Digital Oilfield Market Report Scope & Overview:

Get More Information on Digital Oilfield Market - Request Sample Report

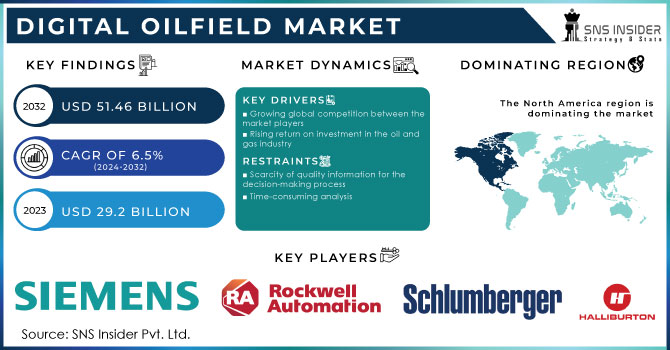

The Digital Oilfield Market size was valued at USD 29.2 billion in 2023 and is expected to grow to USD 51.46 billion by 2032 and grow at a CAGR of 6.5% over the forecast period of 2024-2032.

Digital Oilfield is the integration of developing technologies such as the IoT, mobile connectivity, augmented reality, and the cloud. To maximize the asset performance and value of the gas and oil production life cycle, it integrates people, processes, information, and technology. Digital oilfield help operators to collect, analyze, and react in real time to the information which is related to the oil and gas production in the field.

Digital Oilfields are an important innovation/ digital transformation in the gas and oil industries. The digital oilfield helps to increase the output, reduce the operating cost, and minimize unscheduled well and equipment shutdown by combining the latest digital technology, new innovative processes, and streamlining operations.

Digital Oilfield helps oil and gas companies to increase operational efficiency, data integration, collaboration, optimization of production, workflow automation, and decision support. The software application of digital oilfield shows the behavior of oil or gas field on the computer. For this, workflows are used for automation and clusters for fast and accurate calculation. The oil and gas industry is moving towards Industry 4.0.

Impact of COVID-19

The outbreak of COVID-19 has badly impacted each industry. The Oil and gas industry is one of the severely affected industries by the pandemic. The rapid spread of this coronavirus has forced it to shut down or stop temporarily, which has affected the downstream and upstream operation processes. Before the Coronavirus emergency, the oil and gas companies are already facing problems with an imbalance between demand and supply. But by overcoming this situation, companies come up with new, efficient, and better approaches to supplying their product and services.

Due to the digital transition in the oil and gas industry, they have revamped their business operation very quickly. The digital oilfield market progressed significantly during the period of 2019-2022 with a growth rate of about 17.4%. It shows that the digital oilfield sector is growing rapidly after the pandemic and this outbreak allowed the industry to launch dynamic, forward-thinking, secure, reliable, and diversified systems.

Market Dynamics

Drivers

-

Growing global competition between the market players

-

Rising return on investment in the oil and gas industry

-

Rapidly increasing need for maximizing production potential from mature wells

-

Shifting industries’ focus toward digitalization

The oil and gas industry across the globe is preparing to increase the investment in the digital transformation of the same which can help to cut down their operation cost. Rapidly shifting focus toward the digital transformation of the world helps to maximize the return on investment in the digitalization of the oil and gas industry which drives the market of digital oilfields.

Restrain

-

Scarcity of quality information for the decision-making process

-

Time-consuming analysis

Opportunities

-

Increasing investment by the market players in the digital oilfield market

-

Rapidly developing new technologies and innovations

Challenges

-

Rise in cyber security threats due to digital transformation

The emergence of the digital oilfield has resulted in oil and gas companies relying more heavily on data to maintain their production levels. As these technologies become widespread, the cyber risk for the oil and gas industry has continued to rise.

Impact of Russia-Ukraine War:

The Russian invasion of Ukraine impacted the global oil and gas industry severely which further affected the digital oilfield market. The digital oilfield market has been growing rapidly in recent years, with companies investing heavily in advanced technologies to improve efficiency, reduce costs, and increase production. However, the conflict between Russia and Ukraine has disrupted this growth, causing uncertainty and instability in the market. One of the main ways in which the war has affected the digital oilfield market is through the disruption of supply chains. Many of the key components used in digital oilfield technology are manufactured in Russia or Ukraine, and the conflict has made it difficult for companies to obtain these components. This has led to delays in the implementation of new technologies and has slowed down the pace of innovation in the industry.

Impact of Recession:

The digital oilfield market has been affected significantly due to the recent economic recession. The downturn in the global economy has led to a decrease in demand for oil and gas, resulting in a reduction in exploration and production activities. This has had a direct impact on the digital oilfield market, which relies heavily on these activities. Furthermore, the recession has led to a decrease in investment in the oil and gas industry, which has further impacted the digital oilfield market. Companies are cutting back on their spending, and many are delaying or canceling projects that would have otherwise contributed to the growth of the digital oilfield market.

Key Market segmentation

By Solution

-

Hardware

-

Software & Service

By Processes

-

Reservoir Optimization

-

Drilling Optimization

-

Process Optimization

-

Safety Optimization

-

Others

By Application

-

Onshore

-

Offshore

Regional Analysis

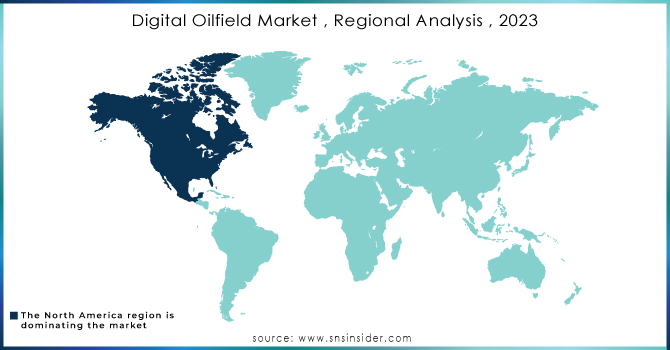

North America region holds the largest market share and dominated the market in 2021 and is anticipated to grow significantly over the forecast period. This is owing to the increasing production of oil and gas. Increasing digitalization, the presence of key market players, and shifting focus toward the benefits of digital oilfields to improve the efficiency across upstream, midstream, and downstream operations are other important factors that boost the growth of the digital oilfield market.

Europe is the second largest growing region of the digital oilfield market which held the largest share in 2020 and now it is projected to show a significant CAGR during the forecast period. This is owing to the enhanced tension in the Russia-Ukraine conflict. UK is growing rapidly towards the deployment of digital oilfield technology over the projected period due to their maturing offshore field.

Need any customization research on Digital Oilfield Market - Enquiry Now

REGIONAL COVERAGE:

-

North America

-

USA

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

The Netherlands

-

Rest of Europe

-

-

Asia-Pacific

-

Japan

-

south Korea

-

China

-

India

-

Australia

-

Rest of Asia-Pacific

-

-

The Middle East & Africa

-

Israel

-

UAE

-

South Africa

-

Rest of the Middle East & Africa

-

-

Latin America

-

Brazil

-

Argentina

-

Rest of Latin America

-

Key Players

The major players are Schlumberger, Halliburton, Rockwell Automation, National Oil Varco, ABB, Siemens, Schneider, Baker Hugh, Weatherford International, Emerson Electric Co., and Infosys, and other key players will be included in the final report.

Recent Development:

-

In May 2022, Halliburton, a prominent U.S. oilfield services company, partnered with Norway's Aker BP to develop an innovative intelligent system that aims to revolutionize field development planning. This collaboration is expected to bring about a new era of efficiency and productivity in the oil and gas industry.

-

In June 2021, Halliburton announced its partnership with Kuwait Oil Company (KOC), a global leader in digital transformation. The collaboration aims to enhance KOC's digital transformation journey by implementing cutting-edge solutions that maximize operational efficiency and increase production.

During ADIPEC 2022, Rockwell Automation presented its cutting-edge solutions and technologies that can aid in the oil and gas industry's transition. Rockwell Automation is a key player in the digitalization transformation, utilizing its Distributed Control System (DCS) to provide a unified automation platform for seamless integration between critical process areas and the rest of the oil and gas facility. This system is anticipated to bring about substantial enhancements in efficiency and productivity.

| Report Attributes | Details |

| Market Size in 2023 | US$ 29.2 Bn |

| Market Size by 2032 | US$ 51.46 Bn |

| CAGR | CAGR of 6.5% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Solution (Hardware, Software & Service, and Data Storage) • By Processes (Reservoir Optimization, Drilling Optimization, Process Optimization, Safety Optimization, and Others) • By Application (Onshore and Offshore) |

| Regional Analysis/Coverage | North America (USA, Canada, Mexico), Europe (Germany, UK, France, Italy, Spain, Netherlands, Rest of Europe), Asia-Pacific (Japan, South Korea, China, India, Australia, Rest of Asia-Pacific), The Middle East & Africa (Israel, UAE, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Schlumberger, Halliburton, Rockwell Automation, National Oil Varco, ABB, Siemens, Schneider, Baker Hugh, Weatherford International, Emerson Electric Co., and Infosys |

| Key Drivers | • Growing global competition between the market players • Rising return on investment in the oil and gas industry |

| Market Opportunities | • Increasing investment by the market players in the digital oilfield market • Rapidly developing new technologies and innovations |