AI Voice Cloning Market Report Scope & Overview:

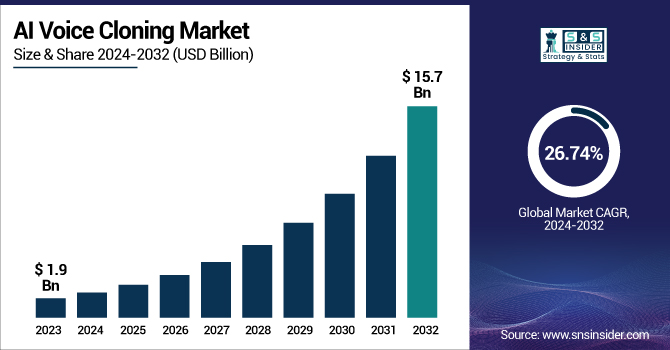

The AI Voice Cloning Market was valued at USD 1.9 Billion in 2023 and is expected to reach USD 15.7 Billion by 2032, growing at a CAGR of 26.74% from 2024-2032.

To Get more information on AI Voice Cloning Market - Request Free Sample Report

The AI Voice Cloning Market report highlights key trends, including adoption across industries, where sectors like entertainment and customer service are leading in deployment. Accuracy and realism benchmarking evaluates cloned voices against human speech, measuring improvements in naturalness and emotional tone. Integration with AI assistants explores how platforms like Alexa and Google Assistant are embedding cloned voices for personalized experiences. Ethical and security concerns address deepfake risks, consent issues, and regulatory challenges. New insights in the report focus on advancements in real-time voice synthesis, regulatory frameworks, and evolving ethical guidelines.

AI Voice Cloning Market Dynamics

Drivers

-

Growing demand for personalized and interactive AI-generated voices is driving adoption in customer service, media, and virtual assistants.

The rising adoption of AI voice cloning in customer service, virtual assistants, and entertainment boosts the market. Businesses use cloned voices for improved personalization in call-centers, chatbots, and audiobooks, which enhances the interaction with users. Not only that, AI voices are better than humans for many reasons: They are scalable, cost-effective, and sound human, therefore, you can have almost unlimited startup funds and resources to improve customer relations, increase repeat customers, and never have to worry about it. Additionally, AI voice synthesis is being utilized by content creators and media houses for dubbing, voiceovers, and accessibility solutions. The fact that voices can be tuned to user specifications only increases usage. The growing quality of speech synthesis, with the advances in deep learning and neural networks, coupled with the demand for better synthetic audio for a variety of applications, is making the AI voice cloning sound more natural over time in gaming, healthcare, advertising, and in some other spheres.

Restraints

-

Ethical and security concerns, including deepfake misuse and identity fraud, are limiting widespread acceptance and raising regulatory challenges.

While AI voice cloning is beneficial, it poses ethical and security issues, factors that have hampered widespread adoption. Deepfake voice technology allows for voice replicas to be made with a startling degree of authenticity, and the risks of identity fraud, misinformation, and unauthorized impersonation grow. Cloned voice deepfake scams for financial fraud or political manipulation have raised yellow flags for regulators and firms alike. Moreover, there are not strict policies regarding consent and data privacy, which is a challenge for both developers and users. To mitigate risks, companies are required to put in place strong authentication and ethical policies. Increasing abuse of AI voices will drive the need for stringent regulation without good governance, which ideally should enable faster adoption in sensitive areas like finance, law enforcement, etc., where voice is imperatively needed to innovate.

Opportunities

-

Advancements in real-time voice synthesis and multilingual AI models are expanding applications in gaming, healthcare, and content localization.

With the evolution of real-time voice synthesis and the new age of multilingual AI models, great opportunities are driving the overall AI voice cloning market. Businesses incorporate AI Speech Synthesis for on-demand voice changing for gaming, virtual assistants and live streaming. Wide language and dialect support — Enhanced language processing capabilities make AI voice cloning support multiple languages and dialects to meet various audiences worldwide. It creates enormous opportunity for industries such as media localization, education, and healthcare. And examples include tailored AI-created spoken voices for individuals who are unable to speak, enabling inclusive alternatives. With improvements in machine learning algorithms, AI voice cloning is becoming faster, more efficient, and generalizable, opening up new use cases in content generation, advertising, and human-computer interaction.

Challenges

-

Regulatory uncertainty and the lack of clear compliance standards create legal risks, slowing market growth and adoption in sensitive industries.

The uncertainty about ethical and legal aspects involving the use of AI voice cloning remains one of the core obstacles in the AI voice cloning market right now due to the absence of any regulatory framework as of now. This has left governments and industry bodies in a quandary on the specifications surrounding consent, privacy, and ownership of voice data. Lack of standard compliance mechanisms for data protection can put legal risks on the business because in some areas the protection of data is changing. For those companies who have developed AI voice cloning technology, the legal risks can be mitigated with clear marketing, transparency, and responsible AI use. In addition, imposing digital watermarking and detection methods to ascertain AI voices is a tough sell. Until regulation catches up, deploying AI voice cloning solutions across industries may have some challenges for businesses.

AI Voice Cloning Market Segmentation Analysis

By Component

The software segment dominated the market and accounted for the maximum revenue share in 2023 and is expected to continue its maximum share during the forecast period. Due to advanced research working on deep learning, speech synthesis, and voice conversion techniques, AI voice cloning solutions are progressing at a steady pace. These trends mostly include enhancing voice quality, personalization, multi-lingual and accented speech, and real-time voice conversion abilities.

The services segment is expected to have the fastest compound annual growth rate during the forecast period. The voice-over industry employs AI voice cloning providers to create voice recordings that sound professional-quality. Business can use AI voice cloning technologies to generate personalised voiceovers for commercials, videos, and other material for E-learning, audiobooks, and other purposes.

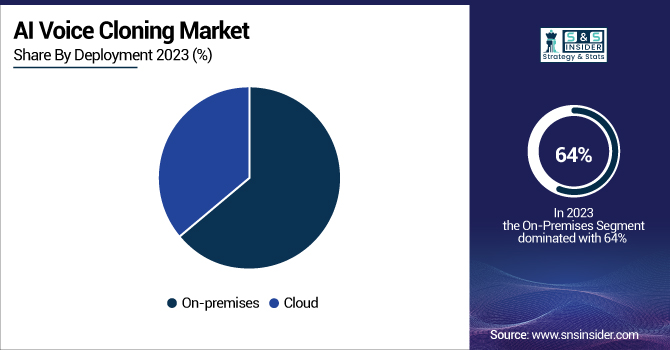

By Deployment

In 2023, the On-premises segment dominated the market and accounted for 64% of revenue share. For organizations that view their voice cloning models and algorithms as proprietary assets, on-premise solutions may be preferable in order to safeguard their intellectual property. Staying in-house allows them to retain the full control of the voice cloning technology and avoids any aggravation from leaking or other random access.

Cloud-based AI voice cloning solutions offer scalable and flexible infrastructure tailored to meet the rigorous demands of voice cloning models. The cloud enables scalable AI voice cloning, which allows organizations to dynamically adjust their AI voice cloning capacity depending on demand and efficiently process a huge amount of data while performing complex tasks like voice cloning.

By Application

In 2023, the audiobooks & podcasting segment dominated the market and accounted for significant revenue share. This advances artificial intelligence voice cloning to create decent audio voices to narrate audiobooks. This allows publishers to create audiobooks in a much more efficient and cost-effective manner. This makes it possible to record audiobooks of a wider array of books, some of which might not have been practical with human narrators in the first place.

The assistive technology segment is expected to see the most substantial compound annual growth rate throughout the forecast period. AI voice cloning can also provide personalized voices for non-speakers or those with verbal challenges. If it is trained on recordings of the person, or if the AI uses a similar voice, the result is a voice that is quite similar to the person, so that they can express who they are more accurately.

By Vertical

Media & entertainment segment dominated the market and accounted for the largest revenue share in 2023. Brands have been using AI voice cloning in media & entertainment to customize the brand voice for their customers. By creating a consistent voice identity, businesses can more effectively engage with their target audiences in different touchpoints like customer support, virtual assistants, and Interactive Voice Response. Personalized brand voices also improve brand identification and experience for users, remain focused.

The healthcare and life sciences segment is expected to register the fastest CAGR during the forecast period. The AI voice cloning technology is being adopted by the healthcare industry to enhance patient care and automate administrative tasks.

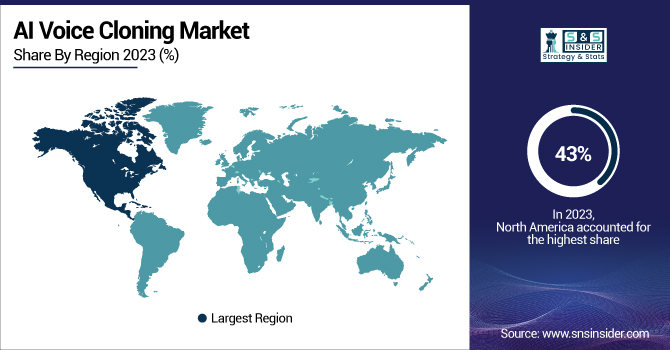

Regional Landscape

In 2023, North America dominated the market and accounted for 43% of revenue share. With the growing prevalence of virtual assistants and chatbots in North America, the functionality of these products has become a staple in a business's customer service arsenal. Virtual assistants, customer support chatbots, and other software solutions upgraded with AI voice cloning can significantly augment and improve these economic sectors with their more natural and human-like voices.

Asia Pacific houses many of the leading tech companies and startups at the forefront of AI innovation. These companies that invest in the research, develop, and commercialize AI Voice Cloning. Partnerships among tech firms, academia and industry participants are spurring growth in a localized market.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key players

The major key players along with their products are

-

Amazon Web Services (AWS) – Amazon Polly

-

Google – Google Cloud Text-to-Speech

-

Microsoft – Azure AI Speech

-

IBM – Watson Text to Speech

-

Meta (Facebook AI) – Voicebox

-

NVIDIA – Riva Speech AI

-

OpenAI – Voice Engine

-

Sonantic (Acquired by Spotify) – Sonantic Voice

-

iSpeech – iSpeech TTS

-

Resemble AI – Resemble Voice Cloning

-

ElevenLabs – Eleven Multilingual AI Voices

-

Veritone – Veritone Voice

-

Descript – Overdub

-

Cepstral – Cepstral Voices

-

Acapela Group – Acapela TTS Voices

Recent Developments

-

July 2024: Microsoft launched an enhanced version of its Azure AI Voice Cloning service, improving voice quality and adding multilingual capabilities.

-

August 2024: Google announced updates to its AI voice cloning models, focusing on real-time voice conversion for applications in gaming and virtual assistants.

-

June 2024: Sonantic introduced a new AI voice cloning solution tailored for the film industry, enabling accurate replication of actors' voices for post-production

|

Report Attributes |

Details |

|

Market Size in 2023 |

USD 1.9 Billion |

|

Market Size by 2032 |

USD 15.7 Billion |

|

CAGR |

CAGR of 26.74% From 2024 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2032 |

|

Historical Data |

2020-2022 |

|

Report Scope & Coverage |

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

|

Key Segments |

• By Component (Software, Service) |

|

Regional Analysis/Coverage |

North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

|

Company Profiles |

Amazon Web Services (AWS), Google, Microsoft, IBM, Meta (Facebook AI), NVIDIA, OpenAI, Sonantic (Acquired by Spotify), iSpeech, Resemble AI, ElevenLabs, Veritone, Descript, Cepstral, Acapela Group |