Agriculture IoT Market Report Scope & Overview:

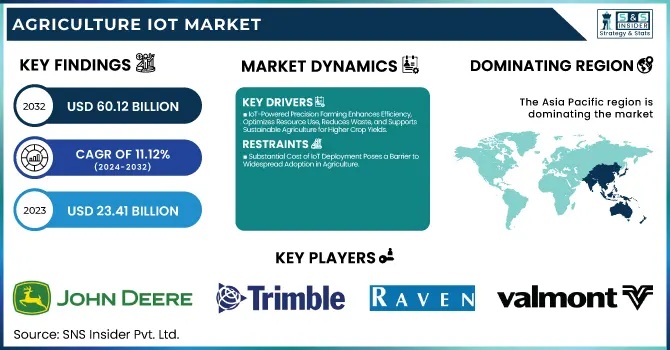

The Agriculture IoT Market was valued at USD 23.41 billion in 2023 and is expected to reach USD 60.12 billion by 2032, growing at a CAGR of 11.12% from 2024-2032. This report includes insights on IoT device shipments, investment trends, percentage of farming activities remotely controlled, and IoT data processing volume. The market is experiencing high growth as a result of greater IoT-enabled sensor adoption, automation, and precision agriculture practices. Investments in smart agriculture solutions are propelling technological innovation, improving operational efficiency, and minimizing the waste of resources. The increasing ratio of remote farmland management alongside the explosion in data generated through IoT is driving even more precise decision-making and efficiency, delineating the path forward for agri-businesses using data-smart, internet-of-things-linked solutions.

To Get more information on Agriculture IoT Market - Request Free Sample Report

Agriculture IoT Market Dynamics

Drivers

-

IoT-Powered Precision Farming Enhances Efficiency, Optimizes Resource Use, Reduces Waste, and Supports Sustainable Agriculture for Higher Crop Yields.

The increasing need for resource savings and enhanced agriculture productivity is boosting the adoption of IoT-driven precision farming. Highly advanced sensors, real-time data analytics, and automated machinery facilitate farmers to enhance irrigation, fertilization, and pest control through optimization, and minimize wastage while optimizing production. The above technologies yield data-driven insights to support exacting decision-making and enhance farm overall efficiency. With increasing pressure to adopt sustainable agricultural practices, IoT solutions are increasingly becoming necessary in reducing environmental footprint as well as meeting food security demands. With the development of connectivity and data analytics features, integration of intelligent technologies in agriculture is poised to transform conventional farming practices, maintaining greater efficiency as well as long-term sustainability.

Restraints

-

Substantial Cost of IoT Deployment Poses a Barrier to Widespread Adoption in Agriculture

The integration of IoT in agriculture requires huge investments of money, rendering it difficult for small and medium-sized farmers to implement these technologies. The cost incurred to buy IoT-equipped sensors, automated equipment, data analytics tools, and cloud platforms can be exorbitant. Installation, maintenance, and training costs also contribute significantly to the expenses. Unavailability of funding and lack of return on investment make the farmers reluctant to shift towards smart agriculture. Lacking inexpensive remedies or incentives by the government, large-scale adoption is limited, especially in the developing world. Consequently, even with the potential of IoT in improving productivity and efficiency, expense has been a determinantal factor hindering mass implementation of it in agriculture.

Opportunities

-

5G and IoT Connectivity Enhance Real-Time Monitoring, Optimize Resource Use, Enable Smart Farming, and Improve Agricultural Productivity and Sustainability.

The rapid expansion of 5G and IoT connectivity will revolutionize contemporary agriculture through the seamless real-time monitoring and precision-based decision-making. Upgraded network infrastructure enables quicker data transmission, making it possible for farmers to monitor soil health, weather conditions, and crop well-being more accurately. This upgraded connectivity enables autonomous farming equipment, intelligent irrigation systems, and remote livestock monitoring, maximizing resource utilization and productivity. Connectivity of reliable and high-speed internet in rural regions will fill the digital divide, promoting the larger use of smart agriculture technologies. As the agricultural industry adopts future-proofed connectivity solutions, data analytics will catalyze greater efficiency, sustainability, and profitability, representing a turning point towards smarter and technology-based methods of farming.

Challenges

-

Limited Internet Connectivity in Rural Areas Restricts IoT Adoption, Hinders Real-Time Data Transmission, and Reduces Efficiency in Smart Farming.

Inadequate rural network infrastructure continues to be a key impediment for the large-scale implementation of IoT in agriculture. Most farms are isolated from the heart of towns or cities and lack continuous or stable access to the internet, thereby rendering real-time data transmission and cloud computing not feasible. IoT-enabled sensors, automated irrigation systems, and precision monitoring devices cannot operate at their best without constant connectivity, thus lowering their efficiency. Farmers struggle to access critical insights on soil health, weather conditions, and crop growth, limiting the benefits of data-driven decision-making. Expanding broadband and 5G networks in agricultural areas is essential to unlocking the full potential of IoT in farming, enabling more efficient resource management, higher productivity, and long-term sustainability in the sector.

Segment Analysis

By Deployment

On-premise solutions led the Agriculture IoT Market in 2023, generating around 57% of the revenue share. This leadership is fueled by farmers' desire for complete control over their data, ensuring security and reducing dependence on external networks. On-premise deployments provide continuous operation even in regions of low internet connectivity, making them well-suited for rural agriculture settings. Moreover, they enable real-time processing of data, minimizing latency and improving decision-making for precision farming.

The cloud segment is expected to grow at the fastest CAGR of 12.24% during the forecast period from 2024 to 2032 because of growing demand for scalable and affordable solutions. Cloud-based IoT facilitates remote monitoring, real-time analytics, and easy integration with AI-powered insights. Its flexibility enables farmers to access important data anywhere, increasing operational efficiency. With better connectivity, more agricultural businesses are moving towards cloud adoption for improved productivity and automation.

By Application

Precision Farming led the Agriculture IoT Market in 2023 with the largest revenue share of around 41%. This is fueled by the rising use of IoT-enabled sensors, GPS technology, and data analytics to maximize crop yield and resource utilization. Precision farming increases productivity by allowing real-time monitoring of soil health, weather, and irrigation requirements. The rising need for sustainable agriculture and lower operational costs further drives its extensive use.

The Aquaculture segment is expected to grow at the fastest CAGR of 14.70% during 2024 to 2032 as a result of the increased adoption of IoT solutions for observing water quality, oxygen, and fish health monitoring. The mounting demand for global seafood and a need for optimizing resource management are driving the usage of IoT across aquaculture. Predictive analytics, automated feeding systems, and real-time environmental monitoring are fueling segment growth.

By Component

The Hardware segment led the Agriculture IoT Market in 2023, with the largest revenue share of around 46%. This is due to the widespread use of IoT-enabled devices like sensors, drones, automated irrigation systems, and GPS trackers. These hardware pieces of equipment are necessary for real-time monitoring, precision farming, and automation, which results in enhanced efficiency. Rising investments in smart farming infrastructure also help in driving the high demand for IoT hardware solutions.

The Services segment is expected to grow at the fastest CAGR of approximately 12.08% during 2024-2032 owing to the increasing demand for installation, maintenance, and data management solutions. As IoT use in agriculture rises, farmers need consulting, support, and analytics-based insights to maximize operations. Managed services, predictive analysis, and cloud-based platforms are fueling demand, facilitating smooth integration and efficiency of IoT solutions in agriculture.

By Connectivity

The Cellular segment led the Agriculture IoT Market in 2023 with the largest revenue share of around 39%. It owes this to its extensive coverage, strong connectivity, and capability to accommodate mass IoT deployments in distant agricultural sites. Cellular networks support real-time data transmission for precision agriculture, livestock tracking, and automated irrigation systems. The growing availability of 4G and 5G networks also further enhances its position in smart agriculture solutions.

The Bluetooth segment is expected to grow at the fastest CAGR of approximately 13.92% during the period from 2024 to 2032 based on cost savings and ease of use for short-range IoT applications. The Bluetooth technology finds wider applications in greenhouses, indoor agriculture, and equipment tracking, where there is a need for localized transmission of data. Low power utilization, hassle-free device connectivity, and compatibility with smartphones and edge computing solutions lead to its faster adoption in smart agriculture.

By Farm Type

The Large segment led the Agriculture IoT Market in 2023 with the largest revenue share of around 52%. This is facilitated by large farms' capacity to invest in sophisticated IoT technologies, such as precision agriculture, automated watering systems, and AI-based analytics. The large farms enjoy economies of scale, which enable them to integrate IoT solutions comprehensively for boosting productivity. Furthermore, strong infrastructure and access to funding allow large-scale agricultural companies to install innovative smart agriculture technologies.

The Small segment is expected to grow the fastest CAGR of nearly 13.12% during the forecast period from 2024 to 2032 because of improving affordability and accessibility of IoT solutions. Government schemes, subsidies, and inexpensive smart farming equipment are making it possible for small farmers to implement precision agriculture. The rising need for effective management of resources, with the growth of cloud-based and mobile IoT applications, is compelling swift adoption across small-scale farms.

Regional Analysis

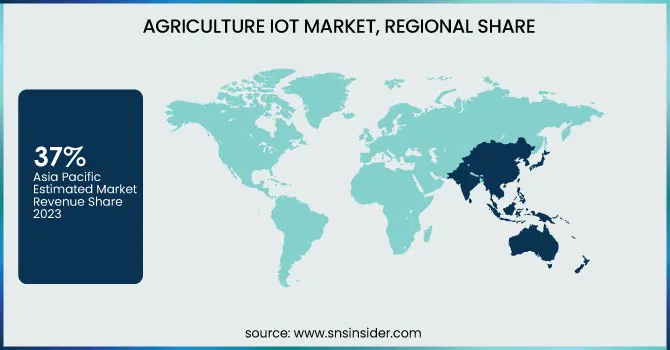

Asia Pacific dominated the Agriculture IoT Market in 2023, capturing the highest revenue share of approximately 37%. This dominance is driven by the region’s vast agricultural land, increasing adoption of smart farming technologies, and strong government initiatives supporting digital agriculture. Countries like China, India, and Japan are heavily investing in IoT-enabled precision farming, automation, and AI-driven analytics to enhance productivity. Rapid urbanization, rising food demand, and the need for efficient resource management are further accelerating IoT adoption in the agriculture sector.

North America is expected to grow at the fastest CAGR of about 10.67% from 2024 to 2032 due to its advanced technological infrastructure and high adoption of precision agriculture. The region benefits from strong investments in smart farming solutions, widespread availability of high-speed connectivity, and increasing integration of AI, cloud computing, and automation in agriculture. Additionally, growing concerns over sustainability and efficiency are pushing farmers to adopt IoT-based solutions for optimized crop management and resource utilization.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

-

Deere & Company (John Deere Operations Center, JDLink)

-

Trimble Inc. (Trimble Ag Software, GFX-750 Display System)

-

Raven Industries Inc. (Viper 4 Plus Field Computer, RS1 Steering System)

-

AGCO Corporation (Fuse Connected Services, AgCommand)

-

Topcon Positioning Systems Inc. (X35 Console, CropSpec Sensors)

-

Blue River Technology (See and Spray, Tractor Integration)

-

Valmont Industries Inc. (Valley 365, BaseStation3)

-

FarmWise Labs (Titan FT-35, Vulcan)

-

Cropin (SmartFarm, SmartRisk)

-

Agrostar (AgroStar Agronomy App, Farm Solutions Platform)

-

Cisco Systems Inc. (Cisco Kinetic for Cities, Cisco Industrial IoT Networking)

-

Telit Corporate Group (Telit IoT Platform, Telit IoT Modules)

-

SWIIM System Ltd. (SWIIM Water Management, SWIIM Crop Monitoring)

-

Decisive Farming Corp. (My Farm Manager, Croptivity)

-

The Climate Corporation (Climate FieldView, FieldView Drive)

-

Hitachi Ltd. (Hitachi IoT Platform, Lumada)

-

Farmers Edge Inc. (FarmCommand, Smart VR)

-

International Business Machines Corporation IBM (IBM Watson Decision Platform for Agriculture, IBM Food Trust)

-

SlantRange Inc. (SlantView Analytics, 3PX Sensor)

-

Heliospectra AB (LX60 Series, ELIXIA)

Recent Developments:

-

2025 – Deere & Company unveiled new autonomous tractors and industrial equipment at CES 2025, enhancing automation in farming to tackle labor shortages. The second-generation autonomy kit integrates AI, computer vision, and cameras for navigation. Deere also introduced an autonomous dump truck and an electric commercial mower, all equipped with advanced automation features.

-

In April 2024, AGCO and Trimble completed their joint venture, forming PTx Trimble to create a leading precision agriculture platform. The venture aims to enhance mixed-fleet farming technology, integrating Trimble's precision ag business with AGCO's JCA Technologies. AGCO holds an 85% stake, while Trimble retains 15%. The move is expected to drive innovation in autonomy, data management, and precision spraying.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 23.41 Billion |

| Market Size by 2032 | USD 60.12 Billion |

| CAGR | CAGR of 11.12% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Hardware, Software, Services) • By Deployment (On-premise, Cloud) • By Connectivity (Wi-Fi, Bluetooth, Cellular, Others) • By Application (Precision Farming, Livestock Monitoring, Smart Greenhouse, Aquaculture, Others) • By Farm Type (Large, Mid-sized, Small) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Deere & Company, Trimble Inc., Raven Industries Inc., AGCO Corporation, Topcon Positioning Systems Inc., Blue River Technology, Valmont Industries Inc., FarmWise Labs, Cropin, Agrostar, Cisco Systems Inc., Telit Corporate Group, SWIIM System Ltd., Decisive Farming Corp., The Climate Corporation, Hitachi Ltd., Farmers Edge Inc., International Business Machines Corporation IBM, SlantRange Inc., Heliospectra AB |