Digital Experience Platform Market Size & Overview:

Get more information on Digital Experience Platform Market - Request Free Sample Report

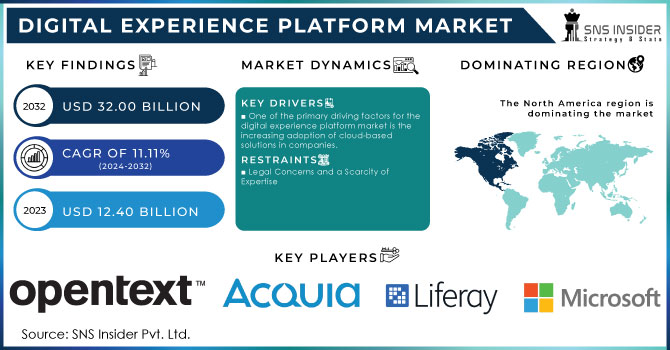

Digital Experience Platform Market was valued at USD 12.27 billion in 2023 and is expected to reach USD 34.50 billion by 2032, growing at a CAGR of 12.22% from 2024-2032.

The Digital Experience Platform market has grown significantly due to the rising demand for personalized and seamless customer experiences across multiple digital touchpoints. The demand is mainly driven by the shift of businesses towards a digital-first strategy, as Digital Experience Platforms offer a unified solution integrating content management, customer data, and personalization tools. 63% of organizations expect to increase their expenditure on Digital Experience Platforms, while 59% will implement Digital Experience Platforms in CRM systems to reduce the complexity of customer interactions. Cloud technologies, AI, and big data analytics offer companies a chance to work with these platforms to make customer engagements more customized and data-driven. For example, the innovation in June 2023 by Adobe Experience Cloud, trusted by 87% of Fortune 100 companies, shows how Digital Experience Platforms allow businesses to create personalized experiences for their customers. Therefore, Digital Experience Platforms are becoming imperative in sectors such as retail, banking, and healthcare, where the digital engagement of customers holds the key to retaining them.

The increasing requirement for a unified digital ecosystem drives the need for Digital Experience Platforms as enterprises have to deliver consistent and personalized experiences across various channels. An undeniable growth trend in this area is the widespread use of mobile devices, social media, and e-commerce platforms, where it becomes a real must to manage customer journeys with a holistic strategy. Further, 82% also use Digital Experience Platforms for multi-channel delivery like web, mobile, and social media to ensure consistent customer engagement. Digital Experience Platforms are capable of analyzing customer data in real time and lead the way for targeting marketing, personalizing content, and improving customer service.

Looking to the future, the Digital Experience Platform market holds immense potential, as advancements in artificial intelligence, machine learning, and automation are expected to enhance the capabilities of these platforms further. These technologies will enable Digital Experience Platforms to deliver even more sophisticated personalization, predictive analytics, and automated workflows, improving the overall customer experience. For example, on December 17, 2024, HP introduced its AI-powered Workforce Experience Platform, designed to enhance digital employee experiences through AI-driven automation and generative tools. Additionally, the continued evolution of the Internet of Things and 5G technologies will expand the range of connected devices and data sources that Digital Experience Platforms can utilize. As digital transformation accelerates, Digital Experience Platforms will be indispensable for businesses aiming to stay ahead of the competition.

Digital Experience Platform Market Dynamics

DRIVERS

-

The Growing Importance of Omnichannel Engagement in Driving the Digital Experience Platform Market

In today’s digital landscape, businesses must engage with customers across various touchpoints, including websites, mobile apps, social media, email, and in-store experiences. 80% of customers who visit physical stores have engaged with a brand via multiple channels, highlighting the need for a seamless omnichannel strategy. Additionally, 67% of consumers now expect the option to purchase online and pick up in-store, emphasizing the importance of integrating digital and physical touchpoints. A Digital Experience Platform enables organizations to consolidate customer data and manage these interactions effectively, ensuring a consistent, personalized experience across all channels. By offering integrated solutions for customer engagement, digital experience platforms allow businesses to track the entire customer journey in real time, optimize content delivery, and enhance communication strategies. This ability to deliver cohesive experiences across platforms is key to boosting customer satisfaction, loyalty, and revenue growth in a competitive market.

-

Surge in Demand for Seamless and Personalized Customer Experiences Driving Digital Transformation Across Industries

As businesses face heightened competition, delivering exceptional customer experiences has become a critical factor for differentiation. Customers now expect personalized, consistent, and seamless interactions across every touchpoint, from online platforms to in-store visits. This shift has led organizations to focus heavily on optimizing their customer-facing processes, ensuring that their services meet the evolving needs of consumers. Digital Experience Platforms play a pivotal role in this transformation by integrating various systems, streamlining workflows, and enabling businesses to provide cohesive, tailored experiences. For instance, in 2024, H&M Group acquired a minority stake in Swedish retail technology platform Voyado, aiming to enhance Voyado’s platform and expand its international reach. This partnership is a reflection of the growing trend of leveraging DXPs to provide personalized customer experiences across multiple channels, strengthening brand loyalty and staying competitive in the evolving marketplace.

RESTRAINTS

-

Concerns Over Data Security and Privacy Impacting Digital Experience Platform Market Adoption

Digital Experience Platforms rely on large volumes of customer data to create personalized experiences, but this raises significant concerns regarding data privacy and security. As businesses collect and process sensitive customer information, they must ensure compliance with strict regulations such as the General Data Protection Regulation in Europe, which adds a layer of complexity to digital experience platform implementation. In the third quarter of 2024, 422.61 million data records were leaked in data breaches, impacting millions of individuals worldwide, and highlighting the growing risks businesses face. Ensuring that customer data is secure and used responsibly requires businesses to invest heavily in robust cybersecurity measures and continuously monitor their practices. This can be challenging, particularly for smaller organizations without the resources to manage data protection effectively. The growing risk of cyberattacks and data breaches only adds to these concerns, making businesses cautious about adopting digital experience platform markets without adequate security protocols in place.

Digital Experience Platform Market Segmentation

By Application

In 2023, the Business to Customer (B2C) segment dominated the Digital Experience Platform market, accounting for the highest revenue share of approximately 65%. This dominance is driven by the increasing demand for personalized, seamless, and consistent customer experiences across various digital touchpoints. As consumers expect more tailored interactions with brands, businesses are leveraging DXPs to enhance customer engagement, optimize marketing strategies, and improve user satisfaction, fueling significant investment in business to customer solutions.

The Business to Business (B2B) segment is expected to grow at the fastest CAGR of about 14.12% from 2024 to 2032. The rapid growth in this segment is attributed to the rising adoption of digital experience platforms by enterprises seeking to streamline complex processes, enhance collaboration, and optimize interactions across business ecosystems. As B2B companies increasingly prioritize efficiency, automation, and personalized engagement with clients and partners, the demand for advanced, integrated digital experience platform solutions is expected to accelerate, driving strong market expansion in this sector.

By Deployment Model

In 2023, the On-Premises segment dominated the Digital Experience Platform market, capturing the highest revenue share of approximately 57%. This dominance is primarily due to the preference for greater control over sensitive data and IT infrastructure among large enterprises. On-premises solutions allow businesses to customize their platforms to meet specific needs, ensuring enhanced security and compliance with industry regulations, which is especially crucial for sectors such as finance and healthcare.

The Cloud segment is expected to grow at the fastest CAGR of about 13.79% from 2024 to 2032, driven by the increasing demand for scalability, flexibility, and cost efficiency. Cloud-based digital experience platforms eliminate the need for heavy upfront investments in hardware, offering businesses the ability to scale their digital experiences effortlessly. As more organizations embrace digital transformation, the accessibility, reduced maintenance costs, and enhanced collaboration features of cloud solutions are making them increasingly attractive, fueling rapid growth in this segment.

By Organization Size

In 2023, the Large Enterprise segment dominated the Digital Experience Platform market, capturing the highest revenue share of approximately 66%. This dominance is attributed to the significant resources and scale at which large enterprises operate, allowing them to invest heavily in advanced digital experience platform solutions. These organizations require highly customized, robust platforms to manage complex customer interactions across multiple channels, and digital experience platforms provide the necessary infrastructure for enhanced personalization, streamlined processes, and improved customer engagement.

The Small and Medium Enterprise segment is expected to grow at the fastest CAGR of about 13.44% from 2024 to 2032. The rapid growth in this segment is driven by the increasing adoption of cost-effective, scalable cloud-based digital experience platforms that allow SMEs to enhance their digital presence without heavy upfront investments. As more SMEs recognize the value of digital transformation for improving customer experiences, the demand for flexible, accessible, and user-friendly digital experience platforms solutions is expected to surge, fueling strong market growth.

By End-use

In 2023, the Retail segment dominated the Digital Experience Platform market, accounting for the highest revenue share of approximately 28%. This leadership is driven by the increasing demand for personalized shopping experiences and the need to integrate multiple customer touchpoints seamlessly. Retailers are leveraging digital experience platforms to enhance customer engagement, optimize marketing strategies, and improve sales, making these platforms crucial for driving growth in an increasingly competitive e-commerce landscape.

The BFSI (Banking, Financial Services, and Insurance) segment is expected to grow at the fastest CAGR of about 14.79% from 2024 to 2032. This growth is fueled by the industry’s growing emphasis on digital transformation to improve customer experiences, streamline operations, and ensure regulatory compliance. As consumers demand more personalized financial services and seamless digital interactions, BFSI organizations are turning to digital experience platforms to drive innovation, enhance service offerings, and maintain a competitive edge in a rapidly evolving market.

By Component

In 2023, the Platform segment dominated the Digital Experience Platform market, capturing the highest revenue share of approximately 74%. This dominance is primarily due to the increasing reliance on Digital Experience platforms to deliver integrated, seamless customer experiences across multiple channels. As businesses seek to centralize and streamline their digital operations, platform-based solutions provide the flexibility, scalability, and advanced features required to enhance personalization, automate processes, and improve overall user engagement.

The Services segment is expected to grow at the fastest CAGR of about 14.33% from 2024 to 2032. This growth is driven by the rising demand for expert consultation, implementation, and ongoing support services as businesses adopt digital experience platforms. As organizations look to fully leverage the potential of their digital platforms, the need for specialized services to optimize, customize, and maintain these solutions is increasing, fueling rapid growth in the services segment.

Regional Analysis

In 2023, the North America segment dominated the Digital Experience Platform market, accounting for the highest revenue share of approximately 44%. This dominance can be attributed to the region's strong technological infrastructure, high adoption of digital transformation strategies, and the presence of major enterprises across various industries. North American companies are increasingly investing in digital experience platforms to enhance customer engagement, streamline operations, and maintain a competitive edge in the fast-evolving digital landscape.

The Asia Pacific segment is expected to grow at the fastest CAGR of about 14.88% from 2024 to 2032. This growth is driven by the rapid digitalization of businesses in emerging markets, the increasing penetration of mobile internet, and the rising demand for personalized customer experiences. As more organizations in the region recognize the potential of digital experience platforms to drive innovation and improve customer satisfaction, the adoption of these platforms is set to accelerate, making Asia Pacific the fastest-growing market.

Need any customization research on Digital Experience Platform Market - Enquiry Now

Key Players:

-

Acquia Inc. (Acquia Drupal Cloud, Acquia Site Studio)

-

Adobe Inc. (Adobe Experience Manager, Adobe Commerce)

-

International Business Machines Corporation (IBM) (IBM Watson Content Hub, IBM Customer Experience Analytics)

-

Liferay, Inc. (Liferay DXP, Liferay Commerce)

-

Microsoft Corporation (Microsoft Dynamics 365, Microsoft Power Pages)

-

Open Text Corporation (OpenText Experience Cloud, OpenText Content Suite)

-

Oracle Corporation (Oracle Content Management, Oracle Eloqua)

-

Salesforce.com, Inc. (Salesforce Marketing Cloud, Salesforce Commerce Cloud)

-

SAP SE (SAP Customer Data Cloud, SAP Commerce Cloud)

-

Sitecore (Sitecore Experience Platform, Sitecore Content Hub)

-

Squiz (Squiz Matrix, Squiz Funnelback)

-

Bloomreach Inc. (Bloomreach Experience Cloud, Bloomreach Discovery)

-

Crownpeak Technology Inc. (Crownpeak DXM, Crownpeak DQM)

-

Magnolia International Ltd. (Magnolia CMS, Magnolia PaaS)

-

Jahia Solutions Group SA (Jahia Digital Experience Manager, Jahia Cloud)

-

Kentico (Kentico Xperience, Kentico Kontent)

-

Progress Software Corporation (Progress Sitefinity, Progress Telerik)

-

Optimizely (Optimizely Web Experimentation, Optimizely Full Stack)

-

CoreMedia (CoreMedia Content Cloud, CoreMedia Studio)

-

Ibexa (Ibexa DXP, Ibexa Content)

-

Pimcore (Pimcore Platform, Pimcore Data Manager)

-

HCL Technologies (HCL Digital Experience, HCL Commerce)

Recent Developments:

-

On May 8, 2024, IBM and SAP announced plans to expand their collaboration by integrating generative AI into industry-specific cloud solutions, enabling clients to transform into next-generation enterprises.

-

On September 11, 2024, Oracle announced enhancements to its Unity Customer Data Platform, introducing AI-driven features to help organizations leverage AI to grow revenue.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 12.27 Billion |

| Market Size by 2032 | USD 34.50 Billion |

| CAGR | CAGR of 12.22% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Component (Platform, Services) •By Organization Size (Small and Medium Enterprise, Large Enterprise) •By Deployment Model (Cloud, On-Premises) •By Application (Business to Customer, Business to Business) •By End-Use (BFSI, Healthcare, IT & Telecom, Manufacturing, Retail, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Acquia Inc., Adobe Inc., International Business Machines Corporation (IBM), Liferay, Inc., Microsoft Corporation, Open Text Corporation, Oracle Corporation, Salesforce.com, Inc., SAP SE, Sitecore, Squiz, Bloomreach Inc., Crownpeak Technology Inc., Magnolia International Ltd., Jahia Solutions Group SA, Kentico, Progress Software Corporation, Optimizely, CoreMedia, Ibexa, Pimcore, HCL Technologies |

| Key Drivers | • The Growing Importance of Omnichannel Engagement in Driving Digital Experience Platform Market • Surge in Demand for Seamless and Personalized Customer Experiences Driving Digital Transformation Across Industries |

| RESTRAINTS | • Concerns Over Data Security and Privacy Impacting Digital Experience Platform Market Adoption |