IT Services Market Report Scope & Overview:

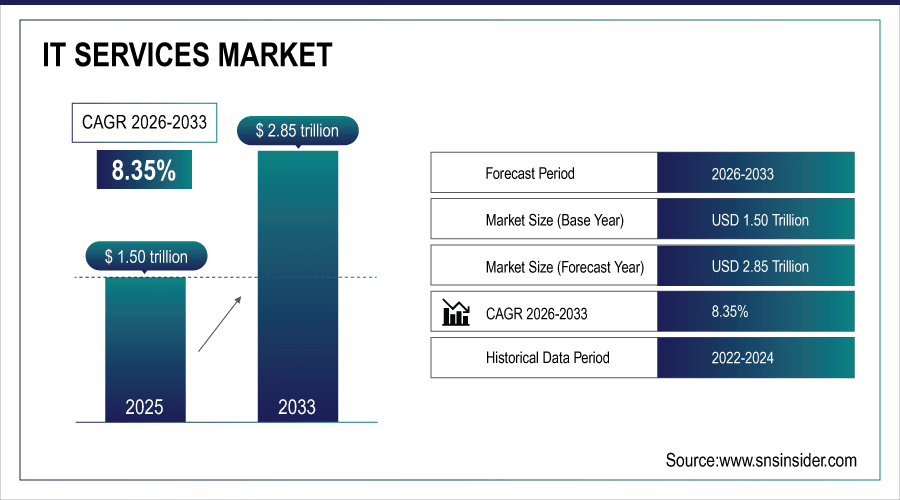

The Global IT Services Market size was valued at USD 1.50 trillion in 2025E. Looking ahead, the market is estimated to reach USD 2.85 trillion by 2033, allowing for a CAGR of 8.35% between 2026-2033.

Increase in adoption of cloud services and digital transformation projects, coupled with growing preference for managed services to drive the Global IT Services Market Demand for automation, cybersecurity products and technologies as AI and big data analytics are driving growth. Moreover, the growth in BFSI, healthcare & retail sector on a global level and transition to proactive IT management has paved way for market opportunities across the globe.

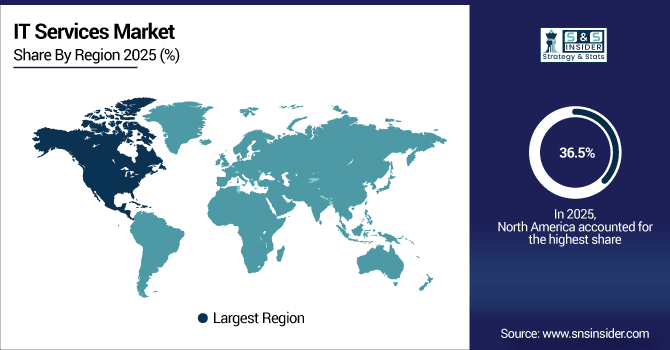

In 2024–2025, cloud deployment held about 55% share, while proactive IT services reached nearly 60%. BFSI and healthcare drove over 40% of demand. North America led the market, with Asia-Pacific growing the fastest.

To Get More Information On IT Services Market - Request Free Sample Report

Market Size and Forecast:

-

Market Size in 2025: USD 1.50 Trillion

-

Market Size by 2033: USD 2.85 Trillion

-

CAGR: 8.35% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

IT Services Market Trends:

-

Accenture, IBM and TCS scaled GenAI-fueled IT solutions in 2025; Microsoft and Google embedded advanced automation into enterprise services.

-

Cloud native went through the roof and hybrid/multi-cloud for enterprise workloads became a thing we don’t raise an eyebrow to.

-

AIOps caught on, automating IT operations and lowering downtime as it increased cost efficiency.

-

Demand for cybersecurity services surged, as companies faced increasing threats associated with cloud workloads and artificial intelligence models.

-

BFSI, Healthcare, and Government were among the sectors pumping up IT outsourcing to optimize digital transformation at scale.

-

Analysts reveal an overall growth of the market; North America also counts for a major share and significant contribution from Asia-Pacific region was noted Using Encoding ASCII Get Bytes (3)

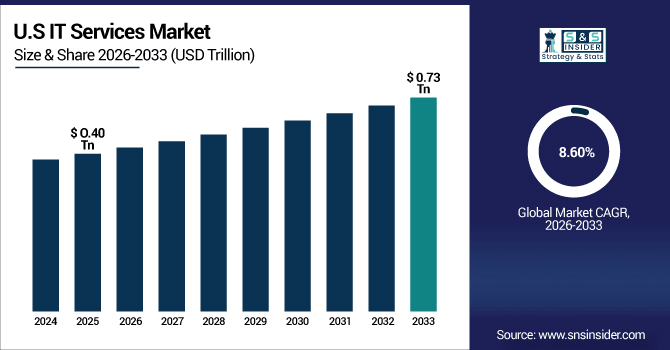

The U.S. IT Services Market was valued at USD 0.40 trillion in 2025E and is projected to reach USD 0.73 trillion by 2033, at a CAGR of 8.60%. The market growth is driven by the growing adoption of cloud platforms, AI, and automation technologies. And in addition, demand from enterprises, SMEs and government supports growth. There’s now an AI-powered and cloud-native solutions released by major market players such as Smile Telecoms, TCS, IBM and Accenture, allowing easier access (to act on all the opportunities opened with 5G expansion, making the IT services market more expandable).

IT Services Market Growth Drivers:

-

Rising Cloud Adoption, Growing Need for Scalability and Cost-Efficiency Drive Enterprises Toward Cloud-Based IT Services

The IT services Market is primarily driven by the increasing adoption of cloud computing and digital transformation. Enterprises are moving more and more from traditional infrastructure-based to cloud-based infrastructures for the sake of being scalable, flexible and cost-effective. This transition is also being driven by the demand for automaton, advanced analytics and secure platforms with explosive growth required across all sectors globally.

-

In April 2025, global enterprises continued shifting workloads to cloud platforms, with adoption levels reaching record highs and a growing share of business applications now hosted in cloud environments compared to the previous year.

IT Services Market Restraint:

-

Shortage of Skilled Professionals, Limited Expertise in Cloud, AI and Cybersecurity Escalates Costs and Delays IT Service Adoption

Lack of skilled professionals; cloud computing, AI, cyber security and DevOps are some of the major factors to hinder IT Services Market. The job market for cyber talents is way overheated, with few who have the knowledge and skillset this country needs, driving labor costs higher and slowing down delivery of projects while increasing job retention issues. This skills gap is preventing firms from embracing new technologies at scale and from scaling IT service delivery optimally.

IT Services Market Opportunity:

-

Expansion in AI & Automation Services Driving Enterprise Efficiency, Accelerating Adoption of Intelligent and ML-Powered IT Solutions

IT Services Market A significant opportunity in the IT services market is growing AI and automation services. Organizations are progressively progressing from pilots and start smalls to operationalize AI at scale in order to automate, improve efficiency, decision-making, and foster better CX. The increasing requirement of intelligent automation among BFSI, healthcare, and retail sectors is further driving the IT vendors to provide AI-based innovative platforms and services.

-

In February 2025, an EY India survey noted that generative AI adoption in the IT industry is boosting productivity, with many firms piloting projects and some already using it in production.

IT Services Market Segmentation Analysis

-

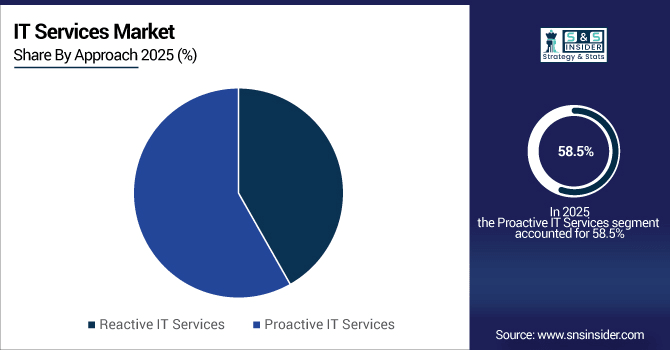

By Approach, Proactive IT Services led the market and represented 58.5% share in 2025; Reactive IT Services is expected to grow at a fastest CAGR of 10.2% from 2026 to 2033.

-

By Type, Operations & Maintenance held the largest share in 2025 at 54.1%, Design & Implementation is projected to grow at the highest CAGR between 2026 and 2033 of 11.4%.

-

By Application, Systems & Network Management dominated with the maximum share of 47.8% in 2025; whilst Security & Compliance Management is expected to be the fastest growing segment at a CAGR of 12.6% throughout the forecast period, i.e., 2026-2033.

-

By Deployment, Cloud-based was the dominant segment with a 61.3% share in 2025 and On-premises will grow at a CAGR of 9.8%-from 2026 to 2033.

-

By End-use, BFSI led the market in 2025 with a share of 28.6% and Healthcare is expected to grow at the fastest CAGR of 13.2% from, 2026 to 2033

By Approach, Proactive IT Services dominate market share, while Reactive IT Services grow fastest

Proactive IT Services were in the front seat of the IT Services Market by 2025 due to its capability of preventing downtime, increasing productivity and maximizing continuous monitoring and support for companies. By contrast, Reactive IT Services are expected to see the most growth as a large number of businesses (especially SMEs) still rely on cost-efficient issue-compliant workarounds.

By Type, Operations & Maintenance lead the segment, while Design & Implementation expand fastest

Services dominated the IT Services Market in 2025, due to the fact that businesses require constant assistance, monitoring and system optimization for their business process to function efficiently and uninterrupted. On the contrary, Design & Implementation is anticipated to register the fastest growth as it is supported by increasing digital transformation projects and growing need for tailor-made IT solutions.

By Application, Systems & Network Management hold majority share, while Security & Compliance Management rise fastest

The end users of Systems & Network Management dominated the market in 2025 since it plays an important role in maintaining seamless IT infrastructure, network connectivity, and performance within organizations. On the other hand, Security & Compliance Management is expected to be the fastest growing market, as a result of the increasing diabetes and stringent government regulations on healthcare across industries.

By Deployment, Cloud-based services drive adoption, while On-premises solutions grow steadily

Cloud was catching on in 2025 as the economic slump had its way, and business everywhere were clamoring for an IT model that was infinitely scalable, low cost, flexible. Hybrid On-premises, however, will still continue growing as certain organizations need in-house infrastructure they can manage and secure.

By End-use, BFSI dominates demand, while Healthcare grows fastest

The BFSI segment held the largest share in 2025, due to extensive utilization of IT services used in digital banking and transactions and compliance with regulatory standards. On the other hand, Healthcare is anticipated to witness the fastest growth as hospitals and providers are aiming to adopt IT systems for better patient record keeping, telehealth, and enhanced health care analytics.

IT Services Market Regional Analysis

North America IT Services Market Insights:

The leading IT Services region is North America, which occupied 36.5% market share in 2025. Tri-County is asserting itself as a driver of market force due to strong IT service provider ecosystem, an evolved digital infrastructure and high take-up of cloud and managed service. A growing usage of AI, big data and cybersecurity solutions as well as significant enterprise IT spending globally are driving the market growth. Additionally, growing spend on digital transformation among BFSI, healthcare and retail industries further validates the position of North America in the global IT services market.

Get Customized Report as Per Your Business Requirement - Enquiry Now

US IT Services Market Insights:

US is the world’s largest market for IT Services with a market share of more than 40% and was followed by Western Europe, Asia Pacific (APAC) excluding Japan and then the other regions. The market is supported by strong international IT service providers which are well established in the country, high cloud scores and fast take-up of technologies such as AI, big data analytics and cybersecurity. Growth in CY20 also driven by rolling out digital transformation projects across BFSI, healthcare and retail.

Asia-Pacific IT Services Market Insights:

Asia-Pacific is growing the fastest and is expected to carry on its growth with a 12.60% CAGR throughout 2026–2033, primarily underpinned by digital transformation advancements in China, India, Japan and South Korea. Growing IT outsourcing, fast cloud adoption and the pivot toward automation and AI-powered services are driving demand. Fast urbanization, government support and investment in the technology infrastructure also adding to the growth momentum has made Asia-Pacific as the most lucrative IT services market across the world. The booming startup culture and increasing presence of international tech players in APAC adds to its reign. Rising need for managed services and hybrid cloud model also drive regional market growth.

China IT Services Market Insights:

China is the largest market in Asia-Pacific for IT services fueled by fast digital transformation, cloud adoption and government-led projects such as “Digital China.” Growth is fueled by strong growth from local IT vendors, increased data center infrastructure and growing enterprise demand for AI and automation. Its investment in cybersecurity, fintech and e-commerce tech serve it as well combined with strong execution to keep its competitive position up.

Europe IT Services Market Insights:

Europe is a leading IT services market with high adoption rates in the UK, Germany, and France where digital transformation initiatives and Industry 4.0 strategies are being emphasized. Growth in the region is supported by growing demand for managed services, cyber security and cloud solutions. Rigorous adherence to GDPR drives NextGen data protection services, and sustained investment in smart cities and IoT bolsters demand. And the fact that Europe is a base for some of the world’s largest IT service providers and technology R&D centers makes it an attractive, mature global market.

Germany IT Services Market Insights:

Germany dominates the IT services market in Europe, owing to its highly developed industrial base and aggressive digitalization drive through the “Industrie 4.0” initiative. The country’s focus on automation, AI implementation and cloud technology at companies in the automotive, manufacturing and finance sectors is driving demand. Strong investments in IT from enterprises and government initiatives will drive fast deployment of advancements.

Middle East & Africa (MEA) and Latin America IT Services Market Insights:

The Middle East & Africa IT services market is burgeoning on the back of aggressive urbanization, escalating digital investments and proliferation of smart city projects sponsored by various governments. Countries such as the UAE and KSA are leading adoption with cloud growth security requirements, large scale digital transformation under “vision 2030”. The deployment of telecom infrastructure and the rise of fintech innovation are pushing IT service adoption up in Africa.

Competitive Landscape IT Services Market Insights:

Accenture is a worldwide computer consulting and integration firm that provides IT services; including digital, technology, media and communications. With a robust consulting heritage, the company collaborates with organizations to work through complex challenges in-process transformation and innovation. Its vast global footprint and big bets on automation and data-driven platforms means that Accenture is a force to be reckoned with in terms of influencing enterprise IT strategies.

-

In July 2025, Accenture expanded its collaboration with Microsoft to roll out generative AI-powered cybersecurity solutions, enhancing threat detection, identity and access management, and security operations for clients like Nationwide.

IBM Corp has a good standing in IT services with hybrid cloud, AI-provided offerings and managed services. Its acquisition of Red Hat further solidifies the leadership in open-source cloud platforms, and IBM Consulting accelerates digital transformation for enterprise. "Increasingly, our clients continue to build upon the resilience of their business operations with flexible, cloud-based models that bring together services from different providers," says IBM General Manager for Automation Dinesh Nirmal.

-

In August-September 2025, IBM made strides in quantum computing, pushing toward a “quantum advantage” with developments such as the Quantum System Two and in-house chip manufacturing, positioning itself at the forefront of next-gen computing.

Tata Consultancy Services (TCS) is one of the world's largest IT service providers, offering consulting services, cloud and AI technologies, and enterprise application management. TCS While TCS is widely known for its outsourcing and digital transformation capabilities, the company serves a whole host of industries ranging from BFSI to retail. That capabilities are supported by its cost-effective global delivery model, innovation hubs across the globe and service automation throughout the enterprise.

-

In April 2025, TCS launched India-specific offerings: Sovereign Secure Cloud, Digi BOLT, and Cyber Defense Suite, aimed at boosting data sovereignty, AI capability, and cybersecurity for public sector and enterprises.

IT Services Market Key Players:

Some of the IT Services Market Companies are:

-

Accenture

-

IBM Corporation

-

Tata Consultancy Services (TCS)

-

Infosys

-

Wipro

-

HCL Tech

-

Capgemini

-

Cognizant

-

SAP SE (IT Consulting & Cloud Services)

-

Deloitte

-

PricewaterhouseCoopers (PwC) Advisory Services

-

Ernst & Young (EY) Advisory Services

-

KPMG IT Advisory

-

Tech Mahindra

-

Oracle IT Services

-

Microsoft Services

-

Fujitsu

-

NTT DATA

-

Atos

-

DXC Technology

| Report Attributes | Details |

|---|---|

| Market Size in 2025 | USD 1.5 Trillion |

| Market Size by 2033 | USD 2.85 Trillion |

| CAGR | CAGR of 8.35 % From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Approach (Reactive IT Services and Proactive IT Services) •By Type (Design & Implementation and Operations & Maintenance) •By Application (Systems & Network Management, Data Management, Application Management, Security & Compliance Management and Others) •By Deployment (On-premises and Cloud) •By End-use (BFSI, Government, Healthcare, Manufacturing, Media & Communications, Retail, IT & Telecom, and Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Accenture, IBM Corporation, Tata Consultancy Services (TCS), Infosys, Wipro, HCL Tech, Capgemini, Cognizant, SAP SE (IT Consulting & Cloud Services), Deloitte, PricewaterhouseCoopers (PwC) Advisory Services, Ernst & Young (EY) Advisory Services, KPMG IT Advisory, Tech Mahindra, Oracle IT Services, Microsoft Services, Fujitsu, NTT DATA, Atos, DXC Technology. |