Document AI Market Report Scope & Overview:

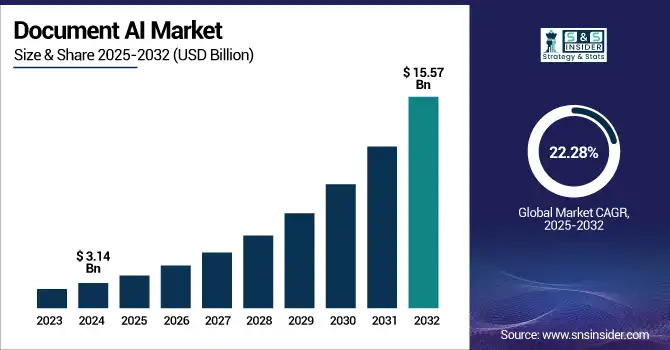

The Document AI Market was valued at USD 3.14 billion in 2024 and is expected to reach USD 15.57 billion by 2032, growing at a CAGR of 22.28% from 2025-2032. The Document AI market is experiencing significant growth due to the experiencing rapid growth due to the increasing demand for intelligent document processing, automated data extraction, and improved workflow efficiency across various sectors. This increased adoption of AI-driven solutions in various sectors such as BFSI, healthcare, legal and retail is further driving the demand. Furthermore, with ease of access regulatory compliance requirements, increasing digital transformation initiatives, and desire to reduce manual errors and operational costs, the Document AI landscape has been quickly proliferating.

To Get more information on Document AI Market - Request Free Sample Report

Google Cloud Document AI supports over 200 languages through its Enterprise OCR—built on 25 years of scanning and OCR research highlighting the platform’s advanced capabilities.

In the financial services sector, where use cases include invoice processing, KYC, loan document automation, and fraud detection, the combined power of Vertex AI and Document AI has reduced model-building times from 150 hours to just 60 hours and cut check-processing delays from hours to minutes.

U.S. Document AI Market was valued at USD 0.88 billion in 2024 and is expected to reach USD 4.31 billion by 2032, growing at a CAGR of 22.01% from 2025-2032.

The U.S. Document AI market is growing due to increasing adoption of AI-powered automation in enterprises, strong digital transformation efforts, and rising demand for efficient data management. Regulatory compliance pressures, high IT infrastructure maturity, and growing use in sectors like finance, healthcare, and legal further fuel market expansion across the country.

Reflecting this momentum, 98% of organizations are actively exploring generative AI, with 39% already in production highlighting rapid uptake in AI infrastructure across U.S. enterprises.

Market Dynamics

Drivers

-

Rising enterprise demand for intelligent document processing is accelerating the adoption of AI-based automation across core business workflows.

As companies strive for the automation of repetitive and document-centric tasks, the demand for Document AI solutions rise. With the ability to extract, classify and analyze large volumes of unstructured text, enterprises use AI for a variety of use cases — from invoice processing to compliance documentation. This reduces operational cost, eliminates manual dependencies, and ensures data accuracy. For many verticals such as banking, healthcare, and legal, Document AI is being leveraged as a part of their digital transformation to faster data extraction/acquisition and more timely, accurate decision-making. The need for intelligent processing has resulted in Document AI becoming a part and parcel of Enterprise technology stacks as the volumes of digital documents continue to grow.

Supporting this shift, Microsoft Power Automate reports that automating high-impact document workflows delivers up to 248% ROI over three years, saves 200 hours per employee annually, and reduces developer time by 20%.

Likewise, Expensya, using Google Cloud’s Document AI, estimates a 90% reduction in time spent on expense reports, with invoice recognition errors dropping by 10% and support tickets reduced by 30%.

Restraints

-

Data privacy concerns and regulatory restrictions are creating hesitation around adopting AI-based document processing in sensitive sectors.

Industries like healthcare, finance, and legal manage extremely personal and corporate data, leaving privacy and compliance at the forefront of their minds. Data ingestion, classification, and analysis are part of the Document AI process, subsequently posing data ownership, confidentiality, and GDPR or HIPPA policy issues. There are fears of data leaking, algorithmic biases, or non-explainability of AI decisions, which makes organizations skeptical about its application. As a result, in domains with stringent data governance and audit requirements, exposing sensitive data to third-party platforms or cloud environments poses a significant adoption hurdle and impedes wide-scale deployment.

Opportunities

-

Expanding use of AI in multilingual and cross-border documentation is unlocking growth opportunities in global trade and international services.

Intelligent, language-agnostic processing is needed as businesses operate in multiple geographies, and any global business will deal with documents in multiple languages and formats. Logistics, legal, and cross-border banking are other verticals where Document AI technologies including multilingual OCR, translation and semantic understanding are gaining traction. This enables organizations to stay compliant with global regulations, track international contracts, and simplify import-export paperwork. Markets that have emerging but complicated documentation ecosystems also present a largely untapped opportunity. The ever-evolving nature of NLP and the translation model can allow Document AI to emerge as a critical enabler of smooth global operations paving the way for highly lucrative growth opportunities for solution providers across the globe.

Reflecting this trend, the Document AI Workbench’s Custom Document Extractor added support for 42 additional global languages in April 2023, expanding capabilities for specialized multilingual workflows.

Moreover, Google Cloud’s Enterprise Document OCR supports text extraction in 200+ languages including handwritten and complex scripts enabling robust, language-agnostic document processing.

Challenges

-

Complexity in handling semi-structured and handwritten documents remains a major technical hurdle in expanding Document AI capabilities.

Semi-structured content and handwritten text can also be found in business-critical documents such as insurance forms, medical records, and historical archives. Although initial versions of OCR have made significant progress over the years, modern-day implementation remains prone to errors due to inconsistency in handwriting styles, low-quality scans, and a wide variety of layouts. This inconsistency causes extraction errors and errors in subsequent decisions. Additionally, tuning to train an AI model for domain-specific variations in structure and terminology Vendors who want to quickly ship high-accuracy plug and play solutions, particularly in domains that still use paper, will find it challenging to overcome these limitations.

Segment Analysis

By Component

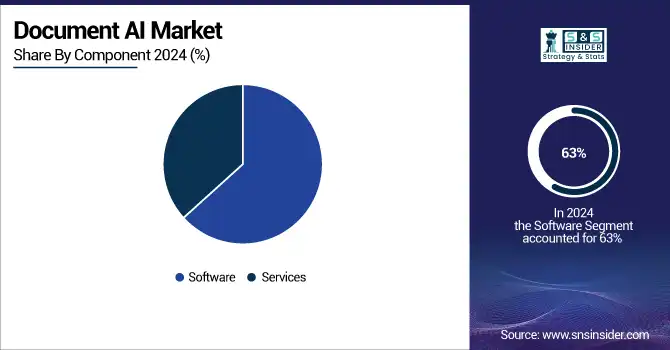

The software segment dominated the Document AI market with a 63% revenue share in 2024 due to its integral role in document parsing, OCR, and AI-driven automation. Organizations prioritized scalable, license-based platforms that integrate easily with existing digital ecosystems. These solutions provide flexible deployment models, ongoing updates, and customizable features for diverse use cases, making them indispensable. The recurring value proposition and ease of integration significantly fueled software adoption across major industry verticals.

The services segment is expected to grow at the fastest CAGR of 23.60% from 2025 to 2032, driven by rising demand for consulting, implementation, and customization support. As companies seek to tailor Document AI solutions to domain-specific needs, service providers offer expertise in workflow optimization, model training, and regulatory alignment. Growing adoption by SMEs and public sector organizations with limited in-house capabilities is further accelerating service-based deployments and long-term managed service contracts.

By Enterprise Size

Large enterprises dominated the Document AI market with a 65% revenue share in 2024, owing to their complex documentation workflows and higher IT investment capacity. These organizations deploy enterprise-grade Document AI platforms for invoice automation, compliance tracking, and knowledge management. Their focus on process efficiency and regulatory adherence makes AI-based document management a strategic necessity. Large data volumes and cross-departmental integration needs further strengthen adoption in sectors like BFSI, telecom, and manufacturing.

Small and Medium Enterprises (SMEs) are expected to grow at the fastest CAGR of 23.71% from 2025 to 2032, as cloud-based Document AI solutions become more accessible and affordable. SMEs are increasingly turning to AI tools to automate repetitive tasks, reduce manual errors, and enhance productivity. Vendors offering modular, pay-as-you-go pricing models have made adoption more viable. Rising digital transformation across emerging economies is also fueling strong uptake among small business sectors.

By End-User

The BFSI segment dominated the Document AI market with a 27% revenue share in 2024 due to high volumes of documentation, regulatory compliance needs, and fraud detection demands. Financial institutions use Document AI for automating KYC, claims processing, and contract analysis, leading to improved accuracy and efficiency. The sector’s prioritization of data security and operational speed makes AI integration essential, positioning it as a leading adopter of document processing solutions.

The healthcare segment is projected to grow at the fastest CAGR of 24.36% from 2025 to 2032, driven by the need to manage patient records, insurance claims, and clinical documentation efficiently. Document AI enables faster data extraction from handwritten notes, medical histories, and lab results. As healthcare providers digitize operations and adopt electronic health record systems, AI-powered document solutions are becoming crucial for improving care quality, compliance, and administrative productivity.

By Application

The fraud detection segment dominated the Document AI market with a 30% revenue share in 2024, largely due to its critical role in verifying authenticity and identifying anomalies in documents. Industries like banking and insurance rely heavily on AI to detect forged documents, mismatched data, and duplicate claims. Real-time document validation has become central to reducing financial losses and operational risk, establishing fraud detection as a priority application across the AI document processing landscape.

The contract analysis segment is projected to grow at the fastest CAGR of 25.09% from 2025 to 2032, fueled by rising legal and commercial document workloads across industries. Document AI helps organizations extract clauses, flag risks, and ensure compliance during contract reviews. Businesses are increasingly seeking tools that offer semantic understanding and quick turnaround in due diligence and procurement workflows. The push for automation in legal tech and supply chain governance is accelerating adoption in this segment.

By Deployment Mode

The cloud segment dominated the Document AI market with a 72% revenue share in 2024 and is expected to grow at the fastest CAGR of 22.89% from 2025 to 2032. This dominance is driven by the scalability, flexibility, and cost-effectiveness of cloud-based solutions, which allow organizations to deploy Document AI tools without extensive infrastructure investments. Cloud platforms support real-time data processing, remote access, and seamless integration with other enterprise applications. As remote work expands and businesses prioritize digital transformation, demand for secure, scalable, and AI-enabled cloud document solutions continues to surge rapidly across sectors.

Regional Analysis

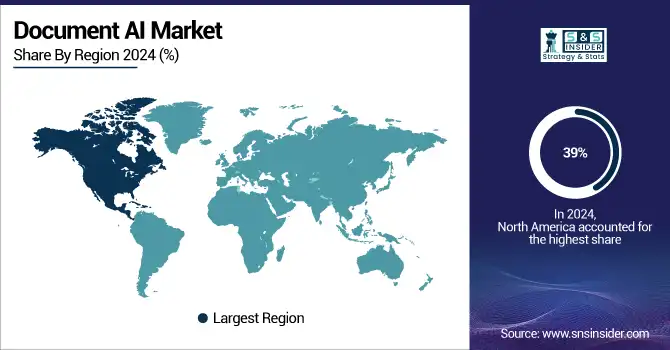

North America dominated the Document AI market with a 39% revenue share in 2024 due to early technology adoption, strong presence of AI vendors, and high enterprise digitalization. The region’s financial, legal, and healthcare sectors extensively use Document AI for compliance, automation, and fraud detection. Robust cloud infrastructure and significant R&D investments further support widespread implementation, making North America the leading hub for innovation and deployment of document-based AI technologies.

The U.S. dominated the Document AI market due to advanced digital infrastructure, strong enterprise demand, and presence of major AI and cloud technology providers.

Asia Pacific is expected to grow at the fastest CAGR of 24.19% from 2025 to 2032, driven by rapid digital transformation, expanding SME sector, and rising investments in AI infrastructure. Countries like China, India, and Japan are increasingly adopting intelligent document solutions to modernize public services, banking, and healthcare systems. The growing availability of affordable cloud-based tools and supportive government initiatives are fueling accelerated adoption of Document AI technologies across diverse industries in the region.

China is dominating the Document AI market in Asia Pacific due to large-scale digitalization, strong government support, and rapid enterprise adoption across industries.

Europe is experiencing steady growth in the Document AI market, driven by increasing demand for automation, regulatory compliance, and intelligent document processing across sectors such as finance, legal, healthcare, and public administration.

Germany is dominating the Document AI market in Europe, driven by strong industrial digitization, enterprise AI adoption, and robust investments in automation technologies.

The Middle East & Africa and Latin America are emerging markets in the Document AI space, with growth driven by digital transformation, government modernization, and increased cloud adoption across sectors like banking, healthcare, and public administration.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

Hybrid Fiber Coaxial Market companies are Google LLC, Microsoft Corporation, Amazon Web Services, Inc. (AWS), IBM Corporation, OpenText Corporation, ABBYY, Kofax Inc., Adobe Inc., Automation Anywhere, Inc., UiPath Inc., WorkFusion, Inc., Hyperscience, Parascript, LLC, Indico Data.

Recent Developments:

-

December 17, 2024 – Microsoft launched Azure Document Intelligence v4.0 with enhanced OCR, markdown-style layout detection, improved table and figure extraction, and advanced classification models—optimizing performance for RAG-based AI workflows.

-

June 17, 2024 – Adobe integrated Firefly into Acrobat, enabling AI-generated images within PDFs and chat-based interactions across multiple document formats, including Word, PowerPoint, and TXT.

-

August 19, 2024 – IBM released Docling, a versatile open‑source AI-assisted tool for converting PDFs and other document formats into structured outputs, maintaining document integrity and facilitating AI-driven workflows .

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 3.14 Billion |

| Market Size by 2032 | USD 15.57 Billion |

| CAGR | CAGR of 22.28% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Software, Services) • By Enterprise Size (Small and Medium Enterprises (SMEs), Large Enterprises) • By Deployment Mode (On-Premises, Cloud) • By Application (Document Management, Identity Verification, Contract Analysis, Risk Assessment, Fraud Detection) • By End-User (BFSI, Healthcare, Retail and E-commerce, Legal, Education, Manufacturing, IT and Telecommunications, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Google LLC, Microsoft Corporation, Amazon Web Services, Inc. (AWS), IBM Corporation, OpenText Corporation, ABBYY, Kofax Inc., Adobe Inc., Automation Anywhere, Inc., UiPath Inc., WorkFusion, Inc., Hyperscience, Parascript, LLC, Indico Data |