Exascale Computing Market Report Scope & Overview:

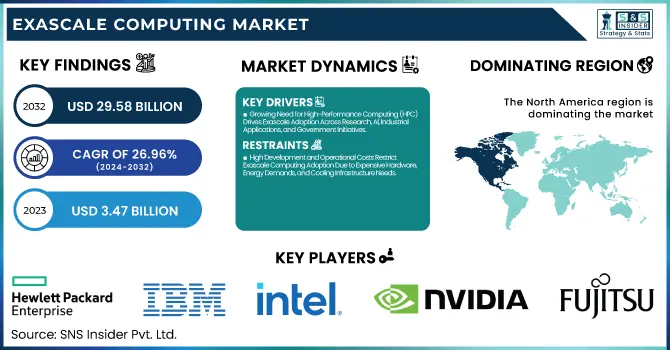

The Exascale Computing Market was valued at USD 3.47 billion in 2023 and is expected to reach USD 29.58 billion by 2032, growing at a CAGR of 26.96% from 2024-2032.

To Get more information on Exascale Computing Market - Request Free Sample Report

This report includes insights on adoption rate, R&D expenditure, energy efficiency data, funding & investment patterns, and algorithm & software development. The market is experiencing aggressive adoption with growing demand for high-performance computing across industries such as healthcare, finance, and defense. Major R&D investments are driving innovation in energy-efficient architecture and optimized software models. Government and private investments are fueling innovation, while software engineering is optimizing system performance and scalability. As exascale computing continues to grow, efficiency and cost remain central areas of focus, influencing the future of computing power and its applications in various industries.

Exascale Computing Market Dynamics

Drivers

-

Growing Need for High-Performance Computing (HPC) Drives Exascale Adoption Across Research, AI, Industrial Applications, and Government Initiatives

The growing requirement for powerful computing in scientific research, sophisticated simulations, and data-intensive workloads is driving the growth of exascale computing. Healthcare, climate simulation, and aerospace industries need massive processing capabilities to manage large datasets and perform real-time analysis. AI and machine learning technology further necessitate this requirement, demanding quicker and more efficient computing systems. In addition, government and defense programs are heavily investing in exascale systems to advance national security and global technology leadership. Sustained innovations in semiconductor and processor technologies are enabling such systems to be scalable and energy-efficient, paving the way for widespread adoption across industries. With computational challenges escalating, exascale computing is fast becoming mandatory to address next-generation scientific and industrial issues.

Restraints

-

High Development and Operational Costs Restrict Exascale Computing Adoption Due to Expensive Hardware, Energy Demands, and Cooling Infrastructure Needs.

Development and maintenance of exascale systems require substantial investment in state-of-the-art hardware, massive-scale data centers, and sophisticated cooling infrastructure. The colossal power usage needed to support these high-performance computing platforms further increases operational costs, thus making it a major challenge for affordability. Organizations have to invest significant money in system overhauls, upkeep, and energy efficiency optimization. Moreover, the intricacies of incorporating exascale computing into current workflow also contribute to the cost of implementation. The investments of the government and corporations are important drivers, but finances can hinder high-scale deployments. Without affordable answers, mass adaptation is limited, keeping the extent of exascale computing for transforming industries like healthcare, climate modeling, and AI-based research limited.

Opportunities

-

Advancements in AI, Machine Learning, and Big Data Analytics Boost Exascale Computing Adoption for Faster Processing and Real-Time Decision-Making.

The growing intricacy of AI models, deep learning algorithms, and big data processing is generating demand for exascale computing. As businesses are dependent on AI for predictive analytics, automation, and decision-making, ultra-high-speed computation needs are more than ever before. Exascale machines accelerate AI training for more precise simulation and real-time data analysis. Healthcare, finance, and autonomous systems gain advantage from increased processing power, which enhances drug development, risk estimation, and applications of machine vision. Further, the convergence of AI-based automation in manufacturing and cybersecurity offers exascale with new applications. As big data and AI keep advancing, exascale computing is instrumental in breaking the technological barrier.

Challenges

-

Cybersecurity and Data Management Risks in Exascale Computing Increase Threats of Data Breaches, Regulatory Challenges, and System Vulnerabilities.

Handling large amounts of sensitive data in exascale computing systems raises the risk of cyberattacks, data breaches, and regulatory challenges. As increasing dependence on high-performance computing for AI, healthcare, and defense purposes grows, securing massive datasets becomes more complicated. Risks of unauthorized access, system exposure, and possible cyberattacks can halt operations and expose sensitive information. Compliance with international data protection laws is also an added complexity, necessitating strong encryption, access control, and real-time threat detection. Organizations need to invest in sophisticated cybersecurity frameworks to maintain data integrity while facilitating seamless scalability. Absence of proper security, the growth of exascale computing is going to face major roadblocks, restricting its mass adaptation within industries.

Exascale Computing Market Segment Analysis

By End Use

The Government & Defense segment led the Exascale Computing Market in 2023 with the largest revenue share of around 34%. It is led by heavy investments in national defense, intelligence, and sophisticated defense simulations. Governments across the globe are utilizing exascale computing for cryptography, surveillance, and high-speed data processing in military systems. Climate modeling, nuclear research, and space exploration efforts also contribute to its leadership. The growing requirement for real-time decision-making and supercomputational capacity strengthens the strong market position of the segment.

The segment Healthcare & Biosciences is expected to expand at the fastest CAGR of 29.71% during 2024-2032. The demand is driven by exascale computing being able to expedite drug discovery, genomic research, and personalized medicine. Sophisticated disease modeling, vaccine design, and bioinformatics simulations demand ultra-high computing power, and exascale becomes imperative for innovation. Furthermore, AI-based diagnostics and biomedical data analysis further increase adoption, spurring the segment's future growth at a rapid rate.

By Component

The Hardware segment led the Exascale Computing Market in 2023 with the largest revenue share of approximately 54%. This dominance is spurred by the substantial investment needed in high-performance processors, GPUs, memory systems, and cooling facilities. The heightened need for power-efficient computing units, dedicated accelerators, and high-speed interconnects only reinforces the strength of the segment. Moreover, government and corporate efforts to establish next-generation supercomputing centers drive the surge in adoption of leading-edge hardware, guaranteeing top-notch computing capability for AI, scientific study, and military use.

The Services segment is anticipated to grow at the fastest CAGR of 24.26% during the forecast period from 2024 to 2032. This high growth is propelled by the increase in the requirement for exascale computer infrastructure integration, maintenance, and optimization. Businesses require professional services to make deployments seamless, compatible software, and performance tuning. Growing use of cloud-based exascale solutions and managed services is also boosting demand. With business models and research centers expanding computing power, expert support and consulting services are imperative, driving market growth.

By Deployment

The On-premises segment led the Exascale Computing Market in 2023 with the largest revenue share of approximately 55%. This is because the demand for specialized, high-performance infrastructure is high in defense, government, and research organizations. On-premises installations allow more control of security, data privacy, and performance optimization, thus being best suited for mission-critical applications. On-premises configurations are also used by industries that need real-time simulations and heavy computing, as they allow low-latency processing. The heavy investment in exascale supercomputers built to order also bolsters the market leadership of this segment.

The Cloud-based segment is expected to grow at the fastest CAGR of around 28.15% from 2024 to 2032. It is fueled by the growing use of scalable, cost-effective, and on-demand computing solutions. Cloud-based exascale computing minimizes infrastructure costs and enables organizations to tap into enormous computing power without significant capital expenditure. Moreover, the advancements in cloud security and AI-based workload management are fueling adoption. With industries focusing on flexibility and remote access, cloud-based exascale solutions are picking up huge momentum.

Regional Analysis

The North America region led the Exascale Computing Market in 2023 with the largest revenue share of around 36%. This is attributed to huge government investments in high-performance computing (HPC) for defense, scientific research, and space exploration. The region also has the presence of major technology companies and research institutions, further fueling developments in exascale computing. In addition, robust investments in AI, cloud computing, and big data analytics boost regional uptake. The U.S. Department of Energy's efforts to build exascale systems further consolidate North America's dominance.

The Asia Pacific region is expected to expand at the fastest CAGR of approximately 29.76% during 2024-2032. Exascale computing adoption is being propelled by fast developments in AI, 5G, and smart city projects. Government spending on supercomputing infrastructure, especially in China, Japan, and India, is driving market growth. The increasing demand for high-performance computing in sectors like healthcare, finance, and manufacturing also drives demand higher. Moreover, rising research and development spending reinforces the region's growth path.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

-

Hewlett Packard Enterprise (HPE) [HPE Cray EX235a, HPE Slingshot-11]

-

International Business Machines Corporation (IBM) [IBM Power System AC922, IBM Power System S922LC]

-

Intel Corporation [Intel Xeon Max 9470, Intel Max 1550]

-

NVIDIA Corporation [NVIDIA GH200 Superchip, NVIDIA Hopper H100]

-

Cray Inc. [Cray EX235a, Cray EX254n]

-

Fujitsu Limited [Fujitsu A64FX, Tofu interconnect D]

-

Advanced Micro Devices, Inc. (AMD) [AMD EPYC 64C 2.0GHz, AMD Instinct MI250X]

-

Lenovo Group Limited [Lenovo ThinkSystem SD650 V3, Lenovo ThinkSystem SR670 V2]

-

Atos SE [BullSequana XH3000, BullSequana XH2000]

-

NEC Corporation [SX-Aurora TSUBASA, NEC Vector Engine]

-

Dell Technologies [Dell EMC PowerEdge XE8545, Dell EMC PowerSwitch Z9332F]

-

Microsoft [Microsoft Azure NDv5, Microsoft Azure HPC Cache]

-

Amazon Web Services (AWS) [AWS Graviton3, AWS Nitro System]

-

Sugon [Sugon TC8600, Sugon I620-G30]

-

Google [Google TPU v4, Google Cloud HPC VM]

-

Alibaba Cloud [Alibaba Cloud ECS Bare Metal Instance, Alibaba Cloud HPC Cluster]

Recent Developments:

-

In November 2024, HPE announced that El Capitan became the world's fastest supercomputer at 1.742 exaflops and one of the top 20 most energy-efficient systems. HPE now holds the top three spots in global exascale computing, with all three systems built by the company. El Capitan will support AI-driven research in national security, energy, climate, and healthcare.

-

In March 2024, NVIDIA announced the Blackwell platform, a major advancement in AI and high-performance computing. Featuring the world's most powerful GPU with 208 billion transistors, the platform improves AI model efficiency, enhances performance for large-scale computations, and reduces energy consumption by up to 25x.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 3.47 Billion |

| Market Size by 2032 | USD 29.58 Billion |

| CAGR | CAGR of 26.96% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Hardware, Software, Services) • By Deployment (On-premises, Cloud-based) • By End Use (Government & Defense, Healthcare & Biosciences, Financial Services, Research & Academia, Manufacturing & Energy, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Hewlett Packard Enterprise (HPE), International Business Machines Corporation (IBM), Intel Corporation, NVIDIA Corporation, Cray Inc., Fujitsu Limited, Advanced Micro Devices, Inc. (AMD), Lenovo Group Limited, Atos SE, NEC Corporation, Dell Technologies, Microsoft, Amazon Web Services (AWS), Sugon, Google, Alibaba Cloud |