Micro Injection Molding Machine Market Key Insights:

To Get More Information on Micro Injection Molding Machine Market - Request Sample Report

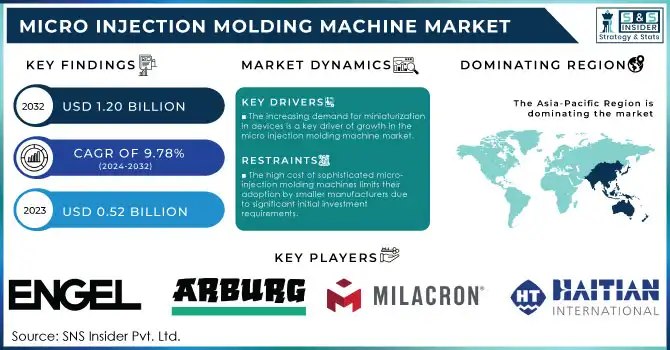

The Micro Injection Molding Machine Market Size was esteemed at USD 0.52 billion in 2023 and is supposed to arrive at USD 1.20 billion by 2032 and develop at a CAGR of 9.78% over the forecast period 2024-2032.

The Micro Injection Molding Machine Market is a rapidly evolving sector driven by the increasing demand for precision components in industries such as medical, electronics, automotive, and aerospace. These machines specialize in producing highly accurate, small-scale plastic parts, catering to the growing miniaturization trends in product design and manufacturing. One of the key factors fueling the market's growth is the rising demand for micro-sized medical devices, including surgical instruments, catheters, and diagnostic equipment, which require extreme precision and consistency. The expanding use of wearable devices and compact electronic gadgets further bolsters the adoption of these machines. In addition, micro injection molding is widely used for high-performance components in the automotive and aerospace industries, as it enables cost-effective production while maintaining stringent quality standards.

Technological advancements, such as multi-material molding, improved automation, and AI-driven quality control systems, are enhancing the efficiency and output of micro injection molding machines. These innovations enable manufacturers to reduce material wastage and production times while achieving unparalleled accuracy. The ability to process advanced thermoplastics and other specialized polymers is another significant development. In terms of market dynamics, leading companies are focusing on partnerships and the development of sustainable, energy-efficient machines to meet environmental and regulatory requirements. The shift toward Industry 4.0 is also prompting manufacturers to integrate IoT-enabled features in these machines, enabling real-time monitoring and predictive maintenance.

MARKET DYNAMICS

DRIVERS

- The increasing demand for miniaturization in devices is a key driver of growth in the micro injection molding machine market.

Industries like medical technology and consumer electronics rely heavily on precision-engineered, small-scale components to meet the evolving needs of modern applications. In the medical field, advancements in microfluidics, implants, and minimally invasive surgical devices necessitate highly accurate, miniature parts. Similarly, the surge in consumer electronics, particularly wearables and IoT devices, has accelerated the adoption of micro-injection molding to produce lightweight, compact, and efficient components.

Emerging trends include the integration of advanced materials such as biocompatible plastics for medical applications and thermoplastics for electronic components. The increasing focus on product miniaturization without compromising performance or durability is encouraging manufacturers to invest in sophisticated micro-molding machinery. Furthermore, the automation of micro injection molding processes is improving production efficiency, reducing defects, and meeting the growing demand for complex and intricate designs. The market is also witnessing broader adoption across industries such as telecommunications and automotive, where miniaturized sensors and connectors play critical roles. As industries continue to innovate, micro injection molding machines are becoming indispensable for achieving the precision and scale required for next-generation technologies.

RESTRAIN

- The high cost of sophisticated micro-injection molding machines limits their adoption by smaller manufacturers due to significant initial investment requirements.

Micro-injection molding machines are highly specialized and sophisticated, designed for producing extremely precise and miniature components. Their advanced features, including high precision, automation, and compatibility with complex materials, make them indispensable in industries such as healthcare, electronics, and automotive. However, these capabilities come at a high cost, which often becomes a significant barrier for smaller manufacturers or startups. The initial investment in these machines, coupled with the expenses of mold design and maintenance, can be prohibitive, limiting adoption to larger enterprises or highly funded projects.

KEY SEGMENTATION ANALYSIS

By Type

The 30-40 tons segment dominated the market with the market share over 48% in 2023, owing to its superior ability to deliver high-precision and efficient production for various applications. This segment is particularly favored in industries such as medical devices, electronics, and automotive, where the demand for smaller, intricate, and highly accurate components is rapidly growing. The 30-40 tons machines provide the ideal balance of power and precision, enabling manufacturers to produce micro parts with tight tolerances and consistent quality. Moreover, these machines are equipped to handle advanced materials, making them suitable for high-performance applications. Their reliability and adaptability have made them the preferred choice among industries prioritizing efficiency and scalability. As industries increasingly move toward miniaturization, the demand for 30-40 tons micro injection molding machines is expected to sustain their leading position in the market.

By Application

The Medical application segment dominated the market with market share over 36% in 2023, driven by the increasing need for precision-engineered miniature components used in a wide range of medical devices. These devices include catheters, surgical instruments, implants, and diagnostic tools, all of which require high-quality, intricate components to function effectively. The demand for micro-molded parts in the medical industry is further fueled by the growing trend toward minimally invasive surgeries, which require smaller, more precise devices for procedures that reduce recovery times and improve patient outcomes. Additionally, advancements in personalized medicine and diagnostics, where customized or specialized components are needed, contribute to the market's growth.

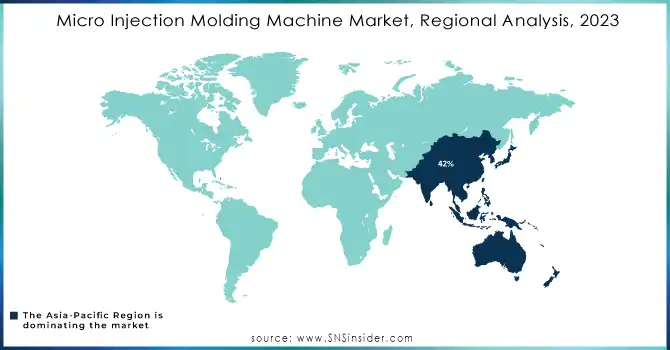

KEY REGIONAL ANALYSIS

The Asia-Pacific region dominated with a market share of over 42% in 2023, driven by its robust manufacturing capabilities, especially in countries like China, Japan, and South Korea. These nations have long-established industries in electronics, automotive, and healthcare, sectors that heavily rely on precision molding technologies. The rapid industrialization and technological advancements across the region have further bolstered this dominance. Additionally, Asia-Pacific is a hub for the production of small and intricate parts, where micro injection molding plays a crucial role due to its ability to create highly detailed and precise components in various materials. The availability of cost-effective labor, along with a strong emphasis on automation and innovation in manufacturing, has made the region an attractive destination for both production and R&D in micro injection molding technologies.

North America is the fastest-growing region in the Micro Injection Molding Machine Market, driven by increasing demand across several key industries, including healthcare, automotive, and electronics. In healthcare, the demand for precision components used in medical devices and implants is growing, requiring advanced molding technologies. Similarly, the automotive sector is adopting micro injection molding for small, lightweight, and high-precision components to enhance vehicle performance and efficiency. The electronics industry also relies on micro injection molding for manufacturing compact, intricate parts used in smartphones, wearables, and other consumer electronics. Additionally, technological advancements in molding techniques, such as the development of more efficient, automated processes, are spurring growth.

Do You Need any Customization Research on Micro Injection Molding Machine Market - Inquire Now

Key Players

-

Arburg GmbH + Co KG (Allrounder series, Electric injection molding machines)

-

Haitian International Holdings Limited (Zeres series, Smart series)

-

Milacron (FANUC Roboshot, Elektron series)

-

Nissei Plastic Industrial Co., Limited (NEX-IV series, Electric injection molding machines)

-

Engel Austria GmbH (e-mac series, Victory series)

-

Sumitomo (SHI) Demag Plastics Machinery GmbH (IntElect series, El-Exis series)

-

Chen Hsong Holdings Limited (JETMASTER series, Smart series)

-

Toyo Machinery & Metal Co. (Si-6 series, EC series)

-

KraussMaffei Group (EX series, PX series)

-

LS Mtron (LSON Series, Electric injection molding machines)

-

Ube Machinery Corporation, Ltd. (US series, U-Monitor series)

-

Fanuc Corporation (Roboshot series, S-series)

-

Sepro Group (Sepro Visual, Sepro T5 series)

-

Sumitomo Heavy Industries (SE-EV series, MEGA series)

-

Milacron (K-Tec series, Elektron series)

-

ENGEL (e-mac 250/100, victory 160/80)

-

Battenfeld GmbH (HM series, AE series)

-

Arburg (Allrounder 320, Allrounder 570)

-

Haitian (Zeres Z, Smart)

-

Nissei (NEX-IV, NE-S series)

Suppliers for Micro Injection Molding Machine Market

-

Arburg GmbH + Co KG

-

Engel Austria GmbH

-

Nissei Plastic Industrial Co., Ltd.

-

Sumitomo (SHI) Demag

-

Husky Injection Molding Systems

-

WITTMANN BATTENFELD GmbH

-

KraussMaffei Group

-

Milacron

-

Toyo Machinery & Metal Co., Ltd.

-

LG Injection Molding Machine

RECENT DEVELOPMENTS

-

In October 2024: Milacron unveiled its new all-electric injection molding machine featuring monosandwich technology at Fakuma 2024. The eQ180 is designed for producing multi-layer parts using post-consumer recyclable (PCR) materials.

-

In July 2024: Engel Austria GmbH expanded its technical center in St. Valentin, Austria, by adding one of the largest injection molding machines from its standard portfolio: the duo 5500 combi M. This machine, with a clamping force of nearly 6,200 tons and weighing 545 tons, measures 105 feet in length, 43 feet in width, and 22 feet in height. Engel will utilize this large, fully equipped machine for collaborative projects with customers and partners.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 0.52 billion |

| Market Size by 2032 | USD 1.20 billion |

| CAGR | CAGR of 9.78% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (0-10 tons, 10-30 tons, and 30-40 tons) • By Application (Medical, Automotive, Fiber Optics, Electronics) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Arburg GmbH + Co KG, Haitian International Holdings Limited, Milacron, Nissei Plastic Industrial Co., Limited, Engel Austria GmbH, Sumitomo (SHI) Demag Plastics Machinery GmbH, Chen Hsong Holdings Limited, Toyo Machinery & Metal Co., KraussMaffei Group, LS Mtron, Ube Machinery Corporation, Ltd., Fanuc Corporation, Sepro Group, Battenfeld GmbH. |

| Key Drivers | • The growing need for precise, miniaturized components in medical technology and consumer electronics, fueled by advancements in wearables and IoT devices, is driving the demand for micro-injection molding. |

| RESTRAINTS | • The high cost of sophisticated micro-injection molding machines limits their adoption by smaller manufacturers due to significant initial investment requirements. |