Robotic Process Automation in BFSI Market Report Scope & Overview:

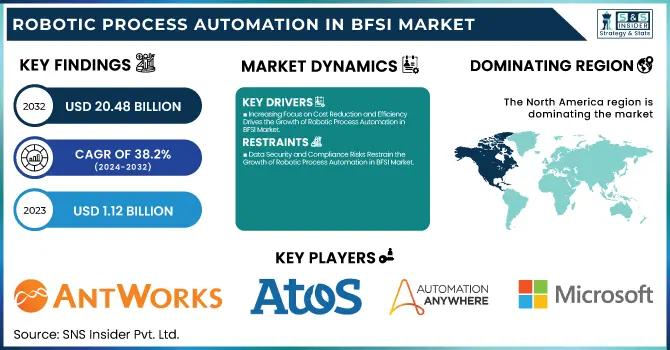

The Robotic Process Automation in BFSI Market Size was valued at USD 1.12 Billion in 2023 and is expected to reach USD 20.48 Billion by 2032 and grow at a CAGR of 38.2% over the forecast period 2024-2032.

To Get more information on Robotic Process Automation in BFSI Market - Request Free Sample Report

The Robotic Process Automation (RPA) in BFSI Market is growing rapidly due to increasing demand for efficiency, cost savings, and enhanced customer experience. Financial institutions use RPA for automating tasks like data entry, transaction processing, fraud detection, and compliance checks, reducing errors and improving productivity. AI and machine learning integration further enhance automation, enabling intelligent decision-making. Cloud-based RPA solutions are expanding, offering scalability. North America and Europe lead the market, while Asia-Pacific sees rapid growth. Key players such as UiPath, Blue Prism, and Automation Anywhere are driving innovation, making BFSI operations more efficient, compliant, and customer-centric.

Robotic Process Automation in BFSI Market Dynamics

Key Drivers:

-

Increasing Focus on Cost Reduction and Efficiency Drives the Growth of Robotic Process Automation in BFSI Market

The BFSI sector is rapidly adopting Robotic Process Automation (RPA) to streamline operations, minimize costs, and enhance productivity. Financial institutions are automating repetitive, rule-based tasks like data entry, transaction processing, fraud detection, and compliance management, significantly reducing operational expenses while improving accuracy and efficiency. The increasing pressure to optimize workflows and reduce human errors is fueling the demand for RPA solutions.

Additionally, RPA helps banks and insurance firms enhance customer experience by enabling faster service delivery and 24/7 support through automation. With growing regulatory requirements, automation ensures compliance by maintaining accurate audit trails and reducing risks. The integration of artificial intelligence (AI) and machine learning (ML) with RPA is further transforming BFSI operations, making processes smarter and more efficient. As financial institutions continue to prioritize digital transformation, RPA adoption is expected to surge, driving overall market growth in the coming years.

Restrain:

-

Data Security and Compliance Risks Restrain the Growth of Robotic Process Automation in BFSI Market

Despite the advantages of Robotic Process Automation (RPA) in BFSI, concerns regarding data security and regulatory compliance pose significant challenges. Financial institutions deal with vast amounts of sensitive customer data, making them prime targets for cyber threats and data breaches. Implementing RPA requires access to critical information, increasing the risk of security vulnerabilities if not properly managed.

Additionally, BFSI firms must comply with stringent regulations such as GDPR, HIPAA, and PCI DSS, which require strict data protection measures. Any failure in compliance can result in legal consequences and reputational damage. Organizations also face challenges in ensuring that RPA bots follow regulatory frameworks consistently. Without robust governance and monitoring mechanisms, automated processes may lead to non-compliance issues. To mitigate these risks, BFSI firms must implement strong cybersecurity frameworks, encryption technologies, and periodic compliance audits to ensure secure and regulatory-compliant automation, which can be a costly and complex process.

Opportunities:

-

Growing Adoption of AI-Powered RPA Solutions Presents Lucrative Opportunities in Robotic Process Automation in BFSI Market

The integration of artificial intelligence (AI) and machine learning (ML) with RPA is revolutionizing automation in the BFSI sector, offering new growth opportunities. Unlike traditional RPA, AI-powered automation enables intelligent decision-making, self-learning capabilities, and predictive analytics, allowing financial institutions to automate more complex processes. AI-driven RPA can handle unstructured data, understand customer behavior, and improve fraud detection mechanisms, significantly enhancing operational efficiency.

Furthermore, cognitive automation helps in automating tasks like loan approvals, underwriting, and investment portfolio management with greater accuracy. Many banks and insurance companies are leveraging natural language processing (NLP) and chatbots to improve customer interactions and automate support services. As BFSI firms continue their digital transformation journey, the demand for AI-enhanced RPA solutions is expected to rise. This presents a significant opportunity for vendors to develop more advanced automation tools that cater to the evolving needs of the financial sector.

Challenges:

-

Integration Challenges with Legacy Systems Create Hurdles in the Adoption of Robotic Process Automation in BFSI Market

One of the biggest challenges in implementing Robotic Process Automation (RPA) in BFSI is integrating automation with existing legacy systems. Many financial institutions still rely on outdated core banking and insurance platforms, which were not designed for seamless automation. Integrating RPA with these traditional systems often requires additional middleware, APIs, or custom development, making deployment complex and costly.

Additionally, legacy systems may have compatibility issues with modern automation tools, leading to operational inefficiencies. Banks and insurance firms also face difficulties in scaling RPA solutions across multiple departments due to fragmented IT infrastructure. Moreover, employees may require extensive training to manage and optimize RPA workflows, further delaying implementation. Without a well-structured digital transformation strategy, organizations may struggle to achieve the full potential of RPA. To overcome these challenges, BFSI firms must invest in modern IT architectures, cloud-based solutions, and strong IT governance frameworks to ensure smooth RPA integration.

Robotic Process Automation in BFSI Market Segments Analysis

By Type

The Services segment held the largest revenue share of 64% in 2023 within the Robotic Process Automation in the BFSI Market, driven by the increasing demand for consulting, implementation, and training services. BFSI firms are actively seeking RPA service providers to streamline automation deployment, optimize workflows, and ensure seamless integration with existing infrastructure. Leading companies such as IBM, UiPath, and Pegasystems have expanded their service offerings to support financial institutions in automation strategy development.

In 2023, IBM launched enhanced RPA consulting services under its Cloud Pak for Business Automation, helping banks automate complex processes like fraud detection and loan approvals. Similarly, UiPath expanded its professional services division, focusing on hyper-automation solutions tailored for BFSI firms.

The Software segment within the Robotic Process Automation (RPA) in BFSI Market is witnessing the highest CAGR of 39.19% during the forecast period. This growth is fueled by increasing investments in advanced AI-powered RPA platforms, enabling financial institutions to automate decision-making, customer service, and compliance management.

The rapid shift towards cloud-based and hybrid RPA solutions is enabling financial institutions to reduce infrastructure costs while improving process efficiency. Additionally, low-code/no-code RPA platforms are gaining traction, allowing BFSI firms to deploy automation without extensive IT dependencies. As digital transformation accelerates across the BFSI sector, demand for advanced automation software will continue to surge, positioning the software segment as the fastest-growing area within the market.

By Organization

The large enterprises segment accounted for the highest revenue share of 68% in 2023 in the Robotic Process Automation (RPA) in BFSI Market, driven by increased investments in intelligent automation solutions to enhance operational efficiency. Large financial institutions, including banks, insurance firms, and investment companies, are leveraging RPA to automate high-volume, rule-based processes such as fraud detection, risk assessment, and compliance reporting.

Large enterprises prioritize scalability, security, and governance, leading to a strong demand for cloud-based RPA solutions integrated with AI and analytics. The increasing need for end-to-end automation across global financial institutions is fueling demand for enterprise-grade RPA platforms with advanced cognitive automation features. Additionally, large enterprises face stringent compliance requirements, making audit-ready RPA solutions essential for risk mitigation.

The SME segment is witnessing the highest Compound Annual Growth Rate (CAGR) in the Robotic Process Automation in the BFSI Market, fueled by the increasing adoption of cost-effective, cloud-based automation solutions. Small and medium-sized financial institutions, including regional banks, credit unions, and fintech startups, are embracing RPA to enhance productivity, reduce operational costs, and improve customer service.

Additionally, WorkFusion launched its AI-powered "Automation Express" platform, designed to help smaller financial firms automate compliance and document processing at a lower cost. The shift towards subscription-based and pay-as-you-go RPA models has made automation more accessible to SMEs, eliminating the need for heavy upfront investments. SMEs are increasingly adopting attended automation to support front-office operations, such as customer inquiries and loan processing.

By Application

The Banking segment accounted for the largest revenue share of 58% in 2023 in the Robotic Process Automation (RPA) in BFSI Market, driven by the increasing need for automation in core banking operations such as fraud detection, transaction processing, and compliance management. With rising digital banking adoption, banks are deploying RPA to streamline customer onboarding, loan approvals, and credit risk analysis. Banks face immense pressure to improve operational efficiency while adhering to stringent regulatory requirements, making compliance-focused RPA solutions a priority. The growing adoption of cloud-based RPA allows banks to scale automation securely across multiple branches.

The financial services & insurance segment is witnessing the highest Compound Annual Growth Rate (CAGR) in the Robotic Process Automation (RPA) in BFSI Market, driven by increasing automation in claims processing, risk management, and regulatory compliance. Insurance firms and financial service providers are implementing RPA to enhance customer service, improve fraud prevention, and streamline underwriting processes.

The rise of digital-only financial services and insurtech companies is further driving demand for automation solutions that reduce operational costs while enhancing process accuracy. The adoption of cognitive automation is also accelerating, allowing insurers to analyze unstructured data from claims documents and customer interactions to make faster, data-driven decisions.

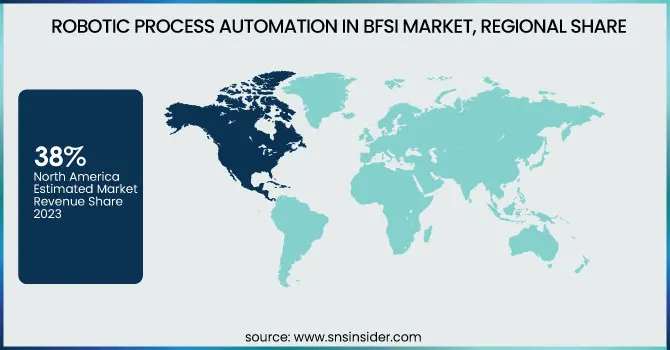

Regional Analysis

North America held the largest market share of over 38% in 2023 in the Robotic Process Automation (RPA) in BFSI Market, driven by the strong presence of leading financial institutions, technological advancements, and high adoption of automation solutions. Major banks and insurance companies in the U.S. and Canada are investing heavily in RPA to enhance operational efficiency, regulatory compliance, and customer experience.

For instance, JPMorgan Chase has implemented AI-powered RPA solutions to automate loan processing and fraud detection, reducing manual workloads. Similarly, Bank of America has deployed RPA for customer service automation and risk assessment, improving turnaround times.

Moreover, the increasing demand for cloud-based RPA platforms and AI-powered automation is accelerating adoption across North America's BFSI sector. With strict regulatory frameworks like the Dodd-Frank Act and GDPR, financial institutions are relying on compliance-focused automation to ensure accuracy and reduce operational risks, further strengthening the region’s dominance in the RPA market.

The Asia-Pacific region is experiencing the highest CAGR of over 40% in the Robotic Process Automation in BFSI Market, driven by rapid digital transformation, rising fintech adoption, and increasing automation investments in emerging economies. Countries such as China, India, Japan, and Australia are witnessing a surge in RPA adoption as banks and insurance firms automate processes like KYC (Know Your Customer), fraud detection, and claims processing.

The growing number of fintech startups and neobanks in the region is further fueling demand for low-cost, scalable automation solutions. Additionally, governments in countries like Singapore and South Korea are promoting digital banking initiatives, leading to increased RPA deployment. With the expansion of cloud-based RPA solutions and AI-integrated automation, the BFSI sector in Asia-Pacific is rapidly transforming, making it the fastest-growing region in the RPA market.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

Some of the major players in the Robotic Process Automation in BFSI Market are:

-

Antworks (ANTstein Square, CMR+ for Intelligent Automation)

-

Atos SE (Atos SyntBots, Atos Codex RPA)

-

Automation Anywhere, Inc. (Automation 360, Bot Insight)

-

Blue Prism Limited (Blue Prism Cloud, Blue Prism Interact)

-

EdgeVerve Systems Ltd. (AssistEdge RPA, XtractEdge Intelligent Document Processing)

-

FPT Software (akaBot, akaOCR)

-

IBM (IBM Robotic Process Automation, IBM Cloud Pak for Business Automation)

-

Kofax Inc. (Kofax RPA, Kofax TotalAgility)

-

Microsoft (Softomotive) (Power Automate, WinAutomation)

-

NICE (NICE Robotic Automation, NEVA—NICE Employee Virtual Attendant)

-

Nintex UK Ltd. (Kryon Systems) (Nintex RPA, Kryon Full-Cycle Automation)

-

Pegasystems Inc. (Pega Robotic Process Automation, Pega Infinity)

-

Protiviti Inc. (Protiviti RPA Consulting, Protiviti Digital Workforce Solutions)

-

UiPath (UiPath Studio, UiPath Orchestrator)

-

WorkFusion, Inc. (WorkFusion Smart Process Automation, WorkFusion Intelligent Automation Cloud)

Recent Trends

-

In November 2024, Blue Prism announced a strategic partnership with Synechron to enhance automation solutions for the financial services and insurance industries. This collaboration aims to assist banks, asset managers, and insurance companies in implementing Blue Prism's connected RPA platform, driving intelligent automation for increased productivity and improved Return on Investment (ROI).

-

In December 2024, Automation Anywhere reported its fifth consecutive non-GAAP profitable quarter, highlighting a significant increase in customer demand for AI Agent transactions. This surge underscores the company's leadership in Agentic Process Automation, with notable adoption across industries such as financial services.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 1.12 Billion |

| Market Size by 2032 | US$ 20.48 Billion |

| CAGR | CAGR of 38.2 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Software, Services [Consulting, Implementation, Training]) • By Organization (SMEs, Large Enterprises) • By Application (Banking, Financial Services & Insurance) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Antworks, Atos SE, Automation Anywhere, Inc., Blue Prism Limited, EdgeVerve Systems Ltd., FPT Software, IBM, Kofax Inc., Microsoft (Softomotive), NICE, Nintex UK Ltd. (Kryon Systems), Pegasystems Inc., Protiviti Inc., UiPath, WorkFusion, Inc. |