Cold Plasma Market Report Scope & Overview:

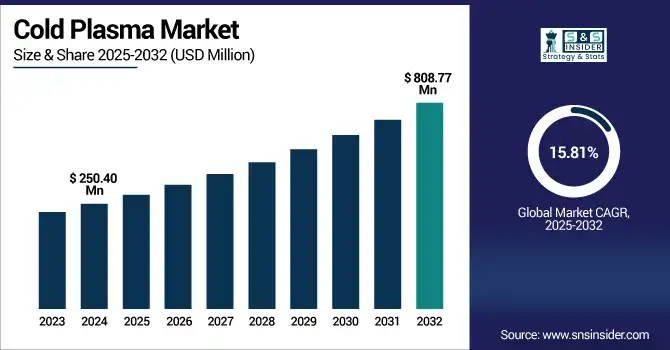

The Cold Plasma Market size was valued at USD 250.40 million in 2024 and is expected to reach USD 808.77 million by 2032, growing at a CAGR of 15.81% over the forecast period of 2025-2032.

To Get more information on Cold Plasma Market - Request Free Sample Report

Sustainability trends are playing a major role in the growth of the global cold plasma market due to the proliferation of environmentally friendly, energy-efficient, and chemical-free products throughout the industries. Cold plasma can be used to reduce hazardous chemical use for sterilization, surface treatment, and food decontamination, thereby resulting in less environmental pollution and reducing workplace hazards. Working at lower temperatures results in energy savings, it decreases greenhouse gas emissions by more than 90% and electricity use by about 60%, helping to meet global climate targets. It also promotes sustainable food security and water purification in support of UN Sustainable Development Goals Zero Hunger and Clean Water. Rising corporate social responsibility (CSR) campaigns and conformance to worldwide sustainability goals are powering the market. In addition, government subsidies including grants will boost coverage the industrial and healthcare usage globally.

For instance, on 10 July 2024, the paper reports a low-cost handheld source of cold air plasma intended for biomedical applications that can be made by anyone. The plasma source employs a 1.4 W corona discharge in the needle-to-cone electrode configuration and is an extremely simple device, consisting basically of two electrodes and a cheap power supply.

The U.S. Cold Plasma Market was valued at USD 82.34 million in 2024 and is expected to reach USD 260.88 million by 2032, growing at a CAGR of 15.53% over 2025-2032.

The U.S. is a global leader in cold plasma industry due to significant investment in R&D, creating innovations in applications across healthcare, food safety, and semiconductors. Led by companies including the Nordson Corporation and the U.S. Medical Innovations, commercialization is further facilitated by product launches and FDA-cleared systems like the Canady Helios Cold Plasma Ablation System. The U.S. is also at the forefront in the use of cold plasma for clean, energy-efficient, and chemical-less processes in alignment with worldwide sustainability objectives. Next-generation industrial infrastructure, collaboration with universities and biotech companies, and strong government backing further drive adoption. The stateside confluence of innovation, regulatory progress, and sustainability encompassed in the emerging cold plasma technology puts the U.S. at the frontier of what is increasingly becoming an extraordinary market opportunity.

For instance,7 May 2024, TAKOMA PARK, Md.–US Medical Innovations, LLC (USMI) announced it has received FDA 510k Clearance (K240297) for the Canady Helios Cold Plasma™ (CHCP) Ablation System for the ablation of soft tissue during surgery. The CHCP system consists of the Canady Helios Cold Plasma XL-1000 CP Smart Electrosurgical Generator, Canady Helios Cold Plasma Ablators, Foot Pedal, and Trolley Cart.

Market Dynamics:

Drivers:

-

Emerging Economies are Driving the Cold Plasma Market Growth

The cold plasma market is driven by growing income levels of the middle-class populations and expanding population in developing markets, and the demand for advanced healthcare solutions, including wound healing and sterilization in APAC and Latin America. Private investment and public-private partnerships are supported by government policies, relaxed regulations, and incentives, aided by the government’s initiative in healthcare, agriculture, and manufacturing. Fast industrialization, especially of textiles, electronics, and the food industry, is escalating the use of cold plasma for surface treatment and pollution control. Increasing concerns over sustainable, chemical-free technology are also in line with global environmental goals, and are making international companies enlarge their presence in R&D and distribution in these regions. Also, the lower cost of production and access to skilled labor draw attention towards these markets with respect to manufacturing and implementation of cold plasma technology.

For instance, on 5 Jun 2025, to gain insight into the magnitude of the problem of chronic skin wounds in a hospital in northern China. Researchers conducted a retrospective analysis of electronic health records of cases and controls, including 1,977 patients with chronic skin wounds admitted to the hospital's medical wards over 5 years.

Restraints:

-

Complexity of Cold Plasma Processes, Restraining the Cold Plasma Market

The global cold plasma market is subject to some restraining factors, including the complexities of the processes associated with cold plasma. It needs exact manipulation of various parameters including gas composition, pressure, and temperature, which results in restricted applicability across industries. Plasma uniformity and performance are challenging to maintain technically as the reactor is scaled up from laboratory to industrial scale. Adoption is rendered challenging owing to high capital cost and the requirement for dedicated infrastructure, particularly from a smaller manufacturer’s perspective. Lack of understanding in plasmonic interaction and safety concerns has been impeding regulatory approval, especially within the medical and food domains. Lack of skilled manpower also limits operation and maintenance, particularly in developing countries.It is important to overcome these issues to achieve the full commercialisation of cold plasma technology.

For instance, in December 2024, the delayed industrial plasma system launch was due to difficulty maintaining plasma uniformity at scale, reflecting technical complexity and challenges in adapting lab technology for continuous industrial applications.

Segmentation Analysis:

By Pressure

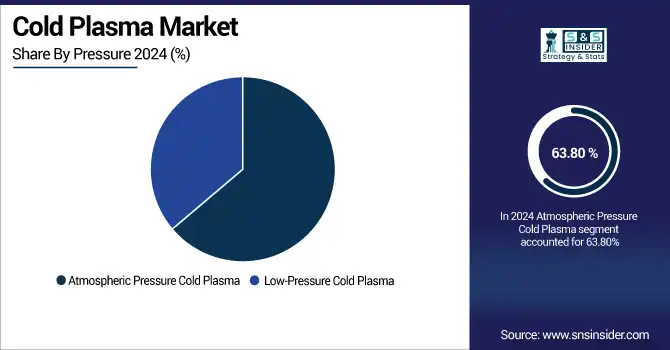

Atmospheric Pressure Cold Plasma was the dominant segment in the Cold Plasma Market analysis, with a 63.80% market share in 2024 owing to its superior flexibility and compatibility. Unlike previous methods, APCP avoids high-cost vacuum chambers and allows for easy, compact, and low-cost device designs. Technological developments allow the detailed control of the plasma parameters, and the operation at low temperatures, and the generation of reactive species, including RONS, improving the efficacy of plasma treatment in healthcare, sterilization, and food processing. Due to its adaptability to different methods of plasma generation, including DBD and gliding arc discharge, this offers the possibility of custom-tailored applications for various industries. The scalability, energy efficiency, and its wide-reaching industrial application prospects enable APCP to enjoy market dominance.

Low-pressure cold Plasma is emerging as the fastest-growing segment in the Cold Plasma Market with the highest CAGR of 16.05% as it is increasingly being used in high-precision and contamination-sensitive industries. It is also being used more and more in food processing for microbial decontamination and extending the shelf-life of products without the use of chemicals or heat. In health care, it allows for the safe sterilization of medical instruments and aids in wound healing and cancer treatment. It is used by electronics and semiconductor industries for a precise, environmentally-sound surface treatment and cleaning. Low-pressure plasma further improves textile and polymer surfaces for improved adhesion and durability as well. It can function in controlled vacuum environments, providing precision and material conservation, accelerating this product’s use in the market.

By Application

In 2024, the Wound Healing segment is the dominant one in the Cold Plasma Industry and holds a 32.80% market share owing to its effective, non-invasive treatment advantages. Weak evidence exists favoring cold plasma that suppresses the drug-resistant microorganisms for healing processes, including bacteria, RONS present in the cold plasma due to the nonspecific prime candidates. It activates immune and repair cells including fibroblasts and keratinocytes and augments tissue regeneration, angiogenesis, and collagen formation. Cold plasma further licensed inflammation and alleviated delayed healing from chronic inflammation. It has the advantage of being able to be easily used at near-room temperature, making it safe for the treatment of acute, fragile, and chronic wounds also including diabetic ulcers and burns. Supported by clinical studies, cold plasma is a non-surgical, non-chemical, and ionized ID Transitional Pro 3x7solution for rapid, safe, and effective wound treatment.

Cancer Treatment is the fastest-growing segment of the Cold Plasma Market. owing to its special antimicrobial, anti-inflammatory, and immunomodulatory effects. Cold plasma Tumoricidal cold atmospheric plasma causes immunogenic cell death in melanoma cells, as noted by their releasing signals to alert the immune system to identify and eliminate tumors. It also lowers the risk of infection during surgery or chemotherapy by sterilizing tissue but not damaging healthy cells. Furthermore, cold plasma interacts with the TME, which results in immune infiltration via angiogenesis and cell activation and tissue regeneration. The high-level immune modulation interaction prospects could lead to improved therapy efficacy with cold plasma combined with immunotherapies, offering cold plasma as a promising non-invasive tool in the field of oncology treatment.

By End-use

The Hospitals segment controls the Cold Plasma Market Analysis with a significant market share of 51.32%. because of the importance of providing cutting-edge medical care and because they have the luxury to purchase high-expense, specialized devices. More than 70% of the medical cold plasma market is focused on hospitals and specialized clinics. Factors including increasing demand for non-invasive treatment for chronic wounds, infections, and cancer are the key drivers for the growth of this market. Hospitals possess the infrastructure, trained personnel, and clinical environment suitable for the safe and effective use of cold plasma. Involvement in R&D demonstrations and clinical studies expedites technical adoption, while commitment to patient safety and recovery aligns cold plasma with contemporary hospital care.

At-home care providers and specialty clinics are other end users that have experienced the fastest growth in the cold plasma market due to the rising demand for portable, non-invasive and cost-effective treatment options. Advancement of compact positive and negative cold plasma devices have facilitated increasing application outside the hospital, including wound healing, skin diseases, and chronically affected conditions. As the trend in health care is moving toward a decentralized and patient-focused model, home therapy is becoming increasingly popular due to its ease of use and cost benefits. Cold plasma is being incorporated in the ambulatory surgery setting at specialized clinics, saving hospitals from the load. Increased awareness and access and favorable regulatory movements also contribute to the fast adoption amongst the alternative care settings, leading to the rapid market growth.

Regional Analysis:

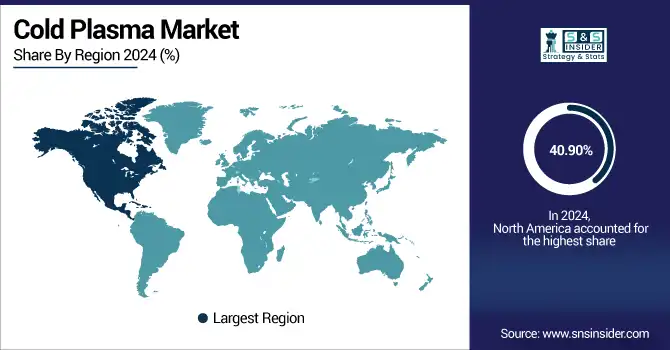

In 2024, the North American region dominated the cold plasma Industry and accounted for 40.90% of the overall revenue share, due to strong growth in the food safety and electronics sectors. The cold plasma market growth in this region is fueled by the rising consumer awareness, stringent food safety regulations including the U.S. Food Safety Modernization Act (FSMA), and increasing contamination risks from complex food supply chains. Cold plasma offers a chemical-free and non-thermal solution for decontamination, aligning with sustainable food safety practices. In the electronics sector, cold plasma is essential for precision surface treatment, cleaning, and etching, supporting eco-friendly manufacturing. The region’s advanced industrial infrastructure, technological innovation, and continuous R&D investments accelerate cold plasma adoption. Together, these factors ensure North America's leadership in driving cold plasma market growth and maintaining its substantial global cold plasma market share.

Europe holds the second-largest cold plasma market share globally due to strict environmental laws and high regulatory support for sustainable technologies. Growth in the region is attributed to the European Union’s Green Deal and climate neutrality targets that are driving the demand for energy-efficient, chemical-free solutions from a variety of sectors including manufacturing, food and beverage, and water and wastewater. Cold plasma is in line with EU regulations by virtue of offering low-emission options for sterilization, surface modification, and food decontamination. Regulations of dangerous chemicals and ozone-depleting gasses, however, push this adoption into the manufacturing and food industries.

In agriculture, cold plasma promotes sustainable methods of seed treatment and food preservation. The EU-funded initiatives, including Horizon Europe, further stimulate the innovation and commercial readiness of cold plasmas. Overall, these moves bolster the region’s cold plasma market share and position it as a frontrunner for global cold plasma market growth.

The Asia Pacific region is projected to grow with the fastest CAGR of 16.62% over the forecast period in the global cold plasma market due to huge regional spending in several industries. Asian governments in Japan, South Korea, and China are making significant R&D and innovation investments with a focus on medical device development and plasma applications in healthcare, including wound healing, infection control, and cancer treatment. These public investments speed clinical trials and product market introductions, driving growth in the cold plasma market. At the same time as the growing trend toward consumer electronics and semiconductor production in the region, particularly in China, South Korea, and Taiwan, is driving demand for cold plasma for surface treatment, cleaning, and manufacturing.

Increasing healthcare infrastructure in the region, coupled with growing spending on the healthcare industry, and modernization of hospitals and clinics, allows for the wider adoption of cold plasma in medical treatments. Furthermore, investments in sustainable food processing and packaging are in line with regulations in the region, which are increasingly focusing on food safety, notably in the high population countries of India and China. Government efforts in advanced manufacturing and clean tech through subsidies, grants, and favorable policies create an additional normative imperative for follow-on. In addition, the increasing role of the private sector and foreign direct investment (FDI) drives the expansion of plasma technology startups and industrial partnerships. This combination of developments makes the Asia Pacific region a thriving hotbed of innovation and penetration, and it is now considered to be the fastest-growing regional market for cold plasma.

The Middle East & Africa hold the smallest share in the cold plasma market trend due to a few restraints. Challenges include underdeveloped healthcare systems, industries still not sufficiently industrialised in key areas (electronics and advanced manufacturing), and limited awareness of emerging technologies including cold plasma. However, cold plasma systems are costly to install and can be complex to use, limiting wider uptake, particularly in small and medium enterprises. Furthermore, the skilled workforce that is accustomed to using and servicing these systems is in short supply. Regulated environments are either less hospitable to biotech or immature relative to other geographic areas, which results in slower approvals and commercialization. The lack of R&D investment and public-private partnerships severely limits the ability to innovate and implement. Collectively, these obstacles play a role in the size of the cold plasma market in the region being relatively small.

The cold plasma industry in Latin America is estimated to contribute a low share to the market; however, the market is expected to grow at a very slow pace due to slow industrial development and growing adoption of eco-friendly technologies. Large market players in food safety, agriculture, and healthcare are exhibiting interest in cold plasma in Brazil, Mexico, and Argentina. Countries, such as Brazil, Mexico, and Argentina are having the future of cold plasma in food safety, agriculture, and Healthcare, especially due to the increasing awareness regarding chemical-free and energy-efficient solutions.

The vast agricultural base in the region provides opportunities for cold plasma in seed treatment, pesticide reduction, and food preservation. Adoption is, however, constrained by high-cost equipment, scant infrastructure facilities, and insufficient technical expertise. 5 of 9 Government actions on clean technology and innovation is nascent but gaining traction. Partnerships with foreign companies and universities are bridging some of the knowledge gap. The cold plasma market is likely to grow slowly in Latin America with increasing investment and awareness.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players:

Cold Plasma Market companies include Adtec Healthcare Limited, Plasma Medical Systems GmbH, NEO Tech, Relyon Plasma GmbH, Enercon Industries Corporation, Vetaphone A/S, Tantec A/S, Henniker Plasma, MKS Instruments, Inc., Europlasma NV., and other players.

Recent Developments:

-

In May 2025, Adtec Healthcare, US Medical Innovations, and Plasma Medical Systems are actively developing and expanding the clinical and therapeutic use of cold plasma devices for wound healing, cancer treatment, and chronic infection control.

-

In Jan 2025, Investments from Japan’s METI and the EU’s Horizon Europe program are explicitly funding cold plasma R&D, including use cases in agriculture, robotics, and water treatment are major applications driving the cold plasma market growth.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 250.40 million |

| Market Size by 2032 | USD 808.77 million |

| CAGR | CAGR of 15.81% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | "• By Pressure (Low-Pressure Cold Plasma, Atmospheric Pressure Cold Plasma) • By Application (Wound Healing, Blood Coagulation, Dentistry, Cancer Treatment, Other Medical Applications) • By End-use (Hospitals, Dental clinics, Research and academic institutions, Other end-users)" |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Adtec Healthcare Limited, Plasma Medical Systems GmbH, NEO Tech, Relyon Plasma GmbH, Enercon Industries Corporation, Vetaphone A/S, Tantec A/S, Henniker Plasma, MKS Instruments, Inc., Europlasma NV., and other players. |