Computational Fluid Dynamics Market Report Scope & Overview:

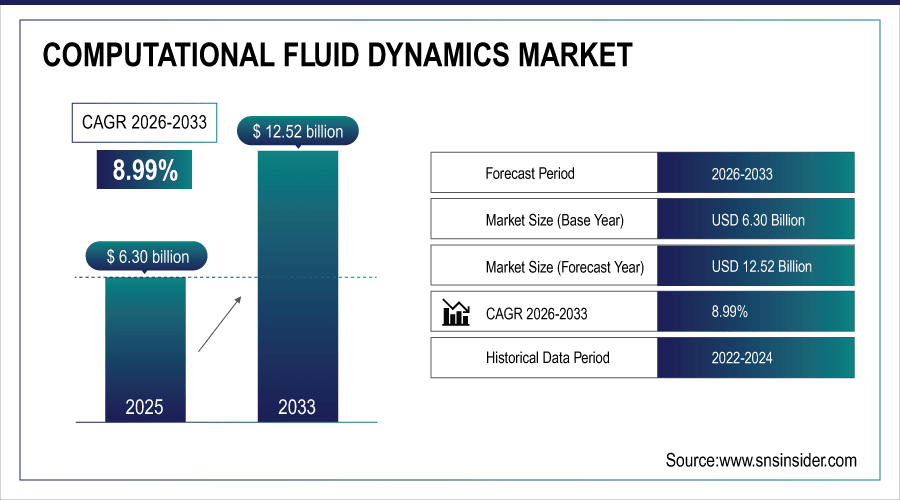

The Computational Fluid Dynamics Market Size was valued at USD 6.30 Billion in 2025E and is expected to reach USD 12.52 Billion by 2033 and grow at a CAGR of 8.99% over the forecast period 2026-2033.

The computational fluid dynamics (CFD) market growth is considerable, as the industries such as aerospace, automotive, energy, and chemical processing, which require accurate and faster simulation tools and effective simulation solutions over static methods, in order to augment operational efficiency. CFD software helps companies to optimize product designs and eliminate some physical prototypes, effectively saving time and money in the product development cycle. The accuracy and scalability of these simulations are better than ever, due to advanced technologies such as artificial intelligence (AI), machine learning (ML), and cloud computing because of which organizations can now achieve high degrees of complexity with their analyses faster and at lower costs. According to study, Companies using CFD have reported up to 50% reduction in physical prototyping costs, enabling significant savings in design and manufacturing budgets.

To Get More Information On Computational Fluid Dynamics Market - Request Free Sample Report

Market Size and Forecast:

-

Market Size in 2025: USD 6.30 Billion

-

Market Size by 2033: USD 12.52 Billion

-

CAGR: 8.99% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

Computational Fluid Dynamics Market Trends

-

Adoption of CFD software is accelerating for energy-efficient product designs globally.

-

Cloud-based CFD platforms enable faster simulations and reduced infrastructure investment requirements.

-

AI and ML integration in CFD improves accuracy and simulation efficiency significantly.

-

SMEs increasingly access advanced CFD tools through cloud-based and subscription models.

-

CFD optimizes aerodynamics and fluid flow, reducing energy consumption and operational costs.

-

Cross-industry digital transformation drives higher adoption of CFD for complex engineering simulations.

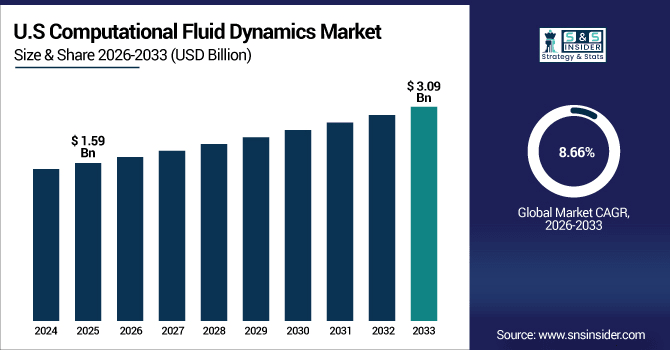

The U.S. Computational Fluid Dynamics Market size was USD 1.59 Billion in 2025E and is expected to reach USD 3.09 Billion by 2033, growing at a CAGR of 8.66% over the forecast period of 2026-2033, driven by early adoption of AI- and cloud-enabled CFD solutions across aerospace, automotive, and energy sectors. Advanced R&D, digital transformation, and focus on energy-efficient designs fuel rapid market growth and innovation.

Computational Fluid Dynamics Market Growth Drivers:

-

Rising Demand for Energy-Efficient Designs Accelerates Global CFD Market Growth

A major factor driving the Computational Fluid Dynamics Market growth is the increasing need for energy-efficient and optimized product designs across industries such as aerospace, automotive, and energy. Companies are under pressure to reduce fuel consumption, improve thermal management, and enhance overall system efficiency. CFD software allows engineers to simulate fluid flow, heat transfer, and aerodynamics accurately without physical prototyping. For instance, automotive manufacturers can reduce drag coefficients and improve fuel efficiency by using CFD-based aerodynamic simulations. Similarly, energy and power plants leverage CFD to optimize cooling systems, reducing operational costs and minimizing environmental impact. This ability to save time, cut costs, and meet sustainability goals has made CFD an indispensable tool in modern engineering, driving market growth.

Energy and power plants leveraging CFD for cooling system optimization can reduce operational costs by 15–20%.

Computational Fluid Dynamics Market Restraints:

-

High Software Costs and Complexity Limit CFD Adoption Among Enterprises

Despite the benefits, High cost and technical complexity are key restraints hampering the growth of the CFD market. Particularly for commercial CFD software which not only demands costly licenses but also a large amount of investment in high-performance computing hardware. CFD also requires specialized knowledge in various topics such as, but not limited to, fluid dynamics, numerical modeling, and solver setups, creating an additional barrier for small and medium businesses to using these solutions. And mistreatment of CFD can result in erroneous findings, speeding up reluctance from firms lacking skilled workforce. These high-end CFD tools require frequent software updates, training, and maintenance, which in turn adds to the operational costs, as a result of which they become less accessible to smaller organizations thereby limiting market penetration.

Computational Fluid Dynamics Market Opportunities:

-

Cloud-Based AI-Enhanced CFD Solutions Unlock New Market Opportunities Globally

There remains a huge opportunity in moving Computational Fluid Dynamics Market solutions to the cloud and enhancing the capabilities by integrating AI/ML. Cloud deployment mitigates the costly on-premise hardware and permits engineers to run complex simulations with higher speed and flexibility. Faster iterations of the product and increasing collaboration across geographies as companies can scale their computational resources as demand grows. In parallel, the integration of AI and machine learning enhances solver performance, follows complex flow phenomena, and automates repetitive work, compressing simulation duration. The trend emerges as an opportunity that helps broaden the market and penetrates the small and medium-sized enterprises (SMEs), Start-ups and research institutions and enables them to purchase advanced CFD capabilities without, up-front capital expenditure making innovation and discovery possible.

Cloud-based deployment reduces the need for expensive on-premise hardware, lowering capital expenditure by 25–40%.

Computational Fluid Dynamics Market Segmentation Analysis:

-

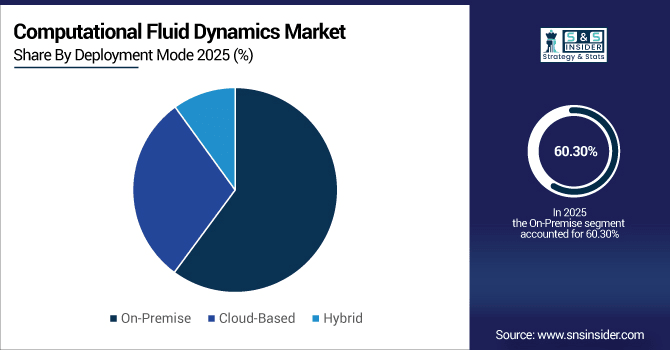

By Deployment Mode: In 2025, On-Premise led the market with share 60.30%, while Cloud-Based is the fastest-growing segment with a CAGR 12.50%.

-

By Product Type: In 2025, Software led the market with share 55.50%, while Services are the fastest-growing segment with a CAGR 11.20%.

-

By Application: In 2025, Aerodynamics & Hydrodynamics led the market with share 28.40%, while Multiphase Flow is the fastest-growing segment with a CAGR 11.80%.

-

By End-User Industry: In 2025, Aerospace & Defense led the market with share 32.60%, while Energy & Power is the fastest-growing segment with a CAGR 12.40%.

By Deployment Mode, On-Premise Leads Market and Cloud-Based Fastest Growth

The On-Premise bug tracking software segment accounted for the largest market share in 2025, due its increasing preference among enterprises to deploy bug tracking software hosted within their IT infrastructure which helps them maintain 100 percent control over their data when it comes to security, customization, and other functions. For larger organizations and regulated industries, that means on-premise solutions are more reliable, easier to integrate with other tools, and in line with internal IT compliance laws. On the other hand, the Cloud-Based segment is the fastest-growing segment, as many people are adopting SaaS models that provide scalability, accessibility from anywhere in the world, and minimum initial costs. As seen, enterprises are quickly moving to the cloud for real-time collaboration, instant updates, and privy but still responsive deployment, which equally inspires lazy yet robust bug tracking solutions over industries.

By Product Type, Software Leads Market and Services Fastest Growth

In the Bug Tracking Software Market by Software, Segment is projected to account for the largest market revenue share by 2025, as organizations are switching to the all in one software solutions to track, manage and resolve the bugs in an effective and efficient manner. Strong features such as automation and workflow management, along with integration with project management tools, power adoption across enterprises large and small. In the meantime, the fastest growing segment is the Services segment owing to increasing demand for consulting, implementation, training, and support services. Companies are looking for guidance by experts to customize solutions, integrate them with existing IT infrastructure, and to get the best out of the ROI. The dual trend showcases the strength of software solutions while also pointing to the growing service-oriented opportunities in the market.

By Application, Aerodynamics & Hydrodynamics Leads Market and Multiphase Flow Fastest Growth

In 2025, the Aerodynamics & Hydrodynamics application segment holds the largest share in the Bug Tracking Software Market, as more and more organizations in aviation, automobile, and industrial engineering are utilizing software to deal with complex simulation and development problems. Such solutions enable teams to report bugs faster, allow for correct workflow tracking and, ultimately, improve project efficiency. On the other hand, the fastest-growing Multiphase Flow segment is driven by the increasing demand for advanced bug tracking in fluid dynamics, thermal management, and Multiphysics modeling simulations. Integrated real-time tracking tools becoming widely incorporated into these complicated applications allows issues to be addressed quickly, project delays to be prevented, and product reliability be heightened, generating substantial growth opportunities in the market.

By End-User Industry, Aerospace & Defense Leads Market and Energy & Power Fastest Growth

The Aerospace & Defense segment dominated the Bug Tracking Software Market with the highest share in 2025 owing to stringent precision, compliance, and reliability requirements across these industries. In aerospace and defence, software adoption for defect management helps organisations include strict quality standards while increasing overall project efficiency. At the same time, the Energy & Power segment is the fastest growing segment as increasing digitization, automation, and rising number of complex infrastructure projects with need for fine issue tracking are some of the key trending factors (TRF) that would shape the global market during the projection period. Companies operating in this industry are leveraging advanced bug tracking solutions to track software performance, ensure the reliability of systems, and decrease downtime, which demonstrates robust growth prospect and considerable opportunities across energy and power applications.

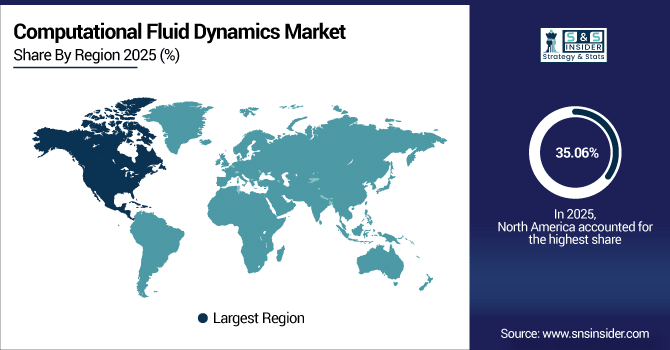

Computational Fluid Dynamics Market Regional Analysis:

North America Computational Fluid Dynamics Market Insights:

The Computational Fluid Dynamics Market in North America held the largest share 35.06% in 2025, due to the large number of aerospace, automotive, and defense companies. Highly developed R&D infrastructure, early adoption of next-gen technologies, and strong investments in simulation-based product development further drives growth in the region. Today, more and more North American companies are using CFD to reduce prototyping costs and speed new product development cycles for analyzing aerodynamics, thermal management, and fluid flow. Top providers like ANSYS, Siemens, Dassault Systèmes, and Altair Engineering dominate this area with high-end solutions. Apart from this, market growth is also driven by energy efficiency and convenience of digital transformation in industries.

Get Customized Report as Per Your Business Requirement - Enquiry Now

U.S. Dominates Computational Fluid Dynamics Market with Advanced Technological Adoption

U.S. dominates the Computational Fluid Dynamics market, driven by advanced technological adoption in aerospace, automotive, and energy sectors. Early integration of AI, cloud-based CFD, and simulation tools enhances efficiency, reduces costs, and accelerates product development, maintaining U.S. market leadership.

Asia-Pacific Computational Fluid Dynamics Market Insights

In 2025, Asia-Pacific is the fastest-growing region in the Computational Fluid Dynamics Market with a CAGR 10.14%, due to major factors such as the rapid industrialization in this region, increased research and development investments, and increasing aerospace, automotive, and energy sectors in many countries like in particular China, India, and Japan. Cloud-based &AI/ML-powered CFD solutions are becoming more popular in the region as they allow faster simulations, and reduced infrastructure costs while enhancing the product development cycle. Small and medium enterprises (SMEs) and startups are integrating more efficient computational fluid dynamics (CFD) tools into their workflow at an incredible rate to optimize designs economically while conducting thermal, fluid, and aerodynamic analysis. Government initiatives focusing on innovation, renewable energy projects as well as digital transformation will further boost the market, and Asia-Pacific is a significant growth region for CFD software and services.

China and India Propel Rapid Growth in Computational Fluid Dynamics Market

China and India are driving rapid growth in the Computational Fluid Dynamics market, fueled by industrial expansion, increasing R&D investments, adoption of AI/ML-enhanced simulations, and rising demand for efficient engineering solutions.

Europe Computational Fluid Dynamics Market Insights

The Computational Fluid Dynamics (CFD) market in Europe accounts for a considerable portion, due to high adoption in aerospace, automotive and energy. Due to energy-efficient and sustainable product designs, this region focuses on thermal management, fluid flow optimization, and aerodynamic analysis using CFD solutions. AI, machine learning, and cloud-based platform integration makes simulation more accurate, speeds up development cycles, and cuts computational costs as well. Major players in the industry keep on innovating and providing advanced software and services in the domain of CFD. Continuous efforts of digital transformation and green engineering boost the acceptance of CFD solutions among European industries, thereby bolstering the overall market growth.

Germany and U.K. Lead Computational Fluid Dynamics Market Expansion Across Europe

Germany and the U.K. drive Europe’s Computational Fluid Dynamics market growth, supported by strong adoption of advanced simulation technologies, energy-efficient design initiatives, and increased integration of AI and cloud-based CFD solutions.

Latin America (LATAM) and Middle East & Africa (MEA) Computational Fluid Dynamics Market Insights

The Latin America (LATAM) and Middle East & Africa (MEA) regions are emerging economies in Computational Fluid Dynamics (CFD), spurred by industrialization and energy infrastructure improvements, as well as a growing demand for advanced engineering solutions. CFD software is used by organizations to optimise fluid flow, thermal management, and aerodynamic designs while minimizing the costs of prototyping and enhancing the efficiency of the products. Cloud-based, AI-powered CFD solutions are increasingly having demand for fast simulations and the ability to run efficiently on-demand. Despite a comparatively smaller market share than North America and Europe, further investment in renewable energy, digital transformation programs, and the growth of industry provides a compelling potential market for CFD to LATAM and MEA.

Computational Fluid Dynamics Market Competitive Landscape

ANSYS leads the CFD market with advanced simulation solutions that optimize aerodynamics, thermal management, and fluid flow across aerospace, automotive, and energy sectors. Its software reduces prototyping costs, accelerates product development, and integrates AI and cloud-based technologies, driving adoption and strengthening its global market presence in high-performance engineering applications.

-

In February 2025, ANSYS introduced the Flamelet-Generated Manifold (FGM) model in its Fluent 2025 R1 release, significantly reducing simulation times from weeks to a single working day while maintaining high fidelity.

Siemens enhances CFD adoption through Simcenter Star-CCM+, offering AI-driven, high-fidelity simulations for industrial design and engineering optimization. The company focuses on energy efficiency, predictive analytics, and scalable solutions, enabling faster design iterations and reducing operational costs. Its strong R&D capabilities position Siemens as a key driver in the global CFD market.

-

In June 2025, Siemens expanded its partnership with NVIDIA to integrate AI capabilities into Simcenter Star-CCM+, enhancing simulation accuracy and efficiency.

Dassault Systèmes, through SIMULIA CFD solutions, delivers precise simulation tools for aerodynamics, eVTOL, and automotive fuel efficiency. Its focus on digital twin technology, high-fidelity modeling, and cloud integration supports faster development cycles, cost reduction, and sustainability initiatives, making Dassault Systèmes a prominent player in the computational fluid dynamics market.

-

In August 2025, Dassault Systèmes launched the 2025 edition of SIMULIA's Computational Fluid Dynamics simulations, offering fast, high-fidelity solutions for applications like eVTOL flight and automotive fuel efficiency certification.

Computational Fluid Dynamics Market Key Players:

Some of the Computational Fluid Dynamics Market Companies are:

-

ANSYS, Inc.

-

Siemens AG

-

Dassault Systèmes

-

Autodesk, Inc.

-

Altair Engineering, Inc.

-

COMSOL AB

-

Hexagon AB

-

The MathWorks, Inc.

-

PTC, Inc.

-

Cadence Design Systems, Inc.

-

ESI Group

-

NUMECA International

-

Convergent Science, Inc.

-

Flow Science, Inc.

-

Bentley Systems

-

SimScale GmbH

-

OpenCFD (OpenFOAM)

-

Airflow Sciences Corporation

-

EnginSoft SpA

-

Azore Software.

| Report Attributes | Details |

|---|---|

| Market Size in 2025 | USD 6.30 Billion |

| Market Size by 2033 | USD 12.52 Billion |

| CAGR | CAGR of 8.99% From 2026 to 2033 |

| Base Year | 2025 |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type (Computational Fluid Dynamics Software, Services, Consulting, Training, Others) • By Deployment Mode (On-Premise, Cloud-Based, Hybrid, Others) • By End-User Industry (Aerospace & Defense, Automotive & Transportation, Energy & Power, Chemical & Pharmaceuticals, Electronics, Construction, Others) • By Application (Aerodynamics & Hydrodynamics, Heat Transfer & Thermal Simulation, Fluid Flow Analysis, Multiphase Flow, Turbomachinery Simulation, Acoustic Analysis (Aeroacoustics), Chemical Reaction & Combustion Analysis, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | ANSYS, Inc., Siemens AG, Dassault Systèmes, Autodesk, Inc., Altair Engineering, Inc., COMSOL AB, Hexagon AB, The MathWorks, Inc., PTC, Inc., Cadence Design Systems, Inc., ESI Group, NUMECA International, Convergent Science, Inc., Flow Science, Inc., Bentley Systems, SimScale GmbH, OpenCFD (OpenFOAM), Airflow Sciences Corporation, EnginSoft SpA, Azore Software, and Others. |