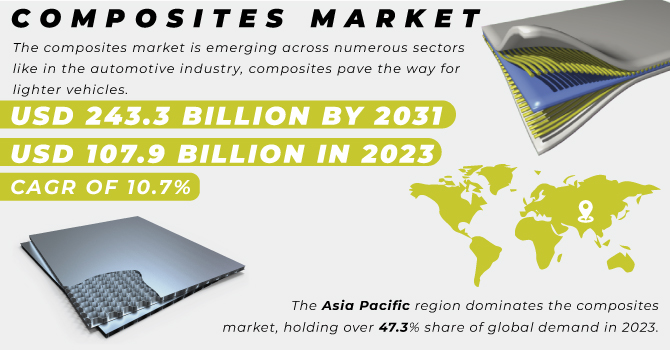

The Composites Market Size was valued at USD 107.9 billion in 2023, and expected to reach USD 243.3 billion by 2031, and grow at a CAGR of 10.7% over the forecast period 2024-2031.

The composites market is emerging across numerous sectors, like in the automotive industry, composites pave the way for lighter vehicles. This translates to significant benefits to improved fuel efficiency and reduced emissions, at the top for both consumers and environmental regulations. They continue in the aerospace industry. As manufacturers raise the operating cost which is driven by the fuel economy, demand for composites is expected to soar. Their lightweight nature makes them perfect for crafting airplanes that fly farther and cleaner. But the benefits extend beyond transportation. Construction is another industry poised to witness a surge in composite use. Their impressive strength and resistance to environmental wear and tear make them ideal for building materials, infrastructure projects, and even eco-friendly housing options. Composites are more than just a material; they represent a future-proof solution for a world demanding innovation and sustainability.

Get more information on Composites Market - Request Sample Report

Drivers

Growing demand for lightweight materials in the composites market

Regulations aimed at reducing pollution and greenhouse gas emissions are pushing industries

Composites can achieve significant weight savings compared to traditional materials like steel or aluminum. In cars, for example, replacing metal parts with composites can translate to lighter vehicles. This translates directly to improved fuel economy cars require less energy to move a lighter weight, leading to fewer emissions and a smaller environmental footprint. Weight reduction in airplanes has a similar impact on fuel efficiency, but the benefits extend further. Lighter airplanes require less powerful engines, which not only reduces fuel consumption but also cuts down on noise pollution during takeoff and landing.

Restraint:

Lack of standardization and manufacturing processes for composites market

Developing and manufacturing composite products often involve significant non-recurring expenses. Unlike established materials, composites require investments in specialized techniques and tooling, which can be a barrier for some industries. The lack of standardized processes and material properties for composites creates uncertainty for manufacturers. This can lead to difficulties in maintaining consistent quality and hinders the development of efficient mass production methods in critical sectors like automotive and aerospace. Furthermore, the absence of established standards discourages exploration of composites for new applications, pushing manufacturers to stick with familiar, traditional materials.

Opportunities

Carbon fiber are becoming increasingly popular for cng and hydrogen storage due to superior properties

Carbon fiber composites are becoming popular in storing compressed natural gas (CNG) and hydrogen. These composites boast exceptional strength-to-weight ratios. This makes them ideal for pressure vessels – they can handle high pressure while remaining remarkably lightweight. In the world of gas storage, this translates to enhanced safety without sacrificing portability. carbon fiber pressure vessels extend far beyond CNG and hydrogen storage. They're also used to store breathing air for firefighting (SCBA/SCUBA systems) and various gases in the marine and aerospace industries, all requiring safe storage under high pressure.

Challenges

Recycling challenges threaten composite market growth

Geo-political tensions can affect the availability and cost of raw materials for composites.

Composites market are revolutionizing various industries by offering a compelling combination of weight reduction, performance enhancement, and fuel efficiency. Lighter vehicles and aircraft require less energy to move, leading to lower greenhouse gas emissions and a smaller environmental footprint. The lightweight nature of composites can contribute to enhanced accident safety in some applications. Composites are often complex blends of materials, making them difficult and expensive to separate for proper recycling.

The impact of war in Ukraine slowdowns the market which brings uncertainty to the composites market. Disruptions to supply chains due to Russia and Ukraine's major exporters of raw materials could lead to shortages and price hikes for resins, fillers, and fibers. Energy price fluctuations stemming from the conflict could further squeeze margins, as composite production is often energy intensive. The ultimate impact will vary by region. European countries dependent on Russian energy might face steeper challenges due to sanctions and energy price rises. Conversely, North America could emerge as a more attractive source of raw materials or finished products if disruptions persist elsewhere.

The impact of an economic downturn can affect the overall market, consumers tend to reduce their expenses and prioritize essential spending. This can lead to a decrease in demand for composite-intensive products like sporting goods, leisure equipment, and certain consumer electronics. Construction projects are often major consumers of composite materials. A decline in construction activity due to economic uncertainty can significantly impact the composites market. Businesses may delay or cut back on investments in new technologies or infrastructure projects that utilize composites, further dampening demand.

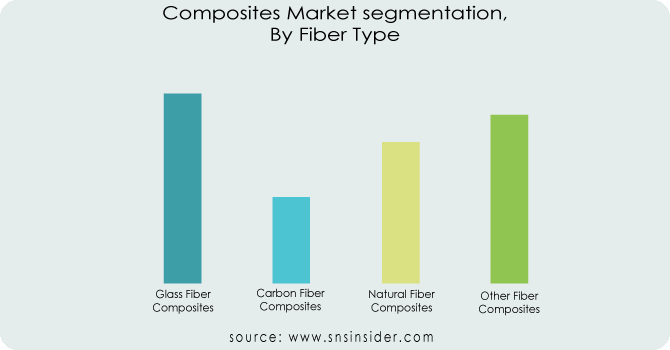

By Fiber Type:

Glass Fiber Composites

Carbon Fiber Composites

Natural Fiber Composites

Other Fiber Composites

The Glass fiber composites sub-segment is dominating the Composites Market in 2023 by fiber type, capturing over 65% of the market share. This popularity stems from its impressive combination of strength, stiffness, and lightness. Glass fiber also boasts excellent resistance to impact, making it the go-to choice for composite manufacturing. carbon fiber and plastic resin create carbon fiber-reinforced polymer. This material finds extensive use in aircraft construction, both inside and outside the plane. Sandwich structures made with CFRP composites are prized for their light weight and exceptional strength. This translates to better fuel efficiency, lower maintenance needs, and compliance with strict environmental regulations in Europe and North America, a boon for aircraft manufacturers (OEMs).

Get Customized Report as per your Business Requirement - Request For Customized Report

By Resin Type:

Thermoset Composites

Thermoplastic Composites

By End-use industry:

Aerospace & defense

Wind Energy

Automotive & Transportation

Construction & Infrastructure

Marine

Pipe

Tanks & Pressure Vessels

Electrical & Electronics

Others

The Automotive & Transportation sub-segment industry has led the composites market, claiming the largest revenue share of 25.0% in 2023 by the end-use industry. like cars, trucks, trailers, buses, trains, subways, and motorcycles, composites are finding their way into various transportation modes. This is because they offer a powerful combination of strength and lightness, making them a compelling alternative to traditional metals. Composites can match the stiffness and strength of metals while significantly reducing weight, allowing manufacturers to create lighter parts. This translates to numerous benefits for the transportation industry.

By Manufacturing Process:

Lay-up

Filament Winding

Pultrusion

Compression Molding

RTM

Others

The Lay-up sub-segment dominated the composites market in 2023, It is projected to capture a revenue share of 40%. This dominance is expected to continue due to its growing use in manufacturing boats, wind turbine blades, and architectural moldings. This method allows for creating a wide range of shapes and sizes for composite products at a lower cost. From marine prototypes to storage tanks, wet layup finds application in diverse end-uses. This technique utilizes prepregs, which are per-impregnated fibers containing cured resin. These fibers are then molded under high heat and pressure within a cavity.

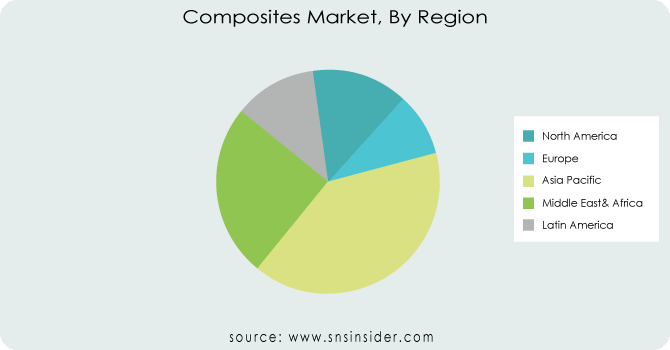

The Asia Pacific region dominates the composites market, holding over 47.3% share of global demand in 2023. This dominance is poised to continue with significant projected growth in the coming years. Several factors contribute to Asia Pacific's attractiveness for manufacturers across industries like automotive, construction, aerospace, and electronics. Major economies like China, India, and Japan boast a strong presence of key composite manufacturers, The US market focuses on the automotive industry's growing appetite for lightweight materials. Additionally, factors like rising electrical & electronics production capacity and steady growth in automotive and aerospace sectors are expected to propel further industry expansion in the forecast period.

REGIONAL COVERAGE:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

The major key players listed in the composites market are Teijin Ltd., Toray Industries, Inc., Owens Corning, PPG Industries, Inc., Huntsman Corporation LLC, SGL Group, Hexcel Corporation, DuPont, Compagnie de Saint-Gobain S.A., Weyerhaeuser Company, Momentive Performance Materials, Inc., Cytec Industries (Solvay, S.A.), China Jushi Co., Ltd., Kineco Limited, Veplas Group and other players.

In February 2024, Owens Corning solidified its position in the building and construction materials industry through a significant acquisition. The company invested USD 3.9 billion to acquire Masonite, a move that also bolsters their glass reinforcement business within the Composites segment.

In February 2023, Solvay and Spirit AeroSystems joined forces to revolutionize sustainable aircraft technologies and processes. This collaboration focuses on research initiatives alongside Spirit's partners in industry, academia, and the supply chain.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 107.9 Billion |

| Market Size by 2031 | US$ 243.4 Billion |

| CAGR | CAGR of 10.7% From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Fiber Type (Glass Fiber Composites, Carbon Fiber Composites, Natural Fiber Composites, Other Fiber Composites) • By Resin Type (Thermoset Composites, Thermoplastic Composites) • By end-use industry (Aerospace & defense,Wind Energy, Automotive & Transportation, Constr, ction & Infrastructure, Marine, Pipe & Tan, Electrical & Electronics, Others) • By Manufacturing Process (Lay-up, Filament Winding, Injection Molding, Pultrusion, Compression Molding, RTM, Others) |

| Regional Analysis/Coverage |

North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America |

| Company Profiles | Solvay (Belgium), Hexion (US), Toray Industries Inc. (Japan), Jushi Group Co., Ltd (China), Hexcel Corporation (US), Owens Corning (US), Teijin Limited (Japan), PPG Industries, Inc. (US), SGL Carbon (Germany), Mitsubishi Chemicals Corporation (Japan), Huntsman International LLC (US). |

| DRIVERS | • After COVID-19, the composites market will be driven by government stimulus programmes. • Utilization and demand for composites are both on the rise. |

| Restraints | • Manufacturing technology are not standardised. • High Prices |

Ans: Key stakeholders considered in the study:

Raw material vendors

distributors/traders/wholesalers/suppliers

regulatory authorities, including government agencies and NGO

commercial research & development (r&d) institutions

importers and exporters

government organizations, research organizations, and consulting firms

trade/industrial associations

end-use industries are the stake holder of this report

Ans: Manufacturers, Consultant, aftermarket players, association, Research institute, private and universities libraries, suppliers and distributors of the product.

Ans: Solvay (Belgium), Hexion (US), Toray Industries Inc. (Japan), Jushi Group Co., Ltd (China), Hexcel Corporation (US), Owens Corning (US), Teijin Limited (Japan), PPG Industries, Inc. (US), SGL Carbon (Germany), Mitsubishi Chemicals Corporation (Japan) and Huntsman International LLC (US) are the major key players of Composites Market.

Ans: Manufacturing technology are not standardised and High Prices are the restraints for Composites Market.

Ans. The projected market size for the Composites Market is USD 243.4 Billion by 2031.

TABLE OF CONTENTS

1. Introduction

1.1 Market Definition

1.2 Scope

1.3 Research Assumptions

2. Industry Flowchart

3. Research Methodology

4. Market Dynamics

4.1 Drivers

4.2 Restraints

4.3 Opportunities

4.4 Challenges

5. Impact Analysis

5.1 Impact of Russia-Ukraine Crisis

5.2 Impact of Economic Slowdown on Major Countries

5.2.1 Introduction

5.2.2 United States

5.2.3 Canada

5.2.4 Germany

5.2.5 France

5.2.6 UK

5.2.7 China

5.2.8 Japan

5.2.9 South Korea

5.2.10 India

6. Value Chain Analysis

7. Porter’s 5 Forces Model

8.Pest Analysis

9. Average Selling Price

9.1 North America

9.2 Europe

9.3 Asia Pacific

9.4 Latin America

9.5 Middle East & Africa

10. Composites Market Segmentation, By Resin Type

10.1 Introduction

10.2 Trend Analysis

10.3 Thermoset Composites

10.4 Thermoplastic Composites

11. Composites Market Segmentation, By Fiber Type

11.1 Introduction

11.2 Trend Analysis

11.3 Glass Fiber Composites

11.4 Carbon Fiber Composites

11.5 Natural Fiber Composites

11.6 Others

12. Composites Market Segmentation, By End-use industry

12.1 Introduction

12.2 Trend Analysis

12.3 Aerospace & defense

12.4Wind Energy

12.5 Automotive & Transportation

12.6 Construction & Infrastructure

12.7 Marine

12.8 Pipe

12.9 Tanks & Pressure Vessels

12.10 Electrical & Electronics

13. Composites Market Segmentation, By Manufacturing Process

13.1 Introduction

13.2 Trend Analysis

13.3 Lay-up

13.4 Filament Winding

13.5 Injection Molding

13.6 Pultrusion

13.7 Compression Molding

13.8 RTM

13.9 Others

14. Regional Analysis

14.1 Introduction

14.2 North America

14.2.1 Trend Analysis

14.2.2 North America Composites Market by Country

14.2.3 North America Composites Market By Resin Type

14.2.4 North America Composites Market By Fiber Type

14.2.5 North America Composites Market By End-use industry

14.2.6 North America Composites Market By Manufacturing Process

14.2.7 USA

14.2.7.1 USA Composites Market By Resin Type

14.2.7.2 USA Composites Market By Fiber Type

14.2.7.3 USA Composites Market By End-use industry

14.2.7.4 USA Composites Market By Manufacturing Process

14.2.8 Canada

14.2.8.1 Canada Composites Market By Resin Type

14.2.8.2 Canada Composites Market By Fiber Type

14.2.8.3 Canada Composites Market By End-use industry

14.2.8.4 Canada Composites Market By Manufacturing Process

14.2.9 Mexico

14.2.9.1 Mexico Composites Market By Resin Type

14.2.9.2 Mexico Composites Market By Fiber Type

14.2.9.3 Mexico Composites Market By End-use industry

14.2.9.4 Mexico Composites Market By Manufacturing Process

14.3 Europe

14.3.1 Trend Analysis

14.3.2 Eastern Europe

14.3.2.1 Eastern Europe Composites Market by Country

14.3.2.2 Eastern Europe Composites Market By Resin Type

14.3.2.3 Eastern Europe Composites Market By Fiber Type

14.3.2.4 Eastern Europe Composites Market By End-use industry

14.3.2.5 Eastern Europe Composites Market By Manufacturing Process

14.3.2.6 Poland

14.3.2.6.1 Poland Composites Market By Resin Type

14.3.2.6.2 Poland Composites Market By Fiber Type

14.3.2.6.3 Poland Composites Market By End-use industry

14.3.2.6.4 Poland Composites Market By Manufacturing Process

14.3.2.7 Romania

14.3.2.7.1 Romania Composites Market By Resin Type

14.3.2.7.2 Romania Composites Market By Fiber Type

14.3.2.7.3 Romania Composites Market By End-use industry

14.3.2.7.4 Romania Composites Market By Manufacturing Process

14.3.2.8 Hungary

14.3.2.8.1 Hungary Composites Market By Resin Type

14.3.2.8.2 Hungary Composites Market By Fiber Type

14.3.2.8.3 Hungary Composites Market By End-use industry

14.3.2.8.4 Hungary Composites Market By Manufacturing Process

14.3.2.9 Turkey

14.3.2.9.1 Turkey Composites Market By Resin Type

14.3.2.9.2 Turkey Composites Market By Fiber Type

14.3.2.9.3 Turkey Composites Market By End-use industry

14.3.2.9.4 Turkey Composites Market By Manufacturing Process

14.3.2.10 Rest of Eastern Europe

14.3.2.10.1 Rest of Eastern Europe Composites Market By Resin Type

14.3.2.10.2 Rest of Eastern Europe Composites Market By Fiber Type

14.3.2.10.3 Rest of Eastern Europe Composites Market By End-use industry

14.3.2.10.4 Rest of Eastern Europe Composites Market By Manufacturing Process

14.3.3 Western Europe

14.3.3.1 Western Europe Composites Market by Country

14.3.3.2 Western Europe Composites Market By Resin Type

14.3.3.3 Western Europe Composites Market By Fiber Type

14.3.3.4 Western Europe Composites Market By End-use industry

14.3.3.5 Western Europe Composites Market By Manufacturing Process

14.3.3.6 Germany

14.3.3.6.1 Germany Composites Market By Resin Type

14.3.3.6.2 Germany Composites Market By Fiber Type

14.3.3.6.3 Germany Composites Market By End-use industry

14.3.3.6.4 Germany Composites Market By Manufacturing Process

14.3.3.7 France

14.3.3.7.1 France Composites Market By Resin Type

14.3.3.7.2 France Composites Market By Fiber Type

14.3.3.7.3 France Composites Market By End-use industry

14.3.3.7.4 France Composites Market By Manufacturing Process

14.3.3.8 UK

14.3.3.8.1 UK Composites Market By Resin Type

14.3.3.8.2 UK Composites Market By Fiber Type

14.3.3.8.3 UK Composites Market By End-use industry

14.3.3.8.4 UK Composites Market By Manufacturing Process

14.3.3.9 Italy

14.3.3.9.1 Italy Composites Market By Resin Type

14.3.3.9.2 Italy Composites Market By Fiber Type

14.3.3.9.3 Italy Composites Market By End-use industry

14.3.3.9.4 Italy Composites Market By Manufacturing Process

14.3.3.10 Spain

14.3.3.10.1 Spain Composites Market By Resin Type

14.3.3.10.2 Spain Composites Market By Fiber Type

14.3.3.10.3 Spain Composites Market By End-use industry

14.3.3.10.4 Spain Composites Market By Manufacturing Process

14.3.3.11 Netherlands

14.3.3.11.1 Netherlands Composites Market By Resin Type

14.3.3.11.2 Netherlands Composites Market By Fiber Type

14.3.3.11.3 Netherlands Composites Market By End-use industry

14.3.3.11.4 Netherlands Composites Market By Manufacturing Process

14.3.3.12 Switzerland

14.3.3.12.1 Switzerland Composites Market By Resin Type

14.3.3.12.2 Switzerland Composites Market By Fiber Type

14.3.3.12.3 Switzerland Composites Market By End-use industry

14.3.3.12.4 Switzerland Composites Market By Manufacturing Process

14.3.3.14 Austria

14.3.3.14.1 Austria Composites Market By Resin Type

14.3.3.14.2 Austria Composites Market By Fiber Type

14.3.3.14.3 Austria Composites Market By End-use industry

14.3.3.14.4 Austria Composites Market By Manufacturing Process

14.3.3.14 Rest of Western Europe

14.3.3.14.1 Rest of Western Europe Composites Market By Resin Type

14.3.3.14.2 Rest of Western Europe Composites Market By Fiber Type

14.3.3.14.3 Rest of Western Europe Composites Market By End-use industry

14.3.3.14.4 Rest of Western Europe Composites Market By Manufacturing Process

14.4 Asia-Pacific

14.4.1 Trend Analysis

14.4.2 Asia-Pacific Composites Market by Country

14.4.3 Asia-Pacific Composites Market By Resin Type

14.4.4 Asia-Pacific Composites Market By Fiber Type

14.4.5 Asia-Pacific Composites Market By End-use industry

14.4.6 Asia-Pacific Composites Market By Manufacturing Process

14.4.7 China

14.4.7.1 China Composites Market By Resin Type

14.4.7.2 China Composites Market By Fiber Type

14.4.7.3 China Composites Market By End-use industry

14.4.7.4 China Composites Market By Manufacturing Process

14.4.8 India

14.4.8.1 India Composites Market By Resin Type

14.4.8.2 India Composites Market By Fiber Type

14.4.8.3 India Composites Market By End-use industry

14.4.8.4 India Composites Market By Manufacturing Process

14.4.9 Japan

14.4.9.1 Japan Composites Market By Resin Type

14.4.9.2 Japan Composites Market By Fiber Type

14.4.9.3 Japan Composites Market By End-use industry

14.4.9.4 Japan Composites Market By Manufacturing Process

14.4.10 South Korea

14.4.10.1 South Korea Composites Market By Resin Type

14.4.10.2 South Korea Composites Market By Fiber Type

14.4.10.3 South Korea Composites Market By End-use industry

14.4.10.4 South Korea Composites Market By Manufacturing Process

14.4.11 Vietnam

14.4.11.1 Vietnam Composites Market By Resin Type

14.4.11.2 Vietnam Composites Market By Fiber Type

14.4.11.3 Vietnam Composites Market By End-use industry

14.4.11.4 Vietnam Composites Market By Manufacturing Process

14.4.12 Singapore

14.4.12.1 Singapore Composites Market By Resin Type

14.4.12.2 Singapore Composites Market By Fiber Type

14.4.12.3 Singapore Composites Market By End-use industry

14.4.12.4 Singapore Composites Market By Manufacturing Process

14.4.14 Australia

14.4.14.1 Australia Composites Market By Resin Type

14.4.14.2 Australia Composites Market By Fiber Type

14.4.14.3 Australia Composites Market By End-use industry

14.4.14.4 Australia Composites Market By Manufacturing Process

14.4.14 Rest of Asia-Pacific

14.4.14.1 Rest of Asia-Pacific Composites Market By Resin Type

14.4.14.2 Rest of Asia-Pacific Composites Market By Fiber Type

14.4.14.3 Rest of Asia-Pacific Composites Market By End-use industry

14.4.14.4 Rest of Asia-Pacific Composites Market By Manufacturing Process

14.5 Middle East & Africa

14.5.1 Trend Analysis

14.5.2 Middle East

14.5.2.1 Middle East Composites Market by Country

14.5.2.2 Middle East Composites Market By Resin Type

14.5.2.3 Middle East Composites Market By Fiber Type

14.5.2.4 Middle East Composites Market By End-use industry

14.5.2.5 Middle East Composites Market By Manufacturing Process

14.5.2.6 UAE

14.5.2.6.1 UAE Composites Market By Resin Type

14.5.2.6.2 UAE Composites Market By Fiber Type

14.5.2.6.3 UAE Composites Market By End-use industry

14.5.2.6.4 UAE Composites Market By Manufacturing Process

14.5.2.7 Egypt

14.5.2.7.1 Egypt Composites Market By Resin Type

14.5.2.7.2 Egypt Composites Market By Fiber Type

14.5.2.7.3 Egypt Composites Market By End-use industry

14.5.2.7.4 Egypt Composites Market By Manufacturing Process

14.5.2.8 Saudi Arabia

14.5.2.8.1 Saudi Arabia Composites Market By Resin Type

14.5.2.8.2 Saudi Arabia Composites Market By Fiber Type

14.5.2.8.3 Saudi Arabia Composites Market By End-use industry

14.5.2.8.4 Saudi Arabia Composites Market By Manufacturing Process

14.5.2.9 Qatar

14.5.2.9.1 Qatar Composites Market By Resin Type

14.5.2.9.2 Qatar Composites Market By Fiber Type

14.5.2.9.3 Qatar Composites Market By End-use industry

14.5.2.9.4 Qatar Composites Market By Manufacturing Process

14.5.2.10 Rest of Middle East

14.5.2.10.1 Rest of Middle East Composites Market By Resin Type

14.5.2.10.2 Rest of Middle East Composites Market By Fiber Type

14.5.2.10.3 Rest of Middle East Composites Market By End-use industry

14.5.2.10.4 Rest of Middle East Composites Market By Manufacturing Process

14.5.3 Africa

14.5.3.1 Africa Composites Market by Country

14.5.3.2 Africa Composites Market By Resin Type

14.5.3.3 Africa Composites Market By Fiber Type

14.5.3.4 Africa Composites Market By End-use industry

14.5.3.5 Africa Composites Market By Manufacturing Process

14.5.3.6 Nigeria

14.5.3.6.1 Nigeria Composites Market By Resin Type

14.5.3.6.2 Nigeria Composites Market By Fiber Type

14.5.3.6.3 Nigeria Composites Market By End-use industry

14.5.3.6.4 Nigeria Composites Market By Manufacturing Process

14.5.3.7 South Africa

14.5.3.7.1 South Africa Composites Market By Resin Type

14.5.3.7.2 South Africa Composites Market By Fiber Type

14.5.3.7.3 South Africa Composites Market By End-use industry

14.5.3.7.4 South Africa Composites Market By Manufacturing Process

14.5.3.8 Rest of Africa

14.5.3.8.1 Rest of Africa Composites Market By Resin Type

14.5.3.8.2 Rest of Africa Composites Market By Fiber Type

14.5.3.8.3 Rest of Africa Composites Market By End-use industry

14.5.3.8.4 Rest of Africa Composites Market By Manufacturing Process

14.6 Latin America

14.6.1 Trend Analysis

14.6.2 Latin America Composites Market by country

14.6.3 Latin America Composites Market By Resin Type

14.6.4 Latin America Composites Market By Fiber Type

14.6.5 Latin America Composites Market By End-use industry

14.6.6 Latin America Composites Market By Manufacturing Process

14.6.7 Brazil

14.6.7.1 Brazil Composites Market By Resin Type

14.6.7.2 Brazil Composites Market By Fiber Type

14.6.7.3 Brazil Composites Market By End-use industry

14.6.7.4 Brazil Composites Market By Manufacturing Process

14.6.8 Argentina

14.6.8.1 Argentina Composites Market By Resin Type

14.6.8.2 Argentina Composites Market By Fiber Type

14.6.8.3 Argentina Composites Market By End-use industry

14.6.8.4 Argentina Composites Market By Manufacturing Process

14.6.9 Colombia

14.6.9.1 Colombia Composites Market By Resin Type

14.6.9.2 Colombia Composites Market By Fiber Type

14.6.9.3 Colombia Composites Market By End-use industry

14.6.9.4 Colombia Composites Market By Manufacturing Process

14.6.10 Rest of Latin America

14.6.10.1 Rest of Latin America Composites Market By Resin Type

14.6.10.2 Rest of Latin America Composites Market By Fiber Type

14.6.10.3 Rest of Latin America Composites Market By End-use industry

14.6.10.4 Rest of Latin America Composites Market By Manufacturing Process

15. Company Profiles

15.1 Teijin Ltd.

15.1.1 Company Overview

15.1.2 Financial

15.1.3 Products/ Services Offered

15.1.4 SWOT Analysis

15.1.5 The SNS View

15.2 Toray Industries

15.2.1 Company Overview

15.2.2 Financial

15.2.3 Products/ Services Offered

15.2.4 SWOT Analysis

15.2.5 The SNS View

15.3 Owens Corning

15.3.1 Company Overview

15.3.2 Financial

15.3.3 Products/ Services Offered

15.3.4 SWOT Analysis

15.3.5 The SNS View

15.4 PPG Industries, Inc.

15.4.1 Company Overview

15.4.2 Financial

15.4.3 Products/ Services Offered

15.4.4 SWOT Analysis

15.4.5 The SNS View

15.5 Huntsman Corporation LLC

15.5.1 Company Overview

15.5.2 Financial

15.5.3 Products/ Services Offered

15.5.4 SWOT Analysis

15.5.5 The SNS View

15.6 SGL Group

15.6.1 Company Overview

15.6.2 Financial

15.6.3 Products/ Services Offered

15.6.4 SWOT Analysis

15.6.5 The SNS View

15.7 Hexcel Corporation

15.7.1 Company Overview

15.7.2 Financial

15.7.3 Products/ Services Offered

15.7.4 SWOT Analysis

15.7.5 The SNS View

15.8 DuPont

15.8.1 Company Overview

15.8.2 Financial

15.8.3 Products/ Services Offered

15.8.4 SWOT Analysis

15.8.5 The SNS View

15.9 Compagnie de Saint-Gobain S.A.

15.9.1 Company Overview

15.9.2 Financial

15.9.3 Products/ Services Offered

15.9.4 SWOT Analysis

15.9.5 The SNS View

15.10 Weyerhaeuser Company

15.10.1 Company Overview

15.10.2 Financial

15.10.3 Products/ Services Offered

15.10.4 SWOT Analysis

15.10.5 The SNS View

16. Competitive Landscape

16.1 Competitive Benchmarking

16.2 Market Share Analysis

16.3 Recent Developments

16.3.1 Industry News

16.3.2 Company News

16.3.3 Mergers & Acquisitions

17. Use Case and Best Practices

18. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

The Food Contact Paper Market size was USD 79.24 billion in 2023 and is expected to Reach USD 114.02 billion by 2031 and grow at a CAGR of 4.65% over the forecast period of 2024-2031.

The Carbon nanotubes Market Size was valued at USD 0.99 billion in 2023 and is expected to reach USD 2.924 billion by 2031, and grow at a CAGR of 14.6% over the forecast period 2024-2031.

PMMA Microspheres Market Size was valued at USD 303.34 million in 2022, and expected to reach USD 547 million by 2030, and grow at a CAGR of 6.6% over the forecast period 2023-2030.

The Humectants chemical market was estimated to be worth USD 26.2 billion in 2022, and it is anticipated to increase to USD 45.3 billion by 2030, expanding at a CAGR of 7.1% over the forecast period of 2023-2030

The Food Grade Alcohol Market size was valued at USD 2.41 billion in 2023. It is estimated to hit USD 3.38 billion by 2031 and grow at a CAGR of 4.2% over the forecast period of 2024-2031.

The Industrial Wastewater Treatment Chemicals Market Size was valued at USD 13.79 billion in 2022, and is expected to reach USD 20.85 billion by 2030, and grow at a CAGR of 5.3% over the forecast period 2023-2030.

Hi! Click one of our member below to chat on Phone