Online Recruitment Market Report Scope & Overview:

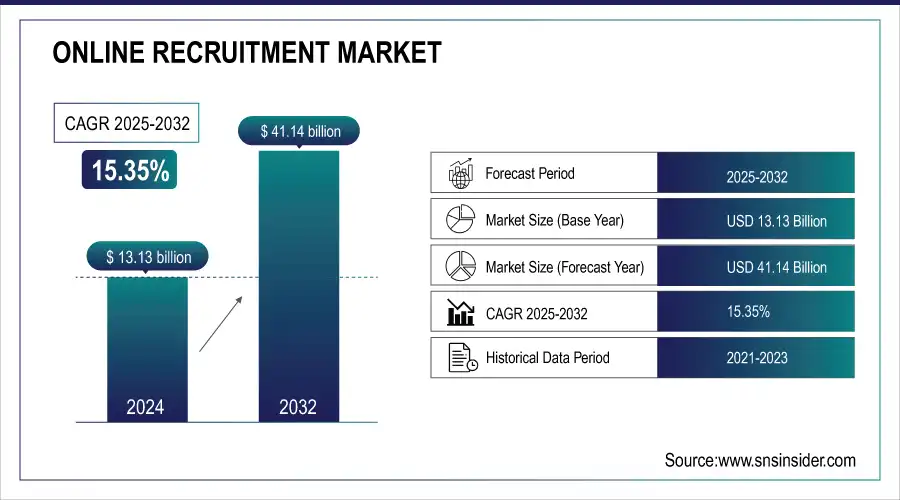

Online Recruitment Market size was valued at USD 15.14 billion in 2025 and is expected to reach USD 63.16 billion by 2035, at a CAGR of 15.35%.

Get more information on Online Recruitment Market - Request Sample Report

The increased number of job openings allows for online recruitment platforms to streamline processes like resume management solutions and employee screening tools. This demand is driven by a move to outsource manual recruiting processes to online platforms. Furthermore, the demand for smartphones is increasing which in turn has led to an upsurge in mobile-based recruitment solutions and this supports market growth.

Market Size and Forecast: 2025

-

Market Size in 2025 USD 15.14 Billion

-

Market Size by 2035 USD 63.16 Billion

-

CAGR of 15.35% From 2026 to 2035

-

Base Year 2025

-

Forecast Period 2026-2035

-

Historical Data 2022-2024

Online Recruitment Market Trends:

-

Increasing adoption of AI & Machine Learning in recruitment platforms for candidate screening, resume parsing, and interview scheduling.

-

Rapid growth of mobile-based recruitment solutions due to smartphone penetration and rising mobile job applications.

-

Expansion of cloud-based recruitment software, enabling scalability, remote accessibility, and integration with HR systems.

-

Integration of social media platforms such as LinkedIn, Facebook, and Instagram for targeted job advertising.

-

Growing demand for video interviewing & chatbot solutions to streamline remote hiring processes.

-

Rising focus on data-driven recruitment & analytics, supporting better decision-making and diversity hiring.

-

Digital transformation across industries driving outsourcing of traditional recruitment processes to online platforms.

Online Recruitment Market Growth Drivers

-

Online recruitment enhances efficiency and reduces costs by streamlining candidate search, application processing, and communication.

The global online recruitment market has been supported by the increasing penetration of the internet which allows employers and job seekers to access digital platforms that offer jobs. According to the International Telecommunication Union, only 65% of people around the world have access to the internet as per its data until the year 2024. This wider access to the internet has changed how we job-hunt, making it possible for candidates from anywhere in the world to compete on a level playing field with employers all over. Just take the United States where the Pew Research Center claims internet penetration is already at almost 92%. This was a very high rate of connection, which meant that people could now connect (over the phone) to a given list of applications running on some important online recruitment platforms like LinkedIn, Indeed, and Glassdoor. Online recruitment is worldwide, with LinkedIn itself having over 900 million users globally.

Online Recruitment Market Restraints:

-

The ease of access to online platforms increases competition among companies for top talent, making it challenging to attract the best candidates.

The Issues Related to data privacy act as major limitation in the market. the increasing volume of personal and sensitive data being shared on recruitment platforms, ensuring data protection is important. As per a survey by the International Association for Privacy Professionals (IAPP), 78 % of the companies have increased data breach and risk management concerns, and compliance with laws like GDPR (General Data Protection Regulation) & CCPA (Personal Privacy Act). This makes these concerns even more prevalent in recruitment, where candidate information such as resumes and contact details are especially sensitive. This includes additional costs associated with acquiring appropriate cybersecurity measures and more responsibilities in navigating the regulatory landscape for data protection, complicating company management of online recruitment processes.

Online Recruitment Market Segment Analysis:

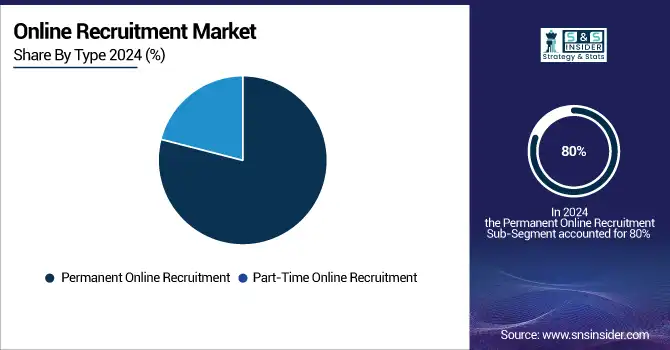

By Type, Permanent Online Recruitment Leads Market While Part-Time Online Recruitment Set for Fastest Growth

Permanent Online Recruitment held the largest revenue share of the market over 80% in 2023. Driven through several factors that comprehensively address the current requirements in a digital economy. Digital platforms have made the recruitment process more efficient and accessible, meeting the growing demand for permanent employees as organizations seek long-term stability and strategic alignment in their workforce. Online recruitment tools are getting smarter with their sophisticated filtering and matching process which ultimately improves the quality of hires while reduced hiring costs. Data analytics and advanced filtering algorithms ensure that companies utilizing these platforms to make permanent hires have access to a more extensive pool of talent and are well-placed to create better matches for their respective roles. All of these are designed to help employers determine if the candidate has enough experience and skills, but also align well with company culture/ values. Additionally, the security offered by permanent positions is highly valued by employees, attracting more qualified candidates in today’s job market.

By Technology, Video Interview Platforms Lead Market While Chatbots Poised for Fastest Growth

The process of recruitment is getting digital from a traditional few years back. Corporations are witnessing massive growth, hiring a thousand candidates each day, and to organize this number of candidates have started using video interview technology with AI support. It simplifies the process of recruiting without the need to visit places that are not necessary, therefore saving time for job seekers and a great relief for companies.

The Chatbot segment is projected to grow with the significant annual growth rate during the forecast period, a result of growing AI based technology adoption by business. They improve a candidate's journey, make responding faster, and give advice on application. They also aid in people analytics providing insights into candidate behaviour and preferences. These technologies are changing the game on recruiting, and it is much faster to streamline all of those as part of technology progression.

By Application, IT Sector Dominates Online Recruitment Market While Other Industries Rapidly Expanding

The IT sector was the largest segment in online recruitment industry, which contributed over 25% of market share revenue on 2023. These initiatives have surged the demand for IT professionals in various industries, consequently resulted into a growing leadership footprint. Companies are using advanced technologies like artificial intelligence, machine learning, and cloud computing combined with their processes, and the need for qualified IT staff to manage or implement said solutions has risen sharply. IT sector has become one of the most significant industries in the online recruitment industry. The global movement to work from anywhere practise and increasing focus on cybersecurity as firms technologically transform corporate laboratory environments in addition has built upon this dominance. The IT sector, in which many positions need special technical knowledge or skills especially benefits from online recruitment solutions. The roles are matched with job requirements through these platforms using advanced algorithms and data analytics.

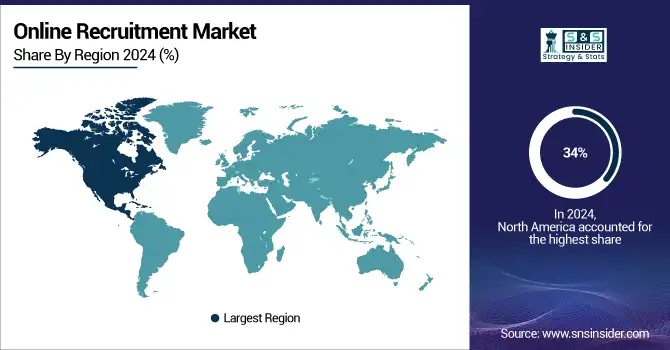

Online Recruitment Market Regional Analysis:

North America Online Recruitment Market Insights

North America held the largest share of more than 34% in the online recruitment market in 2025. This is further driven by a well-digitized corporate sector and the wide adoption of advanced technology companies. Both the U.S. and Canada are early adopters of new technology, such as sophisticated recruitment software featuring AI (artificial intelligence) and ML (machine learning), to help simplify recruiting tasks. In the most recent data, online recruiting platforms are used to some extent by around 80%-90% of U.S. companies. These innovations help an organisation in bridging the gap between their potential candidates and job openings, making recruitment a more responsive process while saving time & cost positioning North America as a key market for online recruitment solutions. North America benefits from a highly skilled workforce and a culture that embraces job mobility and career changes, driving the demand for online recruitment services. The region's strong economic environment and the presence of numerous global corporations necessitate a dynamic recruitment market that can adapt to rapidly changing employment needs and job specifications.

Need any customization research on Online Recruitment Market - Enquiry Now

Asia-Pacific Online Recruitment Market Insights

The APAC region, driven by factors that are unique and distinguishable in shaping your recruitment strategy for success. The online recruitment market in Asia Pacific is witnessing growth due to the increasing preference for automating talent acquisition and leading HR management solution providers extending their reach across emerging economies amidst the technological advancements shaping up an innovative business environment. There is a high global adoption of online recruiting as well, with many developed countries huge number of companies using the online platform.

Europe Online Recruitment Market Insights

Europe accounted for around 28% market share in 2025, driven by widespread adoption of online recruitment in the U.K., Germany, and France. Stringent labor regulations and a focus on transparent hiring practices have encouraged employers to adopt structured online solutions. Germany, with its strong industrial and technology workforce demand, represents one of the largest markets, while the U.K. emphasizes flexible workforces and mobile recruiting adoption. Companies like Adecco, Randstad, and Hays maintain strong positions in the region.

Latin America (LATAM) and Middle East & Africa (MEA) Online Recruitment Market Insights

Latin America (LATAM) accounted for nearly 7% of the market in 2025, led by Brazil and Mexico. The region is witnessing growing adoption of online recruitment due to expanding internet access, increasing mobile penetration, and corporate digital transformation. Government initiatives to support digital job creation also boost platform adoption.

The Middle East & Africa (MEA) held around 5% market share in 2025. The market is growing steadily due to investments in digital HR solutions in the UAE, Saudi Arabia, and South Africa. The rise of smart cities, economic diversification programs, and demand for international workforce mobility are key contributors. However, lower internet penetration compared to other regions poses a challenge to growth.

Online Recruitment Market Key Players:

-

LinkedIn Corporation (Microsoft)

-

Indeed (Recruit Holdings Co., Ltd.)

-

Monster Worldwide, Inc.

-

ZipRecruiter

-

CareerBuilder, LLC

-

Hays plc

-

Randstad Holding N.V.

-

Adecco Group

-

Robert Half International Inc.

-

Korn Ferry International

-

Upwork Inc.

-

Fiverr International Ltd.

-

Jobvite, Inc.

-

Workday, Inc.

-

BambooHR

-

iCIMS, Inc.

-

SmartRecruiters

-

SimplyHired

Competitive Landscape for Online Recruitment Market:

LinkedIn is the world’s largest professional networking platform with over 900 million users globally. It provides advanced online recruitment tools, including LinkedIn Recruiter and Talent Hub, offering data-driven insights into candidate availability, skills, and market trends.

-

In 2023, LinkedIn launched Talent Hub, a platform offering real-time insights into talent pools and labor market dynamics, improving recruiters’ ability to make informed hiring decisions.

Indeed is a global leader in job search and recruitment services, providing employers with direct job postings and candidate database access. The platform dominates in the U.S. and continues to expand internationally.

-

In 2023, Indeed introduced enhanced AI-powered job matching features, improving alignment between job descriptions and candidate resumes to increase recruiter efficiency.

Glassdoor specializes in employer branding and recruitment, enabling companies to showcase culture, benefits, and employee reviews while connecting job seekers with openings.

-

In 2023, Glassdoor expanded its integration with Indeed, providing joint employer branding solutions and streamlining job advertising across both platforms.

|

Report Attributes |

Details |

| Market Size in 2025 | USD 15.14 Billion |

| Market Size by 2035 | USD 63.16 Billion |

| CAGR | CAGR of 15.35% From 2026 to 2035 |

| Base Year | 2025 |

| Forecast Period | 2026-2035 |

| Historical Data | 2022-2024 |

|

Report Scope & Coverage |

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

|

Key Segments |

• By Type (Permanent Online Recruitment, Part-Time Online Recruitment) • By Job Type (Secretarial or Clerical, Accounting and Financial, Computing, Technical, and Engineering, Professional or Managerial, Medical, Hotel or Catering, Sales or Marketing, Other Industrial or Blue Collar) |

|

Regional Analysis/Coverage |

North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

|

Company Profiles |

LinkedIn Corporation (Microsoft), Indeed (Recruit Holdings Co., Ltd.), Glassdoor, Monster Worldwide, Inc., ZipRecruiter, CareerBuilder, LLC, Hays plc, Randstad Holding N.V., Adecco Group, Robert Half International Inc., Korn Ferry International, Allegis Group, Upwork Inc., Fiverr International Ltd., Jobvite, Inc., Workday, Inc., BambooHR, iCIMS, Inc., SmartRecruiters, SimplyHired |