Carbon Nanotubes Market Report Scope & Overview:

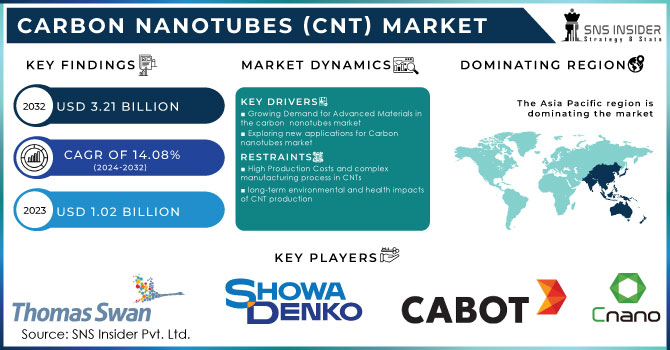

The Carbon Nanotubes (CNT) Market Size was valued at USD 1.0 billion in 2023 and is expected to reach USD 3.3 billion by 2032 and grow at a CAGR of 14.1% over the forecast period 2024-2032.

Get more information on Carbon Nanotubes Market - Request Sample Report

The Carbon Nanotubes (CNT) market is rapidly growing at phenomenal rates, primarily because of its beneficial properties of tensile strength, electrical conductivity, and thermal stability. These unique properties make Carbon Nanotubes valuable to the electronics, energy storage, and advanced composite materials industries. To sustainably enhance their product performance, companies focus on leveraging Carbon Nanotubes. Recent applications demonstrate a strongly growing tendency to use Carbon Nanotubes for high-tech purposes as well as ecological solutions, primarily in terms of strengthening and functional improvement of recycled and waste-based materials. In October 2024, SABIC launched Carbon Nanotubes in recycled plastics, significantly enhancing the mechanical strength thereof. This innovation now makes it possible to apply recycled materials for more demanding industrial purposes. SABIC's development typifies the addition of Carbon Nanotubes in sustainable production to be used to improve product properties besides reducing global plastic waste. In addition, in August 2024, scientists at Rice University synthesized Carbon Nanotubes through waste plastics to promote carbon neutrality. This achievement positions Carbon Nanotubes as a bridging material to reduce plastic waste while optimizing environmental goals for industries orienting toward more eco-friendly supplies of feedstocks.

New frontiers of innovation for energy storage and computing have emerged in the electronics sector through Carbon Nanotubes. On February 26, 2024, Indian scientists from the Centre for Nano and Soft Matter Sciences (CeNS) prepared a new synthesis method for Carbon Nanotubes, which can be highly exploited in applying the technology of batteries and flexible electronics. It can evolve into more efficient energy storage equipment as portable electronics and electric vehicle batteries require more of this component. Also, in July 2024, China rolled out its first carbon nanotube-based tensor processor chip. This was a major discovery towards better high-performance electronics. The Carbon Nanotubes in the chip improve computational efficiency and speed and open up future semiconductor technologies.

Furthermore, further applications using Carbon Nanotubes, in July 2024, scientists at Technion - Israel Institute of Technology exhibited how electrified membranes filled with Carbon Nanotubes can speed up filtration processes. These membranes perform well in industrial applications, like water purification and chemical separation. With Carbon Nanotubes, quicker, energy-friendly separation technologies can be utilized, making the example of Carbon Nanotubes a great path for enhancing industrial processing. Moreover, in November 2023, Nanoramic Laboratories presented Carbon Nanotubes for application in energy storage systems that improve supercapacitor and battery efficiencies. This therefore underlines the importance of Carbon Nanotubes as a way of bringing about effective, more viable solutions for renewable energy storage, an aspect which constitutes a crucial component as the world shifts its course toward cleaner energy technologies.

Carbon Nanotubes (CNT) Market Dynamics:

Drivers:

-

Increasing Use of Carbon Nanotubes in Energy Storage Solutions Drives Market Expansion Across Battery and Renewable Energy Sectors

The increase in the demand for efficient energy storage products is great for the carbon nanotubes market. Carbon Nanotubes have excellent electrical conductivity, making them a potential material for batteries and supercapacitors. Increasing demands for electric vehicles, renewable energy storage, and portable electronics are raising the need for advanced materials that can hold energy longer and more efficiently. As Carbon Nanotubes become finer and improve energy density and charge speeds, they are increasingly integrated into next-generation as well as lithium-ion batteries. Companies are thus actively researching how to arrive at Carbon Nanotubes-based solutions for increasing the lifetimes and capacity of the battery, especially within the developing EV market. Improved supercapacitors using Carbon nanotube enhancement also mean better energy storage systems in photovoltaic as well as wind power installations. All these trends create great opportunities for Carbon Nanotubes to become an essential application in energy storage. This is what drives further market expansion in several sectors.

-

Growing Applications of Carbon Nanotubes in Electronics and Semiconductors Propel Market Growth in High-Performance Computing and Flexible Electronics

Carbon Nanotubes are increasingly being applied in the electronics and semiconductor industries, thus contributing superior electrical properties to increase their performance. Carbon Nanotubes have highly efficient electric-conducting capability with a minimum resistance, which makes them one of the best application materials in terms of high-performance computing and flexible electronics. It also allows them to be used in transistors, sensors, and processors, which make devices faster and more energy-efficient. China put out a carbon nanotube-based tensor processor chip in July 2024; this is one of the good utilisations of Carbon Nanotubes by revolutionizing computers and their technologies. Additionally, Carbon Nanotubes are increasingly applied in flexible, wearable electronics, which require materials that are electrical and at the same time have to be light and bendable. These applications will spike the consumption of Carbon Nanotubes in the electronics industry as the industry producing these products wants to have their generations improve their capabilities. Faster, smaller, and more efficient electronic devices will continue to be the driving need for Carbon nanotube innovations, with long-term market growth potential.

Restraint:

-

High Production Costs and Technical Challenges Restrain the Widespread Commercial Adoption of Carbon Nanotubes Across Industries

High costs of production and technical hurdles are some of the significant limitations that carbon nanotubes face despite growing interest in various industries. The process of producing Carbon Nanotubes is such a complex process that requires specialized equipment and tight control over temperature and pressure conditions, which raises the cost of Carbon Nanotubes production overall. Several manufacturers cannot fully take on these nanotubes because of these factors. For example, the scalability of Carbon nanotube production remains an issue because the current methods employed have not reached such an efficiency level that could allow mass production of the material for commercial applications. Integration of Carbon Nanotubes also encounters issues of dispersion and alignment in composite materials. Although efforts are being made to drive these down to more affordable levels, the commercial viability of Carbon Nanotubes is still somewhat restricted, especially for smaller manufacturers or industries sensitive to cost. This restriction may dampen the adoption rate in certain markets, which would generally result in slower growth of the market.

Opportunity:

-

Emerging Opportunities for Carbon Nanotubes in Sustainable Manufacturing and Waste Recycling Solutions Present New Market Growth Avenues

The growing concern for sustainability and waste management opens new opportunities for Carbon Nanotubes in green manufacturing and recycling solutions. Efforts in the last few years have been directed toward the development of Carbon Nanotubes from waste materials, like plastics, to be reused as value-added Carbon Nanotubes through novel processes. Rice University demonstrated the manufacturing of Carbon Nanotubes from waste plastics in August 2024, thus showing the way that is going to reduce waste and, at the same time, help create sustainable materials available for industry. The recycling of plastics into Carbon Nanotubes will open new opportunities for industries to enhance their environmental footprint of operations while capitalizing on the advantages of better properties of Carbon Nanotubes. In addition to the above potential, Carbon Nanotubes are also under investigation for the development of lightweight, highly conductive, and strong materials that consume less raw material as well as energy. Over time, companies will become significantly more interested in sustainable manufacturing processes, and the demand for these kinds of solutions based on Carbon Nanotubes will increase, hence the market is expected to expand over the following years.

Challenge:

-

Technical Barriers in Scaling Up Carbon Nanotubes Production Pose a Significant Challenge to Meeting Industrial Demand

One major challenge in the carbon nanotube market has been the scale of production of Carbon Nanotubes. Most of the methods available in the production of Carbon Nanotubes, which include chemical vapor deposition, and arc discharge processes, tend to be complex and very resource-intensive in a way that tends to make it hard for one to produce them at an industrial scale required for widespread usage in industry. However, mass production of Carbon Nanotubes of uniform quality is not easy because slight differences in the arrangement of structures of carbon atoms generate disparate properties responsive to the requirements in different applications, including electronics, energy storage, or composite material. Such technical barriers need to be reduced for the market so that a large quantity of high-quality carbon nanotubes can meet the increasing demand in various industries such as automotive, aerospace, and electronics. Current research concerns the generation of enhanced cost-effective processes for the production of Carbon Nanotubes, but the scalability of Carbon Nanotubes will represent a key bottleneck in the future industry until these challenges are overcome.

Carbon Nanotubes (CNT) Market Trends and Innovations

-

Carbon Nanotubes are emerging in many applications, like batteries, where they improve lifetime and performance, especially lithium-ion and zinc-ion technologies. Their strength and conductivity optimize energy storage, which explains why they find their way into electronic vehicles and smart gadgets

-

Composites with Carbon Nanotubes have established their presence with steady enhancements in their mechanical properties. It covers various industries like sports equipment, industrial coatings, and biodegradable polymers

-

Current research in the field of Carbon Nanotubes is also focused on chemical and mechanical sensors, biomedical applications like drug delivery systems, and nerve catheters. Toxicity issue remains one of the significant hurdles for the mass-scale commercialization of this material

-

Carbon Nanotubes are researched for purifying contaminated water and air; testing shows that Carbon Nanotubes can efficiently treat wastewater

-

Advancements in chemical vapor deposition technologies, combined with associated techniques, enable better control over the synthesis of Carbon Nanotubes and, hence, tailored properties such as electrical conductivity.

Carbon Nanotubes (CNT) Market Segments

By Type

The multi-walled Carbon Nanotube (MWCNT) segment dominated the 2023 carbon nanotubes market, with a market share of over 60%. Multi-walled Carbon nanotubes are favorable due to their tensile strength and electrical conductivity, especially for applications in electronics, the automotive industry, and aerospace. They are also less expensive and scalable compared to single-walled Carbon Nanotubes. For example, MWCNT is applied increasingly in composite materials to strengthen and increase conductivity in the battery of electric vehicles and the structural aerospace components. Their applicability in different industries promotes robust market penetration for them.

By Method

The Chemical Vapor Deposition method dominated and captured a revenue share of about 70% in the carbon nanotubes market. These are preferred as they offer highly uniform, high-quality Carbon Nanotubes with better control over the structure and hence the properties of Carbon Nanotubes that make them promising for large-scale industrial applications. Carbon Nanotubes derived from the chemical vapor deposition process are majorly used in semiconductor production and energy storage products such as lithium-ion batteries and supercapacitors. Scalability and efficiency enable chemical vapor deposition to remain the leading producer in the Carbon Nanotubes marketplace, always at the forefront of electronics and renewable energy sectors.

By Application

In 2023, the electronics and semiconductors segment dominated the Carbon Nanotubes market, holding approximately 35% of the market share. Carbon Nanotubes excellent electrical conductivity and strength have made them integral in developing next-generation transistors, sensors, and processors. For instance, Carbon Nanotubes are being used to create faster and more energy-efficient semiconductor chips, as evidenced by China's development of a carbon nanotube-based tensor processor chip in July 2024. Their ability to enhance performance in flexible electronics and computing devices continues to make this segment a leading application for Carbon Nanotubes.

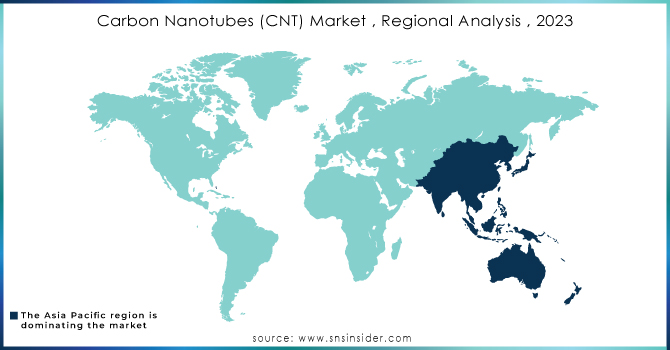

Carbon Nanotubes (CNT) Market Regional Analysis

- In 2023, the Asia-Pacific region dominated the carbon nanotubes market, holding a market share of over 40%. This dominance is driven by strong demand from countries like China, Japan, and South Korea, where Carbon Nanotubes are widely used in the electronics, automotive, and renewable energy sectors. For instance, China’s advancements in Carbon Nanotubes-based technologies, such as the development of a carbon nanotube tensor processor chip in July 2024, have significantly contributed to the region’s leadership. Additionally, the growing manufacturing base for electric vehicles and electronics in Asia-Pacific further supports the region’s dominant position in the Carbon Nanotubes market.

- Moreover, in 2023, North America emerged as the fastest-growing region in the carbon nanotubes market, with a CAGR of approximately 16%. The region's rapid growth is fueled by increasing investments in advanced materials and energy storage solutions, especially in the United States. Major R&D efforts in Carbon nanotube applications, such as batteries and supercapacitors, along with innovations in sustainable manufacturing, have accelerated market expansion. For instance, companies like Nanoramic Laboratories are actively incorporating Carbon Nanotubes in energy storage systems, driving growth across the region. Additionally, government initiatives promoting clean energy technologies are further supporting the Carbon Nanotubes market's expansion in North America.

Get Customized Report as per your Business Requirement - Request For Customized Report

Key Players

-

Arry International Group Limited (multi-walled carbon nanotubes, single-walled carbon nanotubes)

-

Bayer MaterialScience (Baytubes, Baytubes C150P)

-

Cabot Corporation (Vulcan carbon black, Cabot's carbon nanotube solutions)

-

Carbon Solutions Inc. (Carbon nanotube powder, Carbon Nanotubes composite materials)

-

Chengdu Organic Chemicals Co. Ltd. (Chengdu Carbon Nanotubes, Chengdu multi-walled carbon nanotubes)

-

Ferro Corporation (Ferro Carbon Nanotubes products, Ferro Carbon Nanotubes dispersions)

-

Hanwha Chemical Corporation (Hanwha carbon nanotubes, Hanwha Carbon Nanotubes dispersions)

-

Jiangsu Cnano Technology Co. Ltd. (CNano multi-walled carbon nanotubes, CNano single-walled carbon nanotubes)

-

Kuhmo Petrochemical (Kuhmo carbon nanotubes, Kuhmo Carbon Nanotubes masterbatches)

-

LG Chemical Limited (LG Carbon Nanotubes, LG Carbon Nanotube Solutions)

-

Nanocyl SA (Nanocyl NC7000, Nanocyl NC9000)

-

Nantero, Inc. (Nantero NRAM, Nantero carbon nanotube devices)

-

Nikkiso Co., Ltd. (Nikkiso Carbon Nanotubes products, Nikkiso carbon nanotube solutions)

-

Ocsial (TUBALL, TUBALL MATRIX)

-

Resonac Corporation (Resonac carbon nanotubes, Resonac Carbon Nanotubes products)

-

SABIC (SABIC carbon nanotube solutions, SABIC Carbon Nanotubes compounds)

-

Showa Denko K.K. (Showa Denko carbon nanotubes, Showa Denko Carbon Nanotubes products)

-

Solvay S.A. (Solvay carbon nanotube composites, Solvay Carbon Nanotubes masterbatches)

-

Thomas Swan & Co. Limited (Swan Carbon Nanotubes, Swan multi-walled carbon nanotubes)

-

Timesnano (Timesnano multi-walled carbon nanotubes, Timesnano functionalized Carbon Nanotubes)

Raw Materials and The Companies Providing the Raw Materials for Carbon Nanotubes Production

-

Carbon Sources:

-

Air Products and Chemicals, Inc.

-

SABIC

-

Continental Carbon

-

-

Catalysts:

-

Alfa Aesar

-

Heraeus

-

Sigma-Aldrich (Merck)

-

-

Gases:

-

Linde Group

-

Air Liquide

-

Recent Developments

-

July 2024: OCSIAL announced the opening of a new carbon nanotube synthesis plant in Serbia, scheduled to commence operations in October 2024. This facility was expected to enhance the company’s production capabilities and support the growing demand for carbon nanotubes in various applications.

-

October 2023: Birla Carbon completed the acquisition of Belgium-based Nanocyl, a move aimed at expanding its portfolio of battery materials. This strategic acquisition positioned Birla Carbon to strengthen its presence in the energy storage sector and meet the increasing demand for advanced battery technologies.

| Report Attributes | Details |

|---|---|

|

Market Size in 2023 |

US$ 1.0 Billion |

|

Market Size by 2032 |

US$ 3.3 Billion |

|

CAGR |

CAGR of 14.1% From 2024 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2032 |

|

Historical Data |

2020-2022 |

|

Report Scope & Coverage |

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

|

Key Segments |

•By Type (Multi-Walled Carbon Nanotube, Single-Walled Carbon Nanotube) |

|

Regional Analysis/Coverage |

North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

|

Company Profiles |

Thomas Swan & Co. Limited, Arry International Group Limited, Chengdu Organic Chemicals Co. Ltd., Jiangsu Cnano Technology Co. Ltd., Showa Denko K.K., Cabot Corporation, LG Chemical Limited, Nanocyl SA, Kuhmo Petrochemical, Carbon Solutions Inc., Resonac Corporation, Timesnano and other key players |

|

Key Drivers |

•Increasing Use of CNTs in Energy Storage Solutions Drives Market Expansion Across Battery and Renewable Energy Sectors |

|

RESTRAINTS |

•High Production Costs and Technical Challenges Restrain the Widespread Commercial Adoption of Carbon Nanotubes Across Industries |