Urinary Incontinence Treatment Devices Market Report Scope & Overview:

Get more information on Urinary Incontinence Treatment Devices Market - Request Sample Report

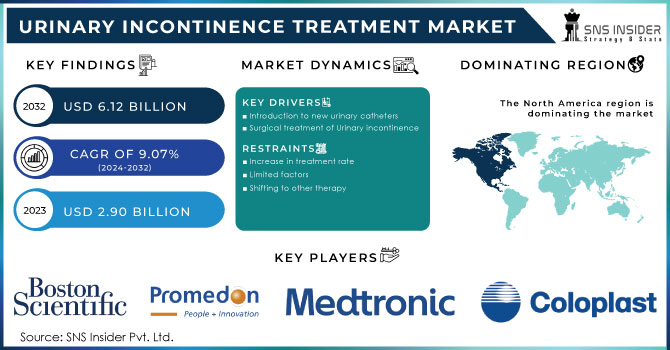

The Urinary Incontinence Treatment Devices Market Size was valued at USD 3.15 billion in 2023 and is expected to reach USD 6.38 billion by 2032 and grow at a CAGR of 8.18% over the forecast period 2024-2032. This report analyzes the increasing prevalence and incidence of urinary incontinence, especially among aging populations and chronic disease patients, and how this is affecting prescription behavior and adoption of treatments across regions. The research delves into technological developments, such as smart wearable devices and minimally invasive therapies, and innovation trends that are enhancing patient outcomes and convenience. Also, it assesses regulatory and market access trends with particular reference to the influence of approvals, reimbursement policies, and healthcare infrastructure on the market. It also judges healthcare expenditure on urinary incontinence therapy across payment models like government funding, private insurance, and out-of-pocket payments with reference to differences in access and affordability across regions.

Market Dynamics

Drivers

-

Growing Prevalence of Urinary Incontinence and Technological Advancements

The rising prevalence of urinary incontinence is a major growth driver for the market for urinary incontinence treatment devices. Based on estimates from the National Association for Continence (NAFC), more than 200 million individuals worldwide are affected by urinary incontinence, and this is found to be higher in women and older adults. The increasing population of geriatric patients, along with conditions such as obesity, post-menopausal alterations, and neurological disorders (Parkinson's and multiple sclerosis), has contributed to increased demand for effective treatment. Furthermore, advancements in technology in urinary incontinence devices are driving the market forward. The advent of wearable electrical stimulation devices, AI-based biofeedback systems, and minimally invasive neuromodulation treatments has enhanced patient outcomes and driven the uptake of these treatments. Firms like Medtronic have come up with InterStim therapy, a sacral neuromodulation device that decreases symptoms of overactive bladder and urge incontinence by a large margin. Additionally, the growing use of home-based devices like INNOVO by Atlantic Therapeutics is promoting self-management of patients. The widening of insurance coverage and reimbursement policies for urinary incontinence procedures in most countries is also fueling market growth. In total, the union of escalating disease burden, new product developments, and increased awareness among patients is anticipated to boost the demand for urinary incontinence treatment devices.

Restraints

-

High Treatment Costs and Limited Reimbursement in Developing Regions

Surgical interventions like urethral sling and artificial urinary sphincters range from USD 5,000 to USD 20,000 and are thus not affordable for most patients, particularly in low- and middle-income countries (LMICs). Moreover, the expense of neuromodulation treatments, e.g., Medtronic's InterStim therapy, is more than USD 30,000, covering the procedure and device implantation. Reimbursement issues further restrict patient access to these treatments. In some nations, government healthcare programs and insurance companies do not cover urinary incontinence devices comprehensively, especially for mild to moderate cases. For example, in most Asian and Latin American countries, patients have to pay a large part of the treatment costs out-of-pocket, deterring adoption. Another major constraint is the shortage of trained health personnel with expertise in pelvic floor diseases and sophisticated urinary incontinence treatments, reducing the availability of effective interventions. Cultural stigma around urinary incontinence also deters many from accessing timely medical attention, resulting in underdiagnosis and reduced treatment rates. Consequently, affordability and access are significant hindrances, barring universal adoption of urinary incontinence treatment devices.

Opportunities

-

Rising Demand for Non-Invasive and Home-Based Treatment Solutions

The growing demand for non-invasive and home care treatment options poses a significant challenge for market development. Patients are increasingly moving away from surgical interventions towards non-surgical treatments like electrical stimulation equipment, wearable pelvic floor trainers, and biofeedback-based solutions, decreasing reliance on surgery. For example, non-invasive home-use electrical stimulation device INNOVO by Atlantic Therapeutics is gaining popularity because it is very easy to use and effective in treating urinary incontinence. InControl Medical's Attain is also increasingly popular for pelvic floor therapy at home. The swift developments in wearable technology and AI add further significance to these devices, with treatment becoming even more convenient and accessible. Another major opportunity is building awareness and education campaigns regarding urinary incontinence and available treatment methods. Government policies and healthcare campaigns encouraging early detection and treatment of incontinence are fuelling market growth. In addition, the increasing use of telehealth and digital platforms for health is making it possible for more patients to be consulted remotely and receive customized treatment protocols, making the effective solutions more accessible. With increased R&D investments and more product launches in intelligent medical devices, the urinary incontinence treatment devices market is set to experience high growth in homecare and non-invasive therapies.

Challenges

-

One of the major challenges faced by the urinary incontinence treatment devices market is the risk of product recalls and stringent regulatory requirements.

There have been several recalls of sling and mesh implants over the years due to issues like erosion, infection, and device malfunction. For instance, in 2019, the U.S. FDA prohibited transvaginal mesh implants for pelvic organ prolapse based on safety reasons, greatly affecting market confidence in similar incontinence products. These recalls lead to apprehension among patients as well as healthcare professionals, thus decelerating adoption rates. Another significant challenge is rigorous regulatory guidelines for the approval of new products. Equipment like neuromodulation systems and implantable artificial sphincters involves huge clinical trials and long FDA or CE mark approval processes, thus pushing market introduction and development costs. Moreover, post-market surveillance and compliance with changing healthcare regulations are added burdens for manufacturers. Concerns about patient safety related to long-term complications, infection, and device failure also pose challenges, instilling reluctance in resorting to surgical or implant-based therapies. These challenges need to be overcome by the industry through ongoing product development, clinical studies, and regulatory compliance to continue to promote patient safety and market growth.

Segmentation Analysis

By Product

In 2023, urethral slings were the leading urinary incontinence treatment devices with a market share of 40.5% of the total revenue. They have been successful due to their high success rate in the treatment of stress urinary incontinence (SUI), extensive use in surgical operations, and favorable reimbursement policies. The minimally invasive procedure and long-term success of these operations have also made them a dominant force in the market. Electrical stimulation devices were the fastest-growing category as a result of being non-invasive, growing interest in home-based therapies, and advancements like wearable and AI-based devices. Growing awareness of conservative treatment and neuromodulation therapies for urge incontinence have boosted the demand for these devices further.

By Incontinence Type

Stress urinary incontinence (SUI) held 48.3% of the market share in 2023, mainly because of its high incidence among women, especially post-childbirth and post-menopause. The extensive use of urethral slings and artificial urinary sphincters for treating SUI was a major factor behind this dominance. Rising awareness and early diagnosis rates have also resulted in more surgical and non-surgical procedures. The mixed incontinence segment is growing at the fastest rate as a result of the rising number of cases involving patients with symptoms of both stress and urge incontinence. The rising demand for combination treatments, such as electrical stimulation devices and urethral slings, is propelling this segment's high growth rate. Furthermore, improvements in personalized treatment strategies and heightened patient awareness are facilitating its growth.

By End-user

Hospitals commanded the highest market share, 54.6%, because of the preference for surgical interventions in a hospital environment, access to sophisticated treatment facilities, and availability of experienced healthcare providers. Hospitals also provide an integrated approach to urinary incontinence treatment, from diagnosis to post-operative care, which has solidified their market leadership. The home-use segment is increasing at the highest rate due to the increased usage of portable electrical stimulation devices and catheters for self-management. The move toward telehealth solutions, convenience of patients, and growing inclination towards non-invasive treatments has highly contributed to the growth of this segment. Improved wearable technology and AI-powered urinary incontinence monitoring have further increased home-based treatment possibilities.

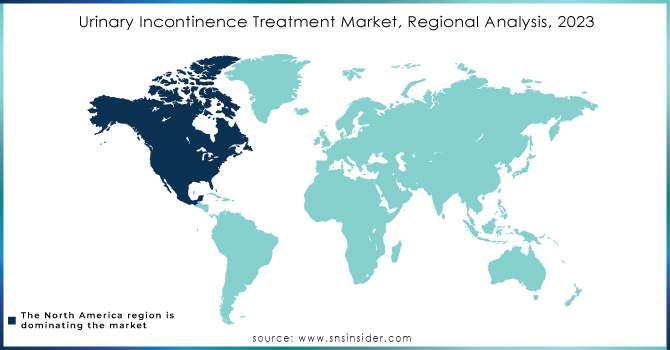

Regional Analysis

North America was the leader in the urinary incontinence treatment devices market in 2023 and held 43.2% of the market revenue globally. This is propelled by the huge incidence of urinary incontinence, well-developed healthcare systems, and the high uptake of sophisticated medical devices like urethral slings and neuromodulation devices. Favorable reimbursement policies and growing awareness about minimally invasive treatments have further fueled market expansion. The U.S. contributes significantly to this due to advanced technology and heightened surgical procedures.

Europe was the second-largest market, with a rising geriatric population and rising healthcare expenditure. Germany, France, and the UK have experienced increased adoption of artificial urinary sphincters and electrical stimulation devices, which are facilitated by government-funded healthcare programs.

Asia-Pacific is the largest growing market led by the accelerating aging population, increasing prevalence of incontinence, and advancing accessibility of healthcare. China, Japan, and India are facing increased demand for catheters and home-use electrical stimulation devices through lower treatment expenditures and enhanced awareness among patients.

Need any customization research on Urinary Incontinence Treatment Devices Market - Enquiry Now

Key Players and Their Urinary Incontinence Treatment Devices

-

C. R. Bard, Inc. (Becton, Dickinson and Company) – Adjustable Continence Therapy (ACT), Urethral Slings, Catheters

-

Coloplast Group – Altis Single Incision Sling, Virtue Male Sling, Catheters

-

Promedon Group – Argus Adjustable Sling System, Remeex System

-

A.M.I. GmbH – ATOMS Adjustable Sling, TOA Sling System

-

Ethicon US, LLC. (Johnson & Johnson) – Gynecare TVT Sling System

-

ZSI Surgical Implants S.R.L. – ZSI 375 Artificial Urinary Sphincter

-

Medtronic plc – InterStim Sacral Neuromodulation System

-

InControl Medical LLC – Attain Pelvic Floor Exerciser, Apex M Electrical Stimulation Device

-

Hollister Incorporated – VaPro Plus Catheters, OnliReady Urinary Catheter

-

Atlantic Therapeutics Group Ltd. – INNOVO Electrical Stimulation Device

-

B. Braun Melsungen AG – Actreen Intermittent Catheters, Urimed Catheters

-

Teleflex Incorporated – Male Slings, Catheter Solutions (Rüsch, LMA, Arrow Brands)

Recent Developments

In March 2025, Relief Srl secured over €1 million (US$1.08 million) in funding for Urorelief, its endourethral medical device designed to treat stress urinary incontinence. The Italian startup plans to use the investment for clinical trials to validate the device and improve treatment options for affected patients.

In Feb 2025, Neuspera Medical, Inc. announced promising six-month clinical trial results for its battery-free percutaneous sacral neuromodulation (pSNM) system, demonstrating efficacy comparable to traditional SNM devices. The findings, which highlight an improved patient experience for urgency urinary incontinence (UUI) management, will be presented at the 2025 SUFU Winter Meeting on March 1, 2025.

| Report Attributes | Details |

| Market Size in 2023 | USD 3.15 billion |

| Market Size by 2032 | USD 6.38 billion |

| CAGR | CAGR of 8.18% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product [Urethral Slings (Female Slings, Male Slings), Electrical Stimulation Devices (Implantable, Non-implantable), Artificial Urinary Sphincters, Catheters] • By Incontinence Type [Stress Urinary Incontinence, Urge Urinary Incontinence, Mixed Incontinence, Overflow Incontinence] • By End-user [Hospitals, Ambulatory Surgery Centers, Clinics, Home Use] |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | C. R. Bard, Inc. (Becton, Dickinson and Company), Coloplast Group, Promedon Group, A.M.I. GmbH, Ethicon US, LLC. (Johnson & Johnson), ZSI Surgical Implants S.R.L., Medtronic plc, InControl Medical LLC, Hollister Incorporated, Atlantic Therapeutics Group Ltd., B. Braun Melsungen AG, Teleflex Incorporated. |