Banking As a Service Market Report Scope and Overview:

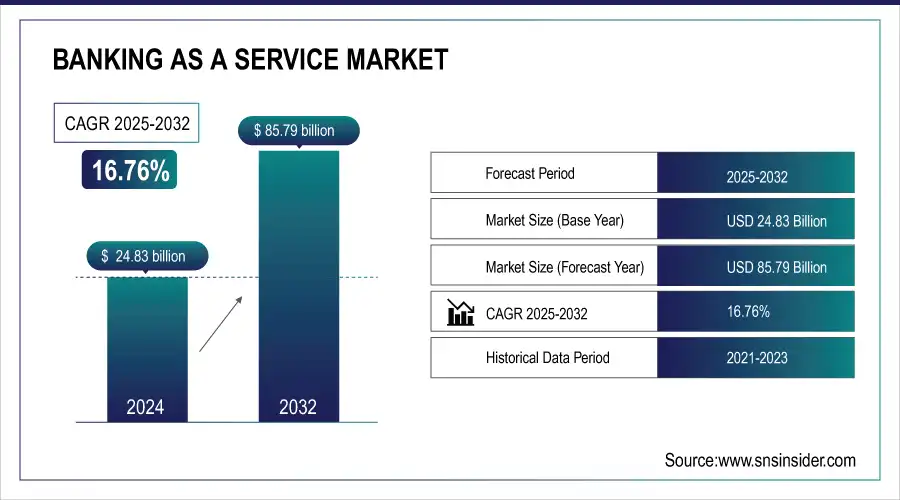

The Banking As a Service Market size was USD 28.99 Billion in 2025 and is expected to Reach USD 136.52 billion by 2035 and grow at a CAGR of 16.76% over the forecast period of 2026-2035.

The Banking as a Service (BaaS) market has emerged as a crucial facilitator of digital transformation in the financial sector, enabling financial institutions and businesses to meet the growing demand for efficient, accessible, and integrated financial services. With organizations and consumers searching for more digital solutions, BaaS has truly gained momentum, providing a model for companies to deliver banking services to their consumers without the need to worry about a traditional banking infrastructure. A recent study found that 55% of banks consider legacy systems as the number one stumbling block for transformation, and so the pressure for modern solutions is ever more pressing. Fintech has transformed the delivery of financial service, forcing banks to turn to stacks of technology partners to innovate and respond to changing markets in real time. With BaaS, institutions can introduce new financial products and services in a matter of weeks, able to respond to consumer demands and market trends in real-time. Customers expect service delivery–the priest of service quality at the Pace of life (or better), on-demand, frictionless, instant, at low or no cost, just as they want from the best of tech companies.

Get More Information on Banking As a Service Market - Request Sample Report

Banking As a Service Market Size and Forecast:

-

Market Size in 2025: USD 24.83 Billion

-

Market Size by 2035: USD 136.52 Billion

-

CAGR: 16.76% from 2026 to 2035

-

Base Year: 2025

-

Forecast Period: 2026–2035

-

Historical Data: 2022–2024

Banking As a Service Market Highlights:

-

Digital transformation and BaaS integration allow companies to embed financial functionalities such as payments, account management, and lending within applications for better customer engagement and more efficiency

-

Provide operational efficiency and innovation– BaaS can help businesses streamline operations, lower costs, and focus on core functions, allowing organizations to develop unique financial solutions to better suit consumer demand through partnerships with specialized BaaS providers

-

Improved regulatory compliance assistance, since many BaaS platforms are equipped with compliance features that aid financial institutions in regulatory compliance across various jurisdictions while delivering new products

-

Digital solutions, while convenient, create cybersecurity challenges, driving the need for stringent protocols to safeguard financial data and sustain customer confidence

-

Market drivers include growing consumer expectations with BaaS enabling banks to match the demand for friction-less, highly personalized digital experiences, with 71% of the consumers wanting instant-to-market services like tech giants provide and 62% of the consumers preferring online banking channels

-

Market restraints include data security concerns since sharing financial data with third-party providers raises privacy risks, with 75% of financial organizations citing data security as a top concern, highlighting the need for stringent safeguards and secure cloud solutions

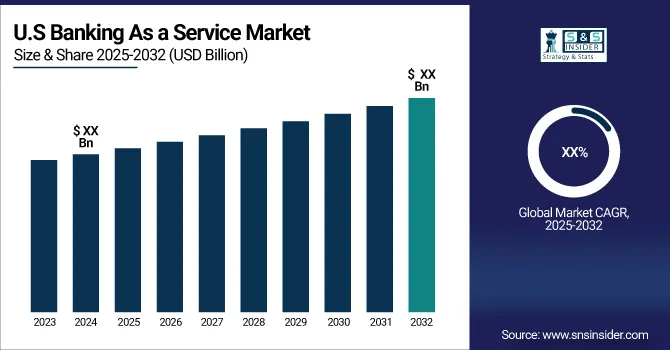

The U.S. Banking as a Service Market size was valued at approximately USD 10.8 Billion in 2025 and is expected to reach around USD 51.2 Billion by 2035, growing at a CAGR of about 16.8% over the forecast period of 2026–2035. driven by increased demand for embedded finance, rapid digitalization of financial services and rapid adoption of API driven banking platforms by fintechs and non-bank organizations. The underlying driver of market evolution in payments, lending, and digital banking services, are also the enablers in this journey continuing to evolve in the form of an enabling regulatory environment for open banking, depth of fintech–bank collaboration and the need for speed in bringing out new products and scaling managing infrastructure

Banking As a Service Market Drivers:

-

Meeting the Rising Tide of Consumer Expectations in Banking

As consumer expectations continue to evolve, the banking sector faces increasing pressure to provide seamless and personalized experiences. Recent trends indicate that 71% of consumers expect their financial institutions to offer the same level of service and convenience as tech giants like Amazon and Apple. This shift is primarily driven by the growing reliance on digital channels, with 62% of banking customers now preferring online services over traditional methods. Banking as a Service (BaaS) platforms are uniquely positioned to meet these demands, enabling institutions to rapidly develop and deploy innovative services that enhance customer satisfaction and loyalty. A recent report highlights that 80% of banking executives recognize the urgency to adapt to these heightened expectations, as failing to do so could result in losing market share to more agile competitors. Additionally, as inflation remains a concern, with the Consumer Price Index increasing by 0.2%, consumers are seeking more value from their banking relationships. In this landscape, Banking as a Service not only streamlines service delivery but also empowers banks to offer tailored solutions that resonate with today's consumers, ultimately driving growth and retention in a highly competitive market.

Banking As a Service Market Restraints:

-

Navigating Data Security Concerns in the Banking as a Service Market

Data security has become a major concern and restraint in the fast-changing Banking as a service (BaaS) market. Another major risk of data privacy arises from BaaS transferring sensitive financial information from banks to third-party providers. In the wake of cyberattacks escalating with every passing day, even a single security breach could spell disaster for financial firms, endangering customer confidence and tarnishing reputations. This was apparent from the recent insights, where 75% of Financial have concern about data security, and need of cybersecurity is now. In addition, incidents such as Bank of America freezing a portion of customer accounts, demonstrate the risks of the digital banking model. At the very least, the 60% of banks that are now looking for private cloud approaches enters the play for a cheaper and data-secure environment. However, BaaS providers still face an uphill battle when it comes to compliance and consumer trust regarding data security. The market will continue to grow, and financial institutions will need enterprise grade data security to both protect themselves and their customers.

Banking As a Service Market Segment Analysis:

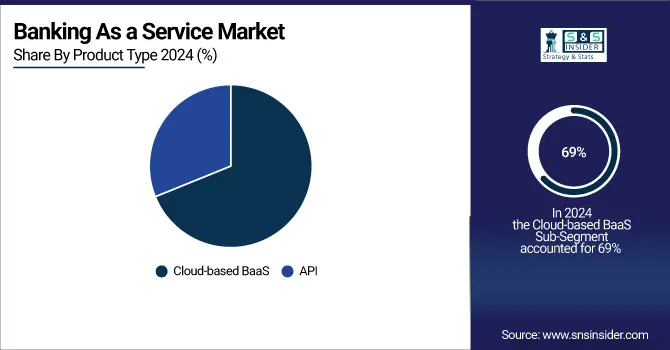

By Product Type

Cloud-based Banking as a Service (BaaS) solutions are leading the BaaS market, capturing approximately 69% of total market share in 2025. Cloud technologies are tackling not just the scalability but also the flexibility and cost of operation allowing banks and fintech firms to deploy new services quickly with a lower cost of infrastructure. Some recent examples are Solarisbank launching a next-gen, cloud-native platform for integrating banking services in 2024, Green Dot Bank offering integrated payment solutions for small businesses in 2023, and N26 expanding its presence in the U.S. investor-focused space targeting tech-savvy consumers. US dominance of the regional BaaS charge has been further buttressed by a bull market for fintechs and a favorable regulatory environment. The EU Digital Finance Strategy is also helping to drive good growth in Europe (notably Germany and the UK) as the agreements on Open Banking and Cloud Adoption are driving players to expand. In Asia Pacific, banks are being compelled to move to a cloud by regulation such as in Singapore or Australia. The demand for cloud-based solutions will be a peak in BaaS demand, although on-premises and hybrid models will remain too excess for the organizations with strict security requirements.

By Platform

The Banking as a Service (BaaS) market has experienced substantial growth, with the platform segment holding about 74% of the market share in 2025. This leadership is largely fueled by the growing customer desire for single-destination banking, which provides seamless, frictionless access to all financial services. The platform segment has a variety of services, including APIs or application development tools or cloud infrastructure to deploy and manage banking applications and is built by financial institutions and FinTech companies efficiently. Hence, integration, faster time to market, and infrastructure cost reduction, particularly for startups and SMEs, are at the heart of these factors. As we discussed previously (see below), recent developments indicate strengths at the market segment level: Solarisbank launched a fast-to-integrate, compact version of its platform, Green Dot Bank was targeting small businesses, and Fidor Solutions was focusing on expanding the functionality of its core offering via advanced APIs. North America dominates the region for the adoption of BaaS platforms, but Europe, and Asia Pacific are witnessing rapid growth due to supportive regulatory environment for business and an aim towards achieving financial inclusion. The platform aspect of the business needs to continuously develop to adapt banking to the evolving needs of the consumers.

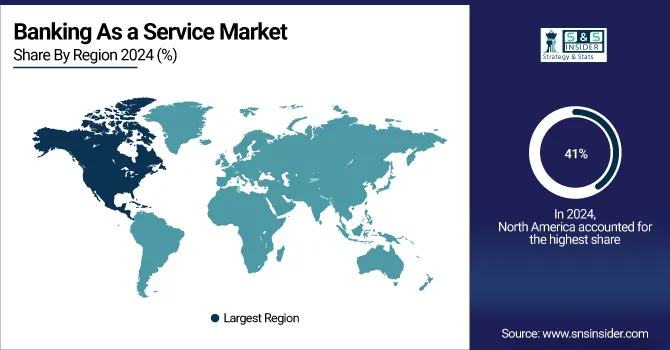

Banking As a Service Market Regional Analysis:

North America Banking As a Service Market Trends:

North America is a major player in the Banking as a Service (BaaS) market, capturing approximately 41% of the total revenue share in 2025 This is also credited to strong fintech environment, favorable regulations and high technology adoption rates by the financial institutions. Fintech circle is filled with all kinds of innovative fintech startups in the US and they utilize BaaS solutions very fast to cater to the consumer needs and this quick response builds competition as well as the growth of the US fintech ecosystem. The logic behind this thinking was evident from its regulatory initiatives such as Banking as a Service 2.0 wherein it nurtured collaboration between traditional banks and fintech firms in a manner that would make the acceptance of digital banking solutions seamless and at the same time within the framework of consumer protection principles. Manchester city Manchester banks are also taking the lead in new technologies including the cloud and AI technologies, fueling operational efficiencies and enhance customer experiences. As consumers keep getting busy in their life these days, Banking as a Service platforms will also enable financial institutions to offer products that are more tailored, and suit their customers is rising expectation. Recently Solarisbank announced a more sophisticated platform, and Green Dot Bank launched to serve the small business market. Availability of strong fintech support and regulatory support and consumer demand is expected to keep North America growing at a consistent rate in the Banking as a Service market.

Do You Need any Customization Research on Banking As a Service Market - Inquire Now

Asia-Pacific Banking As a Service Market Trends:

Asia Pacific is rapidly emerging as the fastest-growing region in the Banking as a Service (BaaS) market, due to rapid digital transformation, increasing fintech adoption, and supportive regulations. A new wave of fintech businesses—many backed by leading firms based in the aforementioned nations, such as China, India, and Singapore—is bringing innovation and competition to finance, generating significant demand for already-embarked BaaS solutions by 2025. Various governments and regulatory authorities across are framing their policies to support digital banking solution and supporter traditional banks to collaborate with fintech companies and ensure alike venture. Additionally, the BaaS platform also solves one of the key issues the world is currently facing which is financial inclusion enabling banking services to the unbanked and underbanked communities in remote areas. By investing heavily in technology such as cloud computing and artificial intelligence, financial institutions in the region are improving operational efficiency and keeping up with the consumer demand for more accessible and customized banking experiences. As recent examples, such as Kookmin Bank's BaaS platform across South Korea and Grab Financial Group's developments in their capabilities highlight, this is a very fast-moving sector. With the digital governance frameworks like India digital India Program enhancing digital finance literacy and the Australian regulatory bodies nurturing innovation, Asia Pacific is evolving to become the epicenter of financial services of the future.

Europe Banking as a Service Market Trends:

Europe represents a mature and highly competitive BaaS market, driven by robust regulatory initiatives, advanced digital infrastructure, and strong adoption of open banking practices. EU’s PSD2 (Payment Services Directive 2), requiring banks to open up APIs for third-party providers is prevalent in the region and adds to innovation and collaboration between banks and 3rd party providers such as fintechs. With fintech hubs such as London and Berlin nurturing startup and scale-up BaaS businesses, the UK, Germany and France are leading the charge. Embedded finance solutions are growing in demand, and corporations from retail to e-commerce and even travel are embedding financial services in their ecosystem. In addition, European consumers are quickly embracing digital banking, compelling traditional banks to utilize BaaS platforms to remain competitive. New & Interesting Launches/Announcements Recent activity, like the embedded finance solutions from Railsr or account aggregation as a Christmas gift from Tink, demonstrates the vibrant nature of the region. Europe is still at the forefront of the global BaaS scene backed up by solid regulation, trust of consumer in the digital bank as well as the continuous innovation from fintech

Latin America Banking as a Service Market Trends:

Latin America is witnessing rapid growth in the BaaS market, driven by financial inclusion initiatives, the rapid expansion of the local fintech landscape, and a strong increase in digital payments. Even more, a large portion of the population remains either unbanked or underbanked as such, BaaS setups tend to deliver an exceptionally in-demand financial service reach in terms of accessibility. Regulators here are out front, including Brazil, Mexico and Colombia, where frameworks are being rolled out for fintech–bank partnerships and digital banking. But of course, the upcoming availability of mobile-first solutions and launch of super-apps in other verticals are pushing consumers to new solutions quicker than ever before. Brazil's Open Banking initiative and Mexico's fintech law, to give just two examples, don't just establish the regulatory framework — they help build an ecosystem designed to spur innovation. With banking-as-a-service pertinent digital wallets, credit solutions, and payment processing systems, these gaps are rapidly being solved by fintechs and even non-financial companies that can act fast. Recent moves such as Nubank´s digital booting and Ualá´s BaaS partnerships indicate progress on the ground in the region. Arguably, Latin America is on course to be one the best positioned BaaS markets on the planet given its technologically savvy and youthful population combined with a regulatory trajectory well on track toward inclusion.

Middle East & Africa Banking as a Service Market Trends:

The Middle East & Africa region is gradually gaining traction in the BaaS market, owing to the rise in smartphone penetration, digital transformation, and financial inclusion programs by the governments. Further segmentation by region shows countries like the UAE, Saudi Arabia, Nigeria and South Africa leading the adoption due to healthy fintech ecosystems propelled by favorable regulatory reforms. For context, in the Middle East, efforts such as Saudi Arabia's Vision 2030 and the UAE's Smart Dubai program are fostering digital banking and fintech innovation, while in Africa, BaaS platforms are tackling the urgent issue of needing to provide mainly unbanked people with accessible banking. For example, mobile money services — M-Pesa needs no introduction in Kenya — show how technology can close financial gaps and BaaS is delivering those innovations in the form of credit, payments, and remittance solutions. New initiatives like Gulf region API-driven offering from Tarabut Gateway and alliances between African BaaS and fintechs show the evolution of this market at pace. As investments into digital infrastructure, agility, and favorable policy building block continue, the Middle East & Africa are set to continue unlocking growth potential in the global BaaS ecosystem.

Banking As a Service Market Competitive Landscape:

Avidia Bank, established in 2007, is a community-focused financial institution headquartered in Massachusetts, USA. It offers retail and commercial banking services, digital banking solutions, and payment innovations. Known for its collaboration with fintech firms, Avidia supports Banking-as-a-Service (BaaS) initiatives, delivering secure, technology-driven financial solutions to individuals, businesses, and partners nationwide.

-

In July 2024, Avidia Bank formed partnership with Q2 Software Inc, for digital banking platform. Avidia will upgrade its online banking capabilities and adopt Personetic’s AI-powered engagement engine through its partnership with Q2 digital banking platform. This will allow Avidia to provide real-time insights and automated saving plans.

Saudi Central Bank (SAMA), established in 1952, is the central financial authority of Saudi Arabia. It essentially regulates banking, insurance and financial institutions promoting stability and transparency of the financial sector. The SAMA has also supported initiatives aimed at developing digital banking, promoting fintech as well as Banking-as-a-Service (BaaS) frameworks to encourage innovation and advance financial inclusion, across the country.

-

In July 2024, Saudi Central Bank (SAMA) launched a new government banking service platform named “Naqd”. The platform will enable government agencies to easily access their accounts at the central bank as well as conduct secure financial transactions on a digital platform.

Wealthify, a UK-based digital investment platform founded in 2016, Wealthify brings together technology and expertise in portfolio management, with a mission to provide simplicity and accessibility. By utilizing the Banking-as-a-Service (BaaS) infrastructure through its partner ClearBank, it helps facilitate employee payments and all financial aspects for its clients.

-

In February 2024, UK-based digital investment platform Wealthify formed partnership with ClearBank. The former company will leverage ClearBank’s embedded banking service to introduce a new instant-access savings account.

Banking As a Service Market Key Players:

-

Solarisbank

-

PayPal Holdings, Inc.

-

Fidor Solutions AG

-

Moven Enterprise

-

Treezor

-

Block, Inc.

-

Bnkbl Ltd.

-

ClearBank

-

Railsr

-

Marqeta, Inc.

-

Tink AB

-

Temenos

-

Plaid

-

BBVA Open Platform

-

10x Banking

-

Synctera

| Report Attributes | Details |

|---|---|

| Market Size in 2025 | USD 28.99 Billion |

| Market Size by 2035 | USD 136.52 Billion |

| CAGR | CAGR of 16.76 %From 2026 to 2035 |

| Base Year | 2025 |

| Forecast Period | 2026-2035 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments |

• By Product Type (API, Cloud-based BaaS) •By End-User (Banks, FinTech, Corporation, NBFC, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles |

Green Dot Bank, Solarisbank AG, PayPal Holdings, Inc., Fidor Solutions AG, Moven Enterprise, The Currency Cloud Ltd., Treezor, Match Move Pay Pte Ltd., Block, Inc., Bnkbl Ltd., ClearBank, Railsr, Marqeta, Inc., Tink AB, Finastra, Temenos, Plaid, BBVA Open Platform, 10x Banking, Synctera |