Conversational Systems Market Report Scope & Overview:

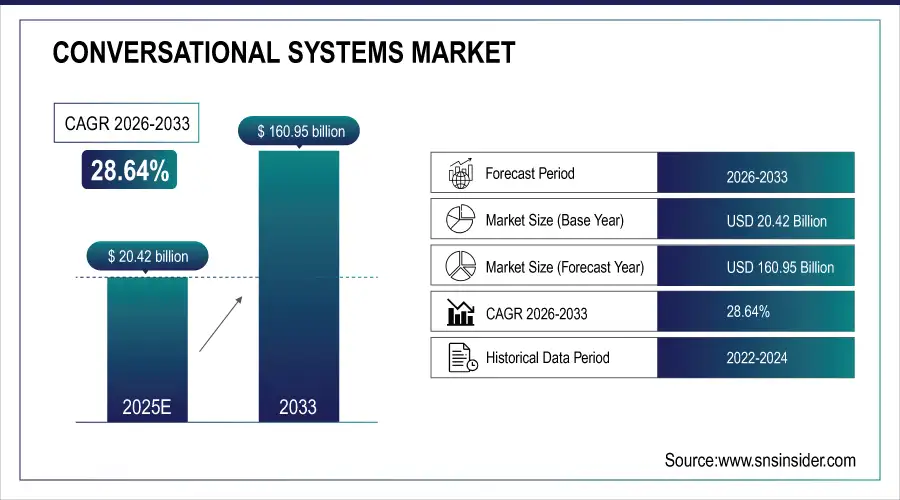

The Conversational Systems Market was valued at USD 20.42 billion in 2025E and is expected to reach USD 160.95 billion by 2033, growing at a CAGR of 28.64% from 2026-2033.

The conversational systems market has witnessed significant growth in recent years, driven by advancements in artificial intelligence, natural language processing, and machine learning technologies. These innovations have made interactions between users and machines more efficient and intuitive. Industries such as retail, healthcare, banking, and customer service have increasingly adopted chatbots, virtual assistants, and voice-activated systems. For instance, approximately 68.2% of smart speaker users in the US use Amazon Echo with Alexa, reflecting the growing popularity of voice-activated systems. In healthcare, Community Health Systems partnered with Denim Health in October 2024 to implement conversational AI across its Patient Access Center, aiming to enhance patient experience and operational efficiency. This integration fosters new opportunities for businesses to improve engagement, streamline operations, and drive market expansion.

Conversational Systems Market Size and Forecast:

-

Market Size in 2025E: USD 20.42 Billion

-

Market Size by 2033: USD 160.95 Billion

-

CAGR: 28.64% from 2026 to 2033

-

Base Year: 2025E

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

Get More Information on Conversational Systems Market - Request Sample Report

This growth in adoption is further amplified by the rising demand for AI-powered solutions, as businesses look to gain a competitive edge in customer service and operational efficiency. In November 2024, Everlytic introduced an AI Studio featuring WhatsApp chatbots, enabling businesses to automate customer interactions and enhance communication efficiency, reflecting this trend. The shift toward omnichannel communication platforms, which combine chatbots, voice assistants, and messaging services, has made conversational systems indispensable across various sectors. With the surge in e-commerce, online banking, and remote services, especially after the pandemic, the need for automated customer support and virtual assistants has increased significantly. This continued rise in demand is supported by the continuous advancements in AI, which now enable more personalized, context-aware, and efficient interactions between users and machines.

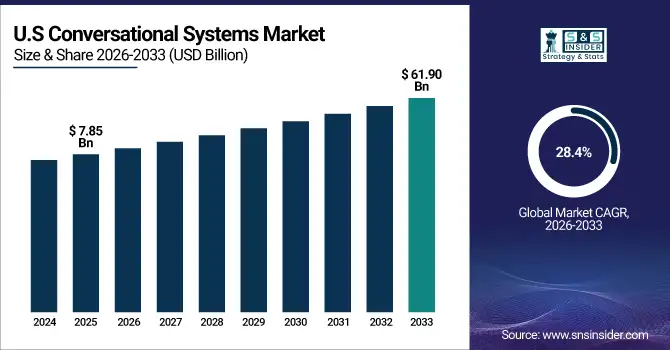

The U.S. Conversational Systems market size was valued at an estimated USD 7.85 billion in 2025 and is projected to reach USD 61.90 billion by 2033, growing at a CAGR of 28.4% over the forecast period 2026–2033. Market growth is driven by the rapid adoption of AI-powered chatbots and virtual assistants across industries such as BFSI, retail, healthcare, IT & telecom, and customer service. Increasing demand for personalized customer engagement, 24/7 automated support, and cost-efficient business operations is accelerating market expansion. Advancements in natural language processing (NLP), machine learning, and voice recognition technologies, along with growing integration of conversational AI with cloud platforms and CRM systems, further strengthen the growth outlook of the U.S. conversational systems market during the forecast period.

Conversational Systems Market Drivers:

-

Growing Enterprise Adoption of AI-Powered Automation Enhances Operational Efficiency and Accelerates Conversational Systems Market Growth

The rapid enterprise-wide shift toward AI-powered automation continues to intensify demand for conversational systems because organizations require more efficient, scalable, and intelligent communication interfaces that reduce manual workloads and deliver real-time responses. As companies expand digital transformation initiatives, the need for automated customer interaction tools—such as chatbots, virtual assistants, and voice-enabled interfaces—creates a strong market pull. Advanced natural language processing, multimodal AI, and integration into CRM and ERP platforms further improve conversational accuracy and contextual understanding, leading businesses to replace traditional support models with automated conversational systems. This cause-and-effect cycle accelerates market expansion by boosting operational efficiency, improving customer experience, and enabling 24/7 availability. Additionally, the growing adoption of hybrid work and omnichannel engagement strategies pushes enterprises to deploy conversational systems that unify communication across digital platforms, creating sustained long-term demand for AI-enabled conversational solutions.

In March 2025, Microsoft integrated enhanced multimodal Copilot functionalities across Dynamics 365, enabling enterprises to automate customer support, streamline internal workflows, and boost real-time communication.

Conversational Systems Market Restraints:

-

Rising Data Privacy Concerns and Complex Regulatory Compliance Requirements Slow Conversational Systems Market Expansion Across Global Digital Communication Ecosystems

Stringent data privacy regulations and increased user sensitivity to data handling practices create major challenges for conversational system deployment, limiting growth across highly regulated sectors such as banking, healthcare, and government services. Since conversational systems process sensitive user interactions—including voice recordings, text inputs, and behavioral patterns—the risk of data breaches or model misuse becomes a central concern. This cause-and-effect dynamic increases compliance burdens, as organizations must invest in encryption, anonymization, secure cloud frameworks, and advanced governance models before implementing conversational solutions. Additionally, cross-border data restrictions and evolving AI regulations make it difficult for enterprises to scale conversational systems globally without legal complexities. These combined challenges slow adoption rates, prolong implementation timelines, and raise operational costs, ultimately restraining the widespread expansion of conversational AI technologies.

Conversational Systems Market Opportunities:

-

Expanding Integration of Generative AI in Customer Experience Platforms Creates New Revenue Opportunities for Conversational Systems Market

The rapid integration of generative AI into enterprise customer experience platforms presents a powerful opportunity for the conversational systems market, as businesses increasingly seek advanced automation tools capable of producing humanlike dialogue, adaptive responses, and contextual decision-making. This cause-and-effect shift is redefining how organizations interact with customers across retail, banking, telecommunications, and service industries, enabling hyper-personalized communication at scale. Generative AI enhances conversational accuracy, emotional intelligence, and multilingual capabilities, creating new possibilities for proactive support, predictive engagement, and fully autonomous digital assistants. As companies modernize their CX infrastructure, conversational systems become essential components that improve satisfaction, reduce service costs, and enhance brand loyalty.

In February 2025, Google launched advanced Gemini-powered conversational APIs for enterprise CX platforms, enabling companies to design highly personalized, generative AI-driven customer interactions.

Conversational Systems Market Segmentation Analysis:

By Type

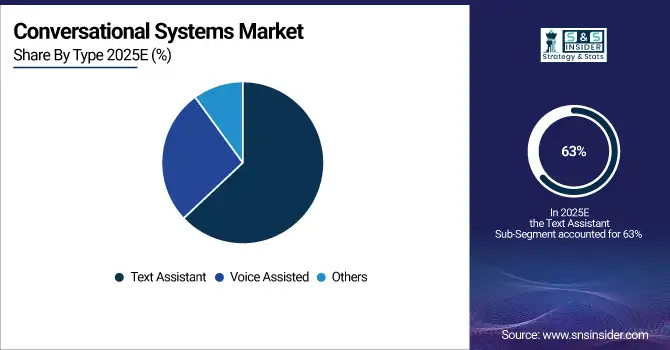

In 2025, the Text Assistant segment led the Conversational Systems Market with the highest revenue share of approximately 63%. This dominance is primarily due to the widespread adoption of text-based chatbots and virtual assistants, which provide businesses with an accessible, cost-effective solution for customer support, e-commerce, and more. Text assistants are favored for their ease of integration across various digital platforms, enabling seamless communication with users through websites, messaging apps, and social media. Their scalability and ability to handle large volumes of text-based interactions further contribute to their market-leading position.

The Voice Assisted segment is expected to grow at the fastest CAGR of 31.22% from 2026 to 2033. The surge in voice-enabled devices and the increasing consumer preference for hands-free interactions are driving this growth. Voice assistants, integrated into smartphones, smart speakers, and other IoT devices, are becoming integral to daily life, enhancing convenience and accessibility. As AI technology improves and voice recognition accuracy increases, businesses are increasingly leveraging voice assistants to offer more personalized and efficient customer experiences, fueling the segment's rapid expansion.

By Component

In 2025, the Compute Platforms segment dominated the Conversational Systems Market, capturing approximately 50% of the revenue share. This dominance can be attributed to the increasing demand for robust and scalable infrastructure to support the complex AI algorithms driving conversational systems. With the growth of cloud computing, businesses are relying more on powerful compute platforms to handle large volumes of data and deliver real-time, high-quality user interactions. The integration of AI, machine learning, and natural language processing further necessitates the use of advanced compute resources, cementing the segment's leading position.

The Services segment is expected to grow at the fastest CAGR of around 32.91% from 2026 to 2033. This growth is driven by the increasing need for tailored solutions, ongoing support, and system maintenance, as companies seek to optimize their conversational systems post-deployment. As businesses continue to embrace AI-driven automation, the demand for professional services, including implementation, customization, and integration, will rise. Moreover, the complexity of managing and updating conversational systems ensures that services will play a critical role in their long-term success, propelling this segment's rapid expansion.

By Application

In 2025, the Customer Support & Personal Assistant segment dominated the Conversational Systems Market, capturing around 35% of the revenue share. This dominance stems from the growing reliance on AI-driven chatbots and virtual assistants to enhance customer service efficiency. Businesses increasingly deploy these systems to handle customer inquiries, troubleshoot issues, and offer personalized assistance around the clock, leading to reduced operational costs and improved customer satisfaction. The scalability of these solutions, combined with their ability to automate repetitive tasks, makes them essential tools for businesses looking to optimize customer interactions.

The Branding & Advertisement segment is expected to grow at the fastest CAGR of about 31.70% from 2026 to 2033. This rapid growth is driven by the ability of conversational systems to deliver targeted, interactive, and engaging experiences for consumers, transforming traditional advertising approaches. Brands are leveraging AI-powered conversational platforms to create personalized marketing campaigns, offer product recommendations, and directly engage with customers through chat and voice assistants. As businesses seek to enhance customer engagement and create more dynamic brand experiences, the demand for conversational systems in advertising is set to soar.

Conversational Systems Market Regional Analysis:

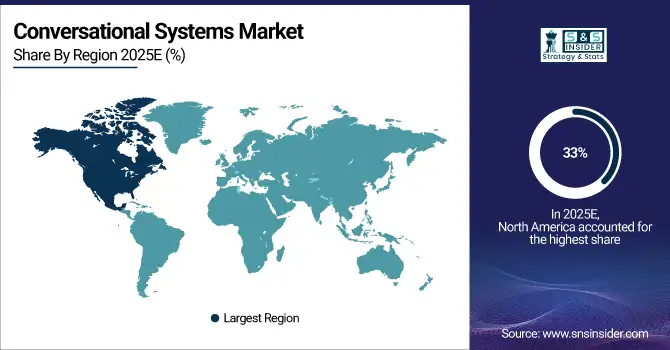

In 2025, North America dominated the Conversational Systems Market, with 33% of the revenue share. This leadership can be attributed to the region's advanced technological infrastructure and early adoption of AI-driven solutions across various industries. Businesses in North America are highly invested in enhancing customer experiences through automated services, such as chatbots and virtual assistants, leading to widespread market adoption. Additionally, the presence of key players and continuous innovation in AI and natural language processing technologies further solidified the region's dominance in the conversational systems space.

Do You Need any Customization Research on Conversational Systems Market - Enquire Now

Asia Pacific is expected to grow at the fastest CAGR of 32.27% from 2026 to 2033. This rapid expansion is fueled by the region's large population, increasing smartphone penetration, and the rising demand for automation in sectors like e-commerce, banking, and customer service. As businesses in Asia Pacific embrace digital transformation and the adoption of AI technologies accelerates, conversational systems are becoming essential tools to meet the region's growing need for personalized and scalable customer interactions. The region's expanding tech ecosystem positions it for sustained market growth in the coming years.

Conversational Systems Market key Players:

-

Google (Google Assistant, Dialogflow)

-

Microsoft (Azure Bot Service, Microsoft Cognitive Services)

-

IBM (Watson Assistant, Watson Discovery)

-

AWS (Amazon Lex, Amazon Connect)

-

Baidu (DuerOS, Baidu Brain)

-

Oracle (Oracle Digital Assistant, Oracle Cloud Infrastructure)

-

SAP (SAP Conversational AI, SAP Business Technology Platform)

-

Nuance (Nuance Mix, Nina Virtual Assistant)

-

Artificial Solutions (Teneo, Teneo Studio)

-

Conversica (Conversica AI Sales Assistant, Conversica AI Lead Assistant)

-

Haptik (Haptik Conversational AI, Haptik Chatbot)

-

Rasa (Rasa Open Source, Rasa X)

-

Rulai (Rulai AI, Rulai Virtual Assistant)

-

Avaamo (Avaamo AI Assistant, Avaamo Chatbot)

-

Kore.ai (Kore.ai Intelligent Virtual Assistant, Kore.ai Enterprise Chatbot)

-

Solvvy (Solvvy AI Support, Solvvy Conversational Automation)

-

Pypestream (Pypestream Conversational AI, Pypestream Support Automation)

-

Inbenta (Inbenta Chatbot, Inbenta AI Search)

-

Saarthi.ai (Saarthi.ai Virtual Assistant, Saarthi.ai Chatbot)

-

TENEO.AI (Teneo AI, Teneo Studio)

-

Genesys (Genesys Cloud, Genesys Digital Customer Service)

-

Adobe (Adobe Sensei, Adobe Experience Manager)

-

Avaya (Avaya OneCloud, Avaya Virtual Assistant)

-

Verint Systems (Verint Intelligent Virtual Assistant, Verint Speech Analytics)

-

Cisco (Cisco Webex Assistant, Cisco Contact Center)

-

Salesforce (Salesforce Einstein, Salesforce Service Cloud)

Competitive Landscape for the Conversational Systems Market:

Google is a U.S.-based technology leader offering advanced conversational AI through Google Assistant and Dialogflow. Google Assistant provides AI-driven virtual assistant capabilities across mobile, smart home, and enterprise devices, supporting natural language understanding, contextual conversations, and proactive suggestions. Dialogflow enables developers and enterprises to build, test, and deploy conversational interfaces for websites, apps, and messaging platforms. Google’s role in the conversational systems market is critical, delivering scalable, intelligent, and user-friendly solutions that enhance customer engagement, automate workflows, and support enterprise digital transformation.

-

In 2025, Google introduced enhanced multilingual support and contextual AI improvements in Dialogflow CX, allowing enterprises to deploy more natural, human-like conversations across global markets.

Microsoft

Microsoft is a U.S.-based technology giant providing conversational AI solutions via Azure Bot Service and Microsoft Cognitive Services. Azure Bot Service enables organizations to design, build, and deploy intelligent chatbots across multiple channels, while Microsoft Cognitive Services offer AI capabilities such as natural language understanding, speech recognition, and sentiment analysis. Microsoft’s role in the conversational systems market is significant, delivering enterprise-ready AI solutions that integrate seamlessly with Microsoft 365, Dynamics 365, and other cloud services, empowering businesses to automate interactions and enhance productivity.

-

In 2025, Microsoft released an updated version of Azure Bot Service with enhanced multi-turn conversation capabilities and tighter integration with Microsoft Teams, enabling enterprises to deploy context-aware virtual assistants for internal and customer-facing applications.

IBM

IBM is a U.S.-based leader in AI-driven enterprise solutions, offering conversational systems through Watson Assistant and Watson Discovery. Watson Assistant enables businesses to deploy intelligent virtual agents and chatbots with deep domain expertise, while Watson Discovery provides advanced AI search and document analysis capabilities. IBM’s role in the conversational systems market is central, providing enterprise-grade solutions that combine AI, machine learning, and natural language understanding to improve customer service, automate workflows, and analyze large volumes of unstructured data.

-

In 2025, IBM launched new Watson Assistant enhancements focused on hybrid cloud deployments and low-code integration, allowing businesses to create personalized conversational experiences with minimal technical overhead.

AWS

Amazon Web Services (AWS) is a U.S.-based cloud computing leader offering conversational AI solutions such as Amazon Lex and Amazon Connect. Amazon Lex powers intelligent chatbots with automatic speech recognition and natural language understanding, while Amazon Connect provides cloud-based contact center services integrated with AI capabilities. AWS’s role in the conversational systems market is crucial, enabling organizations to scale customer engagement, streamline contact center operations, and implement voice- and text-based conversational interfaces in a cost-effective, flexible cloud environment.

-

In 2025, AWS expanded Amazon Lex capabilities with advanced contextual memory and multilingual support, allowing enterprises to deploy more responsive and adaptive chatbots across customer service, e-commerce, and operational workflows.

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 20.42 Billion |

| Market Size by 2033 | USD 160.95 Billion |

| CAGR | CAGR of 28.64% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Compute Platforms, Solutions, Services) • By Type (Text Assistant, Voice Assisted, Others) • By Application (Branding & Advertisement, Customer Support & Personal Assistant, Data Privacy & Compliance, Others) • By Vertical (BFSI, Healthcare & Life Sciences, Media & Entertainment, Retail & E-commerce, Telecommunication, Travel & Hospitality, Other) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Google, Microsoft, IBM, AWS, Baidu, Oracle, SAP, Nuance, Artificial Solutions, Conversica, Haptik, Rasa, Rulai, Avaamo, Kore.ai, Solvvy, Pypestream, Inbenta, Saarthi.ai, TENEO.AI, Genesys, Adobe, Avaya, Verint Systems, Cisco, Salesforce |