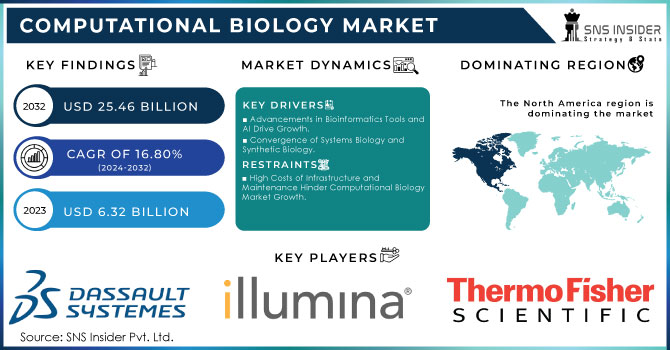

Computational Biology Market Size & Report Overview:

The Computational Biology Market size was valued at USD 6.32 Billion in 2023 and is projected to reach USD 25.46 Billion by 2032, growing at a 16.80% CAGR from 2024-2032.

Get More Information on Computational Biology Market - Request Sample Report

The computational biology market has gained significant traction in recent years as advancements in technology, big data analytics, and biological research converge to offer powerful tools for understanding complex biological systems. Computational biology has greatly transformed genetic data analysis in genomics, becoming one of its most significant applications. Genomics is crucial in oncology research, utilized in 65% of cancer studies, and in identifying rare diseases, 80% of which are genetically linked. The genomics workforce in the U.S. is growing at a projected annual rate of 12% to keep up with the increasing need for experts. Significant financial support, such as USD 3.5 billion from the National Institutes of Health (NIH) and USD 1.5 billion for the All of Us Research Program, showcases the government's dedication to genomics. Around, 90% of hospitals in the United States are incorporating precision medicine, which utilizes genomic data, and the global precision medicine market is worth USD 65.85 billion with the U.S. leading the way. The popularity of genetic testing is increasing, with 10% of American adults having been tested in 2022. The capacity to sequence complete genomes and interpret vast quantities of data has created new opportunities for comprehending the genetic foundation of diseases, evolutionary biology, and human growth. Computational tools enable the discovery of genetic mutations linked to illnesses, resulting in improved diagnosis and customized treatment strategies.

Computational biology has revolutionized the pharmaceutical industry in drug discovery by accelerating the identification of potential drug candidates and forecasting their impacts on human health. Conventional drug discovery techniques are frequently long and expensive, while computational methods can rapidly assess the composition of biological substances and predict the interactions of new compounds with them. This greatly diminishes the necessity for expensive laboratory experiments and trials. Additionally, computational biology allows for the examination of biological pathways and networks to find potential drug targets, providing new approaches for treating complicated illnesses such as cancer, neurodegenerative disorders, and autoimmune diseases. In addition, computational models help researchers forecast the impact of changes in one section of a biological system on other sections, facilitating the creation of specific treatments.

Computational Biology Market Dynamics

Drivers

-

Advancements in Bioinformatics Tools and AI Drive Growth.

Progress in bioinformatics software and algorithms has been crucial in the expansion of the computational biology industry. The demand for accurate and effective analysis of biological data has dramatically increased as datasets from genomics, proteomics, and systems biology have become larger and more complex. The creation of advanced bioinformatics tools like BLAST and software packages such as Bioconductor has allowed researchers to effectively analyze extensive biological datasets. Machine learning and artificial intelligence (AI) play a crucial role in analyzing intricate biological systems, enhancing prediction models, and aiding in the comprehension of diseases on a molecular scale. AI is used to improve computational models for predicting drug interactions, protein folding, and genetic sequencing, resulting in quicker and more precise outcomes. In addition, improvements in computing capabilities, such as cloud computing, have simplified the analysis of large datasets for organizations and researchers, leading to significant savings in time and resources. Advancements like next-generation sequencing (NGS) have generated large volumes of data, resulting in the need for sophisticated bioinformatics tools to analyze and understand this data.

-

Convergence of Systems Biology and Synthetic Biology.

Systems biology, which focuses on examining the relationships among different biological elements like DNA, RNA, proteins, and cells, has become increasingly popular in recent times. Computational biology is essential in systems biology because it offers the necessary tools for simulating intricate biological processes. These models aid researchers in grasping the interactions between various biological systems, providing an understanding of disease mechanisms and possible targets for therapy. In the same way, computational biology plays a vital role in synthetic biology, which entails creating and manipulating biological systems for practical reasons. Computational models are utilized to create synthetic biological systems, forecasting how they will act, and enhancing their efficiency. The increasing enthusiasm for utilizing synthetic biology in fields such as biofuels, agriculture, and pharmaceuticals is fueling the need for computational biology tools. The merging of systems biology and synthetic biology is likely to create new opportunities for research and advancement, especially in gene editing, metabolic engineering, and biomanufacturing fields.

Restraints

-

High Costs of Infrastructure and Maintenance Hinder Computational Biology Market Growth.

The significant obstacle to the expansion of the computational biology market is the expensive setup and maintenance of computational infrastructure. Sophisticated bioinformatics software and algorithms demand significant computational capacity, typically utilizing high-performance computing (HPC) systems, cloud infrastructure, and extensive data storage solutions. Obtaining and maintaining these systems can be too costly for smaller organizations and research institutions. The requirement for specialized hardware, custom software, and skilled personnel to manage and operate the systems further exacerbates this financial burden. Despite offering scalable and cost-efficient computing resources, many organizations still face challenges regarding the enduring expenses linked to storing and processing large quantities of data. These costs can significantly hinder the use of computational biology technologies in smaller institutions and impede overall market expansion. Finding solutions that are budget-friendly is essential to enable a broader range of organizations to access advanced computational biology tools and overcome this obstacle.

Computational Biology Market Segmentation Insights

By Service

The software platforms segment held a market share of 40% in 2023. These platforms offer necessary resources for analyzing, modeling, and simulating biological data. They allow researchers to carry out extensive studies in genomics, proteomics, and drug discovery, proving essential for a range of uses like molecular modeling, sequence analysis, and systems biology. The rapid progress of personalized medicine and the increasing complexity of biological data have led to a surge in the need for bioinformatics tools and platforms. Some examples are Thermo Fisher Scientific's "Ion Torrent Software Suite" for genomic analysis and Illumina’s BaseSpace for bioinformatics in the cloud.

The databases sector is to become the fastest-growing segment during 2024-2032, due to the rise in biological data generation in the Computational Biology Market. There is a demand for organized data storage and retrieval systems to handle large volumes of information due to advances in next-generation sequencing (NGS) and genomics. Biological databases help in sharing, annotating, and analyzing data in different areas like genomics, proteomics, and systems biology. GenBank and EMBL-EBI both offer services for nucleotide and protein sequences, respectively.

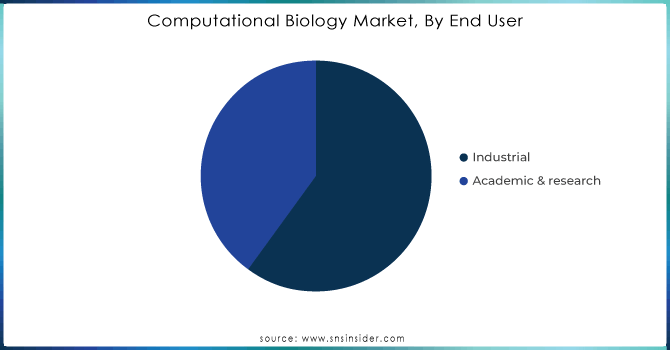

By End-User

The industrial sector dominated the segment in 2023 with 59.88% market share, fueled by the increasing adoption of computational methods in pharmaceuticals, biotechnology, and healthcare. Computational biology plays a crucial role in drug design, clinical trials, and predictive modeling, resulting in a substantial decrease in the time and cost needed to introduce new drugs to the market. Pharmaceutical firms such as Pfizer and Roche utilize computational biology to improve drug discovery processes, study genetic differences, and forecast patient reactions to treatments. Moreover, biotech companies are incorporating computational techniques to enhance efficiency in tasks like protein modification and molecular modeling.

The academic & research is accounted to have a significant growth rate during the forecast period. Driven by the rising use of computational tools in biological research, this segment is currently the most dominant. Universities and research institutions utilize computational biology for genomics, proteomics, and bioinformatics research, leading to progress in personalized medicine, drug discovery, and disease modeling. As the amount of biological data increases rapidly, scientists are increasingly using computational techniques to analyze intricate datasets, which helps speed up research and cut down on expenses. For example, Thermo Fisher Scientific offers bioinformatics platforms and software for academic use.

Need any customization research on Computational Biology Market - Enquiry Now

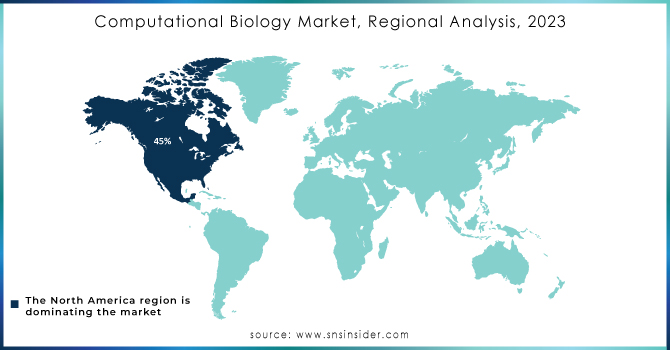

Computational Biology Market Regional Analysis

North America led the market in 2023 with a 45% market share due to significant investments in research and development, the presence of leading biotech and pharma firms, and top-notch healthcare facilities. The universities and research institutions in the area, especially in the United States, play a crucial role in driving progress in computational biology areas like genomics, drug discovery, and personalized medicine. Thermo Fisher Scientific and IBM Watson Health are leading in the use of computational biology for drug discovery and data analysis. Government funding supports the rise of precision medicine initiatives, strengthening the region's dominance.

The Asia-Pacific region is going to be the fastest-growing region during the forecast period 2024-2032, because of increasing healthcare investments, expanding biotechnology industries, and greater use of computational techniques in research. Nations such as China, India, and Japan are quickly enhancing their pharmaceutical and bioinformatics capacities, leading to an increase in market expansion. Research institutions in APAC are partnering with international companies to speed up progress in drug discovery and disease modeling. WuXi AppTec in China and Infosys in India are growing their computational biology offerings, with a focus on genomics, molecular dynamics, and bioinformatics services.

List Of Players and Their Products Related to Computational Biology:

-

F. Hoffmann-La Roche Ltd – Bioinformatics and computational biology tools

-

Illumina, Inc. – Sequencing and bioinformatics software

-

Thermo Fisher Scientific, Inc. – Computational biology tools and services

-

Dassault Systèmes – BIOVIA

-

Genedata AG – Genedata Biopharma Platform, including Screener, Expressionist, Selector, Biologics, Profiler, Bioprocess, Chromatics

-

Chemical Computing Group – Molecular modeling software

-

Schrödinger, Inc. – LiveDesign, PyMOL

-

Certara, Inc. – Biosimulation software

-

Insilico Medicine – AI-driven drug discovery platforms

-

Nimbus Therapeutics – Computational drug discovery platforms

-

Compugen Ltd. – Computational discovery platforms

-

GNS Healthcare – AI-driven precision medicine solutions

-

Evotec SE – Computational drug discovery solutions

-

Genomatica, Inc. – Computational biology-based industrial biotech solutions

-

3BioMed – Computational biology applications in biomedicine

Recent Developments in Computational Biology Market

-

June 2023: Illumina, a major genomics company, extended the capabilities of TruSight Oncology 500 assay, a comprehensive genomic profiling solution. The latter has now received integration with computational biology algorithms for promoting a higher degree of cancer variant detection. As a result, the Drug Discovery & Disease Modelling and planning of oncological treatment become more accurate.

-

April 2023: Insitro, a biotechnological company, has released a novel computational platform for finding therapies for Non-Alcoholic Steatohepatitis. The flagship platform employs advanced machine learning applications to recreate simulation of disease progression with the help of computational biology. This approach ensures an acceleration of the research aimed at finding a cure for NASH.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 6.32 Billion |

| Market Size by 2032 | USD 15.46 Billion |

| CAGR | CAGR of 16.80% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Databases, Infrastructure & Hardware, Software platforms) • By Application (Drug Discovery & Disease Modelling, Preclinical Drug Development, Clinical Trials, Computational Genomics, Computational Proteomics, Others) • By End User (Academic & Research, Industrial) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | F. Hoffmann-La Roche Ltd, Illumina, Inc., Thermo Fisher Scientific, Inc., Dassault Systèmes, Genedata AG, Chemical Computing Group, Schrodinger, Inc., Certara, Inc., Insilico Medicine, Nimbus Therapeutics, Compugen Ltd., GNS Healthcare, Evotec SE, Genomatica, Inc., 3BioMed |

| Key Drivers | • Advancements in Bioinformatics Tools and AI Drive Growth. • Convergence of Systems Biology and Synthetic Biology. |

| Restraints | • High Costs of Infrastructure and Maintenance Hinder Computational Biology Market Growth. |