 2023 | USD 103.1 Billion |

| Market Size by 2032 | USD 508.0 Billion |

| CAGR | CAGR of 19.4% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Shared Hosting, Dedicated Hosting, Virtual Private Server (VPS) Hosting, Colocation Hosting, Others) • By Deployment (Public, Private, Hybrid) • By Application (Intranet Website, Public Website, Mobile Application) • By End-user (Enterprise, Individual) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles |

Amazon Web Services (AWS), Microsoft Azure, Google Cloud Platform, GoDaddy, Bluehost, IBM Cloud, HostGator, Liquid Web, InMotion Hosting, SiteGround |

| Key Drivers | •Increasing cloud infrastructure adoption, especially by small and medium enterprises (SMEs), drives demand for cloud-hosted solutions that offer scalable and cost-effective web hosting options •As more businesses move online, especially in e-commerce, the need for reliable web hosting services is expanding, driven by the demand for high uptime and security features. |

| Market Restraints | •The presence of numerous service providers has led to intense competition, putting downward pressure on pricing, which affects profit margins for hosting providers •With rising cyber threats, maintaining robust security protocols has become costly for hosting providers, which may limit adoption among smaller businesses wary of data privacy risks. |