Confidential Computing Market Report Scope & Overview:

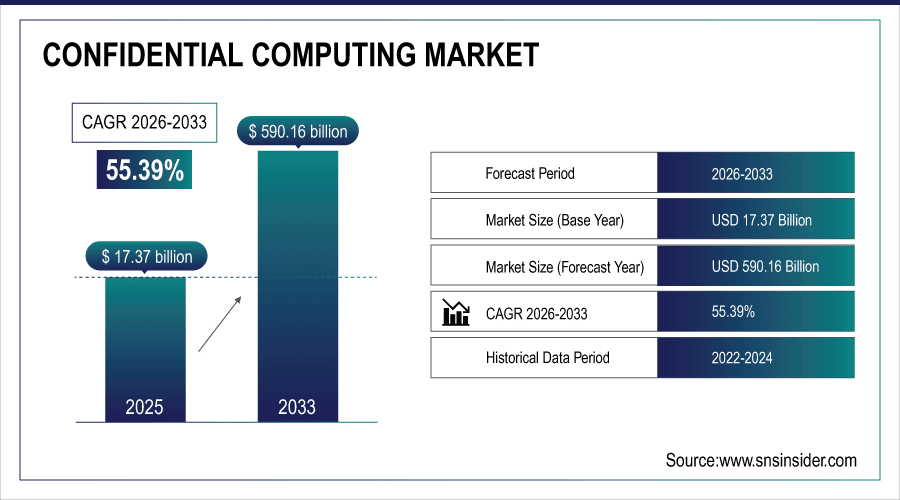

The Global Confidential Computing Market size was valued at USD 17.37 Billion in 2025E. Looking ahead, the market is estimated to reach USD 590.16 Billion by 2033, allowing for a CAGR of 55.39% between 2026-2033.

Increase in awareness of protection of data, stringent regulatory requirements, and high level of security in data and compliance are some of the factors driving the market growth for confidential computing. Cloud adoption and digital transformation are driving increasing demand for secure environments, while sectors such as BFSI, healthcare, and government leverage confidential computing for compliance and secure collaboration. The rise of hardware-based trusted execution environments and growing multi-party computing and AI/ML use cases continue to drive global adoption.

In September 2024, the global Confidential Computing Market reached a multi-billion valuation, driven by strong demand for cloud deployments and rapid growth in software and services. North America led the market, while Asia-Pacific recorded the fastest growth rate.

To Get More Information On Confidential Computing Market - Request Free Sample Report

Market Size and Forecast:

-

Market Size in 2025: USD 17.37 Billion

-

Market Size by 2033: USD 590.16 Billion

-

CAGR: 55.39% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

Confidential Computing Market Trends:

-

The confidential computing market is experiencing rapid growth due to increasing demand for secure data processing and privacy-focused technologies.

-

Cloud-based deployments are leading adoption as hyperscale cloud providers integrate confidential computing into their mainstream offerings.

-

Artificial Intelligence is increasingly integrated, enhancing data protection and enabling secure AI workloads through secure enclaves and advanced encryption.

-

Edge computing drives demand for confidential computing by enabling secure processing of sensitive data closer to its source.

-

Stricter data privacy regulations are accelerating adoption, especially in sectors like banking, healthcare, and public services.

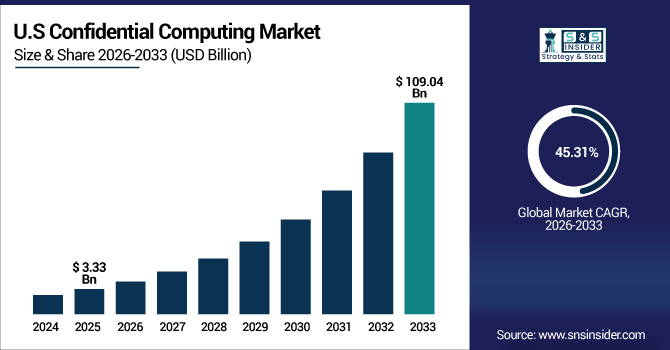

The U.S. Confidential Computing Market was valued at 3.33 USD billion in 2025E and is projected to reach USD 109.04 billion by 2033, growing at a CAGR of 45.31%. Growth is driven by advanced cloud adoption, strict data privacy regulations, and strong demand from BFSI, healthcare, and government. Leading providers like Microsoft, AWS, and Google, along with rising AI use, further accelerate adoption as cyber threats intensify.

Confidential Computing Market Growth Drivers:

-

Rising Data Privacy and Security Concerns, Increasing Cyberattacks and Risks Associated with Data-In-Use Push Organizations Toward Stronger Protection

Confidential computing market: Drivers and Restraints The major factor driving the confidential computing market is the need for protecting and preserving the confidentiality of data. As cyber threats continue to evolve, protecting sensitive data at rest, in motion, and in use becomes increasingly difficult for organizations. Confidential computing brings this closer by protecting data in use through the use of secure enclaves and encryption, reducing exposure to breaches, insider risks, and unauthorized access and providing the assurance that data is in compliance with global data protection regulations.

-

In August 2025, Check Point’s External Risk Management reported a 160% jump in compromised credentials compared to the previous year, revealing how credential theft remains a major vector for attackers accessing data in use.

Confidential Computing Market Restraint:

-

High Implementation Costs Setting Up Confidential Computing Infrastructure (Specialized Hardware, Tees, Integration) Can Be Expensive, Limiting Adoption for Smes.

One of the key challenges hindering the confidential computing market is the expense associated with implementation and complexities related to the same. The implementation of confidential computing involves special hardware, like TEEs (trusted execution environments), and integration into existing IT requires expertise. That gets expensive for smaller and even midsize businesses, which has slowed adoption despite the clear security benefits. Many organizations are reluctant to invest in this next-level of security because there are no easy, low-cost approaches that can be quickly and easily deployed.

Confidential Computing Market Opportunity:

-

AI And Machine Learning Security, Securing Sensitive Training Datasets and Proprietary AI Models During Processing Is a Fast-Growing Opportunity.

One of the biggest opportunities for the confidential computing market is to secure AI and machine learning workloads. By keeping training datasets sensitive and models proprietary while being used, confidential computing provides privacy, compliance and even benefits from competitive advantage to help train workloads that are sensitive across healthcare, finance office s AL, and government use cases (government need for more security).

-

In March 2025, a Hidden Layer report revealed that 74% of organizations acknowledged experiencing an AI-related security breach during the previous year up significantly from 67% underscoring rising vulnerabilities in model protection.

Confidential Computing Market Segmentation Analysis:

-

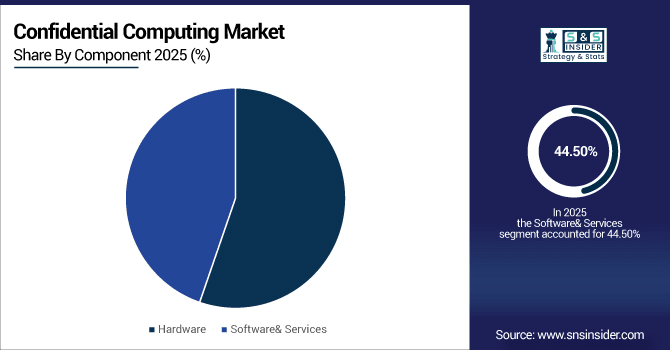

By Component: Software & Services dominated the Confidential Computing Market with a 44.50% market share by 2025, and Hardware is projected to be the fastest-growing segment, growing at a CAGR of 67.10%.

-

By Deployment Cloud was the leading segment in the Confidential Computing Device Market in 2025 accounting for 55.20% of the total share value and is expected to lead in the forecast period 2026-2033 with an estimated CAGR of 68.40%.

-

By Enterprise Size: In terms of enterprises, Large Enterprises drove the Confidential Computing Market with around 85% share in 2025 and is expected to be the fastest-growing segment during the forecast period 2026-2033 with a CAGR of 25%.

-

By Application: Privacy & Security held the largest share of the market in 2025, and IoT & Edge is expected to register the highest CAGR of 40%.

-

By Industry: BFSI dominated the Confidential Computing Market by 47% in 2025, and Healthcare & Life Sciences are expected to grow at a highest CAGR of 35% during the forecast period.

By Component, Software & Services lead market, while Hardware growing Fastest

Software and services dominate the market, as they are essential for developing, deploying, and managing confidential computing systems. These solutions help organizations securely adopt the technology and manage sensitive data efficiently. Hardware segment is growing rapidly due to rising demand for secure processing capabilities, especially in edge scenarios, enabling real-time data protection and integration with advanced encryption technologies for enterprise and cloud environments.

By Deployment, Cloud Leads market, while Edge/On-premise growing Fastest

Cloud deployments lead the market due to flexibility, scalability, and simplified management of confidential computing environments. They allow organizations to securely process data without heavy infrastructure investment. Edge/On-premise deployments are growing fast as organizations seek data sovereignty, low-latency processing, and enhanced security. Edge computing supports IoT applications and sensitive data handling close to the source, improving privacy, performance, and compliance with regional regulations.

By Enterprise Type, Large Enterprises Lead market, while SMEs growing Fastest

Large enterprises dominate market in 2025 due to complex data processing needs, regulatory compliance requirements, and mature IT infrastructure. Confidential computing helps them protect sensitive business data and meet compliance mandates effectively. SMEs are growing fast due to the availability of cost-effective solutions and growing awareness of cybersecurity threats. This enables smaller organizations to securely manage sensitive information and scale operations without compromising data privacy or security standards.

By Application, Privacy & Security Leads market, while IoT & Edge growing Fastest

Privacy and security applications lead the market due to largest drivers of confidential computing, safeguarding sensitive information during processing. Organizations rely on these solutions to protect against unauthorized access and cyber threats. IoT and edge applications are growing rapidly as confidential computing enables secure real-time processing of distributed data. This ensures compliance with data protection regulations, supports latency-sensitive operations, and facilitates safe handling of data generated from connected devices and edge networks.

By Industry, BFSI Dominates market, while Healthcare & Life Sciences growing Fastest

The BFSI sector leads the market due to the high sensitivity of financial data and strict regulatory requirements, necessitating robust confidential computing solutions. Confidential computing ensures data privacy, regulatory adherence, and safe handling of sensitive information across all critical industries. Healthcare and life sciences are experiencing the fastest growth as organizations focus on protecting patient data, complying with healthcare regulations, and enabling secure data sharing for research, collaboration, and innovation.

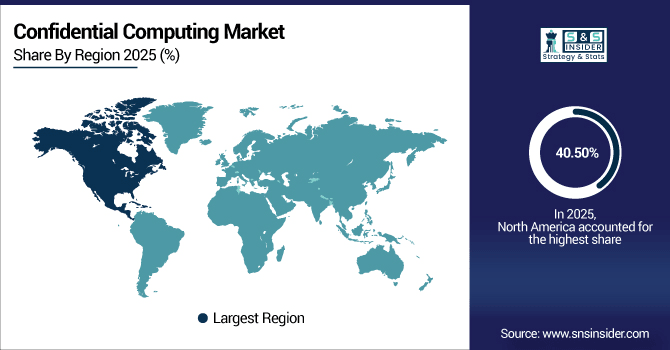

Confidential Computing Market Regional Analysis

North America Confidential Computing Market Insights:

North America is the largest region of Confidential Computing, with a market share of 40.50% in 2025. The region is leading as a result of its advanced digital infrastructure, early implementation of cloud platforms and host to the technology behemoths such as Microsoft, Google, IBM and Intel. BFSI, health, and government are fuelling demand, and tight regulatory frameworks like HIPAA and financial compliance also drive adoption. Continual investment in AI, edge and cybersecurity further boosts North America’s global leadership.

Get Customized Report as Per Your Business Requirement - Enquiry Now

US Confidential Computing Market Insights:

The North America Confidential Computing Market is led by the US owing to the presence of cloud majors including Microsoft, Google and AWS, which are making significant investments in confidential computing infrastructure. Rapid adoption of cutting-edge security technology and strict guidelines including HIPAA and financial compliance laws drive demand. Moreover, sensitive data such as BFSI, healthcare, and government sector use confidential computing for securing such workloads, which has contributed to US leading the largest market share in the region.

Asia-Pacific Confidential Computing Market Insights:

Asia-Pacific is the fastest growing Video Streaming Market, with a CAGR of over 46.65%, due to the rapid internet penetration, low price smartphones and a digital-savvy young population. Increasing middle class population with greater disposable income will drive the low price streaming platforms. Local and Indian-language content caters to a broader user-base while government-led digital infrastructure projects continue to drive adoption of the app. Add to this growing smartphone livestream uptakes, significant investments from both international and domestic players, and alliances between telcos and streaming platforms and it has the region on a media consumption and market development fast track.

China Confidential Computing Market Insights:

APAC Confidential Computing Market in China holds the largest market share due to factors such as it's rapid digitalization, and take up of government policies for data localization and Cyber security. Heavy investments in A.I., cloud infrastructure and semiconductors shore up its technological lead. Increasing implementation in BFSI, Healthcare and Government sectors drives demand, making China the leading player and a significant contributor to market growth in the region.

Europe Confidential Computing Market Insights:

Confidential Computing Market in Europe has a strong growth opportunity with the presence of strict data protection laws such as GDPR and increasing demand for sovereign clouds. The UK, Germany, and France have emerged as early adopters, especially in the BFSI, healthcare, and government industries. Rising attention to cross-border data security and linkages with global cloud providers also increase Europe’s dominance in the market.

German Confidential Computing Market Insights:

Europe’s Confidential Computing Market is primarily dominated by Germany, which is mainly owed to the nation’s strict GDPR compliance that require more advanced data protection. Organizations from automotive to manufacturing to BFSI are looking more and more toward confidential computing to protect their most sensitive information. State-led digitalization projects, along with partnerships with international cloud vendors, are also facilitating the adoption and positioning Germany as a key growth stimulant in the European market.

Middle East & Africa (MEA) and Latin America Confidential Computing Market Insights:

Confidential Computing Market in MEA and Latin America is expanding gradually due to the digital transformation, growing cybersecurity threats, and increasing number of cloud users. MEA: The UAE and Saudi Arabia lead the adoption in MEA, particularly in BFSI, oil & gas, and government, backed by national data protection programs. In Latin America, Brazil and Mexico are the powerhouses with demand emanating from BFSI and telecom as cloud partnerships with global players gain traction and launches pick up the pace, propelling its regional market growth.

Competitive Landscape Confidential Computing Market Insights:

Microsoft is a pioneer in confidential computing with its Azure Confidential Computing platform, offering secure enclaves powered by Intel SGX and AMD SEV. The platform supports enterprise-grade security, compliance-focused solutions, and seamless integration with AI and cloud services.

-

In August 2025, Microsoft launched the Azure Integrated HSM security chip across all Azure servers, significantly enhancing cryptographic performance, reducing latency, and enabling enterprises to run sensitive workloads more efficiently and securely while strengthening compliance and data protection measures across cloud applications.

Google Cloud leverages AMD SEV technology in Confidential VMs and Confidential GKE Nodes to protect data-in-use, supporting privacy, compliance, and secure AI/ML workloads. Its collaboration with open-source communities and robust cloud ecosystem strengthens global confidential computing adoption.

-

In October 2024, Google Cloud expanded its confidential computing hardware by launching Confidential VMs on C3D (AMD SEV) and C3 (Intel TDX) machines. It also introduced signed UEFI binaries for enhanced attestation, ensuring improved security and compliance for sensitive enterprise workloads.

AWS drives confidential computing innovation through Nitro Enclaves, offering isolated compute environments for sensitive data processing. Its global infrastructure, integration with AI/ML services, and strong enterprise adoption make AWS a major leader in confidential computing solutions.

-

In November 2024, Fortanix integrated its DSM Accelerator with AWS Nitro Enclaves, improving application performance without compromising security. This advancement allows enterprises to run secure workloads with lower latency and enhanced cryptographic efficiency across AWS’s global infrastructure.

Confidential Computing Market Key Players:

Some of the Confidential Computing Market Companies are:

-

Microsoft

-

Google Cloud

-

Amazon Web Services (AWS)

-

IBM

-

Intel Corporation

-

AMD (Advanced Micro Devices)

-

Arm Holdings

-

NVIDIA

-

Oracle

-

Alibaba Cloud

-

Huawei Cloud

-

Fortanix

-

R3

-

Cosmian

-

Anjuna Security

-

Accenture

-

Thales Group

-

VMware

-

Edgeless Systems

-

PhoenixNAP

| Report Attributes | Details |

|---|---|

| Market Size in 2025 | USD 17.37 Billion |

| Market Size by 2033 | USD 590.16 Billion |

| CAGR | CAGR of 55.39% From 2026 to 2033 |

| Base Year | 2025 |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments |

• By Component (Hardware and Software & Services) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Microsoft, Google Cloud, Amazon Web Services (AWS), IBM, Intel Corporation, AMD (Advanced Micro Devices), Arm Holdings, NVIDIA, Oracle, Alibaba Cloud, Huawei Cloud, Fortanix, R3, Cosmian, Anjuna Security, Accenture, Thales Group, VMware, Edgeless Systems, PhoenixNAP. |