Retail Colocation Market Report Scope & Overview:

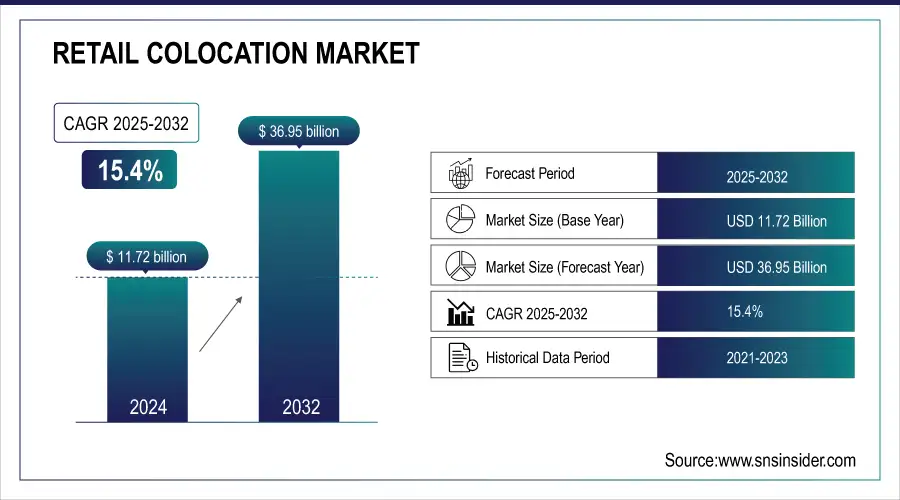

The Retail Colocation Market Size was valued at USD 11.72 billion in 2024 and is expected to reach USD 36.95 billion by 2032 and grow at a CAGR of 15.4% over the forecast period 2025-2032.

The retail colocation market is witnessing robust growth, propelled by exponential growth in IT infrastructure, data, and connectivity demands, four reasons from the pandemic to supply chain breakdowns over the past two years have necessitated enterprises across verticals to migrate away from on-premise data centers and to third-party colocation providers for efficiency, cost-effectiveness, and availability of high-speed, performant networks. Retail colocation services allow SMEs & large enterprises to lease physically smaller areas, configure power flexibly, and deploy quickly. Fueling this global market is the continued expansion of the cloud, edge deployments, and interconnection services, making retail colocation an indispensable part of the global digital infrastructure ecosystem.

To Get more information on Retail Colocation Market - Request Free Sample Report

As per the research, in CBRE (Commercial real estate Service) supply grew another 6,922.6 MW, a 34% annual increase, in the primary data center markets. The 6,350 MW under construction at the end of 2024 was more than two times the 3,077.8 MW at year-end 2023. High demand for space combined with longer lead times caused by power limits and supply chain bottlenecks to driving this surge.

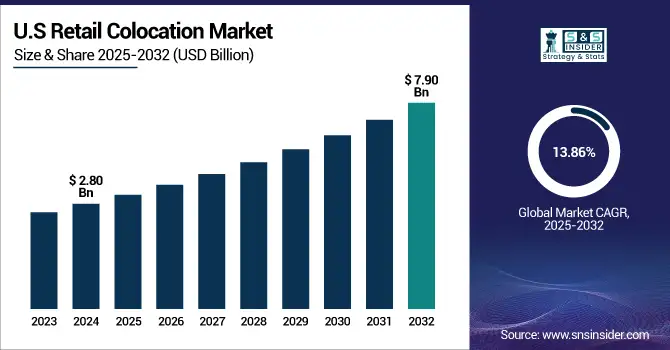

The U.S. retail colocation market size was USD 2.80 billion in 2024 and is expected to reach USD 7.90 billion by 2032, growing at a CAGR of 13.86% over the forecast period of 2025 to 2032. Due to its superior Digital Infrastructure, higher concentration of Tech Giants, along with the highest demand for Cloud and AI services. The biggest data center hubs include Northern Virginia, Dallas, and Silicon Valley, where reliable connectivity and power are present. Domestic semiconductor and data center development is also being bolstered by government initiatives such as the CHIPS Act.

Retail Colocation Market Dynamics

Key Drivers:

-

Surging AI and Cloud Computing Needs in Enterprises Drive Retail Colocation Market Growth Across Key Global Data Center Hubs

The market is significantly driven by the increasing demand for cloud services and artificial intelligence (AI) capabilities among enterprises. The demand for reliable, scalable, and secure data center infrastructure is on the rise as businesses accelerate digital transformation. Retail colocation facilities provide cost cost-effective alternative to building customers' data centers, having immediate access to power, connectivity, and cooling infrastructure. The major part of this expansion is driven by hyperscale and cloud service providers that are launching additional colocation sites to satisfy the increasing AI workloads. This is further exacerbated by vacancies as low as 2.8% and rising rents for new centers, displaying the growing demand for colocation space. Colocation solutions are becoming increasingly essential to enabling enterprise growth and innovation as AI models become larger and more complex, and the data used to train them grows in volume.

Restraints:

-

High Operational and Energy Costs of Colocation Facilities Limit Market Expansion in Price-Sensitive and Power-Constrained Regions

Hampering the growth of the retail colocation industry is the high operational and energy costs associated with maintaining advanced colocation infrastructure. Data centers require tremendous amounts of electricity to operate and cool server hardware, particularly in areas with antiquated grid infrastructure or where renewable power is less accessible. Furthermore, rising power tariffs and strict carbon rules in some jurisdictions make things even more expensive and influence pricing models around colocation. Suited for industries or markets where cost competitiveness would be the line in the sand, these factors represent massive barriers to entry. Such costs may be absorbed by large cloud providers who benefit from scale, but for retail colocation operators serving an array of tenants over a shared infrastructure, performance comes at a price, and that price can be challenging to balance against cost. This will be an ongoing challenge for the industry as energy prices keep changing.

Opportunities:

-

Edge Computing and IoT Expansion Create New Growth Avenues for Retail Colocation Providers in Emerging and Urban Markets Worldwide

The rise of edge computing and Internet of Things (IoT) applications presents a major opportunity for the retail colocation market. As data generation moves closer to the user and device, the need for low-latency colocation at the Edge is skyrocketing. This opens up huge possibilities for retail colocation providers to create micro data centers in suburban and remote locations. Local data processing is needed for smart city projects, autonomous vehicles, and 5G rollouts, which drive this expansion. To help support this type of distributed computing, retail colocation facilities that offer modular, scalable, and high-speed connections are quickly becoming a necessity. While the edge computing environment matures, retail colocation providers will gain from serving a range of use cases in telecom, healthcare, manufacturing, and transportation over the years.

Challenges:

-

Power Supply Constraints and Delayed Infrastructure Timelines Impact Serious Challenges for New Retail Colocation Facility Deployment

The retail colocation market is experiencing a growing delay in facility deployment due to power supply constraints and infrastructure bottlenecks. With a growing demand for colocation services, and a new datacenter being set up online, with the services being provided up is a challenge. The ability for power procurement is frequently challenged by challenges with the grid from the utility, allowing enough time for permits and reaching simple or complex regulatory frameworks to align within the background, especially in cities or power-constrained areas.

According to a February 2025 CBRE report, the amount of colocation capacity under construction more than doubled from 3,077.8 MW in 2023 to 6,350 MW by the end of 2024, highlighting the gap between planned capacity and actual availability.

These prolonged timelines not only impact service delivery and lead to a backlog of enterprise clients who want to ramp up digital infrastructure quickly. These challenges can hinder the market's ability to scale with enterprise and cloud adoption needs without a well-planned augmentation of power provisioning and permitting processes.

Retail Colocation Market Segments Analysis

By End-user

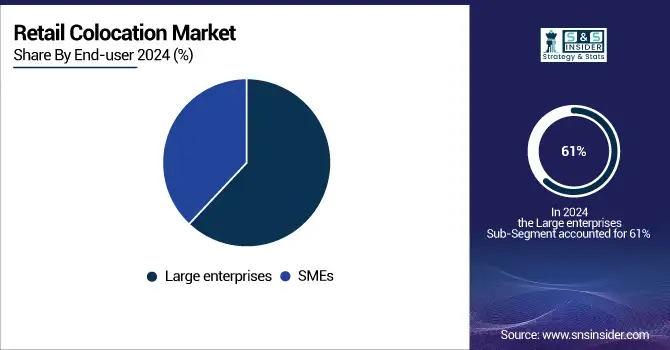

In 2024, large enterprises accounted for 61% of the retail colocation market share due to their massive IT workloads, data needs, and global presence. This increase is due to digital acceleration, economic scaling of resources, and other rising demands for safety against cyberattacks. Edge-ready colocation solutions, such as those from startups EdgeConneX and Cyxtera, are providing SMEs with enterprise-grade infrastructure without the large upfront capital investment previously required.

Small and medium-sized enterprises (SMEs) are witnessing the fastest growth in the retail colocation market, with a CAGR of 16.10%. Edge-ready colocation solutions hitting the market: Startups, including EdgeConneX and Cyxtera, are launching edge-ready colocation solutions providing much-needed access for SMEs that hope to configure enterprise-grade infrastructure with minimal CAPEX.

By Industry Application

In 2024, the IT and telecom sector led retail colocation usage with a 37% market share, fueled by explosive data growth and demand for low-latency services. Such as NTT Ltd and Colt DCS, built out high-density, cloud-adjacent colocation facilities for 5G rollouts, AI workloads, and content delivery, making colocation essential for both core telecom infrastructure and for agile IT development.

The healthcare segment is growing fastest, with a CAGR of 16.5%, as hospitals and medical providers digitize operations and adopt telehealth. Firms such as Iron Mountain and STACK Infrastructure unveiled new HIPAA-compliant colo sites to shoulder the burden of health records and AI-run diagnostics safely. The segment expansion mirrors the increased need by real-time care providers for secure, scalable data environments.

Regional Analysis

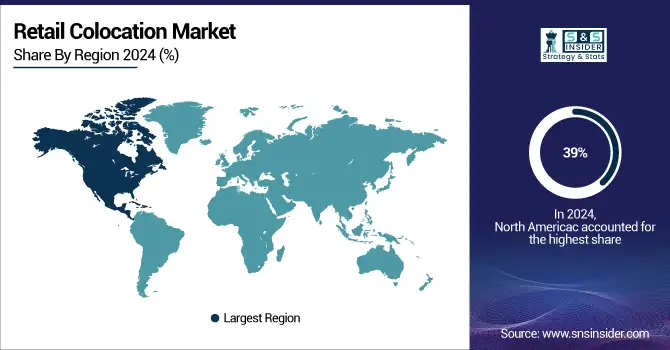

In 2024, North America held an estimated 39% market share of the global retail colocation market, making it the dominant region. High demand for cloud services, a dense internet infrastructure, and tons of digital transformation of retail businesses were supporting factors for making North America a leading region in this cloud marketplace.

Get Customized Report as per Your Business Requirement - Enquiry Now

North America's top data center markets experienced a 70% annual increase in construction supply, reaching 3.9 gigawatts. This growth was propelled by the expansion of AI and cloud computing by Big Tech. More than 500 megawatts of new data center capacity were brought online in the first half of 2024, nearly all of it in the same sub-markets that house existing Silicon Valley data center capacity. Vacancy rates fell to a historic low of 2.8%, and prices for newer centers increased due to the infrastructure built into them.

In 2024, the Asia-Pacific region was the fastest-growing in the retail colocation market, with an estimated CAGR of 17.1%. Asia-Pacific markets drive colocation demand due to rapid digitalization, expanding e-commerce, government smart city initiatives, and growing cloud adoption. Within the Asia-Pacific region, China is a year ahead of the UK in the retail colocation business analysis. This is due to a huge increase in internet users, a fast-growing digital infrastructure, and full support of data centers by the government.

Europe was the largest market for retail colocation in 2024, as a result of the increasing need for robust data privacy regulations, digital transformation, and growing hybrid IT infrastructures. Colocation growth in Europe was driven by GDPR compliance, enterprise cloud adoption, strong connectivity, and demand for secure, scalable IT infrastructure. The UK has been the regional leader in terms of data centre maturity, bolstered by its more developed financial sector and connectivity infrastructure. Colocation demand was also amplified by the continued global business hub positioning of London.

In 2024, the MEA and Latin America showed steady growth in the retail colocation market analysis, driven by digital transformation, cloud adoption, and rising e-commerce. The latest smart city initiatives and the investments in the data center by the UAE and Saudi Arabia put them at the forefront in MEA. Brazil leads the way in Latin America, with its strong backbone of telecom infrastructure, large base of digital consumers, and wealth of foreign investment. In both cases, supportive government policies coupled with demand from businesses modernizing operations towards a scalable, secure IT infrastructure were key enablers.

Key Players

The retail colocation market companies are AT&T Inc., China Telecom, Cogent Communications, Contegix, CoreSite Realty Corporation, Cyxtera Technologies, Inc., Digital Realty Trust, Inc., Global Switch, NTT Communications Corporation, Verizon and others.

Recent Trends

-

In March 2025, Cogent repurposed 55 former Sprint sites into edge data centers, each supporting approximately 40 racks and 350kW of power. This expansion enhances Cogent's colocation footprint, catering to the growing demand for edge computing solutions.

-

In October 2023, Seceon partnered with CoreSite to leverage its Boston data center for hosting its AI/ML-driven cybersecurity platform. CoreSite's scalable infrastructure supports Seceon's need for high-density compute environments, ensuring real-time threat detection and mitigation.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 11.72 Billion |

| Market Size by 2032 | USD 36.95 Billion |

| CAGR | CAGR of 15.4% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By End-user (SMEs, and Large Enterprises) • By Industry Application (IT and Telecom, Healthcare, Retail and E-commerce, Energy and Utility, and Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | AT&T Inc., China Telecom, Cogent Communications, Contegix, CoreSite Realty Corporation, Cyxtera Technologies, Inc., Digital Realty Trust, Inc., Global Switch, NTT Communications Corporation, Verizon, and others. |