Polystyrene Packaging Market Report Scope & Overview:

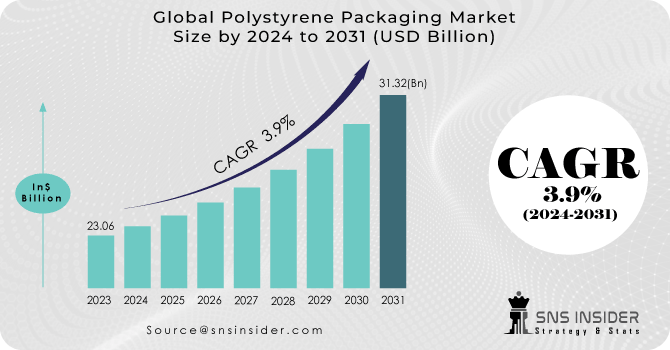

The Polystyrene Packaging Market size was USD 23.06 billion in 2023 and is expected to Reach USD 31.32 billion by 2031 and grow at a CAGR of 3.9% over the forecast period of 2024-2031.

The most widely used polystyrene packaging type is EPS, which accounts for over 90 % of the global market in 2022. EPS is a lightweight and durable material that is ideal for the protection and transport of foodstuffs and beverages.

Get E-PDF Sample Report on Polystyrene Packaging Market - Request Sample Report

The market for global electronics is estimated to increase at a compound annual growth rate of 4.5%. This growth is leading to a demand for polystyrene packaging, which plays an important role in protecting and transporting electronics.

Due to its lack of biodegradability and environmental significance, polystyrene is a hazardous material. The regulation on the reduction of polystyrene packaging is being implemented by governments in many countries.

Also, due to the rise in healthcare and pharmaceutical production, for its transportation the polystyrene packaging is in high demand.

MARKET DYNAMICS

KEY DRIVERS:

-

Increasing use of polystyrene packaging on cosmetics and other products as a result of increased durability

Increasing disposable income, desire to look beautiful and maintain personal hygiene have led to an increase in demand for cosmetics and personal care products over the years. The contents of these products are, however, perishable and have a definite shelf life. The quality and stability of ingredients in cosmetic products may be impaired by exposure to air, warmth, light or colder conditions. Polystyrene packaging provides a very good solution to these problems. It also contributes to the preservation of goods in their natural state and, as a result, can be beneficial for easy transport.

-

Increased use of packaging in pharmaceutical sector

RESTRAIN:

-

The availability of a high number of substitutes

Because of its light weight, ease of manufacture and low cost, polystyrene is one of the most flexible plastics. It has become the go-to takeout container for many restaurants and industries, thanks to its excellent performance characteristics such as heat resistance and durability. However, these materials have a negative impact on people's health and the environment causing consumers to seek alternatives that are more sustainable. The reduction of the world polystyrene packaging market is due to consumers' demands, awareness on sustainability and regulations.

-

Environmental and health issues associated with polystyrene

OPPORTUNITY:

-

Possibility of recycling polystyrene materials

Polystyrene is a flexible polymer which can be used in various products, including packaging, transport and consumer goods. But, when these products are disposed of, it causes damage to the environment because they are undegradable.

-

Raise consumer interest in the use of convenient and affordable packaging

CHALLENGES:

-

Stringent rules concerning the use of polystyrene

Polystyrene packaging can be used for a wide range of foods, such as disposable utensils and plates, single use hot or cold beverage cups, polystyrene meat and egg trays with regard to the manufacture of pharmaceuticals and personal care products. Nevertheless, polystyrene material tends to accumulate and be added to waste due to its various uses.

IMPACT OF RUSSIAN UKRAINE WAR

Depending upon the region, the impact of the war on polystyrene packaging is estimated to be different. As Russia and Ukraine are the two biggest suppliers of Styrene Monomer to European market, this is expected to have a serious impact on markets in Europe. It is expected that this will lead to a lower impact on the North American market since it is more self-sufficient than other regions in production of Styrene Monomer. Since the beginning of the war, the price of styrene monomer has risen by more than 50%. That has resulted in a rise in the prices of Polystyrene packaging.

Russia is a major oil exporter, but currently most countries have reduced imports and imposed sanctions on Russia. The longer sanctions against Russia are in place, the more likely it will be to raise raw material prices or even a shortage of plastics and polymers as we accept fewer Russian oil exports.

IMPACT OF ONGOING RECESSION

The ongoing recessionary crisis has a negative effect on the world market for plastic packaging. The recession is leading to a decrease in consumer expenditures and business investment, which consequently has an impact on the demand of polystyrene packaging. Businesses are decreasing their production and consumers are cutting back on consumption, which is leading to a decline in demand for Polystyrene Packaging

As businesses look for ways to reduce their costs, alternative packaging materials such as paper and cardboard are becoming more competitive. Due to higher levels of inflation and interest rates, it is expected that the market for developed countries such as the United States and Europe will be severely affected. Due to the continued economic growth in those countries, there is an expectation that the markets of developing countries will not be significantly affected.

KEY MARKET SEGMENTS

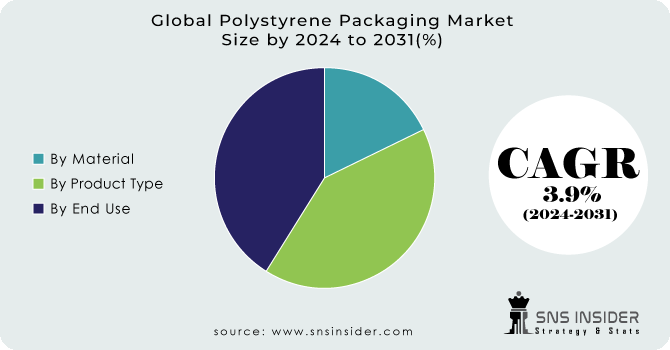

By Material

-

Plastic

-

Foam

By Product Type

-

Bags

-

Bowls

-

Wraps & Films

-

Plates & Trays

-

Boxes & Clamshell

-

Pouches

-

Cups

Polystyrene Cups is expected to hold the major market share accounting for the market share of 12% in 2023. Since cups have properties to maintain food at its temperature, this will help the segment to hold the dominant position.

By End Use

-

Electrical & Electronics

-

Food & Beverage

-

Automotive

-

Consumer Goods

-

Cosmetics & Personal Care

-

Pharmaceutical

-

Aerospace

Get Customized Report as Per Your Business Requirement - Request For Customized Report

Food and Beverage segment to hold the dominant market share of 33% in 2023. This is due to the increased demand for the packaged food products.

REGIONAL ANALYSIS

In 2023, North America will be the largest polystyrene packaging market, accounting for more than 30% of the global market. The rising demand for polystyrene packaging in the food and beverage, electronics and medical sectors is a major factor contributing to market growth in this region.

Europe accounted for over 25% of global polystyrene packaging market share in 2023, making it the second largest polystyrene packaging market. The growing demand for polystyrene packaging in the food and beverage industry, car or building industry is driving market growth in this region.

The Asia Pacific region is the fastest increasing market for polystyrene packaging. Increasing demand for polystyrene packaging in food, beverages, electronics and pharmaceutics industries is a major factor driving market growth in this region. India is the third largest pharmaceutical products production by volume. This will help create demand for the polystyrene packaging.

REGIONAL COVERAGE:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

Key Players

Some major key players in the Polystyrene Packaging market are Styrochem, Sonoco Products Company, Sealed Air Corporation, Alpek SAB de CV, Monotez, Rogers Foam, Huhtamaki Oyj, ACH Foam Technologies, Versalis, Jackon and other players.

Sealed Air Corporation-Company Financial Analysis

RECENT DEVELOPMENT

-

In order to reach its sustainability and recycling goals, on May 2022, Alpek acquired OCTAL Holding SAOC, a leading provider of PET packaging.

| Report Attributes | Details |

| Market Size in 2023 | US$ 23.06 Bn |

| Market Size by 2031 | US$ 31.32 Bn |

| CAGR | CAGR of 3.9% From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • by Material (Plastic, Foam) • by Product Type (Bags, Bowls, Wraps & Films, Plates & Trays, Boxes & Clamshell, Pouches, Cups) • by End Use (Electrical & Electronics, Food & Beverage, Automotive, Consumer Goods, Cosmetics & Personal Care, Pharmaceutical, Aerospace) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Styrochem, Sonoco Products Company, Sealed Air Corporation, Alpek SAB de CV, Monotez, Rogers Foam, Huhtamaki Oyj, ACH Foam Technologies, Versalis, Jackon |

| Key Drivers | • Increasing use of polystyrene packaging on cosmetics and other products as a result of increased durability • Increased use of packaging in pharmaceutical sector. |

| Key Restraints | • The availability of a high number of substitutes • Environmental and health issues associated with polystyrene. |