Construction Estimating Software Market Report Scope & Overview:

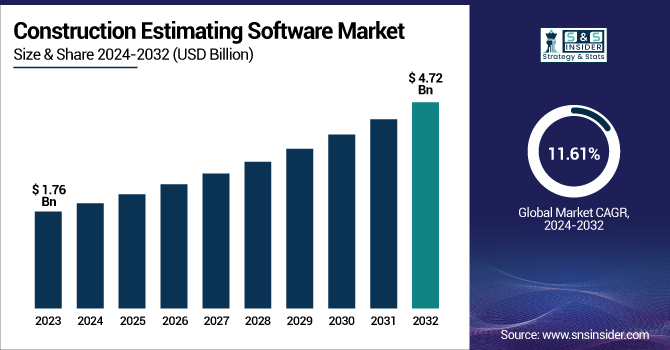

The Construction Estimating Software Market was valued at USD 1.76 billion in 2023 and is expected to reach USD 4.72 billion by 2032, growing at a CAGR of 11.61% from 2024-2032.

To Get more information on Construction Estimating Software Market - Request Free Sample Report

This report includes an analysis of time savings metrics, comparing subscription-based vs. one-time purchase models, the impact of digital transformation, and the role of API & third-party integrations in market expansion.

The Construction Estimating Software Market is experiencing rapid expansion because of rising demand for cost-effective and precise project planning solutions. Time saved is one major reason, as automation eliminates the need for manual calculations. The move towards subscription-based models is also gaining popularity because of flexibility and cost-effectiveness. Digitalization is changing the way work gets done, improving productivity. In addition, API & third-party integrations are increasing software capabilities, enhancing connectivity with accounting and project management applications.

U.S. Construction Estimating Software Market was valued at USD 0.49 billion in 2023 and is expected to reach USD 1.31 billion by 2032, growing at a CAGR of 11.45% from 2024-2032.

Growth is driven by increased adoption of digital tools to increase accuracy and efficiency in cost estimating. The adoption of cloud and AI-based solutions increases real-time collaboration and automates processes. Subscription pricing is becoming increasingly popular due to their affordability and flexibility. Also, API & third-party integration with accounting and project management software improves workflow efficiency. The need to complete projects more quickly and to optimize costs also fuels market growth.

Construction Estimating Software Market Dynamics

Drivers

-

Growing Infrastructure and Commercial Construction Boosts Demand for Advanced Estimating Software to Enhance Cost Accuracy, Efficiency, and Project Profitability.

The surge in infrastructure and commercial construction is increasing the demand for accurate cost estimation tools. Mass urbanization, combined with government plans for smart cities and green infrastructure, is compelling developers and contractors to implement sophisticated estimating software. The intricacy of contemporary construction projects requires comprehensive budgeting, risk assessment, and cost prediction, which makes automated tools a necessity. In addition, increased material prices and manpower shortages are forcing the industry to adopt digital technologies that drive precision and productivity. Real-time integration of data, cloud-based working, and analytics powered by AI are also enhancing adoption further. With construction companies trying to keep cost overruns to a minimum and boost profitability in projects, dependence on estimating software keeps on increasing, facilitating smooth planning and execution in a highly competitive marketplace.

Restraints

-

Traditional Construction Methods and Legacy Systems Hinder Digital Estimating Software Adoption, Slowing Efficiency, Accuracy, and Cost-Saving Benefits.

Construction firms often use traditional estimation methods and legacy systems, making the adoption of digital tools a struggle. Spreadsheets and paper-based processes for decades cause reluctance to use new technologies, particularly in small companies with fewer IT facilities. Doubts regarding the learning curve, training expenses, and interruptions of current projects also prolong the implementation of software. Moreover, established experts who have spent decades getting accustomed to conventional practices may hesitate to accept automated tools. Perceived sophistication of new estimating software, along with uncertainty regarding long-term advantages, usually leads to decision procrastination, as well. Without mass adoption of digital solutions, construction companies can find it difficult to capture the precision, efficiency, and cost savings offered by advanced estimation software in an increasingly competitive landscape.

Opportunities

-

AI and Machine Learning Enhance Cost Estimation Accuracy, Automate Processes, Optimize Resource Allocation, and Improve Budget Forecasting in Construction.

The integration of AI and machine learning is revolutionizing construction estimating as it enhances prediction accuracy for cost and automates intricate calculations. Sophisticated algorithms process past project data, market trends, and current price fluctuations to provide accurate estimates with fewer human mistakes and inefficiencies. AI tools can detect areas of cost savings, allocate resources more efficiently, and forecast future budget overruns before they arise. Machine learning continually improves estimation models, updating them according to changing construction requirements and price conditions. Automation also simplifies labor-intensive activities like quantity takeoffs and bid preparation, allowing for quicker decision-making. As building companies look to more intelligent, data-based approaches to drive efficiency and profitability, AI-based estimating software is becoming more popular, with a competitive advantage in a business where accuracy and cost management are key to the success of a project.

Challenges

-

Cyber Threats and Data Privacy Risks Endanger Digital Construction Estimating, Requiring Secure Storage, Encryption, and Strong Access Controls.

As construction companies increasingly use digital platforms for estimating costs, data privacy and cybersecurity threats have emerged as major issues. Sensitive project information such as financial estimates, supplier agreements, and bidding information is held on cloud-based systems, and thus it becomes a target for cyber attacks. Unauthorized access, ransomware, and data breaches can disrupt business operations, causing financial losses and damage to reputation. Also, keeping pace with emerging data protection policies increases complexity for software adoption. Most companies have poor cybersecurity features, making them more susceptible to potential breaches. As digitalization is picking up pace in the construction industry, maintaining secure storage of data, encryption, and multi-layered access controls becomes important to gaining confidence and lessening risks relating to cyberattacks in cost estimation software.

Construction Estimating Software Market Segment Analysis

By Deployment

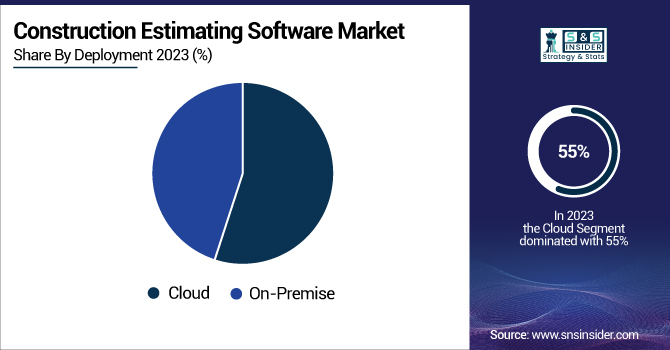

The cloud segment led the Construction Estimating Software Market in 2023 with the largest revenue share of around 55%. This leadership is fueled by the growing adoption of cloud solutions because of their scalability, real-time collaboration, and lower initial costs over on-premise counterparts. Construction companies enjoy hassle-free access to data, remote management of projects, and integration with other digital applications, boosting overall efficiency. Moreover, seamless updates, stronger security capabilities, and lower IT infrastructure needs render cloud-based estimating software the favorite among large and mid-sized organizations.

The on-premise segment is anticipated to expand at the fastest CAGR of approximately 12.44% during 2024-2032 based mainly on its popularity among companies valuing data security and absolute control over their estimating software. Organizations dealing with highly sensitive project information prefer on-premises deployment to reduce cybersecurity threats and adhere to stringent regulatory compliance. Moreover, large-scale organizations with in-place IT infrastructure choose on-premises deployment to provide seamless integration with in-house systems. Customization features and one-time licensing models also add to the segment's speeding adoption, especially among organizations unwilling to shift to cloud-based equivalents.

By Enterprise Size

The large enterprise segment led the Construction Estimating Software Market in 2023, with the largest revenue share of around 66%. This is due to large construction companies' large project portfolios, which necessitate advanced estimating software for proper budgeting and cost management. These companies can afford to invest in high-end software with AI-based analytics, real-time collaboration, and cloud-based features. Additionally, the need for compliance with regulatory standards, integration with existing enterprise resource planning (ERP) systems, and demand for high customization further drive adoption among large-scale construction companies.

The small & medium enterprise (SME) segment is expected to grow at the fastest CAGR of about 12.69% from 2024 to 2032, driven by increasing digital adoption and affordability of cloud-based estimating solutions. SMEs are identifying the advantage of automation of cost estimation in saving time, reducing errors, and increasing efficiency. Subscription pricing models, lowering the initial capital required, contribute to these products being more available. Moreover, government support to SME digitalization and increasing competition in the building industry make it worthwhile for small companies to spend money on estimating software to help them improve their project management and profitability.

By End-use

The Architects & Builders segment led the Construction Estimating Software Market in 2023 with the largest revenue share of nearly 41%. This is due to increasing demand for accurate cost estimation at the design and planning phase. Estimating software is depended upon by architects and builders for maximizing material choices, project feasibility analysis, and checking budgetary alignment. The integration of Building Information Modeling (BIM) with estimating tools further enhances accuracy, making these solutions essential for reducing cost overruns and improving project execution efficiency in large-scale developments.

The Contractors segment is expected to grow at the fastest CAGR of about 13.18% from 2024 to 2032, fueled by increasing construction activity and the demand for real-time cost control. Contractors need estimating software to handle bidding, labor costs, and procurement efficiently. The trend towards digital project management and the use of cloud-based solutions improve operational effectiveness, leading to quick adoption. Moreover, the increasing focus on minimizing project delays and enhancing cost transparency increases the importance of estimating software for contractors to stay competitive in the transformed construction landscape.

By Software License

The Subscription License segment dominated the Construction Estimating Software Market in 2023, holding the highest revenue share of approximately 59%. This dominance is driven by the growing preference for flexible, cost-effective software solutions that require lower upfront investment. Subscription-based models offer scalability, regular updates, and cloud-based access, making them ideal for businesses seeking continuous improvements without high initial costs. Additionally, small and mid-sized firms benefit from pay-as-you-go options, while software providers generate recurring revenue, ensuring continuous innovation and support, further strengthening the adoption of subscription licenses.

The Perpetual License segment is expected to grow at the fastest CAGR of about 13.18% from 2024 to 2032, primarily due to the increasing demand for long-term cost savings and complete software ownership. Large enterprises and firms prioritizing data security prefer perpetual licenses as they eliminate recurring subscription costs and allow full control over the software. Additionally, companies operating in regions with limited internet access or strict regulatory compliance requirements opt for on-premise perpetual licenses to maintain operational continuity, fueling market growth.

Regional Analysis

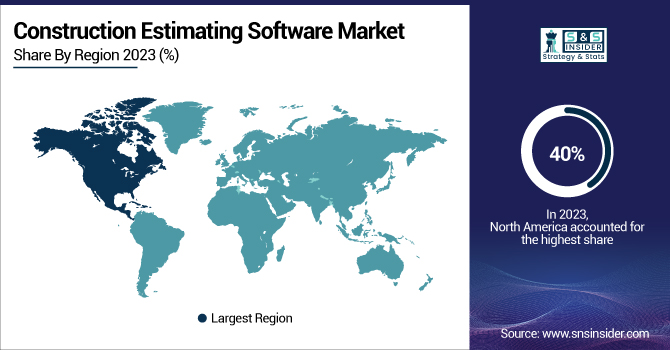

North America dominated the Construction Estimating Software Market in 2023, holding the highest revenue share of approximately 40%. This dominance is attributed to the region’s advanced construction industry, high adoption of digital solutions, and strong presence of key software providers. The increasing demand for cost-efficient project management, integration of AI and cloud-based technologies, and strict regulatory compliance drive widespread software adoption. Additionally, large-scale infrastructure projects and government investments in smart cities further contribute to the significant market share in North America.

Asia Pacific is expected to grow at the fastest CAGR of about 14.00% from 2024 to 2032, driven by rapid urbanization, expanding construction activities, and increasing digital transformation in the industry. Governments in the region are heavily investing in infrastructure development, boosting demand for cost estimation solutions. The growing adoption of cloud-based construction software, rising foreign investments, and increasing awareness of automation benefits further accelerate market growth. Additionally, the expanding presence of software providers catering to regional construction needs fuels adoption.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

-

AppliCad Public Company Limited: [Roof Wizard, RoofScape]

-

Autodesk Inc.: [Autodesk Takeoff, Autodesk BIM 360]

-

Bluebeam Software Inc.: [Bluebeam Revu, Bluebeam Studio]

-

Corecon Technologies, Inc.: [Corecon V8, Corecon Mobile]

-

esti-mate: [esti-mate Desktop, esti-mate Online]

-

ETAKEOFF, LLC: [eTakeoff Dimension, eTakeoff Bridge]

-

Glodon Company Limited: [Glodon TAS, Glodon TRB]

-

Microsoft: [Microsoft Dynamics 365 Project Operations, Microsoft Project]

-

PlanSwift Software: [PlanSwift Professional, PlanSwift Metric]

-

PrioSoft Construction Software: [Contractor's Office, QuickBooks Integration Module]

-

ProEst: [ProEst Cloud, ProEst Mobile]

-

RIB Software SE: [RIB iTWO, RIB CostX]

-

Sage Group plc: [Sage Estimating, Sage 300 Construction and Real Estate]

-

STACK Construction Technologies: [STACK Estimating, STACK Takeoff & Estimating]

-

Trimble Inc.: [Trimble Quest, Trimble Accubid]

-

Vision InfoSoft (JDM Technology Group): [Electrical Bid Manager, Plumbing Bid Manager]

Recent Developments:

-

In January 2024, Bluebeam announced two AI-powered features—Auto Align for drawing overlays in Revu 21 and automated title block recognition in Bluebeam Cloud. The company also launched Bluebeam Labs, a collaborative workspace for AEC professionals.

-

In March 2025, Microsoft announced new Copilot capabilities for Dynamics 365 Project Operations. Features include AI-powered time, expense, and approval optimization, set for public preview in April 2025 and general availability by September 2025.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 1.76 Billion |

| Market Size by 2032 | US$ 4.72 Billion |

| CAGR | CAGR of 11.61% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Software License (Perpetual License, Subscription License, Others) • By Deployment (Cloud, On-premise) • By Enterprise Size (Large Enterprise, Small & Medium Enterprise) • By End-use (Architects & Builders, Construction Managers, Contractors, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | AppliCad Public Company Limited, Autodesk Inc., Bluebeam Software Inc., Corecon Technologies, Inc., esti-mate, ETAKEOFF, LLC, Glodon Company Limited, Microsoft, PlanSwift Software, PrioSoft Construction Software, ProEst, RIB Software SE, Sage Group plc, STACK Construction Technologies, Trimble Inc., Vision InfoSoft (JDM Technology Group) |