Connected Car Market Size & Overview:

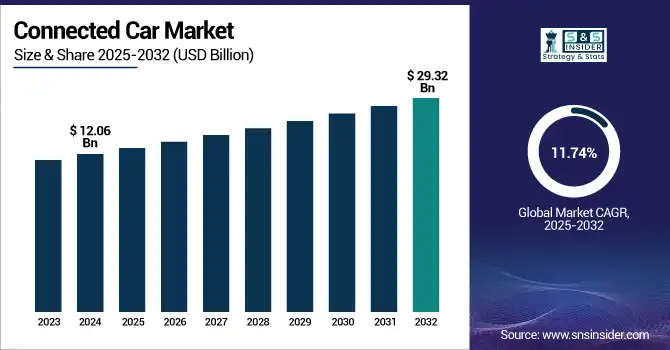

The Connected Car Market size was valued at USD 12.06 billion in 2024 and is expected to reach USD 29.32 billion by 2032, growing at a CAGR of 11.74% over the forecast period of 2025-2032.

To Get more information on Connected Car Market - Request Free Sample Report

The connected car market is experiencing rapid growth, driven primarily by advancements in 5G connectivity, Internet of Things (IoT), and increasing consumer demand for in-vehicle infotainment and real-time vehicle diagnostics. Automakers are integrating advanced telematics systems, vehicle-to-everything (V2X) communication, and AI-powered driving assistants to enhance safety, efficiency, and user experience. With governments across the globe enforcing stricter safety regulations, the adoption of connected technologies such as automatic crash notifications, emergency assistance, and over-the-air (OTA) updates is accelerating significantly.

Additionally, the rise in electric vehicles (EVs) and autonomous driving systems is amplifying the need for seamless connectivity between vehicles, infrastructure, and the cloud. Strategic partnerships between technology providers and automotive OEMs are fostering innovation, while smart city developments are creating a supportive ecosystem for connected mobility. As consumers increasingly prioritize convenience, safety, and sustainability, the connected car market is poised for strong growth over the coming years, transforming how transportation is perceived and experienced.

Market Dynamics:

Key Drivers:

- Rising Demand for Advanced Driver Assistance Systems Enhancing Road Safety and Driving Experience

One of the key drivers of the connected car market is the growing demand for Advanced Driver Assistance Systems (ADAS), which are transforming modern transportation by making driving safer, smarter, and more efficient. As road safety concerns rise globally, consumers and regulators are increasingly favoring vehicles equipped with intelligent features such as adaptive cruise control, lane-keeping assist, blind-spot detection, and automatic emergency braking. These technologies rely heavily on real-time data exchange, high-speed connectivity, and sensor integration all of which are central to connected car platforms. Automakers are actively embedding ADAS into their vehicles not only to meet evolving safety regulations but also to enhance consumer appeal and brand value. With increasing awareness of accident prevention and the convenience of semi-autonomous features, the market is witnessing a surge in adoption, positioning ADAS as a major growth catalyst in the connected car ecosystem for both developed and emerging markets.

Restraints:

- The interconnectedness of modern vehicles creates a significant cybersecurity challenge. A recent study highlights a 380% rise in cyberattacks targeting connected cars.

The rising use of advanced driver assistance systems (ADAS) and in-car infotainment systems has led to a 17% annual growth in demand for automotive chips. Because of the pandemic's persistent effects on the supply chain, this results in a critical bottleneck. It gets harder to find reliable suppliers as countries like the US and China looking for dominance in the chip business. This may result in price fluctuations and maybe even restrict chip exports, making it more challenging for automakers to meet the growing demand for connected car technologies. When all of these challenges are considered, there may be a delay in the production of linked vehicles.

Challenges:

- The rising geopolitical pressures will be a great threat for the market players.

For instance, China's technological progress is being impeded by chip sanctions imposed by the US, which could have an effect on the supply chain of connected auto components. After a decade of consistent growth, China's procurement of chip equipment fell by 3% in 2022 alone. This demonstrates China's reliance on foreign machinery for producing chips a vulnerability made apparent by geopolitical tension.

Segmentation Analysis:

By Technology

In 2024, the embedded technology segment dominates the connected car market due to its seamless integration, regulatory support, and superior reliability. Embedded systems come pre-installed by OEMs, enabling consistent access to telematics, diagnostics, and safety features without dependence on external devices. Automakers prefer this model for its compliance with regulatory mandates on emergency response systems and real-time vehicle monitoring. Additionally, embedded solutions offer enhanced cybersecurity and support for over-the-air (OTA) updates, making them a reliable and secure choice for modern vehicles.

During 2024 to 2032, the integrated technology segment is projected to grow at the fastest pace. This growth is driven by increasing smartphone penetration, consumer preference for personalized infotainment, and the flexibility offered by app-based services. Integrated systems allow users to connect their devices directly to the vehicle, offering a cost-effective and customizable alternative to embedded solutions. As digital lifestyle integration becomes a priority, integrated connectivity will experience significant adoption in the years ahead.

By Connectivity Solution

In 2024, cellular connectivity comprising 3G, 4G, and increasingly 5G dominates the connected car market. Its widespread availability, high-speed data transmission, and support for real-time applications such as navigation, remote diagnostics, and vehicle-to-everything (V2X) communication make it the preferred connectivity solution for automakers and consumers alike. Cellular networks enable seamless updates, advanced infotainment, and safety features like emergency call systems, solidifying their position as the backbone of connected vehicle infrastructure.

During 2024 and 2032, 5G-based cellular connectivity within the broader cellular segment is expected to witness the fastest CAGR. However, among all distinct technologies, satellite communication is projected to experience the fastest standalone growth due to its potential to enable connectivity in remote and underserved regions. As autonomous driving and global fleet management expand, demand for uninterrupted, borderless communication will rise. Satellite systems will play a crucial role in complementing terrestrial networks and ensuring reliable coverage across varied terrains and geographies.

By Services

In 2024, safety and security services lead the connected car market due to increasing consumer awareness, government regulations, and OEM focus on enhancing vehicle protection. Features such as automatic crash notification, stolen vehicle tracking, emergency call (eCall), and remote locking systems are now essential offerings. These services not only improve driver confidence but also align with stringent safety mandates across regions, making them a central component in modern connected vehicles.

From 2024 to 2032, Vehicle-to-Everything (V2X) services are anticipated to grow at the fastest CAGR. As the industry moves toward autonomous and smart mobility, V2X will play a pivotal role in enabling real-time communication between vehicles, infrastructure, and pedestrians. Its ability to support traffic optimization, collision avoidance, and environmental monitoring makes it crucial for future urban mobility ecosystems. Increased investments in smart city projects and 5G rollout will further accelerate the adoption of V2X technology in connected transportation.

By Vehicle Type

In 2024, passenger cars dominate the connected car market, driven by rising consumer demand for infotainment, navigation, remote diagnostics, and advanced safety features. Automakers are increasingly integrating connected technologies into passenger vehicles to enhance user experience and meet growing expectations for convenience, security, and real-time services. The mass production and high volume sales of passenger cars also contribute to their leading market share, supported by strong demand in both developed and emerging economies.

Between 2024 and 2032, light commercial vehicles (LCVs) are expected to witness the fastest CAGR. The surge in e-commerce, logistics, and last-mile delivery services is prompting fleet operators to adopt connected solutions for real-time tracking, route optimization, and vehicle health monitoring. Businesses are leveraging connected technologies in LCVs to improve operational efficiency, reduce downtime, and ensure driver safety. This increasing commercial reliance on connectivity is set to fuel rapid growth in the LCV segment over the forecast period.

Regional Analysis:

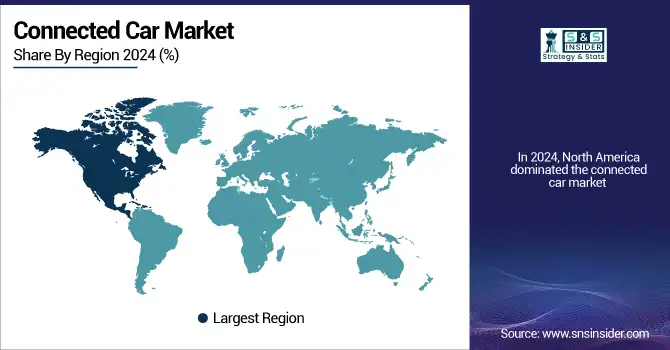

In 2024, North America dominated the connected car market due to its advanced automotive infrastructure, high adoption of digital technologies, and strong presence of key OEMs and tech providers. The region benefits from early deployment of 5G networks, favorable government regulations for vehicle safety, and growing consumer demand for in-car connectivity and autonomous driving features. Additionally, increased investment in smart transportation and the presence of major players developing V2X and telematics solutions are accelerating market expansion. The U.S. leads with high penetration of premium vehicles equipped with advanced infotainment, navigation, and safety systems. These factors, combined with rising focus on cybersecurity and data-driven services, are driving North America's continued leadership and future growth in the connected car ecosystem.

Asia Pacific is expected to witness the fastest CAGR in the connected car market from 2024 to 2032, driven by rapid urbanization, expanding middle-class population, and increasing vehicle ownership. Countries like China, Japan, South Korea, and India are investing heavily in smart mobility, 5G infrastructure, and intelligent transportation systems. Automakers are collaborating with tech firms to offer cost-effective connected solutions tailored to regional demand. Government initiatives promoting EVs, road safety, and digital transformation are also boosting adoption. With rising consumer interest in in-car connectivity and growing support for autonomous technologies, Asia Pacific is emerging as a key growth engine for the global market.

Get Customized Report as per Your Business Requirement - Enquiry Now

Connected Car Market Key Players:

Continental AG, Robert Bosch, Harman International, Airbiquity, Visteon, Cloudmake, Intellias, Tesla, Ford Motor Company, Audi, AT & T, Qualcomm Technologies, Verizon, TomTom International BV, Sierra Wireless, Changan Automobile, Tata Motors, PATEO Corp.

Recent Development in the Connected Car Market:

- In 2024, Harman International Partnered with Qualcomm to launch a 5G-based Telematics Control Unit for connected vehicles.

-

In 2024, Intellias Introduced its next-gen IntelliKit digital cockpit with Snapdragon and BlackBerry IVY at CES 2024.

| Report Attributes | Details |

| Market Size in 2024 | USD 12.06 Billion |

| Market Size by 2032 | USD 29.32 Billion |

| CAGR | CAGR of 11.74% from 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Technology (Embedded, Tethered, Integrated) • By Connectivity Solution (Cellular (3G, 4G, 5G), Dedicated Short-Range Communication (DSRC), Satellite Communication, and Wi-Fi & Bluetooth) • By Services (Driver Assistance, Safety & Security, Entertainment & Apps, Remote Diagnostics, Navigation, Fleet Management, Vehicle-to-Everything (V2X) Services) • By Vehicle Type (Passenger Cars, Light Commercial Vehicles (LCVs), Heavy Commercial Vehicles (HCVs)) • By End Market (Original Equipment Manufacturer (OEM), Aftermarket) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Taiwan, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Continental AG, Robert Bosch, Harman International, Airbiquity, Visteon, Cloudmake, Intellias, Tesla, Ford Motor Company, Audi, AT&T, Qualcomm Technologies, Verizon, TomTom International BV, Sierra Wireless, Changan Automobile, Tata Motors, PATEO Corp. |