Cognitive Automation Market Report Scope & Overview:

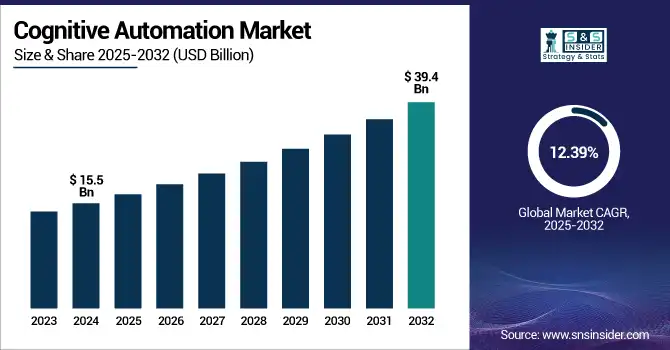

The Cognitive Automation Market size was valued at USD 15.5 billion in 2024 and is expected to reach USD 39.4 billion by 2032, growing at a CAGR of 12.39% during 2025-2032.

To Get more information on Cognitive Automation Market - Request Free Sample Report

The Cognitive Automation Market is experiencing rapid growth as enterprises increasingly seek to streamline complex business processes through intelligent automation. The AI, ML, NLP, and RPA combine under this market to help machines perform the tasks that require a human sort of understanding and decision-making ability. Data Intelligent Document Processing (IDP) is one critical field in this space that helps convert unstructured and semi-structured data (invoices, forms, contracts, mails, etc.) into actionable insights. Intelligent document processing (IDP) solutions employ AI, machine learning, and natural language processing technologies to automatically extract, classify, and validate data from documents, minimizing manual efforts and errors. This can be especially useful in industries like BFSI, healthcare, legal, and logistics that have document-intensive processes. With organizations journeying and evolving into Digital Transformations, their demands in the form of scalable, secure, and intelligent automation solutions are continuously increasing. This change is projected to propel the global cognitive automation market into multi-billion-dollar valuations by the end of the decade. Additionally, an IDP that works seamlessly with cognitive workflows strengthens compliance, drives operational efficiency, and expedites decisions while serving as a mission-critical component of next-gen enterprise automation strategies.

In June 2025, at the Nasdaq Investor Conference, Cognizant CFO Jatin Dalal stated that IT service pricing will shift within 3–5 years, separating costs between human engineers and virtual agents, driven by AI adoption. AI now handles work equal to 12,000 employees, with 20% of coding AI-assisted. Despite global economic pressures, the BFSI sector is boosting tech investments, and Cognizant has secured three major outcome-based deals.

Market Dynamics

Drivers:

-

AI, ML, and NLP are transforming RPA into cognitive automation by enabling intelligent, adaptive, and context-aware workflows.

The advancement in cognitive automation is being driven through the integration of Artificial Intelligence (AI), Machine Learning (ML), and Natural Language Processing (NLP) with Robotic Process Automation (RPA) platforms. This real-time integration takes automation tools beyond the limits of conventional rule-based bots, which follow a set of predefined steps, allowing them to now understand unstructured data emails, documents, or chat. Machine learning enables the system to make accurate predictions by learning from previous actions. NLP, on the other hand, helps bots to understand intent, sentiment, and context which leads to intelligent customer interactions and document processing. The outcome is hyper-automation, stretchable, self-optimizing workflows that can change with ever-evolving business requirements and deliver the highest levels of operational efficiency ever.

In April 2025, UiPath CEO Daniel Dines, in The Verge’s Decoder podcast, announced a strategic shift toward “agentic AI” by combining rule-based RPA with large language models (LLMs). This hybrid model uses bots for precision tasks and LLMs for decisions and user interactions. He highlighted their AI Trust Layer and the acquisition of Peak to boost vertical AI capabilities.

Restraints:

-

High implementation costs hinder SMEs from adopting cognitive automation, widening the gap with larger enterprises.

SMEs suffer prohibitive upfront costs when implementing cognitive automation including cost of advanced software licenses, infrastructure to host cloud solutions and hiring specialized AI engineers and data scientists. Furthermore, embedding solutions into legacy systems involves significant integration effort, professional services, and ongoing support, all of which compound total ownership costs. Although the ROI on these in the long term with enhanced workflows and a reduction in manual errors is large, the initial capital requirement is still a major challenge for businesses low on resources. Consequently, most of them postpone or down-prioritize these transformational projects, which makes them have a lack in market penetration and the gap in adoption between the big companies and little ones increase.

In December 2024, The Times reported that hotels like Zedwell implemented AI-powered check-in kiosks and chatbots to automate front-desk operations. This innovation reduced check-in times from 3–10 minutes to just 2.5 minutes. As a result, Zedwell cut its reservation team size by 66%. The move highlights how small businesses are leveraging AI to boost efficiency and lower operational costs.

Opportunities:

-

Emerging Markets Accelerate Cognitive Automation Adoption Amid Rapid Digital Transformation and AI Investments.

Cognitive automation is gaining substantial traction across emerging economies in Asia‑Pacific and Latin America, as governments and enterprises accelerate digital transformation initiatives. Countries like China and India are agility industrialized, and demand for intelligent automation in manufacturing, retail, healthcare, and BFSI. These are ideas the local governments are trying to implement by giving tax breaks, grants to companies that are working from government funded research and giving public private partnerships that will allow the vendors to tailor the solutions by each local need. Such as China, US and some other countries Brazil, Mexico, Argentina and Colombia are also investing heavily in AI infrastructure and talent development, realising the strategic value of cognitive automation. This wave of modernization not only boosts operational efficiency but also creates new market opportunities for global and local automation providers.

In June 2025, Japanese insurer Dai‑ichi Life partnered with Capgemini to launch its first Global Capability Centre (GCC) outside Japan, in Hyderabad, under a BOT model. The GCC will drive digital transformation across Japan, the U.S., and Australia, focusing on AI, data analytics, cybersecurity, and software development. Leveraging India's tech talent and Capgemini’s expertise, the initiative aims to enhance operational efficiency and customer experience.

Challenges:

-

Cognitive automation integration faces hurdles as legacy systems lack APIs, use outdated architectures, and present security and compliance risks.

Integrating cognitive automation into outdated IT infrastructures often reveals deep-rooted incompatibilities between modern AI-driven tools and legacy systems. These systems have outdated APIs, are based on older languages, and use siloed databases that cannot easily talk to each other. On-premises mainframes by their very rigid architecture are hostile to real-time data exchange, leading organizations to gravitate toward brittle, point-to-point integrations or expensive middleware bridges. Retrofitting AI agents into systems not originally designed for them also incurs greater security exposure and compliance risks that organizations will have to grapple with. It takes a lot of API, data normalization, and retraining of workers to get these types of projects off the ground, and even when successful, the rollout is careful, and has to be gradual or services break very easily.

In June 2025, according to Axios, digital twin technology is helping enterprises tackle legacy IT challenges by simulating real-time interactions between outdated systems and modern applications. DXC Technology is at the forefront, enabling safer testing and reducing dependency on fragile infrastructure. The integration of AI and automation further enhances simulation accuracy and accelerates digital transformation.

Segmentation Analysis:

By Type:

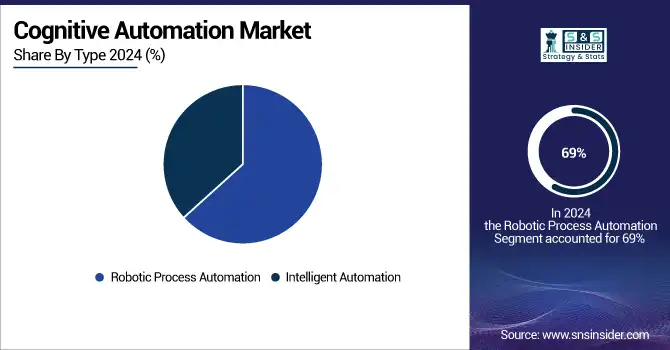

The robotic process automation segment dominated the market and accounted for 69% of the cognitive automation market share in 2024, due to the rapidly deployable nature, cost-effectiveness, and capability to integrate easily with the existing legacy systems. RPA was primarily adopted by automating repetitive, rule-based tasks across BFSI, healthcare, and retail, which has reduced operational business costs and improved accuracy. Of these, RPA is projected to continue to dominate through 2032, fueled primarily by enterprise-wide digital transformation and increased back-office automation.

The intelligent automation is anticipated to experience the fastest CAGR during the forecast period due to the increase of AI and ML in corporate workflows. Unlike conventional RPA, it can handle unstructured information, decide and learn from the current event, hence, highly suitable for dynamic use cases like fraud detection, personalized healthcare, and supply chain forecasting scenarios. The increase in demand for plug and play solutions across diverse industries will also help drive the adoption and scalability of this segment.

By End-User

The BFSI sector dominated the cognitive automation market in 2024 and accounted for a significant revenue share, due to its early adoption of automation for enhancing customer service, reducing fraud, and streamlining operations such as loan processing and compliance. RPA and AI-based tools help banks automate high-volume tasks and ensure regulatory adherence. By 2032, BFSI will continue to lead, driven by digital banking trends, increased fintech partnerships, and the growing need for operational resilience and cost optimization.

Pharma & Healthcare is expected to register the fastest CAGR through 2032, as automation improves patient engagement, accelerates drug discovery, and streamlines administrative tasks. Intelligent automation supports personalized medicine, predictive diagnostics, and clinical documentation. Rising healthcare digitization, data-driven care models, and the need to reduce human error in critical workflows will drive rapid growth, especially in post-pandemic healthcare systems seeking scalable, AI-powered solutions for better outcomes and efficiency.

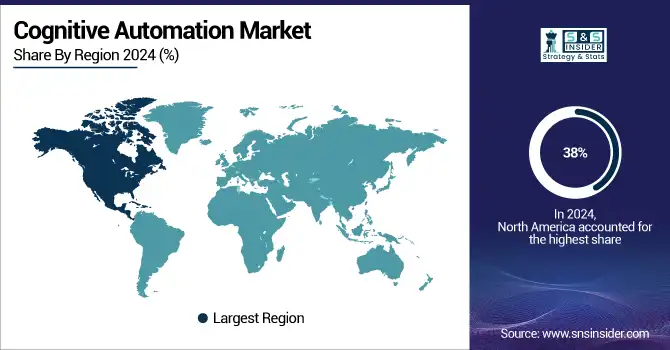

Regional Analysis:

North America dominated the cognitive automation market in 2024 and accounted for 38% of revenue share, owing to robust digital infrastructure, high AI adoption rates, and strong enterprise investments in automation technologies. Major industries such as BFSI, healthcare, and IT lead automation deployments to enhance efficiency and customer experience. With established players, favorable regulations, and ongoing innovation in AI and RPA, North America is expected to maintain its leadership through 2032, especially in driving enterprise-scale intelligent automation initiatives.

The U.S. automation market is projected to grow from USD 6.8 billion in 2024 to USD 18.7 billion by 2032, registering a CAGR of 13.5%. Growth is fueled by strong enterprise AI adoption, digital-first strategies in BFSI and healthcare, and rising demand for intelligent workflow solutions. Continued innovation, cloud-native automation platforms, and regulatory compliance needs will further accelerate market expansion.

Asia Pacific is projected to register the fastest CAGR during the forecast period, driven by rapid industrialization, digital transformation initiatives, and expanding tech ecosystems in countries like China, India, and Japan. Government support for AI adoption, a growing pool of skilled tech talent, and increased automation demand across manufacturing, retail, and telecom sectors will propel growth. The region's cost-sensitive markets also favor scalable, cloud-based automation solutions to enhance productivity and competitiveness.

Europe’s cognitive automation market is propelled by increasing demand for operational efficiency, workforce augmentation, and seamless integration of AI and RPA across key industries such as manufacturing, banking, and healthcare. The EU’s strong regulatory frameworks, supportive funding initiatives like Horizon Europe, and growing emphasis on digital sovereignty are accelerating adoption. The shift toward smart manufacturing, sustainability, and cross-border data strategies will continue to drive automation growth across the region through 2032.

Germany dominates the cognitive automation market due to its well-established industrial sector, leadership in Industry 4.0, and proactive investment in AI and robotics. Automation is widely adopted across automotive, machinery, and logistics to reduce costs and enhance precision. Government-backed initiatives, such as “AI Made in Germany,” and collaboration between tech firms and academic institutions are fostering innovation. Germany’s focus on intelligent, scalable solutions positions it for sustained leadership in Europe's automation evolution.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players :

The major cognitive automation market companies are Automation Anywhere, Blue Prism, Edge Verve Systems Ltd., FPT Software, KOFAX Inc., NICE, NTT Advanced Technology Corp., OnviSource Inc., Pegasystems, UiPath, IBM, Microsoft, and Others.

Recent Developments:

In June 2024, Automation Anywhere, a global leader in AI-powered automation, launched its AI + Automation Enterprise System, a next-generation platform that seamlessly integrates artificial intelligence with automation to deliver transformative business outcomes at scale.

In April 2023, Kofax, a prominent player in intelligent automation solutions, announced the revamp of its Kofax Marketplace—a centralized digital hub offering a wide range of apps, connectors, tools, and templates to simplify and enhance integration with leading business and automation platforms.

In May 2024, IBM introduced a series of major updates to its Watson platform, celebrating its one-year milestone. The new features include advanced data and automation capabilities, aimed at making AI more accessible, affordable, and flexible for businesses across industries.

|

Report Attributes |

Details |

|

Market Size in 2024 |

US$ 15.51 Billion |

|

Market Size by 2032 |

US$ 39.43 Billion |

|

CAGR |

CAGR of 12.39% From 2025 to 2032 |

|

Base Year |

2024 |

|

Forecast Period |

2024-2032 |

|

Historical Data |

2021-2023 |

|

Report Scope & Coverage |

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

|

Key Segments |

• By Type (Robotic Process Automation, Intelligent Automation) |

|

Regional Analysis/Coverage |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

|

Company Profiles |

Automation Anywhere, Blue Prism, Edge Verve Systems Ltd., FPT Software, KOFAX Inc., NICE, NTT Advanced Technology Corp., OnviSource Inc., Pegasystems, UiPath, IBM, Microsoft and others in the report |