Construction Management Software Market Report Scope & Overview:

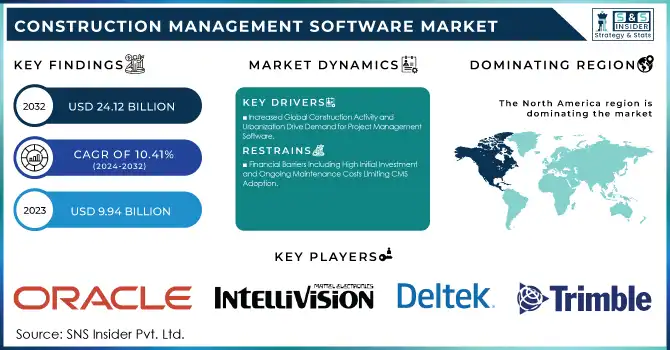

The Construction Management Software Market was valued at USD 9.94 billion in 2023 and is expected to reach USD 24.12 billion by 2032, growing at a CAGR of 10.41% from 2024-2032.

Get More Information on Construction Management Software Market - Request Sample Report

The construction management software market has experienced significant growth in recent years, due to the increasing need for streamlined operations and enhanced project efficiency. As construction projects become more complex, companies need solutions that provide better control over costs, schedules, and resources. The demand for these software tools is further fueled by the growing trend toward digital transformation within the construction industry, with 68% of businesses already using or planning to use AI in the future. However, 42% of businesses cite digital skills gaps as a significant barrier to adoption. Additionally, 67% of construction tech firms prioritize AI-driven data analysis solutions, as AI reduces project planning time by an average of 15%. These advancements enhance real-time data analytics, allowing for more informed decision-making and improved project outcomes.

A key factor contributing to expanding the construction management software market is the rising focus on sustainability and compliance with building regulations. Software solutions enabling accurate project tracking and compliance management have become essential for ensuring construction firms meet environmental standards and other regulatory requirements. The growing emphasis on safety protocols and risk mitigation within the industry has also amplified the adoption of these solutions. Businesses adopting new tech saw 1.4% higher revenue growth and 1% higher profit growth, with AI-driven safety audits detecting violations 28% more effectively than manual inspections. Additionally, as the construction sector becomes increasingly globalized, companies are looking for tools that can scale and support projects across different regions, adding to the demand for versatile and customizable software platforms.

The future opportunities in the construction management software market are promising. The continued shift towards automation, the integration of advanced technologies like the Internet of Things, and the increased focus on Building Information Modeling will provide further avenues for growth. Companies are also exploring ways to improve the user experience by incorporating intuitive interfaces and mobile applications, making these solutions more accessible and efficient for on-site teams. In November 2024, Trimble expanded access to its advanced construction project management tools, offering enhanced features for cost control, scheduling, and collaboration. As the construction industry embraces innovative practices and seeks to optimize its operations, the demand for cutting-edge software solutions will undoubtedly continue to rise, presenting substantial growth prospects for both established and emerging market players.

MARKET DYNAMICS

DRIVERS

-

Increased Global Construction Activity and Urbanization Drive Demand for Project Management Software

The expansion of infrastructure projects and rapid urbanization worldwide are significantly increasing construction activities, creating a need for efficient project management tools. As cities grow and governments invest in large-scale infrastructure, the complexity of construction projects rises, requiring sophisticated solutions to handle diverse tasks such as resource management, scheduling, budgeting, and collaboration. With more stakeholders involved, effective project management is critical to ensure timely delivery, adherence to budgets, and quality standards. As of January 2023, U.S. construction spending is valued at USD 1.823 trillion, highlighting the scale of investment in the sector. Additionally, as the construction sector becomes more digitized, the demand for software that integrates real-time data and streamlines communication between teams has surged. Consequently, this increased scale and complexity of construction projects is driving the adoption of construction management software to maintain efficiency and control throughout the project lifecycle.

-

Technological Advancements Fueling the Growth of Construction Management Software

The integration of advanced technologies such as cloud computing, AI, IoT, and BIM is transforming the construction industry, significantly enhancing the capabilities of construction management software. These technologies enable real-time collaboration, remote monitoring, and improved project efficiency. Cloud-based solutions ensure data is accessible from any location, facilitating seamless communication and decision-making. AI and machine learning enhance predictive analytics, helping to identify risks and optimize project planning. IoT sensors provide real-time data on site conditions, enabling better resource management. BIM improves collaboration with accurate 3D models, streamlining design and execution. In 2024, Houzz introduced platform enhancements aimed at improving project management for large construction and design firms, focusing on better coordination and efficiency for complex projects. These technological advancements are driving CMS adoption, offering scalable, integrated solutions for modern construction.

RESTRAINTS

-

Financial Barriers Including High Initial Investment and Ongoing Maintenance Costs Limiting CMS Adoption

The implementation of Construction Management Software involves significant initial investment, including software licensing, hardware, and employee training. These costs can be a major barrier for smaller construction firms that operate with tight budgets or limited resources. For instance, the Basic Plan ranges from USD 41 to USD 1,245 for up to 5 contractors, the Premium Plan from USD 74 to USD 2,490 for up to 10 contractors, and the Advanced Plan costs around USD 500 to USD 2,739. In addition to the upfront expenses, ongoing maintenance, software updates, and potential customization costs further contribute to the financial burden. For companies looking to maintain profitability, these expenses can outweigh the perceived benefits of CMS, leading to reluctance in adopting such systems. This financial challenge is particularly evident in regions with smaller construction businesses, where the cost-benefit ratio of investing in CMS may not be immediately apparent.

SEGMENT ANALYSIS

By Offering

In 2023, the Solution segment dominated the Construction Management Software market, capturing approximately 68% of the revenue share. This dominance is primarily driven by the growing need for integrated software solutions that streamline project management tasks such as scheduling, budgeting, and resource allocation. As construction projects become more complex, businesses are increasingly turning to comprehensive CMS solutions to enhance efficiency, improve collaboration, and reduce errors, making these solutions essential for large-scale operations.

The Service segment is expected to experience the fastest CAGR of about 12.02% from 2024 to 2032. This growth is fueled by the increasing demand for consulting, implementation, and support services that help businesses effectively deploy and manage CMS platforms. As companies look to optimize their software investments, the need for expert guidance and ongoing maintenance services is escalating. Additionally, the rise of cloud-based CMS solutions, which require continuous updates and customization, further drives the demand for professional services in the sector.

By Deployment

In 2023, the On-premise segment led the Construction Management Software market with the highest revenue share of approximately 60%. This dominance can be attributed to the preference for on-premise solutions by large construction firms, who require complete control over their data and operations. These solutions offer greater customization, enhanced security, and the ability to integrate seamlessly with existing infrastructure, making them a popular choice for enterprises with specific compliance or regulatory needs.

The Cloud segment is expected to experience the fastest CAGR of about 11.95% from 2024 to 2032, driven by its scalability, cost-effectiveness, and flexibility. As businesses increasingly embrace digital transformation, cloud-based CMS solutions provide real-time collaboration, easy updates, and reduced IT infrastructure costs. The growing trend toward remote work and the need for decentralized project management are further fueling the shift toward cloud solutions, making them an attractive option for construction companies looking to enhance efficiency and global collaboration.

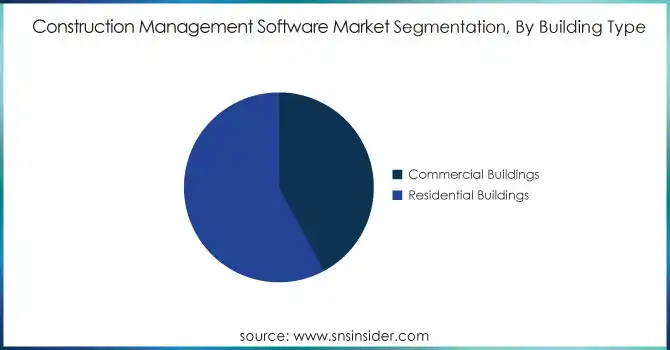

By Building Type

In 2023, the Residential Buildings segment dominated the Construction Management Software market, capturing about 58% of the revenue share. This dominance is driven by the continued demand for residential construction, particularly in rapidly growing urban areas. With the complexity of residential projects increasing, including the need for efficient resource management, scheduling, and budgeting, construction firms rely on CMS to streamline operations, ensure timely delivery, and stay within budget, making these solutions vital for residential builders.

The Commercial Buildings segment is expected to grow at the fastest CAGR of about 11.51% from 2024 to 2032. This growth is fueled by the expansion of commercial real estate development, driven by urbanization and economic growth. As commercial construction projects tend to be larger and more intricate, they require advanced CMS solutions to handle the increased scale and complexity. The demand for real-time collaboration, regulatory compliance, and efficient project management in commercial sectors is propelling the growth of this segment, positioning it for significant expansion in the coming years.

By End Use

In 2023, the Builders & Contractors segment led the Construction Management Software market, holding a substantial revenue share of approximately 50%. This dominance is attributed to the essential role builders and contractors play in the construction industry, where they manage project execution, resources, and timelines. CMS solutions are crucial for these professionals to streamline operations, improve communication with stakeholders, and reduce costly errors, making them a preferred choice for businesses looking to enhance efficiency and ensure project success.

The Construction Managers segment is expected to experience the fastest CAGR of about 11.73% from 2024 to 2032. This growth is driven by the increasing demand for construction managers to oversee more complex and large-scale projects. As construction projects evolve and require real-time decision-making, CMS tools provide managers with the capabilities to coordinate teams, track progress, and ensure compliance with regulations, thus making them indispensable in managing projects effectively. The growing focus on data-driven decision-making further accelerates the adoption of CMS in this segment.

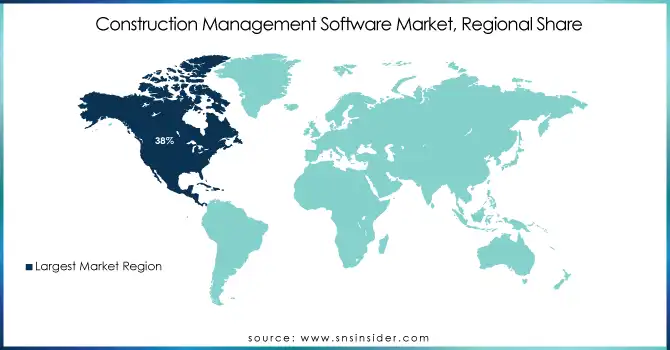

REGIONAL ANALYSIS

In 2023, North America dominated the Construction Management Software market with a leading revenue share of approximately 38%. This dominance can be attributed to the region’s advanced construction industry, which consistently adopts cutting-edge technologies to improve project efficiency and productivity. The high demand for innovative CMS solutions from large-scale construction firms, coupled with significant investments in infrastructure and commercial projects, drives the continued growth of the market in North America. Additionally, the region’s strong economic position and technological infrastructure support the widespread use of CMS across various sectors.

Asia Pacific is expected to grow at the fastest CAGR of about 12.16% from 2024 to 2032, driven by rapid urbanization and infrastructure development across emerging economies. As the region experiences significant economic growth and an increase in construction projects, there is a heightened need for efficient project management solutions. The rising adoption of digital technologies in construction, combined with government investments in smart cities and large-scale infrastructure, is fueling the demand for CMS in Asia Pacific. This expansion presents significant opportunities for growth, positioning the region as the fastest-growing market.

Get Customized Report as per your Business Requirement - Request For Customized Report

KEY PLAYERS

-

Oracle (Oracle Aconex, Oracle Primavera)

-

Intelvision (Information not readily available)

-

Deltek (Deltek Ajera, Deltek Vantagepoint)

-

Procore Technologies (Procore Project Management, Procore Quality & Safety)

-

Sage Group (Sage Construction and Real Estate, Sage 100 Contractor)

-

Trimble (Trimble ProjectSight, Trimble Prolog)

-

Autodesk (Autodesk Construction Cloud, Autodesk BIM 360)

-

Kahua (Kahua Project Management, Kahua Program Management)

-

Bentley Systems (Bentley ProjectWise, Bentley SYNCHRO)

-

Buildertrend Solutions (Buildertrend Project Management, Buildertrend Financial Tools)

-

Jonas Construction Software (Jonas Enterprise, Jonas Premier)

-

ConstructConnect (ConstructConnect Project Intelligence, ConstructConnect Bid Management)

-

HomeBuilder Systems (Information not readily available)

-

Intuit (QuickBooks Contractor Edition, QuickBooks Time)

-

Systemates (Projectmates, Projectmates Mobile)

-

MITEK (MiTek SAPPHIRE Suite, MiTek BuilderMT)

-

Smartsheet (Smartsheet Project Management, Smartsheet Construction Templates)

-

UDA Technologies (ConstructionOnline, ConstructionSuite)

-

Branch Metrics (Information not related to construction management)

-

monday.com (monday.com Work OS, monday.com Construction Management Template)

-

Wrike (Wrike Project Management, Wrike Construction Management Template)

-

EZOfficeInventory (EZOfficeInventory Asset Tracking, EZOfficeInventory Inventory Management)

-

Finalcad (Finalcad One, Finalcad Live)

-

Constellation CMiC (CMiC Enterprise, CMiC Field)

-

RIB CCS (Candy, BuildSmart)

Recent Developments

-

In 2024, ARCO adopted Oracle Textura to enhance payment processes, improving invoicing, lien waivers, and subcontractor coordination. This integration boosts compliance, reduces administrative tasks, and enhances overall payment efficiency.

-

In 2024, Deltek introduced significant enhancements to its ERP software, Costpoint, designed for government contractors. These updates leverage artificial intelligence to automate tasks, ensure compliance, and improve project delivery efficiency.

-

In 2024, Procore is pursuing FedRAMP authorization for its construction management software to meet federal standards. This will enhance its ability to serve public sector clients, ensuring better data protection and compliance.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 9.94 Billion |

| Market Size by 2032 | USD 24.12 Billion |

| CAGR | CAGR of 10.41% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Offering (Solution, Service) • By Deployment (On-premise, Cloud) • By Building Type (Commercial Buildings, Residential Buildings) • By Application (Project Management & Scheduling, Safety & Reporting, Project Design, Field Service Management, Cost Accounting, Others) • By End Use (Builders & Contractors, Construction Managers, Engineers & Architects) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Oracle, Intelvision, Deltek, Procore Technologies, Sage Group, Trimble, Autodesk, Kahua, Bentley Systems, Buildertrend Solutions, Jonas Construction Software, ConstructConnect, HomeBuilder Systems, Intuit, Systemates, MITEK, Smartsheet, UDA Technologies, Branch Metrics, monday.com, Wrike, EZOfficeInventory, Finalcad, Constellation CMiC, RIB CCS |

| Key Drivers | • Increased Global Construction Activity and Urbanization Drive Demand for Project Management Software • Technological Advancements Fueling the Growth of Construction Management Software |

| RESTRAINTS | • Financial Barriers Including High Initial Investment and Ongoing Maintenance Costs Limiting CMS Adoption |