Composite Packaging Market Report Scope & Overview:

Get more Information on Composite Packaging Market - Request Sample Report

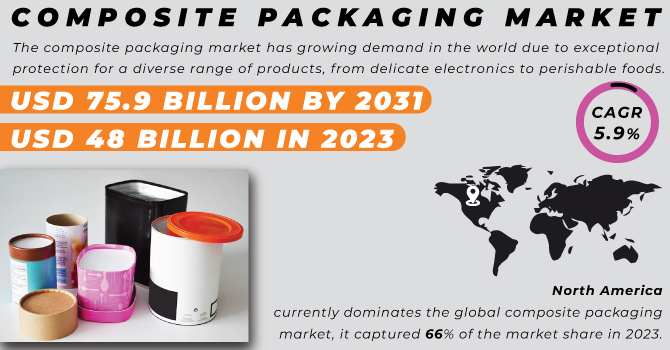

The Composite Packaging Market Size was valued at USD 73.57 billion in 2023 and is projected to grow to USD 112.96 billion by 2032, reflecting a remarkable compound annual growth rate (CAGR) of 5.28% during the forecast period from 2024 to 2032

The composite packaging market has growing demand in the world due to exceptional protection for a diverse range of products, from delicate electronics to perishable foods. This advantage stems from the ingenious combination of multiple materials, leading to superior strength and resistance to external threats like moisture, light, and mechanical stress. The composite materials allow manufacturers to create customized packaging solutions, that affect a wide range of needs, lightweight containers for on-the-go snacks, or a robust enclosure for industrial components. Sustainability gives rise to the composite packaging market. With heightened environmental awareness and regulations aiming to reduce plastic use, manufacturers are increasingly turning to composite materials as a viable alternative to traditional packaging formats. biodegradable components, composite packaging helps minimize the environmental impact of packaging waste, all while offering the same level of protection and functionality.

Market Dynamic

Drivers

-

Rising disposable income, and E-commerce sector are fueling the growth of the composite packaging industry

-

Development of new composite packaging solutions caters the packaging industry

A market shift toward the e-commerce platform, rising disposable income, and the development of more advanced pharmaceuticals are key drivers for the composite packaging industry's booming market value. The global e-commerce surge is particularly expanding the use of composite packaging. As online shopping becomes increasingly popular, consumers rely on secure and reliable packaging to ensure their products arrive safely. Additionally, the rise of complex medications, driven by government and World Health Organization initiatives, necessitates specialized packaging solutions like composites to maintain the sterility and protection of these drugs during transport and storage.

Restraint:

-

Fluctuations in raw materials for composite packaging pose a challenge for manufacturers

The high cost of raw materials for composite packaging reduces manufacturers profit margins. The volatile pricing of key materials like wood pulp and aluminum disrupts budgeting and production planning for composite packaging manufacturers. raw material prices pose a challenge for composite packaging manufacturers. To mitigate this, exploring alternative suppliers and diversifying material sources could be beneficial.

Opportunities

-

High-quality materials and expending industries drive growth in composite packaging

-

Expanding presence in developing countries with growing consumer demand for packaged goods

High-quality materials used in composite packaging create significant growth potential for the industry. Several factors contribute to the overall market size and growth like the thriving retail sector, ongoing advancements in transportation infrastructure, and the ever-expanding logistics industry. Furthermore, the development and launch of innovative new composite packaging solutions will undoubtedly fuel further market expansion.

Challenges

-

Balancing sustainability with affordability remains a challenge for manufacturers

Developing and implementing eco-friendly features and improved recyclability in composite materials often involve more complex processes and potentially more expensive materials. This can increase the overall production cost for traditional composite packaging. Fluctuations in the cost of raw materials used in both traditional and sustainable composite materials can complicate pricing strategies. consumers increasingly express interest in sustainability, they may be hesitant to pay a premium for eco-friendly packaging options. Manufacturers find it challenging to balance between offering sustainable solutions and maintaining price competitiveness.

Impact of Russia-Ukraine War:

The Russia-Ukraine war can disrupt the composite packaging market in several ways Russia and Ukraine are significant exporters of key materials used in composite packaging, such as wood pulp, aluminum, and plastic resins. The war can disrupt these supplies, leading to shortages and price hikes for these raw materials. Disruptions in transportation routes can create logistical challenges, delaying the delivery of raw materials or finished composite packaging products. The war might lead to changes in consumer spending patterns, potentially impacting the demand for certain products and subsequently, the demand for specific types of composite packaging.

Impact of Economic Downturn:

The impact of an economic downturn is leading to a slowdown the market on the composite packaging market, affecting both demand and production. , consumers tend to reduce these expenses and prioritize essential goods over discretionary spending. This can lead to a decline in demand for packaged products, impacting the market for composite packaging materials. Businesses may postpone or reduce investments in new packaging solutions or production lines, further dampening demand for composite materials. Consumers may switch to lower-priced products with less elaborate packaging, leading to a decline in demand for premium composite packaging solutions used for high-end products.

Key Market Segmentation

By Material

The plastic sub-segment dominates the composite packaging market by material in 2023, it is projected for over 45% of market share and is expected to maintain its dominance throughout the forecast period. Plastic provides exceptional barrier properties, shielding products from moisture, gases, and light. This superior protection helps maintain the freshness and quality of packaged products for extended periods. Plastic boasts impressive durability and flexibility, making it adaptable to various packaging needs. Additionally, its lightweight nature translates to lower transportation costs and facilitates efficient manufacturing of composite packaging.

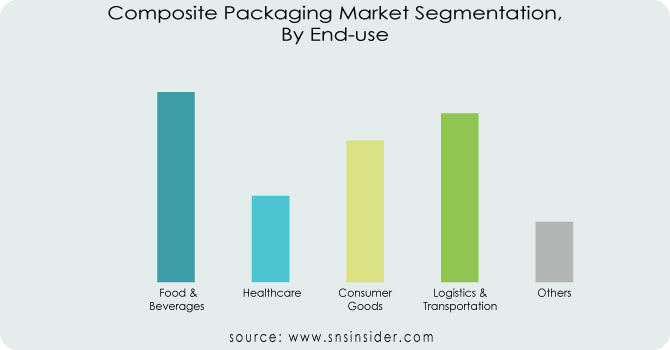

By End-use

The food & beverage sub-segment leads the composite packaging market by end-use and captures an overall 33.4% in 2023. This dominance is driven by effectively extending the shelf life of food & beverage products, minimizing spoilage and waste. The composite materials safeguard products from damage during storage and transportation, ensuring quality and safety for consumers. Composite packaging often offers features that enhance consumer convenience, such as easy opening mechanisms or resealable closures. This contributes to the segment growth.

Get Customized Report as per your Business Requirement - Request For Customized Report

Regional Analysis:

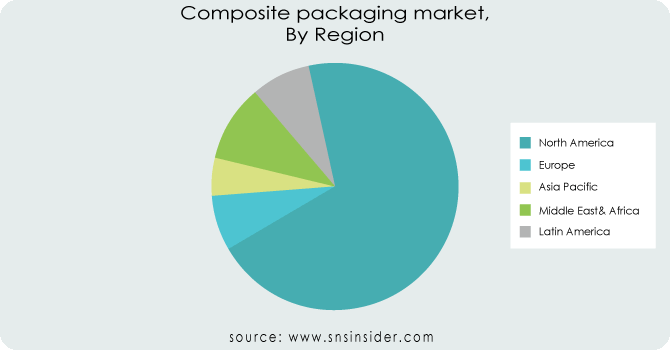

North America currently dominates the global composite packaging market, it captured 66% of the market share in 2023. This dominance can be attributed to the growing preference for eco-friendly packaging solutions among North American consumers is significantly propelling market growth in the region. The presence of numerous leading players in the composite packaging industry and their innovative product offerings further contribute to regional dominance. Europe stands as the second-largest market and manufacturers are at the for developing modern and efficient packaging solutions. this region is high demand for packaged food and beverage products, such as bakery & confectionery, dairy items, and others, fuels the need for advanced composite packaging solutions.

Key Players

The major key players listed in the Composite packaging market are Amcor, DS Smith, Mondi, Smurfit Kappa, Sonoco Products Company, Crown Holdings, Tetra Pak, International, Coveris Holdings,Constantia Flexibles, NPP, GWP Packaging, Zipform Packaging, Envirocore CC , and others players.

Recent Developments

-

In November 2023, Sonoco acquired Amcor Packaging's composite can operations. This move will solidify Sonoco's position as a leader in the Asia Pacific market and the benefit of the acquisition is highlighted.

-

In July 2023, The Mitsubishi Chemical Group, Toppan Inc., and Kyoeisha Chemical joined forces to develop a groundbreaking material recycling process and focus on collaboration and innovation). This technology has the potential to revolutionize plastic composite packaging recycling by separating and extracting different kinds of resins.

-

In June 2022, Corona India made a significant stride towards sustainability by introducing a groundbreaking 100% biodegradable and composite packing solution made from barley straw. This innovative, circular packaging aligns with Corona India's commitment to environmental protection.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 73.57 Billion |

| Market Size by 2032 | USD 112.96 Billion |

| CAGR | CAGR of 5.28% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Material Type (Glass, Plastic, Metal, Paper) • By End User (Food and beverage industry, Consumer goods, Household, Retail and wholesales, Cosmetics, Pharmaceuticals, Others) |

| Regional Analysis/Coverage |

North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America |

| Company Profiles | Amcor Limited, BASF SE, TetraPak International S.A., Smurfit Kappa Group PLC, Sealed Air Corporation, and others. |