Contract Packaging Market Report Scope & Overview:

Get More Information on Contract Packaging Market - Request Sample Report

The Contract Packaging Market Size was valued at USD 69.45 billion in 2023 and is projected to reach USD 120.36 billion by 2032 growing at a CAGR of 6.3% from 2024 to 2032.

Contract packagers are specialist, they bring expertise and resources to the table, allowing companies to benefit from economies of scale and avoid significant upfront investments in machinery and facilities. Additionally, contract packagers can design customized packaging solutions that keep up with changing consumer trends, and navigate the complexities of global supply chains with its varying regulations and preferences for packaging materials. The rise of global supply chains adds another layer to the benefits of outsourcing packaging. Contract packagers can navigate the complex web of regulations and regional preferences for materials, ensuring companies stay compliant and cater to local markets.

In today's competitive landscape, companies are increasingly focusing on what they do best. By partnering with contract packagers, businesses gain access to specialized expertise and resources, leading to a trifecta of benefits such as cost savings, improved efficiency, and boosted productivity. Furthermore, outsourcing offers flexibility and scalability, allowing companies to adapt to evolving market demands with agility. They can also tap into a global pool of talent and benefit from economies of scale. Ultimately, the outsourcing trend empowers businesses to streamline operations, sharpen their competitive edge, and fuel growth.

MARKET DYNAMICS

KEY DRIVERS:

-

Booming e-commerce demands eco-friendly, protective, beautiful custom packaging, fueling contract packagers.

The explosion of e-commerce is reshaping the packaging industry. Consumers now expect their online orders to arrive not just safe and sound, but also looking good. This has fueled a significant increase in demand for specialized packaging solutions. Eco-friendly materials are a must, as sustainability is a major concern. But protection remains paramount, packaging needs to ensure fragile items survive the rigors of shipping.

-

Rising focus on drug safety and anti-counterfeiting in pharma is boosting demand for contract packagers with compliance expertise.

RESTRAINTS:

-

Strict rules govern the materials used in packaging.

Regulations are increasingly promoting the use of eco-friendly materials like recycled content or bioplastics. Additionally, they may limit the use of non-recyclable or difficult-to-recycle materials.

OPPORTUNITY:

-

Outsourcing packaging allows for faster turnaround times and a more efficient supply chain.

-

The key opportunity lies in offering specialized services that help businesses navigate ever-evolving packaging regulations while maintaining quality and safety.

Businesses can leverage the expertise of contract packagers to implement stringent quality control measures throughout the packaging process. This not only ensures product integrity but also builds trust with consumers who prioritize safety. Contract packagers are constantly innovating and keeping a pulse on emerging packaging trends. By partnering with them, businesses gain access to cutting-edge solutions that meet evolving regulations while potentially offering a competitive edge through sustainable or efficient packaging options.

CHALLENGES:

-

Evolving consumer demands and packaging innovations are reshaping the industry.

A major challenge for contract packagers is staying agile. They constantly need to adapt to evolving consumer preferences and emerging packaging trends. This means being quick to develop new, creative solutions to meet changing market demands and stay ahead of the curve in this fast-paced industry.

-

The growing complexity of packaging design and materials is a major hurdle for contract packagers.

IMPACT OF RUSSIA UKRAINE WAR

The war in Ukraine is causing widespread effects through the contract packaging market, disrupting supply chains and raising costs. Major companies like Ball Corp and Coca-Cola are exiting Russia, further straining an already stressed system. Paper and packaging companies like Mondi are suspending operations in Ukraine and grappling with complex situations in Russia. The conflict has also sent shockwaves through commodity prices. Aluminum, a key material in packaging, saw a dramatic surge, while kraft pulp prices jumped by $1,000 per tonne. These rising costs will likely be passed down the line, impacting contract packagers and potentially leading to higher prices for consumers. The full extent of the war's impact remains to be seen, but it's clear that the contract packaging market faces a period of uncertainty and potential price hikes.

IMPACT OF ECONOMIC SLOWDOWN

The economic slowdown is squeezing the contract packaging industry. Production slowdowns across various industries, a key indicator being the significant drop in cardboard demand, paint a worrying picture. Early 2023's hopeful projections of rising box demand have evaporated, with the American Forest & Paper Association reporting a first-quarter boxboard operating rate down over 6% compared to the previous year. The paper and packaging industry was slammed by slowdowns in 2023, leading to major production cuts by leading producers. Packaging Corp., a leading North American container board producer, confirms the severity, with shipments dropping a staggering 13% numbers reminiscent of the 2009 financial crisis. The contract packaging market is clearly facing the downsides of a sluggish economy.

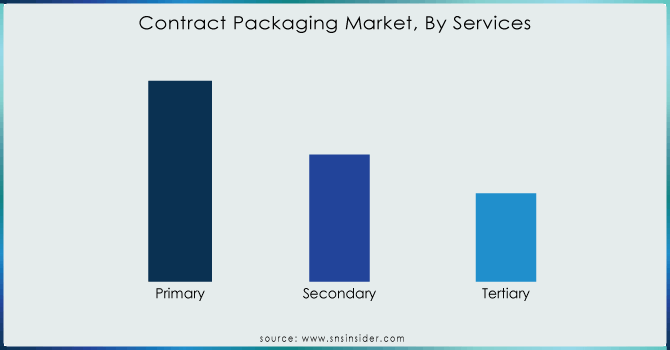

By Services

-

Primary

-

Secondary

-

Tertiary

The primary packaging segment, which directly encases the product, reigns supreme in the contract packaging market, with share of over 45.5%.. Several trends are fueling this growth. Today's consumers have a strong preference for packaging that's both unique and visually appealing. The booming e-commerce and direct-to-consumer sales channels also play a role, demanding packaging that can survive the rigors of shipping and grab attention on a digital shelf overflowing with options.

Do You Need any Customization Research on contract packaging market - Enquire Now

By Material

-

Plastic

-

Metal

-

Glass

-

Paper

-

Paperboard

Plastic reigns supreme in the contract packaging market, and this dominance is likely to continue. Its versatility is unmatched plastic can be rigid or flexible, adapting to the specific needs of any product. This is essential in an industry where countless products require unique packaging solutions. Furthermore, plastic acts as a fantastic barrier, protecting products from moisture, oxygen, and other enemies that lurk in the environment. This is especially crucial for food and pharmaceuticals, where maintaining product quality is paramount.

By Vertical

-

Food

-

Beverages

-

Pharmaceuticals

-

Home Products and Fabrics

-

Cosmetics and Beauty Care

-

Others

The food and beverage industry, with its vast array of products, is dominating the contract packaging market. This industry demands a unique blend of functionality and compliance. Packaging needs to keep food and drinks fresh and safe, while also adhering to strict regulations. Contract packagers are the perfect fit for this challenge. They specialize in creating efficient and cost-effective packaging solutions specifically for food and beverages, making them the preferred choice for this ever-evolving industry.

REGIONAL ANALYSIS

The contract packaging market with Asia Pacific reigning supreme. This region is a treasure trove for packaging service providers, especially in the realms of food and beverage, healthcare, and cosmetics. The reasons behind this dominance are three-fold: a booming manufacturing sector, a surge in consumer spending, and rapid urbanization. North America follows closely behind, fueled by its well-established consumer goods industries, including food, pharmaceuticals, and personal care products. Stringent regulations, a relentless emphasis on safety, and robust quality standards make this region a haven for contract packagers.

Europe joins the top contenders with its diverse and mature packaging industry, where sustainability, innovation, and strict environmental compliance are key drivers. Latin America is a rising star, propelled by a growing consumer base, increasing disposable income, and a flourishing retail sector. Brazil and Mexico are leading the charge in this region. Finally, the Middle East & Africa market is expected to experience moderate growth due to rapid infrastructure development and economic diversification efforts, which are fostering a surge in manufacturing activities.

REGIONAL COVERAGE:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

Key players

Some of the major players in the Contract Packaging Market are AmeriPac Inc., Nulogy Corporation, Wepackit Inc., Sterling Contract Packaging Inc., Unicep Packaging, Summit Container, Stamar Packaging, Sharp Packaging, Jones Packaging, Aaron Thomas Company Inc., DHL, Green Packaging Asia, Co Pak Packaging And Others Players.

RECENT DEVELOPMENTS

-

In a move to expand its offerings, Sharp, a leader in pharmaceutical packaging and clinical trial supplies, acquired Berkshire Sterile Manufacturing (BSM) in October 2023. BSM, a Massachusetts-based company, specializes in contract development and manufacturing of sterile injectable products for clinical trials and commercial use.

-

Anticipating a surge in demand for biologics, mRNA therapies, and contract packaging, Pharmapack Europe announced in January 2023 the addition of two new dedicated zones by 2024. These zones will cater specifically to the growing need for specialized biological packaging solutions.

-

In August 2023, The Shippers Group teamed up with Pacific Coast Producers to donate supplies and replenish the shelves of local food banks.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 69.45 Bn |

| Market Size by 2032 | US$ 120.36 Bn |

| CAGR | CAGR of 6.3% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Services (Primary, Secondary, Tertiary), By Material (Plastic, Metal, Glass, Paper, Paperboard) • By Vertical(Food, Beverages, Pharmaceuticals, Home Products And Fabrics, Cosmetics And Beauty Care, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | AmeriPac Inc., Nulogy Corporation, Wepackit Inc., Sterling Contract Packaging Inc., Unicep Packaging, Summit Container, Stamar Packaging, Sharp Packaging, Jones Packaging, Aaron Thomas Company Inc., DHL, Green Packaging Asia, Co Pak Packaging |

| Key Drivers | • Booming e-commerce demands eco-friendly, protective, beautiful custom packaging, fueling contract packagers. • Rising focus on drug safety and anti-counterfeiting in pharma is boosting demand for contract packagers with compliance expertise. |

| Key Restraints | • Strict rules govern the materials used in packaging. |