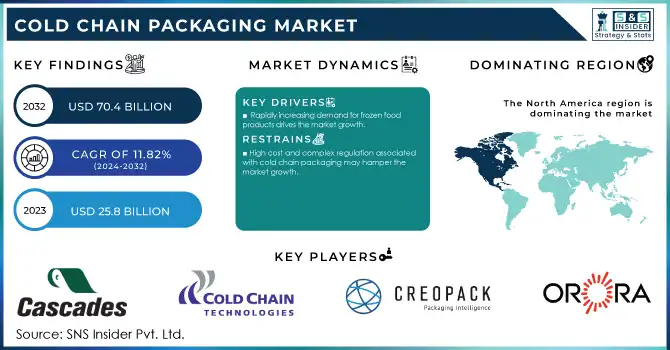

Cold Chain Packaging Market Report Scope & Overview:

The Cold Chain Packaging Market size was USD 25.8 Billion in 2023 and is expected to reach USD 70.4 Billion by 2032 and grow at a CAGR of 11.82% over the forecast period of 2024-2032.

Get more information on Cold Chain Packaging Market - Request Sample Report

Growing environmental consciousness and stringent regulations regarding plastic waste management are driving the demand for bio-based and compostable packaging solutions in the cold chain packaging market. Firms are gravitating towards more sustainable options including plant-based packaging materials, ones that are derived from plant-based polymers like bio-polyethylene (Bio-PE) and polylactic acid (PLA). Such materials help lower the carbon footprint and cater to a rising consumer appetite for sustainable solutions. As an example, notable European initiatives such as the Circular Economy Action Plan or the single-use plastics ban led to an increasing demand for biodegradable packaging solutions. New developments in material technology mean that bio-based and compostable packaging also has similar thermal insulation and sturdiness as some traditional packaging, which will allow temperature-controlled goods to be transported e.g. food and medicines while contributing to sustainability targets.

For instance, in the United States, the General Services Administration (GSA) has implemented a rule encouraging federal agencies to reduce single-use plastic packaging. This initiative aims to promote the use of sustainable packaging alternatives, including compostable materials, within federal operations.

Improvement in packaging technologies is changing the cold chain packaging market by enhancing efficiency, dependability and sustainability. The temperature control ability has been highly enhanced after the application of innovations like the integrated application of phase-change materials (PCMs) and vacuum-insulated panels (VIPs), therefore allowing temperature-sensitive products like vaccines and perishable foods to be transported without the risk of spoilage. Similarly, IoT-enabled smart packaging solutions are increasing in popularity, facilitating real-time monitoring of variables such as temperature, humidity, and location, with the help of sensor chips, and further supporting product integrity while also complying with regulatory standards.

Government agencies have recognized the importance of these technologies. The National Science Foundation (NSF) has funded research into developing long-service-life vacuum insulation materials, aiming to replace traditional options and enhance thermal performance in packaging.

Cold Chain Packaging Market Dynamics

Drivers

-

Rapidly increasing demand for frozen food products drives the market growth.

One of the primary factors propelling the growth of the cold chain packaging market is the rapidly growing consumption of frozen food products. With increasing hectic lifestyles and time-saving practices, more consumers are turning to convenience foods, particularly frozen meals. Frozen food provides a longer shelf life, a solution for easy storage, and ready-to-eat help for busy consumers. Urbanization and increasing income brackets particularly in emerging markets also drive this trend even harder. It is upheld by the headways in packaging through consistent food chain storekeeping and transportation fortifying food safety and maintaining quality The use of more efficient cold chain logistics, enabled through advancements in packaging technologies, has become fundamental to preserving these products end-to-end as they increasingly travel long distances through global supply chains. The increasing consumption of frozen food, in turn, creates the demand for improved cold chain packaging solutions that are expected to keep the temperature, quality, and nutritional value preserved in the product.

For instance, In October 2022, CSafe launched CSafeAPS, a novel reusable pallet shipper. In frozen and chilled conditions, it offers dependable and adaptable thermal protection.

Restraint

-

High cost and complex regulation associated with cold chain packaging may hamper the market growth.

In high cost and stringent regulations for cold chain packaging limits the growth of this market. In particular, cold chain packaging solutions may also require specific materials (e.g., phase-change materials [PCMs], vacuum-insulated panels [VIPs]) that lead to higher overall costs than traditional packaging. Finally, for long-distance transport, upkeeping the specified temperatures is an added expense. Adding to this, there is a stringent regulation to be maintained within the cold chain packaging industry in different regions, especially in regions such as pharmaceuticals and food. Regulatory compliance including for example the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA) aspect regulation for transportation for temperature-sensitive products is complex and resource-intensive. Such regulations require extensive records-keeping, tracking, and reporting, all of which add costs to businesses. Despite having a crucial role, high packaging costs, along with compliance to ever-evolving regulations, may slow down the cold chain packaging solutions in SMEs, due to limited budgets.

Cold Chain Packaging Market Segmentation

By Product Type

Expanded Polystyrene (EPS) containers held the largest market share around 39% in 2023. It is owing to its insulating properties, cost-effectiveness, and lightweight materials as well as versatility. EPS is widely used in the packaging of temperature-sensitive products including pharmaceuticals, food & vaccines due to its excellent thermal insulation property which helps retain the required temperature for long periods. It is light and non-damaging, easy to carry, and firm enough to reduce product damage in-transit. Additionally, EPS containers are not as expensive as other materials such as vacuum-insulated panels or phase-change materials and are therefore highly attractive to companies wanting to achieve some balance of cost and performance. Additionally, EPS is commercially available and can be tailored in numerous shapes and sizes to meet the needs of diverse products, which secures its dominant position in the market.

By Material

The insulating material held the largest market share around 42% in 2023. It is expected to do so in the future as they are required to keep sensitive products within a certain temperature range during transportation & storage. Expanded Polystyrene (EPS), polyurethane, and polyethylene are some of these materials, which provide near-zero heat transfer to ensure the desired temperature range for perishables such as food, pharmaceuticals, and vaccines are met. High-performance thermal insulation is essential to preserve the storage time for temperature-sensitive materials and to avoid material spoilage or degradation, which is especially relevant for biopharmaceuticals and frozen foods that need very strict temperature controls. Additionally, as thermal insulation materials are light in weight and inexpensive, they are some of the easiest handling materials in cold chain packaging.

By Application

Food held the largest market share around 48% in 2023. It is due to increasing demand for perishable food items, including fresh produce, frozen foods, meat products, and dairy products, which must remain in a temperature-controlled environment throughout the supply chain, according to the report. In an age of convenience and demand for ready-to-eat meals, the industry is experiencing growth for cold chain packaging in order to ensure food safety, quality, and shelf-life. By using cold chain packaging solutions, such as insulated containers, refrigerants, and temperature-controlled packaging, food products maintain their nutritional value and freshness, preventing spoilage and waste. As international trade grows, transporting temperature-sensitive food items over larger distances is becoming increasingly important. This in turn, has increased the demand for efficient cold chain packaging in the food sector as well, with the growing trend of e-commerce and online food delivery services.

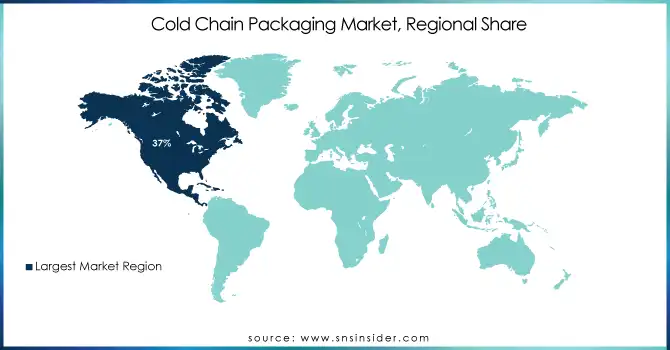

Cold Chain Packaging Market Regional Analysis

North America held the largest market share around 37% in 2023. It is owing to the presence of an established, and highly-regulated cold chain logistics infrastructure that supports the transportation of food & beverage and pharmaceuticals both across a wide region. Cold chain packaging market in the US and Canada is gaining traction due to the increasing demand from the food, pharmaceuticals and biotechnology industries, which require stringent temperature control of products to maintain product quality and safety. The quick growth of frozen food and ready-to-eat meals and a rising e-commerce and online grocery industry increases the demand for efficient cold chain packaging in the food sector. The rising need for cold chain packaging for vaccines, biologics, and other temperature-sensitive medical products has further boosted the demand in North America due to the presence of well-established healthcare and pharmaceutical industries. In addition, huge investments in cold chain infrastructure cold chain logistics and also, these latter aspects have made a strong foothold for North America in the global cold chain packaging market.

To Get Customized Report as per your Business Requirement - Request For Customized Report

Key Players

-

Cascades Inc. (Insulated Containers, Protective Packaging)

-

Cold Chain Technologies (TempPallet, COLDCHAINBOX)

-

Creopack (CreoTemp, CreoPack)

-

Orora Group (Orora Cold Chain, OroraFresh)

-

Cryopak (Thermal Blankets, Cryopak EPS Containers)

-

TCP Company (TCP Insulated Containers, TCP Pallet Shippers)

-

Intelsius (Envirotainer, PolyBox)

-

Pelican Products, Inc. (CoolPall, Pelican BioThermal Shippers)

-

Softbox (E-Box, Softbox Pharma)

-

Sofrigam (ThermoBox, ThermoSafe)

-

Sonoco ThermoSafe (ThermoSafe, Sonoco Cold Chain Shippers)

-

va-Q-tec (va-Q-tainer, va-Q-box)

-

Inmark (ThermoCool, PackTech)

-

Cold Chain Technologies (CryoPort, SmartBox)

-

Isotemp (Isotemp ThermoBox, Isotemp Foam)

-

Clariant (Clariant Pharma Packaging, Active Temperature-Control Bags)

-

Sealed Air (Bubble Wrap, TempGuard Insulation)

-

Vericool (Vericooler, Vericooler Biodegradable Insulation)

-

APC (Advanced Polymeric Packaging, ColdChain Products)

-

Isobox (Isobox CoolBox, Isobox Insulation Systems)

Recent Development:

-

In 2023: Cascades introduced new sustainable and eco-friendly cold chain packaging solutions, focusing on the use of recyclable materials to reduce environmental impact. This move is part of their ongoing commitment to environmental responsibility.

-

In 2022: Cold Chain Technologies launched the SmartSense temperature monitoring system to enhance the safety and compliance of pharmaceutical cold chain logistics. This system offers real-time monitoring of temperature-sensitive products.

| Report Attributes | Details |

| Market Size in 2023 | US$ 25.8 Bn |

| Market Size by 2032 | US$ 70.4 Bn |

| CAGR | CAGR of 11.82% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type (EPS container, PUR container, Pallet shippers, Vacuum insulated panels, and others) • By Material (Insulating Material, Refrigerants, Hydrocarbon) • By Application (Pharmaceuticals, Food, and Industrial) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Cascades Inc., Cold Chain Technologies, Creopack, Orora Group, Cryopak A TCP Company, Intelsius, Pelican Products, Inc., Softbox, Sofrigam, Sonoco ThermoSafe, va-Q-tec |

| Key Drivers | • Rapidly increasing demand for frozen food products drives the market growth. |

| Market Opportunities | • High emphasis on regulatory compliance of food and pharmaceutical products. |