Automatic Identification and Data Capture Market Size & Overview:

To Get More Information on Automatic Identification and Data Capture Market - Request Sample Report

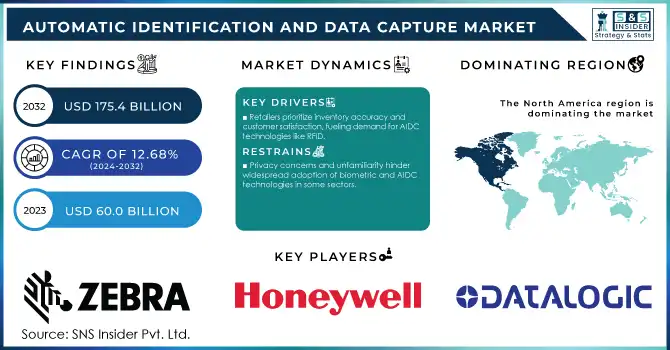

The Automatic Identification and Data Capture Market was valued at USD 60.0 billion in 2023 and is expected to reach USD 175.4 Billion by 2032, growing at a CAGR of 12.68% over 2024-2032.

The Automatic Identification and Data Capture (AIDC) Market is booming due to constant improvements in technology and an insatiable need for real-time processing of information in various industries. Thus, Identifying and Data Capturing (AIDC) technologies such as barcode scanning, RFID (Radio Frequency Identification), and biometric systems are important for improving operational efficiency, inventory management, supply chain optimization, and minimizing human error. Such technologies automate data acquisition and processing, reduce dependency on manual input, and provide increased accuracy in tracking goods, assets, and people. AIDC has a vast applications in retail to track inventory and improve the experience of consumers. Major retailers such as Amazon and Walmart use RFID technology to track the movement of products from warehouses to store shelves. Thus, enabling accurate stock levels, minimizing stock-outs, and optimizing the operational process. In manufacturing, for instance, AIDC technologies like RFID help manufacturers track raw materials, equipment, and tools throughout the production process, ensuring materials are available when they are needed, and improving production efficiency and reducing downtime.

AIDC assures better patient safety and better care in the healthcare sector. RFID tags help track patient records, medications, and medical equipment, preventing errors in medication administration, and providing real-time tracking of medical devices to maintain their availability and sterilization at all times. Biometric systems are also being used in healthcare environments for the secure identification of patients and staff, further protecting patient information and ensuring the correct procedures are administered on the appropriate patients.

AIDC technologies have been more widely used in logistics and supply chain management, such as shipment tracking, vehicle fleet management and inventory management over a large and complex network. AIDC reduces errors, makes tracking more accurate, and increases efficiency in these domains, which translates into cost savings and improved reliability of delivery times. As AIDC technologies keep gaining pace in the industries, continuous advancements in RFID, barcode scanning, and biometrics will further fuel the market.

Automatic Identification and Data Capture Market Dynamics

Drivers

-

The retail industry’s push for better inventory control and customer experience is driving the demand for AIDC technologies like RFID.

-

Government initiatives promoting automation, data security, and technology adoption are accelerating AIDC implementation across sectors.

-

AIDC technologies help reduce human error, streamline processes, and lower operational costs, which appeals to industries like manufacturing and logistics.

AIDC (Automatic Identification and Data Capture) technologies are extremely effective when it comes to minimizing human errors and eliminating unnecessary processes and costs, especially in manufacturing and logistics industries. They require the most accurate data for inventory, supply chain and asset management in sectors such as retail or logistics. AIDC solutions such as barcode scanning, RFID, and biometrics automate this manual process, reducing errors and improving efficiencies and speed as the AIDC solutions work with real-time data ensuring accuracy across the operations. In manufacturing, for example, RFID can track raw materials, tools, and products within production lines, receiving the necessary resources on time and avoiding production downtimes. Likewise, AIDC systems in logistics have provided better shipment visibility that increases the accuracy of inventory control and delivery efficiency. While instant data access enables enterprises to arrive at quicker decision-making processes, freedom of access also reduces bottlenecks, and, ultimately improves the overall efficiency of operations.

In addition, AIDC technologies help lower expenses by reducing labor requirements, which can often be expensive and error-prone. They further reduce incurred expenses from lost or misplaced inventory, allowing warehouse processes to run smoother. Using RFID to track assets saves companies money from replacing lost items, and avoids overstocking. Moreover, the AIDC solutions combined with biometrics and voice recognition systems provide high security and operational efficiency. In sectors such as healthcare and banking, biometrics are used to ensure the security and authentication of sensitive information to prevent fraud and improve access management. With the upgradation and maturity level concerning AIDC technologies as well as more value in each implementation than other technologies, price-benefit ratios are expected to grow, driving up efficiency and cost savings from various sectors.

Restraints

-

The vast amount of data generated by AIDC systems can overwhelm organizations if they lack proper data analytics tools to process and derive meaningful insights.

-

In certain sectors, consumer hesitation to adopt biometric systems and other AIDC technologies due to privacy concerns or unfamiliarity can restrict their widespread use.

-

Integrating AIDC technologies with existing IT systems and databases can be challenging, particularly for businesses that have legacy infrastructures in place.

For legacy infrastructure, integrating small business automatic identification and data capture (AIDC) technology with legacy IT systems and database applications offers several challenges to the business. As a result, legacy systems that operate on now-pervasive hardware and software architectures are unlikely to support all of the capabilities that AIDC technologies like RFID, barcode scanning, and biometrics enable. This mismatch makes it tough to create a seamless data exchange between AIDC solutions and existing systems of the enterprise (ERP or inventory management, tools). The process of integration could take a lot in terms of time, and technical and economic resources. For AIDC technologies, businesses might need to upgrade or replace their existing infrastructure. It might entail acquiring new gear like RFID readers or barcode scanners or an upgrade to the software to process the massive amount of data associated with AIDC systems. For organizations with extensive legacy systems, the process of upgrading can be cumbersome and disruptive, potentially halting essential business operations and leading to inefficiencies or system outages. Additionally, legacy AIDC providers often struggle to fit AIDC in with legacy IT systems to enable real-time data processing. Its nature of generating vast amounts of data requires processing and analytical consideration in real-time to optimize supply chains, locate assets, and keep inventory in check. On the other hand, legacy systems might not be able to accommodate such high data throughput, which can lead to delays in terms of data processing and decision-making. AIDC technologies are designed to deliver operational benefits like efficiency and accuracy, but those bear the drawback of being compromised.

Staff will also need to be trained in managing the new, unified systems, which will increase costs and potential delays. Among small companies, the money and time consuming nature of integration such as this makes it a deterrent for investment in AIDC technologies. Therefore, businesses need to evaluate whether it is feasible and cost-effective to upgrade their systems before deploying an AIDC solution to facilitate smoother implementation.

Automatic Identification and Data Capture Market Segment Analysis

By Component

The hardware component led the market revenue with a share of 61.8.0% in 2023. For the forecast period, growing demand for AIDC hardware devices, including RFID (radio-frequency identification) tags, scanners, barcode solutions, magnetic stripe cards, optical character recognition systems, biometric systems, and smart cards, will likely continue as the leading driver by segment. With constant advancements in design and technology, we are seeing newer solutions being launched at a much faster pace. More example, in May 2024, Hanwha Vision, a developer of video surveillance systems and other vision solutions, announced a unique dual-lens Barcode Reader (BCR) camera that helps the logistics industry increase efficiency and prevent losses. With both video capture and barcode recognition functions in a single device, the product tracks parcel barcodes at specific 2 meters per second on high-speed conveyors. However, development towards increased portability along with higher efficiency and reliability is driving manufacturers to invest in research, to come out with competitive developments in the market.

The services segment is anticipated to grow at the fastest CAGR during the forecast period. In addition to AIDC technologies, service providers also provide extensive support such as installation, configuration, and long-term maintenance of systems and products, among others. They also offer training and consulting services to help organizations effectively implement and use AIDC technologies in their operations. Technical support and troubleshooting assistance are also provided by service providers to facilitate and ensure the smooth functioning of these products and reduce any disruptions during data capture processes.

By End-Use

The global market was analyzed across BFSI, telecommunication, IT, and others and the BFSI segment held the largest revenue share in 2023. The banking sector is indeed a significant contributor, with its rising requirement for advanced technologies like smart cards. Many financial organizations have implemented these systems due to their capacity to track assets, process secure transactions and recognize procedures. With governments worldwide attempting to limit the vulnerability of such institutions to security breaches and respond effectively to cyber threats, the market for products such as barcoded documents, biometrics systems, and smart cards tends to be on the rise.

The retail segment is projected to be the fastest-growing over the forecast period. This segment is anticipated to increase its share in the industry owing to the growing usage of automatic identification & data capture technologies including barcode & RFID tags in the areas of supply chain management, billing, and replenishment of orders in the retail value chain. The surge in urbanization and demand for different consumer goods are pushing the retail business to grow continuously in various other economies across the globe and hence AIDC technology adoption in this sector is growing. As retail distribution centers face new identification challenges that threaten longer-term goals, manufacturers are simultaneously improving upon traditional laser scanning capabilities and developing complementary technologies to address these challenges.

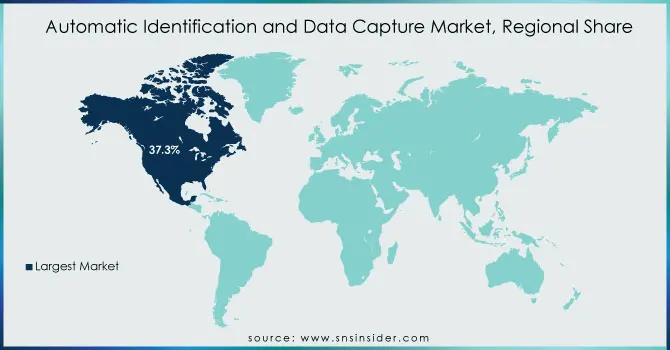

Automatic Identification and Data Capture Market Regional Analysis

In 2023, North America held the largest revenue share of 37.3% in the market. This is because of increasing awareness along with the high adoption of AIDC devices and high investments to introduce these technologies in high-potential industries, such as retail, healthcare, and manufacturing. In addition, the rise of advanced technology acceptance and the technological development of various industries are factors likely to increase the growth of the regional market. The demand for security and efficiency in industrial processes has also led to the wide adoption of advanced equipment, including, but not limited to barcode readers and biometric systems.

Asia Pacific is predicted to grow with the highest CAGR between 2024-2032. With the growing purchasing power and rising living standards of the middle-income population, many multinational retail and logistics corporations have been expanding their presence in the Asia Pacific region. There has been a large-scale regional expansion of the regional automatic identification and data capture business due to this. Major players like Toshiba, Panasonic, and GoDEX International will help keep the industry moving forward. Furthermore, industrial automation technology development in developing countries such as China and India opens new avenues for AIDC manufacturers to enhance offerings.

Do You Need any Customization Research on Automatic Identification and Data Capture Market - Enquire Now

Key Players:

The major key players along with their products are

-

Zebra Technologies – ZT600 Series Industrial Printers

-

Honeywell International Inc. – Honeywell Xenon 1900g Barcode Scanner

-

Datalogic S.p.A. – Gryphon 4500 2D Barcode Reader

-

Sato Holdings Corporation – CL4NX Plus Industrial Thermal Printer

-

Intermec (now part of Honeywell) – Intermec CN51 Mobile Computer

-

Keyence Corporation – SR-2000 3D Laser Scanner

-

Toshiba Tec Corporation – B-EX6T1 Industrial Printer

-

Seiko Epson Corporation – TM-T88V POS Printer

-

Avery Dennison Corporation – AD-830 UHF RFID Reader

-

NCR Corporation – NCR RealPOS Barcode Scanner

-

Cognex Corporation – In-Sight 7000 Vision Systems

-

Omron Corporation – V680-TR Vision Sensor

-

SICK AG – RFID System SICK RLA

-

Mettler Toledo – Advanced Weighing and AIDC Systems

-

SMARTRAC Technology – Smart Cosmos RFID Solution

-

Panasonic Corporation – TOUGHBOOK 33 Mobile Computer

-

TSC Auto ID Technology Co., Ltd. – TTP-2410MT Thermal Transfer Printer

-

PDC Healthcare – On-Demand Labeling Solutions for Patient Identification

-

Printrak International – Digital Fingerprint Solutions

-

Impinj Inc. – Impinj Speedway Revolution RFID Reader

Recent Developments in the Automatic Identification and Data Capture Market

-

January 2024 - Honeywell expanded its AIDC portfolio by introducing advanced RFID solutions for warehouse and inventory management. This technology is designed to improve the speed and accuracy of data collection, reducing operational downtime in logistics.

-

March 2024 - Zebra Technologies launched new AI-powered barcode scanning solutions that integrate with existing ERP systems. These solutions aim to enhance real-time data processing for supply chain optimization, improving efficiency in manufacturing and retail environments.

| Report Attributes | Details |

| Market Size in 2023 | US$ 60.0 Bn |

| Market Size by 2032 | US$ 175.4 Bn |

| CAGR | CAGR of 12.68% from 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Hardware, Software, Services) • By End Use (Manufacturing, Retail, Transportation & Logistics, Hospitality, BFSI, Healthcare, Government, Energy & Power, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Zebra Technologies, Honeywell International, Datalogic S.p.A, Sato Holdings Corporation, Intermec, Keyence Corporation, Toshiba Tec Corporation, Seiko Epson Corporation, Avery Dennison Corporation, NCR Corporation, Cognex Corporation, Omron Corporation, SICK AG, Mettler Toledo, SMARTRAC Technology, Panasonic Corporation, TSC Auto ID Technology, PDC Healthcare, Printrak International, Impinj Inc |

| Key Drivers | • The retail industry’s push for better inventory control and customer experience is driving the demand for AIDC technologies like RFID. • Government initiatives promoting automation, data security, and technology adoption are accelerating AIDC implementation across sectors. • AIDC technologies help reduce human error, streamline processes, and lower operational costs, which appeals to industries like manufacturing and logistics. |

| Market Restraints | • The vast amount of data generated by AIDC systems can overwhelm organizations if they lack proper data analytics tools to process and derive meaningful insights • In certain sectors, consumer hesitation to adopt biometric systems and other AIDC technologies due to privacy concerns or unfamiliarity can restrict their widespread use • Integrating AIDC technologies with existing IT systems and databases can be challenging, particularly for businesses that have legacy infrastructures in place. |