Construction Software Market Report Scope & Overview:

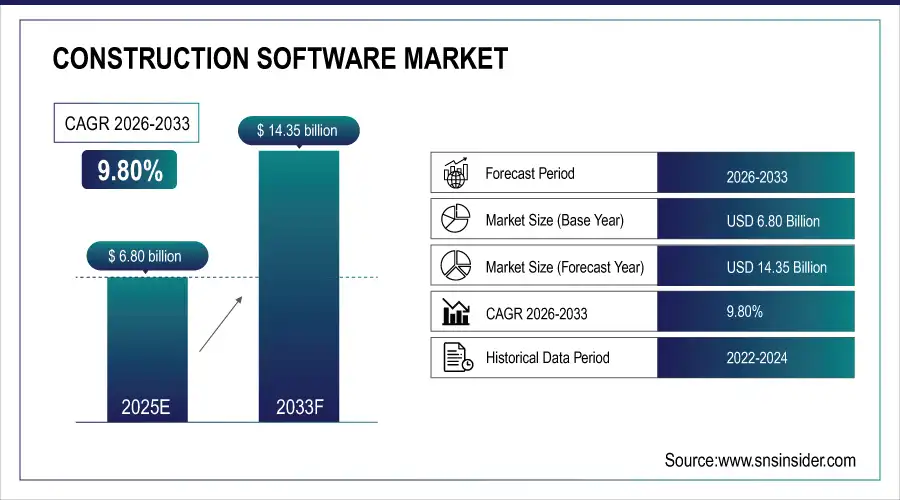

The Construction Software Market Size was valued at USD 6.80 Billion in 2025E and is expected to reach USD 14.35 Billion by 2033 and grow at a CAGR of 9.80% over the forecast period 2026-2033.

The demand for construction software is primarily high as the construction projects around the world are becoming more complex and larger in nature. Companies are implementing the use of digital tools to improve project management, workflow process, and greater efficiency. Given their ability to ensure real-time collaboration and optimise the use of resources while maintaining costs, advanced software solutions including project management, financial management and field productivity platforms go a long way towards reducing ambiguity and uncertainty about projects. Demand for quality and safety management modules is also increasing with the increasing need for safety and regulatory compliance as it aids firms in managing risks while complying with industry standards effectively. According to study, over 60% of construction firms globally now use project management, financial management, or field productivity software to streamline workflows.

Market Size and Forecast:

-

Market Size in 2025: USD 6.80 Billion

-

Market Size by 2033: USD 14.35 Billion

-

CAGR: 9.80% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information On Construction Software Market - Request Free Sample Report

Construction Software Market Trends

-

Increasing adoption of cloud-based construction software for real-time collaboration and management.

-

Growing focus on digital project management tools to optimize resources and reduce errors.

-

Rising demand for sustainable and green construction solutions supporting LEED and energy efficiency.

-

Expansion of AI, IoT, and BIM integration to improve project planning and monitoring.

-

Shift towards mobile-enabled and remote-access software for distributed construction teams.

-

Regulatory compliance and safety-focused software gaining traction in global construction projects.

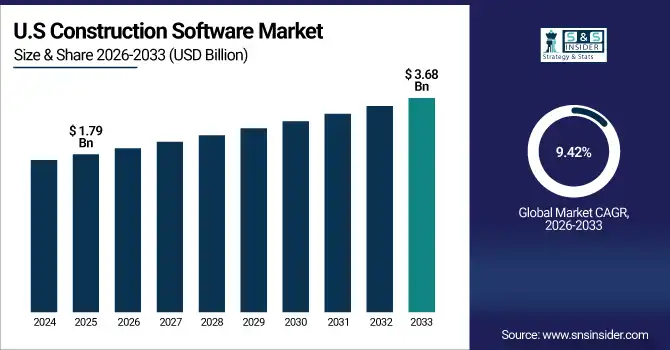

The U.S. Construction Software Market size was USD 1.79 Billion in 2025E and is expected to reach USD 3.68 Billion by 2033, growing at a CAGR of 9.42% over the forecast period of 2026-2033, driven by high technological adoption, increasing digital project management, cloud-based solutions, AI integration, and stringent safety and regulatory compliance, enhancing efficiency, collaboration, and cost control across large-scale construction projects nationwide.

Construction Software Market Growth Drivers:

-

Digital Transformation and Cloud Solutions Revolutionize Construction Efficiency and Real-Time Project Collaboration Globally

Construction projects are getting more complex as they are located in different sites and involve huge volumes of stakeholders. In order to adapt to this complexity, construction firms are quickly beginning to implement digital tools like project management, financial management, and field productivity software. These gain from the cloud enable teams to collaborate better and instantaneously, track project status with live tracking, accomplish the best use of the resources, and minimize errors. Cloud solutions, which provide the ability to easily scale over time, flexibility, and remote access, are especially attractive as they help architects, contractors, and subcontractors work together seamlessly. The increasing digital adoption drives the market growth directly by increasing efficiency, cutting costs, and enhancing visibility of the projects.

Cloud solutions enable real-time collaboration for 80–90% of project stakeholders, improving communication and decision-making.

Construction Software Market Restraints:

-

High Implementation Costs and Training Challenges Hinder Widespread Construction Software Adoption Worldwide

However, even with the benefits, especially small and medium-sized enterprises have serious problems in implementing advanced construction software. Investment for software purchase, infrastructure configuration, and employee training is enormous. Moreover, the technical nature of integrating new software with the existing systems and legacy tools further drives up the price. These have the potential to slow down the adoption rates, especially in regions where the firms are running on low budgets or have low IT resources. Market growth of certain segments can also be hindered by the resistance from employees of the company who are comfortable with traditional manual processes.

Construction Software Market Opportunities:

-

Growing Demand for Sustainable Construction Software Enables Eco-Friendly Projects and Regulatory Compliance

The world is shifting towards sustainable and energy-efficient construction. There is a substantial opportunity for construction software in the area of green building, including energy-efficient design and planning, and adherence to LEED or other building credentialing systems. These solutions help firms meet regulations and satisfy environmentally conscious clients by allowing them to keep a close eye on resource consumption, cut down on material waste, and embrace sustainable construction practices. With various countries implementing stringent emission norms, demand for this type of software will see an uptrend, providing the vendors opportunity to innovate and grow their market share.

About 70% of firms in developed regions rely on software to meet LEED and other environmental standards.

Construction Software Market Segmentation Analysis:

-

By Type: In 2025, Project Management led the market with share 45.02%, while Quality and Safety are the fastest-growing segment with a CAGR 11.70%.

-

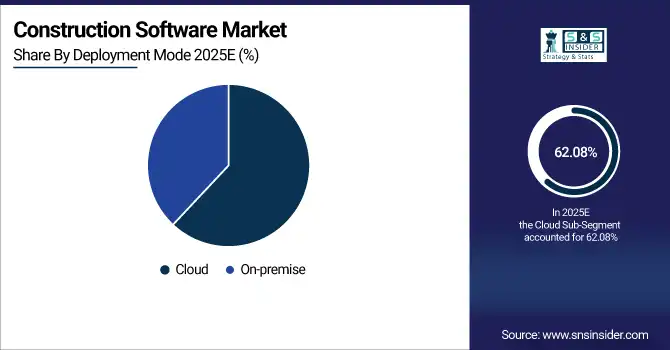

By Deployment: In 2025, Cloud the market 62.08%, while On-Premise fastest-growing segment with a CAGR 12.40%.

-

By Organization Size: In 2025 Large Enterprise led the market with share 58.24%, while Medium and Small Enterprise the fastest-growing segment with a CAGR 11.20%.

-

By Application: In 2025, General Contractors led the market with share 34.60%, while Sub-Contractors is the fastest-growing segment with a CAGR 11.60%.

By Type, Project Management Leads Market and Quality and Safety Fastest Growth

In the Construction Software Market, the Project Management segment is the largest, as effective management of complex projects necessitates coordination between large project teams, with construction teams often monitoring automated workflows in multiple locations to allocate resources effectively. The need for real-time tracking, workflow automation, and expenditure control in large scale construction projects is fuelling its adoption. On the other hand, Quality and Safety segment is the rapidly growing segment, with focus of companies moving towards regulatory compliance, on-site safety and risk mitigation. The increasing need for safety management tool came from the fact that the market is moving toward reducing operational errors, maintaining the quality of project, and increasing the operational efficiency of the construction operations.

By Deployment, Cloud Leads Market and On-Premise Fastest Growth

Cloud deployment comes through as a leader in the Construction Software Market as it offers the flexibility, and scalability that enhances the process and provides a real-time access to your project data for your team sitting at multiple locations. Cloud solutions to streamline collaboration for architects, contractors, and subcontractors while enabling resource utilization, streamlined workflows, and cost control. Simultaneously, On-Premise deployment is the fastest-growing segment since organizations are looking for better control over data, security, and customization. These factors mostly driving overall market growth and it also reflects the need of companies to balance ease of use of cloud with regulatory compliance, sensitive data management, and software configuration needs and these factors highlighting adoption of on-premise solutions.

By Organization Size, Large Enterprise Leads Market and Medium and Small Enterprise Fastest Growth

In the Construction Software Market, Large Enterprises are predominant owing to their diverse project portfolios, abundant resources, and the requirement for comprehensive software solutions that support variety of teams, locations, and workflows effectively. These organizations leverage sophisticated project management, finance, and field productivity capabilities that allow for greater cross-silo collaboration, resource optimization, and data-driven decision-making for enterprise-wide processes. On the other hand, medium and small enterprises are the fastest growing group as the number of enterprises adopting economical, cloud-based solutions to compete with larger firms is increasing. The growing digitisation of the smaller organisations indicates the market is going towards scalable, available and configurable software solutions for companies large and small.

By Application, General Contractors Leads Market and Sub-Contractors Fastest Growth

General Contractors are ahead in the Construction Software Market segment mainly because of their responsibility to manage large projects, collaborate with several stakeholders at once, and to complete it on time and budget. With advanced software solutions, they are able to expedite project planning, track progress in real time, optimize resources, and control costs. Meanwhile, Sub-Contractors is the fastest-growing segment due to their growing utilization of digital tools to increase site-level productivity, manage tasks, and improve contractor and architect collaboration. That increasing adoption of mobile-enabled and cloud-based solutions among sub-contractors point to broader operational efficiency and technology-led project management in some segments of the construction value chain.

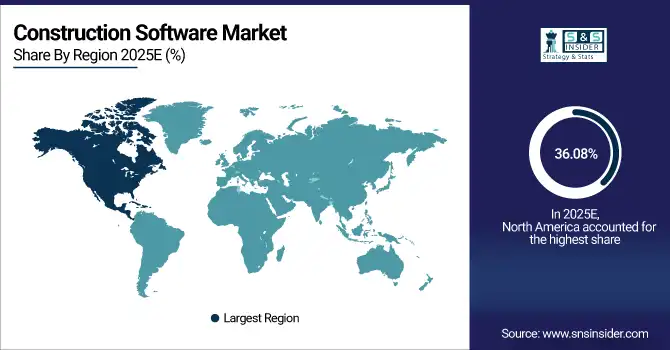

Construction Software Market Regional Analysis:

North America Construction Software Market Insights:

North America accounted for the largest share 36.08% of the Construction Software Market in 2025, driven by high digital adoption, advanced infrastructure, and presence of key vendors in the regions. Regional construction companies are aggressively utilizing cloud-based and AI-enabled solutions to mitigate project complexities, remove bottlenecks, and facilitate close-workings between various stakeholders. The market is further driven by high regulatory standards, an emphasis on safety compliance, in addition to increasing demand for sustainable and energy-efficient construction practices. Furthermore, extensive investment in smart city trends, massive commercial & other areas and biggest particulate such as Building Information Modelling (BIM) solutions create a significant presence and consistent growth in the region.

Get Customized Report as per Your Business Requirement - Enquiry Now

U.S. Dominates Construction Software Market with Advanced Technological Adoption

The U.S. dominates the Construction Software Market due to advanced technological adoption, widespread cloud-based and AI-enabled solutions, strong regulatory compliance, focus on safety, and increasing demand for sustainable, energy-efficient, and large-scale construction projects across commercial and residential sectors.

Asia-Pacific Construction Software Market Insights

In 2025, Asia-Pacific is the fastest-growing Construction Software Market with a CAGR 10.68%, due to rapid urbanization, infrastructure development, and growing investment in commercial, residential, and industrial construction projects. Cloud-based and mobile enabled construction software that enhance project productivity, resource management and collaboration among the stakeholders are being adopted in countries signified by the likes of China, India, Japan, Australia, etc. This is expected to boost the market owing to rising smart city projects and initiatives taken up by government authorities for construction-related activity in the digital space. Also, the increasing awareness about safety compliance, quality management along with rampant adoption of cutting-edge technology such as, Building Information Modeling (BIM), AI and IoT contributes to higher software adoption and thus, Asia-Pacific becomes a vendor opportunity market.

China and India Propel Rapid Growth in Construction Software Market

China and India propel rapid growth in the Construction Software Market due to increasing infrastructure development, urbanization, and adoption of digital solutions such as cloud-based software, AI, and BIM, driving efficiency, collaboration, and project management across the construction sector.

Europe Construction Software Market Insights

The Construction Software Market in Europe is expected to rise due to the increasing use of digital solutions for multiple construction projects in an effort to optimize efficiency, collaboration, and resource management. Cloud-based platforms, Building Information Modeling (BIM), and AI-enabled tools are increasingly used by firms to optimize project planning, perform quality control, and address compliance. The area's emphasis on sustainability, energy-efficient building practices, and safety standards creates a demand for software tools to help make construction sustainable. Furthermore, Developments led by both stakeholders’ including investment in extensive infrastructure, commercial and residential projects have a strong component of software adoption, making Europe a major market for vendors targeting growth in mainstream and western based technological innovation of the construction industry.

Germany and U.K. Lead Construction Software Market Expansion Across Europe

Germany and the U.K. lead Construction Software Market expansion across Europe due to high technological adoption, strong regulatory standards, emphasis on safety compliance, and increasing demand for digital solutions that enhance efficiency, project management, and sustainable construction practices.

Latin America (LATAM) and Middle East & Africa (MEA) Construction Software Market Insights

Construction Software Markets in Latin America and Middle East & Africa are experiencing moderate growth supported by infrastructure development, an increase in urbanization and investment in large-scale commercial, industrial and residential projects. Construction software that is cloud based and mobile user friendly is slowly capitalizing in these areas to allow organizations to manage projects, collaborate and optimize resources seamlessly. Increasing demand for safety compliance, quality management, and regulatory standards is also supporting the growth of software adoption. Moreover, increasing emphasis on sustainable construction, energy-efficient buildings as well as on digital construction technologies such as Building Information Modeling (BIM) and artificial intelligence powered tools is encouraging vendors to strengthen their market footprint in the evolving economies of Asia Pacific, Latin America and the Middle East and Africa.

Construction Software Market Competitive Landscape

Procore is a cloud-based construction management platform that connects project teams, streamlines workflows, and enhances collaboration. By integrating various tools and data sources, Procore enables real-time decision-making, improves project efficiency, and ensures quality and safety across the construction lifecycle.

-

In November 2024, Procore introduced AI-driven agents and a connected resource management platform at Groundbreak 2024, enhancing labor, equipment, and materials coordination.

Autodesk provides comprehensive construction software solutions, including Building Information Modeling (BIM) and cloud-based project management tools. Their platforms facilitate design, coordination, and construction processes, promoting efficiency and collaboration among stakeholders. Autodesk's tools support sustainable practices and innovation in the construction industry.

-

In February 2024, Autodesk launched Informed Design, a cloud-based solution that connects design and manufacturing workflows, enabling architects to use customizable, pre-defined building products for accurate results.

Bentley Systems offers advanced infrastructure engineering software, focusing on digital twins and asset performance. Their solutions support the design, construction, and operation of infrastructure projects, enhancing collaboration and data management. Bentley's tools aim to improve project outcomes and lifecycle management for infrastructure professionals.

-

In November 2024, Bentley Systems introduced an advanced open visualization platform for displaying infrastructure digital twins, transforming geospatial, engineering, and architectural data into immersive, hyper-realistic environments.

Construction Software Market Key Players:

Some of the Construction Software Market Companies are:

-

Procore Technologies

-

Oracle Corporation

-

Autodesk Inc.

-

Bentley Systems

-

Trimble Inc.

-

Sage Group plc

-

Microsoft Corporation

-

Constellation Software Inc.

-

SAP SE

-

RIB Software SE

-

Jonas Construction Software

-

Buildertrend

-

Fieldwire

-

CMiC

-

Newforma

-

Heavy Construction Systems Specialists (HCSS)

-

Kahua

-

Intelvision, LLC

-

Vectorworks, Inc.

-

E-Builder, Inc.

| Report Attributes | Details |

|---|---|

| Market Size in 2025 | USD 6.80 Billion |

| Market Size by 2033 | USD 14.35 Billion |

| CAGR | CAGR of 9.80% From 2026 to 2033 |

| Base Year | 2025 |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Project Management, Financial Management, Quality and Safety, Field Productivity, Others) • By Deployment Mode (Cloud, On-premise) • By Organization Size (Large Enterprise, Medium and Small Enterprise) • By Application (General Contractors, Building Owners, Architects and Engineers, Sub-Contractors, Specialty Contractors) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Procore Technologies, Oracle Corporation, Autodesk Inc., Bentley Systems, Trimble Inc., Sage Group plc, Microsoft Corporation, Constellation Software Inc., SAP SE, RIB Software SE, Jonas Construction Software, Buildertrend, Fieldwire, CMiC, Newforma, Heavy Construction Systems Specialists (HCSS), Kahua, Intelvision, LLC, Vectorworks, Inc., E-Builder, Inc., and Others. |