Food Grade Alcohol Market Report Scope & Overview:

The Food Grade Alcohol market size was valued at USD 3.79 Billion in 2023 and is expected to reach USD 5.18 billion by 2032, growing at a CAGR of 3.55% over the forecast period of 2024-2032. This report provides key statistical insights and trends in the food-grade alcohol market, covering production capacity and utilization by country and type in 2023. It analyzes feedstock prices across major markets, highlighting cost fluctuations in sugarcane- and grain-based ethanol. The report examines the regulatory impact, including new purity standards and policy shifts affecting production. It also explores environmental metrics, such as emissions reduction and waste management practices. Additionally, it delves into innovation and R&D trends, focusing on sustainable alcohol production and microbial fermentation advancements. Lastly, it assesses adoption rates across regions, with a focus on the growing demand in the food & beverage industry.

Get E-PDF Sample Report on Food Grade Alcohol Market - Request Sample Report

Drivers

Increasing demand for alcoholic beverages drives the market growth.

High demand for alcoholic beverages is one of the underlying factors responsible for the growth of the food-grade alcohol market, as ethanol is an essential component in the production of wine, spirits, and beer. The growing consumption of premium and craft alcoholic beverages, particularly in regions such as North America, Europe, and Asia-Pacific, has significantly contributed to the purchase of high-purity food-grade ethanol. However in developing economies, rapid urbanization and increasing per capita net disposable income have further boosted liquor consumption due to the emergence of nightlife culture. More consumers are opting for organic and non-GMO alcohol, so there is an election for high-quality, clean alcoholic beverages, which is also shaping market trends. Additionally, the approval for ethanol for use in alcoholic beverages and the rising investments in distilleries have further enhanced the market development where food-grade alcohol is an important substance in the beverage sector.

Restraint

Stringent government regulations and policies regarding the production and sale of alcohol may hamper the market growth.

Strict government regulations and policies regarding the production and distribution of alcohol will be considered as a major obstacle for the food-grade alcohol market growth. In some countries, strict licensing criteria along with taxation policies and production quotas are in place to curb consumption and minimize the risk to the health of the general population. Regions such as North America and Europe have high excise duties as well as trade restrictions on beverages employing ethanol basis which raises costs to manufacturers and could limit market development. Furthermore, various standards of pureness and documentation, enforced by the U.S. FDA and the European Food Safety Authority (EFSA), are also obstacles to production. Partial or total prohibition of alcohol in some regions also limits existing market opportunities. These regulatory challenges impede new entrants and decrease the rate of innovation, restricting the overall growth potential of the food-grade alcohol market.

Opportunities

Increasing use of food-grade alcohol in the pharmaceutical industry creates an opportunity for the market.

The rising use of food-grade alcohol in the pharmaceutical industry will further accelerate the overall market growth. Its role of solubility in the preparation of medicinal formulations including but not limited to cough syrups, antiseptics, and tinctures makes ethanol a broadly used solvent due to its effective antimicrobial properties. Global growing construction for hand sanitizers and disinfectants because of the outbreak of worldwide health issues Moreover, pharmaceutical companies have started to work on drug formulations with high concentrations of alcohol as it ensures better stability and effectiveness of active ingredients. This growth is also driven by regulatory approvals for the use of ethanol in oral and topical medications in North America and Europe. With the growth of the pharmaceutical industry, the demand for food-grade alcohol is expected to grow, hence opulently rewarding the manufacturers and suppliers available in the market.

Challenges

Availability of alternative ingredients and substitutes for food-grade alcohol.

The high availability of substitutes and alternatives for food-grade alcohol is expected to challenge the growth of the market; as industries are inclined toward cost-effective and eco-friendly solutions. Non-alcoholic solvents such as glycerin, vinegar, and plant-based extracts are being increasingly used in preservation and flavor enhancement in the food and beverage sector instead of ethanol. Likewise, in pharma, propanol & other antimicrobial agents provide comparable alternatives in sanitizers & disinfectants. Furthermore, the increasing preference for clean-label and organic products is also compelling manufacturers to investigate the use of non-ethanol-based fermentation for food preservation and flavor development. Consumers are also shifting toward products made with water or plant-derived solvents due to regulatory concerns regarding alcohol levels in food and personal care ingredients. The power of these increasing innovations and alternatives may also restrict the development of the food-grade pattern of alcohol in the entire year with a projection timeframe.

Market segmentation

By Product

The ethanol segment held the largest market share, around 68%in 2023. the ethanol segment dominated the food-grade alcohol market owing to its widespread applications in food & beverages, pharmaceuticals, and personal care industries. Ethanol is crucial to beer, wine, or spirits making up the beverage industry, and the growing interests of consumers in premium, spiritous beverages, craft beer, and organic wine only help to reinforce its preeminence. Finally, due to its high solubility and ability to kill microorganisms, ethanol is fundamental in pharmaceuticals for drug formulations, antiseptics, and sanitizers.

By Source

Molasses & Sugarcane segment held the largest market share, around 32% in 2023. Demand for the product is supported by the use of molasses-based ethanol in alcoholic beverages, flavor extracts, and food preservatives in the food & beverage industry. In addition to this, the dominance of this segment has been bolstered by government policies promoting bio-based ethanol production, especially in Brazil and India. Diverse end-use application accounts and constantly increasing demand for natural and renewable sources of ethanol are underpinning the leading position of the molasses & sugarcane segment, amongst the different sources for ethanol production.

By Function

Coloring & flavoring held the largest market share around 40% in 2023. The coloring & flavoring segment accounted for the largest market share in the global food-grade alcohol market, due to their wide occurrence applications in the food & beverage industry. Food-grade alcohol, especially ethanol, plays a vital role in food extraction & food preservation, to get and savor the natural flavors of raw ingredients such as vanilla, fruits, and herbs for prolonged taste and fragrance in food products. It also serves as a carrier for food colorants, enabling even dispersion of colors in confectionery, bakery, and beverage products.

By Application

Food & Beverages held the largest market share around 42% in 2023. It is primarily due to its widespread applications in alcoholic beverages, flavoring agents and preservatives. While ethanol is a critical food-grade alcohol in the manufacture of beer, wine, spirits, and other alcoholic beverages, increasing consumer demand for high-end and craft alcoholic drinks is expected to spur market growth. In addition, the use of food-grade alcohol as a solvent for extracting flavors, essential oils and food colorants makes it an important ingredient in processed food, confectionery and bakery products. Due to its antimicrobial properties, it also helps in food preservation by increasing shelf life without affecting quality.

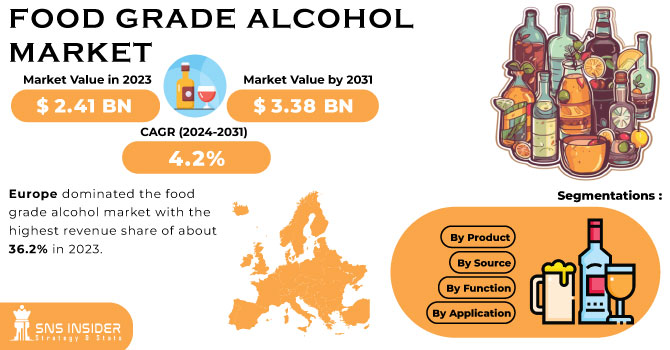

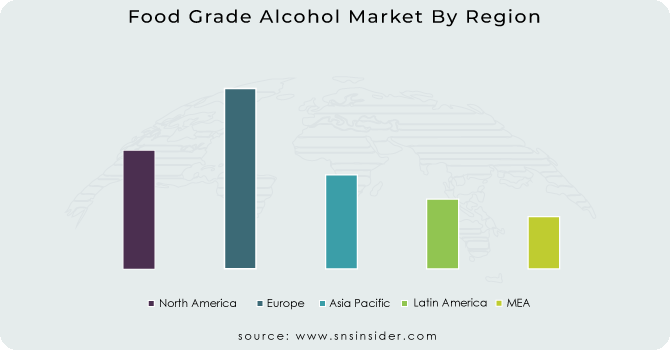

Regional Analysis

Europe held the largest market share, around 34% in 2023 It is owing to the presence of an established alcoholic beverage sector, stringent regulatory framework, and rise in demand for natural ingredients. Germany, France, the U.K., and Italy are among the largest producers and consumers of wine, beer, and spirits, which in turn is the major factor driving the food-grade ethanol market in this region. Moreover, Europe boasts of stringent food safety regulations, and the European Food Safety Authority (EFSA) has strict controls in place to guarantee that food-grade alcohol used in beverages, flavoring agents, and preservatives is of high quality. Ethanol Natural Flavor Extraction and Preservation The growing need for organic and clean-label products among consumers has further increased the use of ethanol in natural flavor extraction and preservation in foodstuff as well.

North America held a significant share in the forecast period. It has experienced a noticeable increase in movement towards organic and natural food products. Rising consumer inclination towards clean and sustainable alternatives has increased organic and natural food-grade alcohol demand. This endorsement of new consumer options will support the growth of the food-grade alcohol market across North America. Moreover, the high-income levels in the region and strong economy support this growth potential for the market as well. Consumers with higher disposable income are more likely to treat themselves to luxury food and beverage products, which include food-grade alcohol. On top of that, this aspect is aiding the growth of the food-grade alcohol market in North America.

Get Customized Report as per Your Business Requirement - Request For Customized Report

Key Players

-

Cargill Incorporated (Ethanol 96%, Alcohol USP)

-

MGP (Food-Grade Ethanol, Distilled Spirits)

-

Cristalco (CristalCo Ethanol, CristalCo Organic Alcohol)

-

Fonterra Co-operative (Dairy Ethanol, Whey Alcohol)

-

Archer Daniels Midland Company (ADM High Purity Ethanol, Corn Alcohol)

-

Wilmar International Ltd. (Wilmar Ethanol, Food-Grade Rectified Spirit)

-

Extractohol (Extractohol 200 Proof, Extractohol 190 Proof)

-

Pure Alcohol Solutions (Food-Grade Ethanol, Neutral Grain Spirit)

-

Grain Processing Corporation (GPC Industrial Alcohol, GPC Beverage Ethanol)

-

Roquette (Roquette Ethanol, Organic Ethanol)

-

Manildra Group (Extra Neutral Alcohol, Grain-Based Alcohol)

-

Greenfield Global (Pharmco Ethanol, Pure Neutral Spirits)

-

Sasma BV (Organic Food-Grade Ethanol, Sasma High Purity Alcohol)

-

BruggemanAlcohol (Bruggeman Ethanol, Rectified Alcohol)

-

Mackay Sugar Limited (Molasses-Based Alcohol, Cane Ethanol)

-

Cofco Biochemical (COFCO Ethanol, Fermented Alcohol)

-

Lantic Inc. (Sugarcane-Based Ethanol, Neutral Spirits)

-

Ethanol Energy (Extra Neutral Alcohol, High-Purity Ethanol)

-

NCP Alcohols (NCP Rectified Spirit, NCP Food-Grade Ethanol)

-

Sekab Biofuels & Chemicals (Sekab Green Ethanol, Bio-Based Alcohol)

Recent Development:

-

In 2023, Cargill increased its food-grade ethanol production capacity to cater to the growing demand from the beverage and pharmaceutical sectors. This expansion aimed to ensure a stable supply of high-quality ethanol for various applications.

-

In 2023, Fonterra Co-operative invested in advanced fermentation technologies to enhance the production of high-purity dairy-derived ethanol. This innovation aimed to meet the growing demand for specialized food and pharmaceutical applications.

| Report Attributes | Details |

| Market Size in 2023 | US$ 3.79 Bn |

| Market Size by 2032 | US$ 5.18 Bn |

| CAGR | CAGR of 3.55% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Ethanol and Polyols) • By Source (Fruits, Sugarcane & Molasses, Grains, and Others) • By Function (Coloring & Flavoring Agent, Preservative, Coatings, and Other) • By Application (Healthcare & Pharmaceutical, Beverages, Food, Personal Care, and Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Cargill Incorporated, MGP, ADM, Cistalco, Fonterra Co-operative, Archer Daniels Midland Company, Wilmar International Ltd., Extractohol, Pure Alcohol Solutions, Grain Processing Corporation |