Core Banking Software Market Report Scope & Overview:

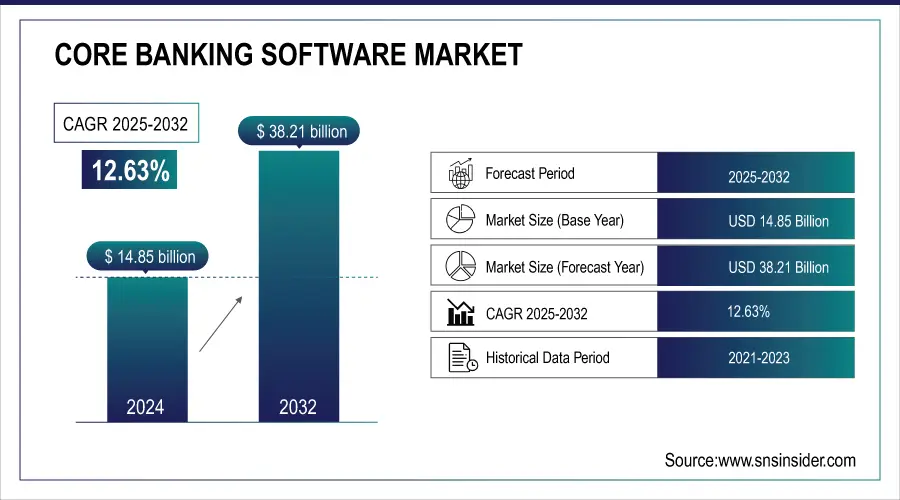

The Core Banking Software Market was valued at USD 14.85 billion in 2024 and is expected to reach USD 38.21 billion by 2032, growing at a CAGR of 12.63% from 2025-2032.

The Core Banking Software Market is expanding rapidly as banks adopt digital transformation, cloud solutions, and AI-driven analytics to improve operations and customer experience. Rising mobile banking, omnichannel platforms, automation, and fintech investments are driving growth globally. Increasing demand for secure, scalable banking platforms and regulatory compliance further accelerates market adoption and innovation. In 2025, Mambu and system integrator Avenga completed a full-core migration for Marginalen Bank in Sweden, modernizing its legacy infrastructure to a scalable, cloud-native platform underpinned by Mambu SaaS.

To Get more information on Core Banking Software Market - Request Free Sample Report

Key Core Banking Software Market Trends

-

AI, chatbots, and robotic automation are streamlining banking operations and enabling personalized customer interactions.

-

Omnichannel banking integration of mobile, online, and branch services is enhancing unified customer experiences.

-

Open banking and API platforms are fostering fintech collaboration and innovative financial services.

-

Rising cybersecurity threats are driving stronger data protection and compliance in core systems.

-

Demand for instant payments is boosting adoption of real-time processing capabilities.

-

Legacy system modernization is accelerating shifts to modular, microservices-based architectures for agility and cost efficiency.

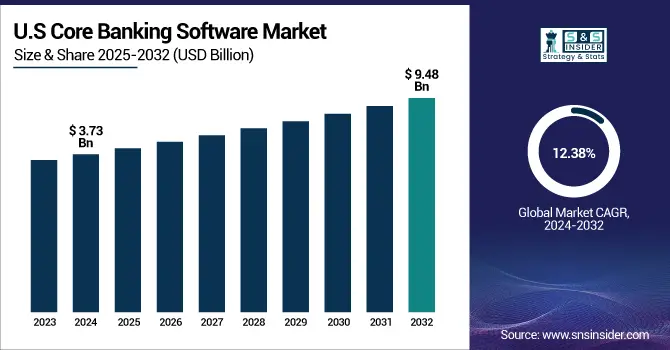

U.S. Core Banking Software Market was valued at USD 3.73 billion in 2024 and is expected to reach USD 9.48 billion by 2032, growing at a CAGR of 12.38% from 2025-2032.

The U.S. Core Banking Software Market is expanding as banks modernize infrastructure with automation, AI, and cloud-native platforms. Rising demand for real-time transactions, mobile-first banking, and seamless omnichannel experiences is fueling adoption. Additionally, stricter regulatory compliance and increasing fintech collaborations are accelerating market growth across financial institutions.

Core Banking Software Market Growth Drivers:

-

Increasing need for centralized banking systems to support multi-channel operations, real-time transaction processing, and integrated financial product management globally

Increasing need for centralized banking systems is significantly boosting demand for advanced core banking software solutions. Banks require platforms that integrate various services such as savings, loans, payments, and wealth management under a single architecture. Real-time transaction processing and seamless data flow across branches, ATMs, mobile, and internet banking are becoming essential, with systems like Sanchez Computer Associates' Profile handling up to 1,900 transactions per second (TPS), demonstrating high-volume efficiency.

Globally, over 85% of central banks are researching, piloting, or developing central bank digital currencies (CBDCs), highlighting the growing emphasis on centralized, scalable banking infrastructure. This ensures consistency in customer experience, operational accuracy, and cost efficiency. As financial institutions expand worldwide, centralized platforms help standardize operations, manage compliance requirements, and enhance scalability. The ability to provide integrated services and cross-selling opportunities positions centralized core systems as a cornerstone of banking modernization strategies globally.

Core Banking Software Market Restraints:

-

Complexity of migration from legacy banking systems to modern platforms creates operational risks, time delays, and customer service disruptions

Complexity of migration from legacy systems continues to hinder widespread adoption of core banking solutions. Transitioning data and processes from outdated platforms to modern, digital-first systems involves high technical risks and potential service interruptions. Banks face challenges such as ensuring data integrity, managing downtime, and training staff during migration. The risk of customer dissatisfaction due to temporary service outages or transaction errors further complicates the process. Additionally, long project timelines and unexpected technical setbacks often inflate costs. Institutions dependent on legacy platforms remain hesitant to embrace change, slowing digital transformation and creating a barrier for broader market adoption.

Core Banking Software Market Opportunities:

-

Growing adoption of cloud-based core banking platforms offers scalability, cost efficiency, faster deployment, and enhanced security for financial institutions worldwide

Growing adoption of cloud-based platforms presents a major opportunity for core banking software providers. Cloud solutions reduce infrastructure costs while offering scalability and flexibility to meet changing business needs. Financial institutions can deploy services faster and ensure real-time updates without heavy hardware dependencies. Enhanced data security, disaster recovery, and compliance features built into cloud offerings further increase trust. Additionally, cloud systems enable banks to expand services to underserved regions, reaching new customer bases. The demand for subscription-based and pay-as-you-go models makes cloud adoption financially attractive, positioning it as a transformative trend in the global core banking software market.

Key Core Banking Software Market Segment Analysis

-

By Component, Solution led with ~70% share in 2024; Services fastest growing (CAGR 14.51%).

-

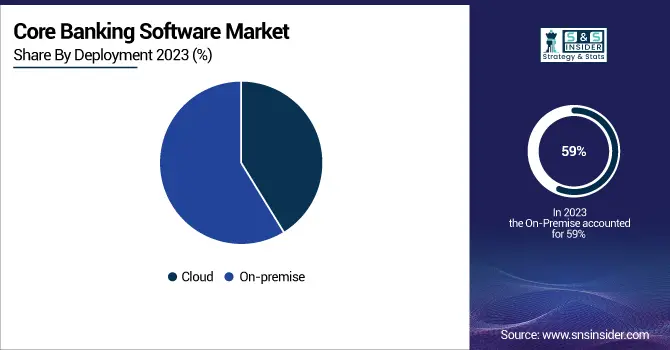

By Deployment, On-premise held ~59% share in 2024; Cloud fastest growing (CAGR 13.70%).

-

By End Use, Banks dominated ~63% in 2024; Financial Institutions fastest growing (CAGR 14.14%).

-

By Banking Type, Large Banks (Greater than USD 30 billion in Assets) led with ~38% share in 2024; Community Banks (Less than USD 5 billion in Assets) fastest growing (CAGR 15.10%).

By Deployment, On premise led while Cloud is expected to expand fastest

In 2024, the on-premise segment dominated the core banking software market, supported by its established role in security, control, and data ownership. Large banks relied on these systems to meet strict regulatory needs and protect sensitive data. Heavy infrastructure investments and hesitancy toward cloud migration sustained on-premise dominance globally.

From 2025 to 2032, the cloud segment is expected to expand at the fastest pace, driven by scalability, cost efficiency, and rapid deployment. Growing demand for subscription-based models, real-time updates, and easy access accelerates adoption. Advanced disaster recovery, security, and compliance capabilities make cloud the most attractive, fastest-growing deployment model.

By Component, Solutions dominated while Services are projected to lead growth

In 2024, the solution segment dominated the core banking software market, driven by strong demand for integrated and scalable platforms. Banks prioritized centralized management, real-time processing, and advanced analytics, ensuring widespread adoption. Significant modernization investments and the rising need for efficiency made solutions the most preferred and revenue-generating segment globally.

From 2025 to 2032, the service segment is projected to grow at the fastest pace as banks demand customization, migration support, and continuous maintenance. Rapidly changing customer needs, technological advancements, and complex integration requirements increase reliance on service providers. Outsourcing reduces risks, optimizes operations, and accelerates transformation, positioning services as the fastest-growing segment.

By End Use, Banks held the largest share while Financial Institutions are expected to grow rapidly

In 2024, the banks segment dominated the core banking software market as core platforms remained essential for deposits, loans, and payments. Ongoing digital transformation encouraged heavy investments in centralized management, regulatory compliance, and customer engagement. Large customer bases, complex operations, and strict regulatory demands reinforced banks as the leading end-user group globally.

From 2025 to 2032, financial institutions segment are projected to grow at the fastest pace, led by adoption among non-bank firms, microfinance organizations, and credit unions. Rising demand for seamless transaction processing, cost efficiency, and customer-focused solutions fuels growth. Expansion into underserved markets and competition with traditional banks drive agile platform adoption.

By Banking Type Large Banks (Greater than USD 30 billion in Assets) dominated while Community Banks (Less than USD 5 billion in Assets) are set for fastest growth

In 2024, Large Banks (Greater than USD 30 billion in Assets) dominated the core banking software market, supported by massive technology budgets and continuous modernization initiatives. These institutions emphasized efficiency, global standardization, and regulatory compliance, leading to substantial investments in advanced solutions. Their wide branch networks, extensive customer bases, and complex portfolios reinforced dominance in adopting sophisticated platforms globally.

From 2025 to 2032, Community Banks (Less than USD 5 billion in Assets) are projected to grow at the fastest pace as they accelerate digital adoption to compete with larger players. Rising customer demand for mobile and online banking drives transformation. Affordable cloud-based solutions, lower upfront investments, and faster deployment enable significant growth among smaller banks worldwide.

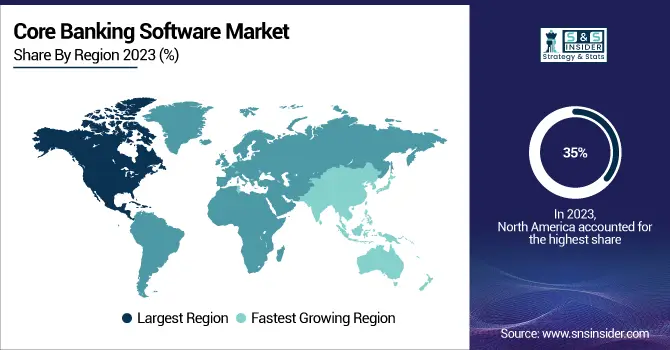

North America Core Banking Software Market Insights

North America dominated the Core banking software market with about 35% revenue share in 2024 due to strong presence of leading technology providers, advanced financial infrastructure, and early adoption of digital banking solutions. Strict regulatory frameworks, high investments in modernization, and demand for secure, scalable platforms drive continuous upgrades. Established banks and financial institutions in the region prioritize innovation, ensuring North America maintains its dominant position in the market.

Get Customized Report as per Your Business Requirement - Enquiry Now

Asia Pacific Core Banking Software Market Insights

Asia Pacific is expected to grow at the fastest CAGR of about 14.30% from 2025–2032, driven by rapid digitalization of financial services, growing fintech ecosystems, and government initiatives promoting cashless economies. Rising banking penetration in emerging markets, coupled with high smartphone adoption and increasing demand for real-time services, accelerates transformation. Expanding middle-class populations and focus on inclusive banking drive strong growth momentum for core banking software adoption across Asia Pacific.

Europe Core Banking Software Market Insights

Europe holds a strong position in the core banking software market, fueled by regulatory compliance requirements, digital transformation initiatives, and modernization of outdated banking systems. Banks are prioritizing secure, scalable, and customer-focused platforms to improve efficiency and meet evolving expectations. Growing cloud adoption and increasing fintech collaborations are further accelerating technology integration, supporting steady adoption and sustained market growth across the European financial services landscape.

Middle East & Africa and Latin America Core Banking Software Market Insights

Middle East & Africa and Latin America are emerging markets for core banking software, supported by growing digital banking penetration, financial inclusion programs, and ongoing modernization efforts. Rising smartphone adoption, expanding fintech partnerships, and demand for affordable, scalable platforms are accelerating adoption. These factors collectively drive steady growth, positioning both regions as important contributors to the global core banking software market’s future expansion.

Core Banking Software Market Competitive Landscape:

Finastra, established in 2017, stands as a global leader in the core banking software market, providing advanced, scalable, and cloud-ready platforms. Its innovative solutions enable real-time transaction processing, ensure regulatory compliance, and enhance customer experience, making it a trusted partner for banks and financial institutions worldwide. With a strong focus on digital transformation, Finastra is driving modernization and agility across the sector. The company’s cloud-first approach positions it at the forefront of reshaping core banking operations for long-term growth.

-

In January 2024, Allied Banking Corporation (Hong Kong) migrated from Finastra’s Equation to its cloud-first Essence core banking system, modernizing operations and launching Retail Analytics for greater efficiency.

nCino, founded in 2012, is a key player in the core banking software market, delivering innovative, cloud-based platforms that drive operational efficiency, compliance, and customer satisfaction. Its advanced solutions enable banks to streamline lending, onboarding, and account opening while ensuring scalability and real-time data insights. Widely adopted by global financial institutions, nCino continues to lead digital transformation through modern, agile, and customer-centric approaches, making it a preferred partner for banks seeking innovation and long-term growth in a competitive environment.

-

In 2025, nCino strengthened its portfolio by acquiring Sandbox Banking, adding an Integration Platform as a Service (iPaaS) to enhance interoperability, connectivity, and efficiency across banking systems and customer journeys.

Key Players

Some of the Core Banking Software Market Companies

-

Capgemini

-

Finastra

-

FIS

-

Fiserv, Inc.

-

HCL Technologies Limited

-

Tata Consultancy Services (TCS)

-

Mambu

-

Avaloq

-

EdgeVerve Systems (Finacle)

-

Backbase

-

nCino

-

Forbis

-

Securepaymentz

-

Novatti

-

Capital Banking Solutions

-

Infosys Limited

-

Jack Henry & Associates, Inc.

-

Oracle Corporation

-

Temenos Group

-

Unisys

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 14.85 Billion |

| Market Size by 2032 | USD 38.21 Billion |

| CAGR | CAGR of 12.63% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Solution, Service) • By Deployment (Cloud, On-premise) • By End Use (Banks, Financial Institutions, Others) • By Banking Type (Large Banks – Greater than USD 30 billion in Assets, Midsize Banks – USD 10 billion to USD 30 billion in Assets, Small Banks – USD 5 billion to USD 10 billion in Assets, Community Banks – Less than USD 5 billion in Assets, Credit Unions) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Capgemini, Finastra, FIS, Fiserv, Inc., HCL Technologies Limited, Tata Consultancy Services (TCS), Mambu, Avaloq, EdgeVerve Systems (Finacle), Backbase, nCino, Forbis, Securepaymentz, Novatti, Capital Banking Solutions, Infosys Limited, Jack Henry & Associates, Inc., Oracle Corporation, Temenos Group, Unisys |