High-Performance Computing Market Report Scope & Overview:

Get More Information on High-Performance Computing Market - Request Sample Report

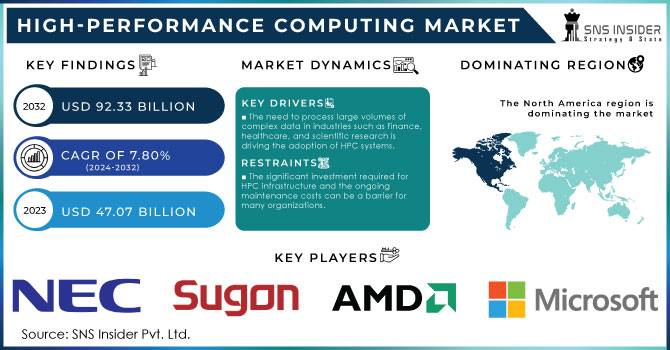

High-Performance Computing Market was worth USD 47.07 billion in 2023 and is predicted to be worth USD 92.33 billion by 2032, growing at a CAGR of 7.80 % between 2024 and 2032.

The high-performance computing (HPC) industry is set to grow in the future fuelled by several factors such as push for high-performance computing, evolution of virtualization and ongoing growth across IT sectors. Academic institutions, defence agencies, energy companies and government bodies are all turning to HPC systems that have the capacity to quickly process huge amounts of data. As digital data volume increases rapidly, the demand for high-performance and dependable storage technologies is likewise expanding; driving adoption. $2.5 billion investment to the launch of next-gen HPC system by US Department of Energy to enhance computational capabilities for Scientific Research and National Security the National Science Foundation (NSF) is providing $500 million to support HPC infrastructure at colleges and universities, necessary for pushing the frontiers of knowledge in areas such as climate science or genomics.

The fields where HPC technology is becoming increasingly popular are scientific, business and government-related problems making it a high-demand and high-investment area. Adding to it is the cloud-based HPC systems, are also assisting in accelerating its adoption. Microsoft has introduced new virtual machines to its Azure HPC offerings that the company says will improve performance as much as 60% and deliver more scalability for industries such automotive and aerospace. Amazon Web Services (AWS) introduced the new HPC7g instances that are built to deliver superior performance for high-performance computing workloads, thereby significantly boosting cloud-based simulations and modeling. The challenges like high maintenance costs, inadequate expertise and security are pose significant hurdles. However, with the increasing demand for HPC systems especially from industries such as aerospace and automotive, healthcare or finance where these systems simplify complex business processes. The proliferation of large datasets and data centers also contributes to growth, which will propel revenue expansion in the HPC market into the future.

Drivers

-

The need to process large volumes of complex data in industries such as finance, healthcare, and scientific research is driving the adoption of HPC systems.

-

The growing preference for cloud-based high-performance computing solutions, which offer scalability and cost-efficiency, is significantly boosting market growth.

-

Government agencies and defence sectors are increasingly adopting HPC systems to enhance computing efficiency and support national security and economic development initiatives.

The major factor driving that the High-Performance Computing (HPC) market is a considerable demand for data processing across industries especially in sectors like finance, healthcare and scientific research. Organisation are seeing an exponential growth in the volume, velocity and variety of data that they need to process. Global data creation is predicted to exceed a staggering 180 zettabytes by 2025, soars from around 79 zettabytes made worldwide as of last year. And with more data being generated you need data driven, analogue computers that can scale and capable of handling complex and large-scale data sets in real-time.

These systems are capable of performing trillions of calculations per second, which allows them to be used in the rapid and accurate processing also large data sets. For example, in finance HPC systems are employed for real-time analytics and algorithmic trading as fast ticks can impact profitability. Similarly, in healthcare area HPC is making possible to analyze huge genomic datasets for personalized medicine and drug discovery. The COVID-19 pandemic has again highlighted the significance of HPC in speeding up research and development, especially modeling and simulating virus spread as well as creating vaccines. HPC systems are quite essential in the world of data-driven computing, as the increasing complexity of these datasets and workloads means that organizations need high performance for fast, accurate processing.

Restraints

-

The significant investment required for HPC infrastructure and the ongoing maintenance costs can be a barrier for many organizations.

-

A shortage of expertise in managing and operating HPC systems is limiting their widespread adoption across various industries.

-

The slow pace of innovation in high-performance workstations may also act as a restraint, impacting the overall growth of the HPC market.

High cost associated with the implementation and maintenance of HPC systems will be one of the main constraints that is likely to affect this market in a negative way, particularly during initial stages. This means that HPC systems are significant investment to build up not just the infrastructure at initial setup buying all those high-end servers, top of line processors and storage solutions but also in ongoing operational costs. For instance, the cost of electricity alone for running HPC systems can be staggering. A modern HPC system can consume as much electricity per year as a small town, approximately 10 megawatts. As this lack of energy efficiency results in large operating costs especially on places where the cost of electricity is high. Secondly, these empowering machines produce a lot of heat and require specific cooling systems to keep them running cool which entail additional cost. These costs translate into a significant financial barrier to entry for smaller businesses and research facilities, preventing them from enjoying the widespread market penetration of HPC.

Segment Analysis

By Deployment

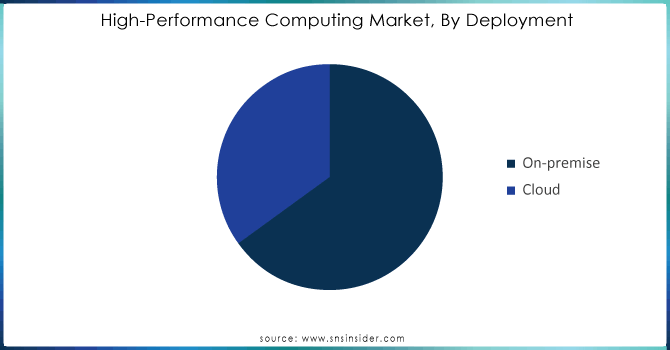

The on-premise segment held the largest market share in 2023 and is expected to grow significantly over the forecast period. This preference is largely driven by the need for data security, A lot of governments consider securing classified information on national intelligence and personal data as their main concern thereby choosing Private Cloud over the other counterparts. Enterprises want to protect their enterprise data, and that leads them to opting for an on-premise implementation vs a cloud-based solution. Mexico´s over-passed Data Protection Laws (2010) for example, announced that the data assets could be widely shared through all of Mexico. But the government continues to stir locally, all information regarding residents that is used by a state institution must be stored and processed in Indonesia as well which they claim aims for security. These trends are expected to drive the continued growth of on-premise deployments.

However, the fastest-growing segment is likely to be cloud which will witness a compound annual growth rate (CAGR) of more than 8.3% over the forecast period. One of the main benefits with cloud deployment is that it will be able to help organizations decrease operating costs within devices in addition to conserving financial resources, which can reduce virtually no functional assistance techniques. A lot of organizations today choose cloud as it offers benefits in form increased efficiency and cost-effectiveness which are also key growth drivers of this segment.

Need any customization research on High-Performance Computing Market - Enquiry Now

By End-use

The manufacturing sector is expected to grow significantly in the forecast period, owing to an increased demand due its properties for computation-intensive and time-consuming processes that are industry need. Various manufacturers are using simulation and CAD software with HPC systems to achieve higher efficiency. In the manufacturing sector, HPC systems have high value for computational fluid dynamics (CFD), computational structural mechanics, and computational electromagnetics. These features not only enhance the overall functioning but also increase computer speeds and allow for faster retrieval of vital information.

At the same time, government and defence segment is expected to expand at a compound annual growth rate (CAGR) of more than 8.7% over forecast period, Higher adoption of advanced IT solutions to make defense agencies more efficient at computing Meanwhile, govt organizations is likely to deploy HPC systems for a number of their digitization initiatives that support the wider economic development High-performance computing is increasingly being sought after in both the manufacturing and government sectors for its ability to enhance operational efficiency, as well as play a key role in advancing technology within these industries.

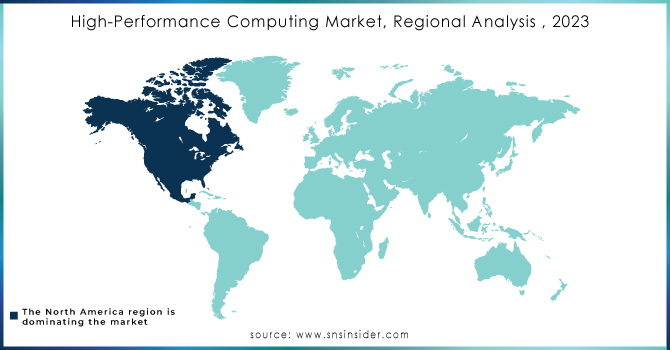

Regional Analysis

North America region market held the largest share of over 38% in 2023, Positioning it as a leading and biggest market for tech-oriented solutions from every aspect. The region is also significant in relation to the global economy, and especially so when it comes to developing and deploying emerging technologies. In databases, since people have started to realize the greatest demand in processing of huge amount raw data, the importance of robust security measures has also increased. Major global companies Boeing and General Motors are located in North America, as well as many SMEs that adopt HPC systems to enhance their capabilities. This is further augmenting the use of HPC systems in the region.

Asia Pacific is projected to grow with the highest CAGR of 8.2% during the forecast period, driven by increasing adoption of HPC systems for scientific research and weather forecasting among other applications, especially in countries such as India and China). China is one of the top high-performance computing countries. The country also houses some of the fastest supercomputers on US Government's Hit-List, which includes Tianhe 2 (Milkyway-2) and Sunway TaihuLight. Tianhe-2 was developed by the Chinas National University of Defense Technology and received funding from the governments of Guangzhou city and Guangdong province. The APAC HPC market is expected to grow over the next couple years by a mix of factors.

KEY PLAYERS:

The major key players are Advanced Micro Devices Inc., NEC Corporation, Hewlett Packard Enterprise, Sugon Information Industry Co. Ltd, Intel Corporation, International Business Machines Corporation, Microsoft Corporation, Dell EMC (Dell Technologies Inc.), Dassault Systems SE, and Lenovo Group Ltd & Other Players

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 47.07 Billion |

| Market Size by 2032 | USD 92.33 Billion |

| CAGR | CAGR of 7.80 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • by Component (Hardware, Software, Services) • by Deployment (On-premise and Cloud) • by Computation Type (Parallel Computing, Distributed Computing, Exascale computing) • by End-use (BFSI, Gaming, Media & Entertainment, Retail, Transportation, Government & Defense, Education & Research, Manufacturing, Healthcare & Bioscience, and Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Micro Devices Inc., NEC Corporation, Hewlett Packard Enterprise, Sugon Information Industry Co. Ltd, Intel Corporation, International Business Machines Corporation, Microsoft Corporation, Dell EMC (Dell Technologies Inc.), Dassault Systems SE, and Lenovo Group Ltd |

| Key Drivers | •There is a growing demand for efficient computation, great scalability, and dependable storage. •Increasing need for high-speed, accurate data processing. |

| RESTRAINTS | •Concerns about cyber security. •Commercial high-performance computer clusters have substantial deployment costs. |