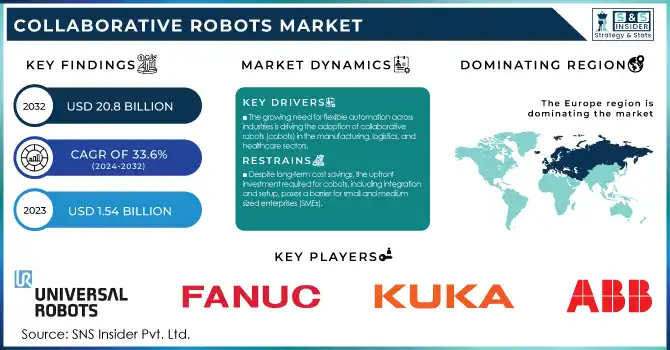

Collaborative Robots Market Size & Overview:

The Collaborative Robots Market size was valued at USD 1.54 Billion in 2023 and is expected to grow to USD 20.8 Billion by 2032 and grow at a CAGR of 33.6 % over the forecast period of 2024-2032.

To get more information on Collaborative Robots Market - Request Free Sample Report

The collaborative robots market has been growing with the developments in automation and the rising interest in cost-effectiveness in various industries. According to the latest data from the International Federation of Robotics and the U.S. Bureau of Labor Statistics, automation adoption in manufacturing has increased by over 40% in the last five years. This has been mainly caused by the developed countries labor shortages and rising wages. The U.S. government has also engaged in promoting technology in advanced manufacturing, including automation with such activities as the Advanced Manufacturing Leadership Strategy, investing $1.2 billion in the enhancement of robotics in 2023 within the automotive, electronics, and other industries. At the same time, in Asian-Pacific China and South Korea have been among the top investors in robotics in the industry 4.0 framework. MIIT (Ministry of Industry and Information Technology) reported that China was the leader in industrial robot installation in 2023, having around 35% of all industrial robots globally. EU has also supported the adoption of cobots, investing a lump sum of €7.5 billion in various sectors between 2021 and 2027, through its Digital Europe Programme. These government efforts have been significantly driving the collaborative robot market, positioning cobots as an important part of industrial automation, particularly in automotive, electronics, and healthcare.

Trends of the Collaborative Robots Market

The major beneficial Cobot market trends include advances in safety standards and technological development. IRSC (International Robot Safety Conference) 2024, mentioned the ISO 10218 standard revisions to meet the current demand for human-safe cobots. This is an important trend since collaborative robots will continue working side-by-side with human workers, using them in such manufacturing, electronics, and automotive applications. The integration of artificial intelligence is another beneficial trend since this makes robots more autonomous and better at understanding the risks, hence safer and more efficient. A recent market development in September 2024 is ABB Robotics’ panoramic innovator, the Ultra Accuracy feature for the GoFa cobots. This feature allows the safe performance of ultra-precision paths, as cobots maintain an exceptional path accuracy of 0.03 millimeters. The cobots use pre-calibrated designs and make use of the RobotStudio AR software to enable manufacturers to simulate and program tasks offline with nearly perfect accuracy, reducing OPEX and deployment time. All these trends allow to make more industrial applications automated due to the demanding precision acceptor – such as electronic, automotive, and aerospace ones. As companies increasingly rely on automation to boost productivity, the cobot market is expected to grow rapidly, driven by innovation and evolving safety standards.

Collaborative Robots Market Dynamics

Drivers

-

The growing need for flexible automation across industries is driving the adoption of collaborative robots (cobots) in the manufacturing, logistics, and healthcare sectors.

-

Advances in safety features and AI-driven technologies have enabled better human-robot collaboration, making cobots more user-friendly and boosting their adoption in various applications.

One of the key factors propelling the collaborative robots market is the growing demand for automation in a variety of industries. Companies today face many obstacles, including a lack of manpower, and the need to increase salaries and streamline operations, and collaborative robots or cobots are the perfect solution. This equipment offers to operate in conjunction with a human, creating a more secure and efficient workflow. Cobots are mainly used in the manufacturing, logistics, and healthcare sectors. For example, in the automotive industry, cobots are mainly used for assembly, welding, and painting. Ford and BMW have deployed cobots in their production, resulting in enhanced quality and lower levels of human labor.

In the electronics industry, cobots are also applied for PCB assembly and component placement, which require a high level of accuracy and repetitive precision. The International Federation of Robotics reported that in 2023, in comparison to the previous year, about 10 percent more cobots had been installed. Another study showed that cobots would be applied in about 29 percent of global manufacturing facilities by 2026, indicating significant application growth. In the healthcare industry, cobots gradually gain popularity and are used in different areas, including non-invasive surgeries, rehabilitation, and laboratory automation. In hospitals, they are deployed to handle hazardous materials, reducing human contact with harmful substances. Increases in the use of automation-based solutions and ease of programming contribute to the growth of demand for cobots.

Restraints

-

Despite long-term cost savings, the upfront investment required for cobots, including integration and setup, poses a barrier for small and medium-sized enterprises (SMEs).

-

Compared to traditional industrial robots, collaborative robots often have limitations in terms of payload and operational speed, restricting their use in heavy-duty applications.

One of the key restraints in the collaborative robots market is their limited payload and speed capabilities. Collaborative robots are designed to work alongside humans and, therefore, have to be safe for interaction. This design means that they are less capable than traditional industrial robots intended to process heavy materials at high speeds. Most cobots only have a payload of around 3-35 kg. This restraint makes businesses in certain industries less likely to purchase these compared to industrial robots, which can have a payload of over 500kg. Based on a survey by Universal Robots conducted in 2023, some 25 percent of manufacturers choose traditional industrial robots because they require higher payloads and speed, even though cobots offer superior flexibility. Ultimately, the restraints stop cobots from replacing traditional robots in industries that require industrial robots’ high capabilities, such as automotive assembly or heavy material handling.

Collaborative Robots Market Segment analysis

By Payload Capacity

The up to 5kg payload capacity segment dominated the collaborative robots market in 2023, comprising 45% of the revenue share. The main reason for this dominance is the increased manufacturing of lightweight, versatile robots that can be utilized in a wide range of industrial settings, particularly small and medium enterprises. According to the European Robotics Association, up to 5kg of cobots are mainly used in assembly, material handling, and pick-and-place operations, which require high precision but can be performed without heavy lifting. The governments have supported this trend by offering incentives for SMEs to implement automation to increase efficiency and competitiveness. It can be illustrated by the Small Business Administration (SBA) which has introduced grants for SMEs in the U.S. to purchase light robots in 2023, which caused their sales to increase by 30% in the country. This segment is expected to remain dominant due to its flexibility, cost-effectiveness, and ease of programming, which appeal to a wide range of industries.

By Vertical

In 2023, the automotive industry accounted for more than 25% of the revenue share in the market of collaborative robots. Cobots have become widespread in automotive production, they are used for welding, painting, gluing, and assembling. This approach allows manufacturers to ensure efficient production and eliminate as much human error as possible. According to the U.S. Department of Commerce, the use of such robots in automotive production has increased by 22% over the past year. The main reason for this trend is the ever-increasing pressure on auto manufacturers to optimize their production. Recurrent labor shortages have become an accelerator of robotic implementation, especially given the fact that, as noted by the U.S. Department of Commerce, the production of such type of transport supports more than 400,000 jobs. Another reason for the growth is the support from the state in the form of subsidies and tax incentives that are given by most states to companies that adopt robotics.

On the other hand, the electronics segment will grow with the most significant CAGR over the forecast period. This is due to the ever-increasing demand for electronics all over the world and the search for the possibility of maximum miniaturization and greater precision of the component manufacturing process. The South Korean Ministry of Trade, Industry, and Energy highlights that in 2023, the use of cobots in the electronics production sector increased by 35% in contrast to the previous year, which, given the dynamics of the global market, is likely to increase.

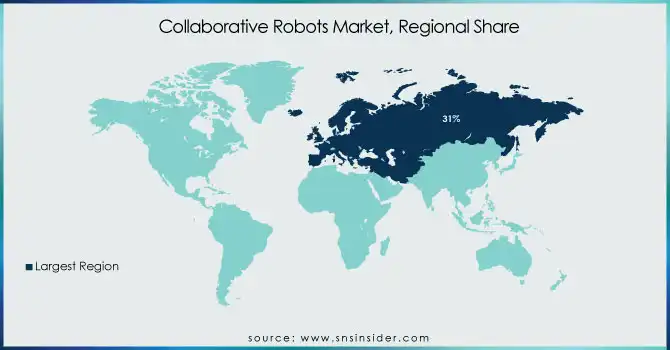

Regional Analysis

In 2023, Europe dominated the collaborative robots market owing to a revenue share of more than 31%. Europe as stringent industrial automation witnessed lucrative growth in Germany, France, and Italy. Germany reported a leading number of cobots as the government’s Industries 4.0 initiative focused on digital adoption and incorporation of robots in the manufacturing sector. According to the European Commission, robot and automation investments increased by 15% in 2023, understanding that this strategy would enhance productivity and reduce labor costs in the automotive, aerospace, and electronics industries. Moreover, European producers increased cobot incorporation to address their sustainability goals, reduce emissions, and improve precision in complex applications. According to the French Ministry of Economy and Finance, France`s robotics sector experienced a 12% growth in cobot implementation in 2023. The country is a prime market in Europe, with the government’s France Relance recovery plan prompting increased deployment.

The Asia-Pacific region is projected to grow with a significant CAGR during the forecast period. Noteworthy, China, Japan, and South Korea reported lucrative growth during this period as the drivers of automation and government incentives for industrial development. China remains the largest deployer of industrial robots and enacts cobot incorporations as part of the nation’s “Made in China 2025” strategy. The Ministry of Industry and Information Technology noted that more than 150,000 cobots were employed in Chinese factories during 2023, representing a 25% increase from 2022.

On the other hand, North America generated a considerable market share as automation investments increased, primarily in the healthcare, automotive, and electronics industries. According to the U.S. Bureau of Economic Analysis (BEA), in 2023 automation technologies investment soared by 18%, with cobots being the key drivers. In America, the number of government-sponsored inventions in the U.S. and Canada in the robotics industry is on the rise. NIST’s U.S. government funds for automation and AI will upsurge the market.

Need any customization research on Collaborative Robots Market - Enquiry Now

Key Players

-

Universal Robots (UR3e, UR5e)

-

FANUC Corporation (CR-15iA, CR-35iA)

-

KUKA AG (LBR iiwa, KMP 600)

-

ABB Ltd. (YuMi, IRB 6700)

-

Yaskawa Electric Corporation (Motoman HC10, Motoman HC20)

-

Rethink Robotics (Baxter, Sawyer)

-

Adept Technology (Adept Viper, Adept Cobra)

-

Teradyne Inc. (Universal Robots, DENSO VS-068)

-

Staubli Robotics (TX2-60, TX2-40)

-

Nachi-Fujikoshi Corp. (MZ07, MZ12)

-

Omron Corporation (LD series, TM series)

-

Epson Robots (C4, G3 series)

-

Kawasaki Heavy Industries (DUA Series, RS007N)

-

Doosan Robotics (M0609, M0617)

-

Robot System Products AB (RSP X, RSP U)

-

Siasun Robot & Automation Co., Ltd. (SR Series, Yaskawa Robots)

-

MOTOMAN (MH Series, MPL Series)

-

Insight Robotics (Firebot, Drones for Search & Rescue)

-

AUBO Robotics (AUBO-i5, AUBO-i3)

-

Hannover Messe (E-Series, K-Series) and others

Recent Developments

May 2023: Universal Robots, a prominent cobot manufacturer, announced the launch of a new UR20 model with higher payload capacity and longer reach. Designed for heavy-duty manufacturing in automotive, aerospace, and other industries, the new product will allow the company to increase its market share.

July 2023: FANUC Corporation unveiled a new robotics manufacturing facility in Japan. The project was supported by government funding, as Japan seeks to become a leader in industrial automation. With its new facility, FANUC will expand production volumes by 30% to accommodate the growing demand for cobots in the Asia-Pacific region.

| Report Attributes | Details |

| Market Size in 2023 | USD 1.54 Billion |

| Market Size by 2032 | USD 20.8 Billion |

| CAGR | CAGR of 33.6 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Payload (Up to 5 Kg, 5-10 Kg, Above 10 Kg) • By Application (Assembly, Pick & Place, Handling, Packaging, Quality Testing, Machine Tending, Gluing & Welding, Others) • By Industry (Automotive, Electronics, Metals & Machining, Plastics and Polymers, Food and Beverages, Furniture and Equipment, Pharma, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]). Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles |

Universal Robots, FANUC Corporation, KUKA AG, ABB Ltd., Yaskawa Electric Corporation, Rethink Robotics, Adept Technology, Teradyne Inc., Staubli Robotics, Nachi-Fujikoshi Corp., Omron Corporation, Epson Robots, Kawasaki Heavy Industries, Doosan Robotics, Robot System Products AB |

| Key Driver | •The growing need for flexible automation across industries is driving the adoption of collaborative robots (cobots) in the manufacturing, logistics, and healthcare sectors •Advances in safety features and AI-driven technologies have enabled better human-robot collaboration, making cobots more user-friendly and boosting their adoption in various applications. |

| Market Restraints | •Despite long-term cost savings, the upfront investment required for cobots, including integration and setup, poses a barrier for small and medium-sized enterprises (SMEs). •Compared to traditional industrial robots, collaborative robots often have limitations in terms of payload and operational speed, restricting their use in heavy-duty applications. |