Bone Morphogenetic Protein Market Size Analysis:

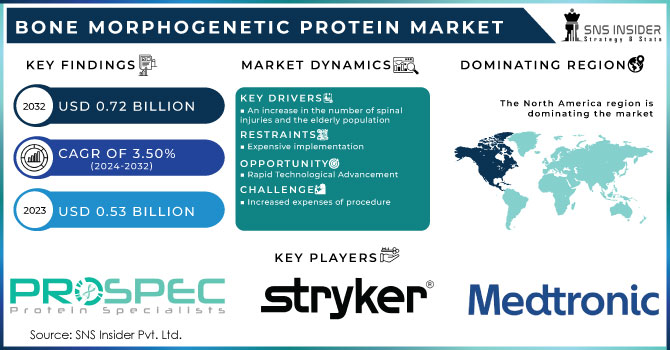

The Bone Morphogenetic Protein Market size was valued at USD 341.26 million in 2024 and is expected to reach USD 504.30 million by 2032, growing at a compound annual growth rate (CAGR) of 5.02% from 2025 to 2032.

Get More Information on Bone Morphogenetic Protein Market - Request Sample Report

The bone morphogenetic protein (BMP) market is growing considerably due to a rise in the number of patients suffering from osteoporosis. Globally, the prevalence of osteoporosis is 18.3%, increasing with age and among women. In the U.S, some 12.6% of adults aged 50 years and older have osteoporosis, and 43.1% have low bone mass (the precursor to osteoporosis), conditions that increase the risk of fractures. Such an increasing occurrence has caused the rapid growth of BMPs, important for new bone formation and healing, particularly in intraspinal and orthopedic surgeries.

Recent developments in MIS and the growing number of spine fusion procedures have even more accelerated the BMP market. Studies have shown that BMPs stimulate bone formation, promote faster healing, and have positive effects on the patient. Furthermore, the population is getting older, and degenerative bone diseases are becoming more prevalent in the world, which has driven the demand for powerful bone regeneration treatment as well. Investigations of developing more effective and safer BMP-like molecules through R&D are also increasing. The potential of BMPs has been acknowledged by regulatory bodies, with approved indications increasing, aiding market expansion.

For instance, recent research has focused on developing stable BMP variants that can be delivered more accurately with the aim of either enhancing the therapeutic effects/or lowering the side effects.

Bone Morphogenetic Protein Market Dynamics:

Drivers:

-

Expanding Applications and Advancing Technologies Fueling Market Growth

Bone morphogenetic protein (BMP) market is primarily driven by the need in the clinic, technical innovation, and a supportive regulatory environment. BMPs have also been increasingly used in various surgical disciplines, ranging from trauma through dental bone augmentation to other reconstructive surgeries.

For instance, an article published in February 2023 in Bone Reports reported improved osteoinductive ability of recombinant BMP-6 in craniofacial repair surgeries. And the demand is only rising, due to the aging population and increasing number of fractures (those related to osteoporosis number more than 8.9 million a year, according to the International Osteoporosis Foundation). Add that to the rapid increase in R&D investment.

In 2023, the U.S. academic-industry partnership received more than USD 15 million in NIH funding for new BMP delivery systems. Regulatory guidance is shifting toward BMPs, with the FDA’s 2023 update to its guidance for combination products easing review pathways for BMP-based bone graft substitutes. Moreover, the abundant availability of recombinant human BMPs (rhBMP-2 and rhBMP-7) resulting from protein engineering facilitates their use in large-scale surgeries. Together, these attributes have translated to improved clinical performance and expanded the therapeutic range of BMPs, establishing them as an indispensable element in bone regeneration procedures.

Restraints:

-

Safety Concerns, Cost, and Usage Limitations Impede Wider Adoption

The primary concern is safety; for instance, a 2022 study in The Spine Journal found more complications post-surgery, such as unwanted bone growth and inflammation, particularly when BMP-2 is applied in cervical spinal fusion for procedures not officially sanctioned. Furthermore, the high cost of treatment limits the adoption of BMP, particularly in low- and middle-income countries. An average cost for BMP-2 per surgical use can be in excess of USD 5,000, a value that may heavily burden healthcare budgets, particularly when cheaper autograft alternatives are considered. In addition, the market is also stifled by stifling market dynamics through close regulation.

In 2023, EMA released new warnings regarding the use of BMP concerning the risk of adverse events, leading to re-evaluations about the use of BMP in some subpopulations of patients. IP issues and production complexity impede supply-side scale-up and limit the clinical availability. Reimbursement issues in many countries, due to inconsistent clinical outcomes, add more to the friction. In addition, with the lack of extended follow-up data on newer generation BMP analogs, surgeon confidence and patient enthusiasm are diminished. These multifarious barriers indicate that, although BMPs demonstrate considerable promise for the clinic, safety, cost, and regulatory limitations need to be overcome to fully exploit the market potential.

Bone Morphogenetic Protein Market Segmentation Analysis:

By Type

The rhBMP-2 segment held the majority share in 2024, 74.2% of the overall market. This dominance is due to its powerful osteoinductive properties and broadening clinical use in orthopaedic and spinal procedures. rhBMP-2 has been broadly cleared by such regulatory bodies as the FDA for indications such as lumbar spinal fusion and is thus a surgeon’s top pick. Its excellent applicability and effectiveness in promoting bone healing make it widely used. Furthermore, rhBMP-2 has been the subject of many clinical trials, substantiating its role in generating effective bone healing results.

The rhBMP-7 market is smaller, but is expected to increase at a moderate CAGR as new uses of the treatment are identified in non-union bone fracture treatments and reconstructions. Development is motivated by continued investigation into its magnetic applications in tissue regeneration and musculoskeletal repair.

By Application

The spinal fusion segment was the leading segment in 2024, accounting for a share of 52.3% of the market. This is mostly related to the large number of spinal fusion operations globally, especially in an aging population, and degenerative disc disease or spinal instability. Their successful performance has been driven by the capacity of BMPs, especially rhBMP-2, to obviate the use of autografts and minimize operation time.

The trauma segment is anticipated to register the highest CAGR from 2025 to 2032. This rise is owed to an increasing occurrence of fractures caused by accidents, slips, and sports injuries. Increasing use of BMPs for difficult fractures, particularly in trauma orthopedics, in combination with evidence-based clinical guidelines, is stimulating their application in trauma patients. Progress in BMP localized delivery systems is also improving trauma-based surgery outcomes and is rising the demand in this market.

Regional Insights:

North America held the majority of the market share in 2024, attributed to a greater number of spinal fusion surgeries, good reimbursement coverage, and a well-developed healthcare system. The U.S. bone morphogenetic protein market size was valued at USD 128.41 million in 2024 and is expected to reach USD 175.82 million by 2032, growing at a compound annual growth rate (CAGR) of 4.06% from 2025 to 2032. Key opinion leaders in the field in the U.S. and Europe are taking the lead, while early adoption of advanced BMP-based solutions is supported by substantial funding of clinical studies in the United States. According to CDC statistics, more than 400,000 spinal fusions are performed each year in the United States, and BMPs, including rhBMP-2, are used in many of them. Its leadership is also reinforced by robust FDA backing for BMP usage and growing orthopedic surgical trends within aging demographics. There are pockets in Canada where use is moderately widespread, largely because of public health approaches and surgical improvements.

The European market is also the second-largest market. High prevalence of osteoarthritis and trauma cases needing bone regeneration are the compelling factors for market growth in this region. Germany has a leading role in the area due to its well-organized network of orthopedic surgery and a large number of clinical BMP studies. The nation also has supportive insurance policies and its extensive use in spinal and dental surgery. France and the UK are both actively helping with research and friendly regulatory routes. Europe is more accepting of the less invasive treatment for bone replacement procedures, and also BMP (Bone Marrow Procedure) in dental and craniofacial reconstruction has driven the market as compared to the U.S/Canada. Nations like Italy and Spain are also trending upwards as elderly populations and trauma cases sideline other patients.

By 2025–2032, Asia Pacific is expected to grow the fastest because of an aging population, growing accident-related injuries, and the development of healthcare infrastructure. The region is primarily led by China, which is being aided by the increasing number of spinal procedures and government-supported biotech developments. There has been an obvious growth of orthopedic operations, and more than 4.5 million bone fractures are reported per year in the country. India and Japan are both contributors of note; India has a growing pool of trauma cases and medical tourism, and an aging Japan means plenty of surgical demand. South Korea and Singapore are contributing to funding for biomedical R&D that can facilitate BMP use in personalized medicine and tissue engineering.

Bone Morphogenetic Protein Market Key Players:

Leading bone morphogenetic protein companies operating in the market comprise Medtronic plc, Cellumed Co., Ltd., Cell Guidance Systems LLC, Merck KGaA, Prospec-Tany Technogene Ltd., Qkine Ltd., Bio-Techne, Thermo Fisher Scientific Inc., Proteintech Group, Inc., and STEMCELL Technologies.

Recent Developments in the Bone Morphogenetic Protein Market:

In April 2025, CGBio received FDA Investigational Device Exemption (IDE) approval for Novosis Putty, a novel bone graft material combining rhBMP-2 with a ceramic scaffold. This milestone advances the product’s entry into the U.S. market, enhancing treatment options for spinal fusion and bone regeneration surgeries.

In January 2025, Qkine announced a strategic partnership with ReproCELL to advance the development and commercialization of high-quality recombinant proteins, including Bone Morphogenetic Proteins.

| Report Attributes | Details |

| Market Size in 2024 | USD 341.26 million |

| Market Size by 2032 | USD 504.30 million |

| CAGR | CAGR of 5.02% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (rhBMP-2, rhBMP-7) • By Application (Spinal Fusion, Trauma, Reconstruction, and Oral Maxillofacial) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Medtronic plc, Cellumed Co., Ltd., Cell Guidance Systems LLC, Merck KGaA, Prospec-Tany Technogene Ltd., Qkine Ltd., Bio-Techne, Thermo Fisher Scientific Inc., Proteintech Group, Inc., and STEMCELL Technologies. |